A summarizing review of what has been happening at the crypto markets of the past week. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko. The last 7 days in cryptocurrency markets: Price Movements: Crypto markets react to bullish Ethereum “London” hard fork. Volume Dynamics: Trade volume for perpetual futures markets peaks during US/EU trading hours which suggests a flouting of geographic restrictions. Order Book Liquidity: On average, bid-ask spreads for Bitcoin-Dollar pairs has improved since January. Macro Trends: Treasury bond yields are falling around the world despite strong…

Author: Editorial Office CVJ.CH

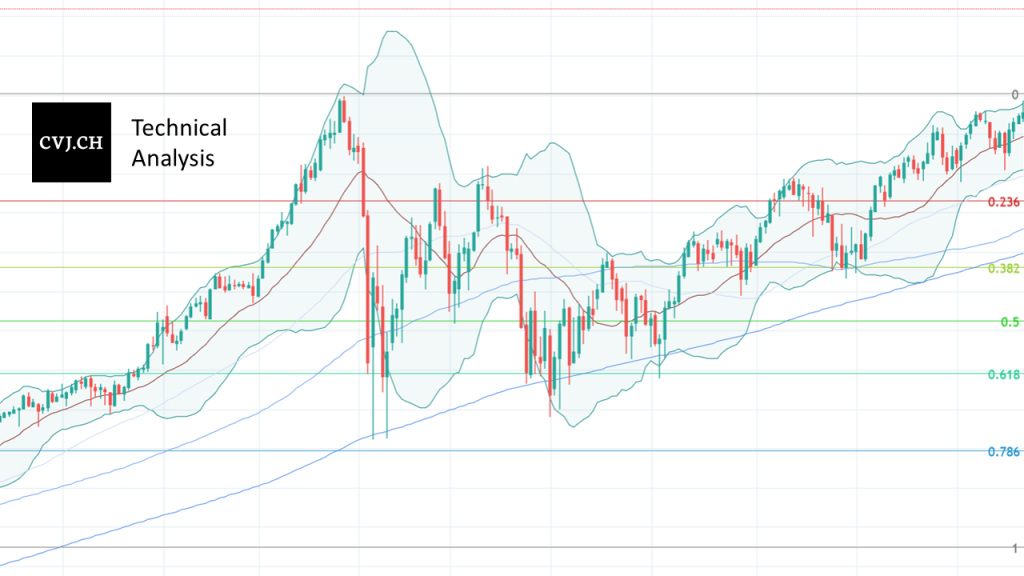

Bitcoin USD daily basis Bitcoin USD chart analysis – Overcoming the 40,000 resistance zone At the beginning of the reporting week, it looked as if the newly climbed price area above the 40,000 mark could not be defended. The strong upward movement of the previous week was followed by a first correction on Sunday, which brought the price back to 39,149 USD by Monday. On Tuesday, Bitcoin exited the market lower again at 38,191 USD. On Wednesday, initial buying set in, bringing the price back to 39,722 USD and thus just below the 40,000 USD resistance zone. A strong sign…

In Europe and the United States, cryptocurrencies are often dismissed as “pure speculative tools.” However, Bitcoin can open new doors for many developing countries through open and censorship-resistant value transfer, as the example of El Salvador shows. In June, El Salvador became the first nation-state to accept Bitcoin as legal tender, setting an important milestone in terms of adoption of the cryptocurrency. The decision to integrate Bitcoin into the country’s financial system drew harsh criticism from the International Monetary Fund (IMF) and the United Nations Economic Commission. They argued that Bitcoin was purely a means of speculation and not suitable…

The Boerse Stuttgart Digital Exchange (BSDEX) is the first multilateral and regulated trading venue for digital assets in Germany. Currently, more than 20,000 participants are connected to BSDEX – both private investors and institutional players. A conversation with CEO Sebastian Warnke. As the only classical stock exchange in Europe, the Boerse Stuttgart Group operates a multilateral trading system for cryptocurrencies with BSDEX. The cryptocurrencies Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC) and Ripple (XRP) are traded almost around the clock, seven days a week. The Boerse Stuttgart Group also brings its experience from 160 years of securities trading to the market…

A summarizing review of what has been happening at the crypto markets of the past week. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko. The last 7 days in cryptocurrency markets: Price Movements: Bitcoin is up 8% this week, registering its largest weekly gain in months. Volume Dynamics: Ahead of Ethereum’s big upgrade, trade volume continues to surge relative to Bitcoin. Order Book Liquidity: Price slippage on FTX and Binance has fallen over the past 2 months despite the regulatory crackdown on exchanges. Macro Trends: Microstrategy shares are…

By 2028, Switzerland will need more than 117’000 new skilled workers in the field of information and communication technologies (ICT). This demand for talent is also emerging in the fast-growing Crypto Valley, where new technologies such as blockchain require additional, specific expertise. The training company TIE International has recognized this, which is why it founded Switzerland’s first blockchain apprenticeship together with two companies from the Crypto Valley. For former Federal Councilor Johann Schneider-Ammann, too, it is clear “that the future and immense potential for the business location are emerging in the Crypto Valley”. Attractive apprenticeships are intended to promote young…

Bitcoin USD daily basis Bitcoin USD Chart Analysis – Countermovement to the 40’000 USD Resistance Zone In the reporting week, the countermovement that started in the previous week was consistently continued. On Sunday, the Bitcoin price was already able to close the week at the first resistance zone around 35’000 USD. With the positive momentum of the previous week behind it, it managed to overcome said the resistance area on Monday. This led to a real price firework, which lifted the price in the course of the day even briefly above the 40’000 mark. The day’s closing price of 37’262…

The largest cryptocurrency exchange, Binance, is restricting its withdrawal limit for unverified users by 97% effective immediately, among other measures. The proactive step against money laundering is intended to counter ongoing allegations by regulators. The largest crypto exchange by trading volume has sharply reduced its daily withdrawal limit. Unverified accounts could previously withdraw up to 2 BTC. Now, only around $2000 (0.06 BTC) may be withdrawn per day. The change has already been implemented for new users, and will be phased in for existing users by August 23. Introducing a limit on daily withdrawals is a common practice among most…

The company behind investment app Robinhood is listing on NASDAQ this week, allowing its customers to subscribe to one-third of available shares directly in the app. The IPO follows strong growth over the past year, particularly in cryptocurrencies. Robinhood, the largest mobile platform for commission-free investing, filed its IPO with the U.S. Securities and Exchange Commission on the 1st of July. The company will be listed on NASDAQ under the ticker symbol HOOD and hopes to raise $2 billion in its debut on the public markets. The company is backed by Goldman Sachs and JPMorgan at a $35 billion valuation.…

From creating a marketplace for non-fungible tokens (NFTs) to building an air-gapped cold vault to enabling new sustainable digital assets, seven global crypto and digital asset startups join Mastercard’s Start Path program. Two Swiss companies are among them. Credit card company Mastercard announced a new Start Path global startup engagement program dedicated to supporting fast-growing digital assets, blockchain and cryptocurrency companies. As a continuation of Mastercard’s digital assets work, seven startups have joined the program, including GK8, Domain Money, Mintable, SupraOracles, STACS, Taurus, and Uphold. Expansion in the blockchain sector Together with Mastercard, they seek to expand and accelerate innovation…

The development team behind the largest decentralized exchange, Uniswap, is restricting access to more than 100 tokens in an effort to adapt to an evolving regulatory landscape. Tokenized stocks and derivatives that embody securities are primarily affected. A blog post announced the controversial move and, in the same move, removed the affected tokens from the official user interface. The full list includes majority financial products (put/call) and derivatives from the Synthetix protocol, as well as synthetic shares in the form of blockchain tokens. The tokens are still available on Uniswap, but it is necessary to interact with a third party…

A summarizing review of what has been happening at the crypto markets of the past week. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko. The last 7 days in cryptocurrency markets: Price Movements: Binance’s Euro markets diverged sharply from global crypto-to-fiat markets following the latest wave of regulator restrictions. Volume Dynamics: The average trade size on decentralized exchanges is magnitudes greater than trade size on centralized exchanges. Order Book Liquidity: USDC’s liquidity is improving across exchanges although its usage as a quote asset remains far behind Tether. Macro…

JPMorgan is the first major U.S. bank to offer all of its wealth management clients access to crypto funds. The bank gave the green light to its financial advisors to begin offering a number of crypto financial products. U.S. financial services firm JPMorgan has given its financial advisors the green light to offer five cryptocurrency products effective immediately, according to Business Insider. The new option is now open to all clients seeking investment advice. This includes self-managing clients in the commission-free Chase trading app, the mass of affluent clients who have their assets managed by JPMorgan Advisors, and the institutional…

BNY Mellon has joined a consortium of banks that are collaborating to develop a platform to support the entire lifecycle of digital assets. The collaboration includes other big-name U.S. banks that are gradually entering the industry. The collaboration follows an announcement by BNY Mellon in February 2021 that it would build a new digital assets unit. This includes multi-asset custody for traditional and digital assets. Now, the oldest bank in the United States is expanding further in the space, while other established financial services providers are also taking action. Consortium of major U.S. banks BNY Mellon is now making its…

Mastercard has announced that it will expand its card program to include crypto wallets and exchanges, in a collaboration with Circle. This is expected to make it easier for customers to convert cryptocurrency to traditional fiat currency, and spend it via a regular credit card. Five months after Mastercard announced it would bring select stablecoins to its network, the credit card giant is getting active again. The latest collaboration with USDC issuer Circle is a crucial step to expand the ecosystem. In doing so, Mastercard aims to set the stage for the future of crypto payments in a secure and…

A Federal Reserve research paper proposes regulation for the stablecoin ecosystem and calls for ways to address systemic risks. Their issuers should be regulated as banks and central banks should launch their own digital currencies (CBDCs). A member of the Board of Governors of the Federal Reserve System as well as a Yale University professor propose oversight of the stablecoin ecosystem in a recently published paper, “Taming Wildcat Stablecoins”. They call for addressing systemic risks, regulating stablecoin issuers as banks, and introducing central bank digital currencies (CBDCs). Furthermore, they conclude that privately issued stablecoins are not an effective medium of…