Bitcoin is still a young digital currency, or alternatively a digital asset. Thanks to its uncorrelatedness to traditional asset classes and its high risk-adjusted return profile, Bitcoin is ideally suited for inclusion in a balanced portfolio.

A young emerging asset class

The still young digital currency Bitcoin is currently perceived more as a store of value than as a digital currency. The underlying protocol based on block chain and cryptography, guarantees a disintermediate value transfer via the Internet. Bitcoin is the currency of this decentralized payment network and, like other crypto-currencies, is traded around the clock on various exchanges. In a portfolio categorization, Bitcoin and digital currencies are likely to be included in alternative investments. Bitcoin could be categorized as an "early-stage venture" - with worldwide tradability and real-time price feed. The investment horizon and weighting should also be chosen in this way: As a multi-year "venture investment" with high risk and potentially substantial return potential.

In 2009, the Bitcoin Whitepaper laid the foundation for a decentralized payment network. This created a long-awaited opportunity to transfer not only information, but also values via the Internet - without the intervention of a third party. The rules of the system are manifested in the software. Bitcoin is the currency that can be transmitted in the system. In addition to the hard-coded upper limit for the total supply, the creation of new Bitcoins and thus the inflation rate is clearly defined. Newly minted Bitcoins are created exclusively as a reward for securing the payment system. The unique feature is that this reward is halved every 4 years until no new Bitcoins are created from 2140 onwards. Bitcoin was programmed as a hard currency with a deflationary character.

Digital Gold

As a result, Bitcoin is often referred to as digital gold due to its limited supply. Bitcoin is not something physical like gold. You cannot touch Bitcoin and therefore create an emotional connection with your senses. Bitcoin only exists virtually. But that is of diminishing importance in today's digital world. At the latest, future generations will have a different understanding of digital values. "Millenials" and the next "Generation Z" are growing up with an awareness of the value of digital objects.

While gold is well known as an alternative asset class, Bitcoin still has a niche existence. This is probably also due to the fact that Bitcoin has only just turned eleven. Gold has served as a store of value for thousands of years and could be traded on traditional exchanges as early as the 1960s. However, the characteristics of both assets with respect to the limited supply situation are quite similar. Furthermore, both assets have good tradability. A correlation between the two assets has been observed for the first time in 2019. The virtual character of Bitcoin even provides certain advantages in terms of transferability and storage.

As a currency, Bitcoin, like gold, is not suited for everyday use. While gold coins are not accepted as a means of payment, a transaction in the Bitcoin network with the necessary confirmations simply takes too long for the everyday use. "Second Layer Solutions" such as the Lightning Network are intended to improve this situation in the future. This gives Bitcoin an additional option for an expanded future demand. With a possible future worldwide adaptation as a digital means of payment.

However, the assets Bitcoin and Gold should not be played off against each other. With their properties, both have excellent conditions to increase in value in a money-printing world.

Entering the world of traditional finance

The path that Bitcoin has already taken in his short lifetime is quite remarkable. The limited supply, the deflationary structure, as well as value storing features combined with borderless, censorship-resistant transferability, including 24/7 trading, give Bitcoin a serious justification for its existence. In its eleven-year existence, not only did the price increase steadily, but also a quickly growing infrastructure around the currency could be observed.

Bitcoin is slowly but surely fighting its way into the traditional financial world as an accepted asset class. Numerous adaptations of the tradability by traditional financial institutions, but also regulatory developments such as in Switzerland and Germany speak for itself. Only a few institutional investors have had access to this new asset class recently. A large proportion is clearly underinvested due to regulatory uncertainties, or a lack of investment opportunities.

Individual investors are most likely to pay greater attention to Bitcoin in the coming age of digital currencies. The emergence of government-issued or private digital currencies will further promote the adoption of crypto-currencies, including Bitcoin.

Bitcoin has its optionality with its relatively low market capitalization and the potential for a strong, broader adoption by the masses. Be it as digital preservation of value, new asset class, or alternative currency. 150 billion USD is the current market capitalization. A fraction of the USD 8 trillion of gold and a tiny fraction of the trillions of other asset classes.

Bitcoin as an addition to a portfolio

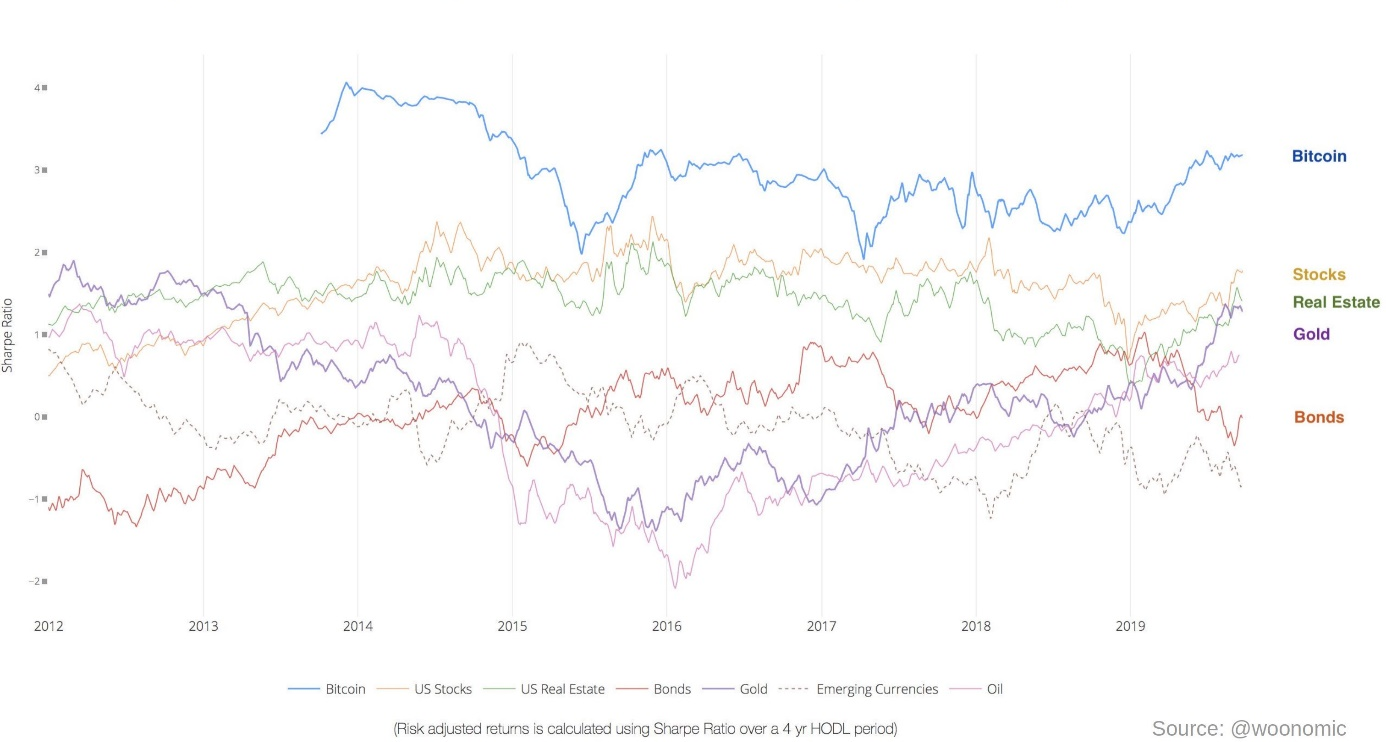

Bitcoin has a highly attractive risk/reward profile. Its optionality - with the right weighting - makes it an almost indispensable addition to a portfolio. Even without considering the macro situation, this asset class offers an attractive, risk-adjusted and uncorrelated return opportunity based on pure portfolio theory.

Bitcoin has a high volatility. A volatility that discourages many market participants. The Bitcoin price has experienced corrections of up to 90% in its 9'000'000% appreciation since its inception. Nevertheless, Bitcoin has achieved an annual increase in value since its inception, which no asset class has yet achieved. Since 2010, every Bitcoin investor has been able to generate a positive return with a minimum holding period of three and a quarter years. Since December 2010 Bitcoin has gone through eight major bull and bear cycles. The average bull market cycle is 158 days, with an average return of 1100%. The median "drawdown" is 113 days, with an average decline of 57%.

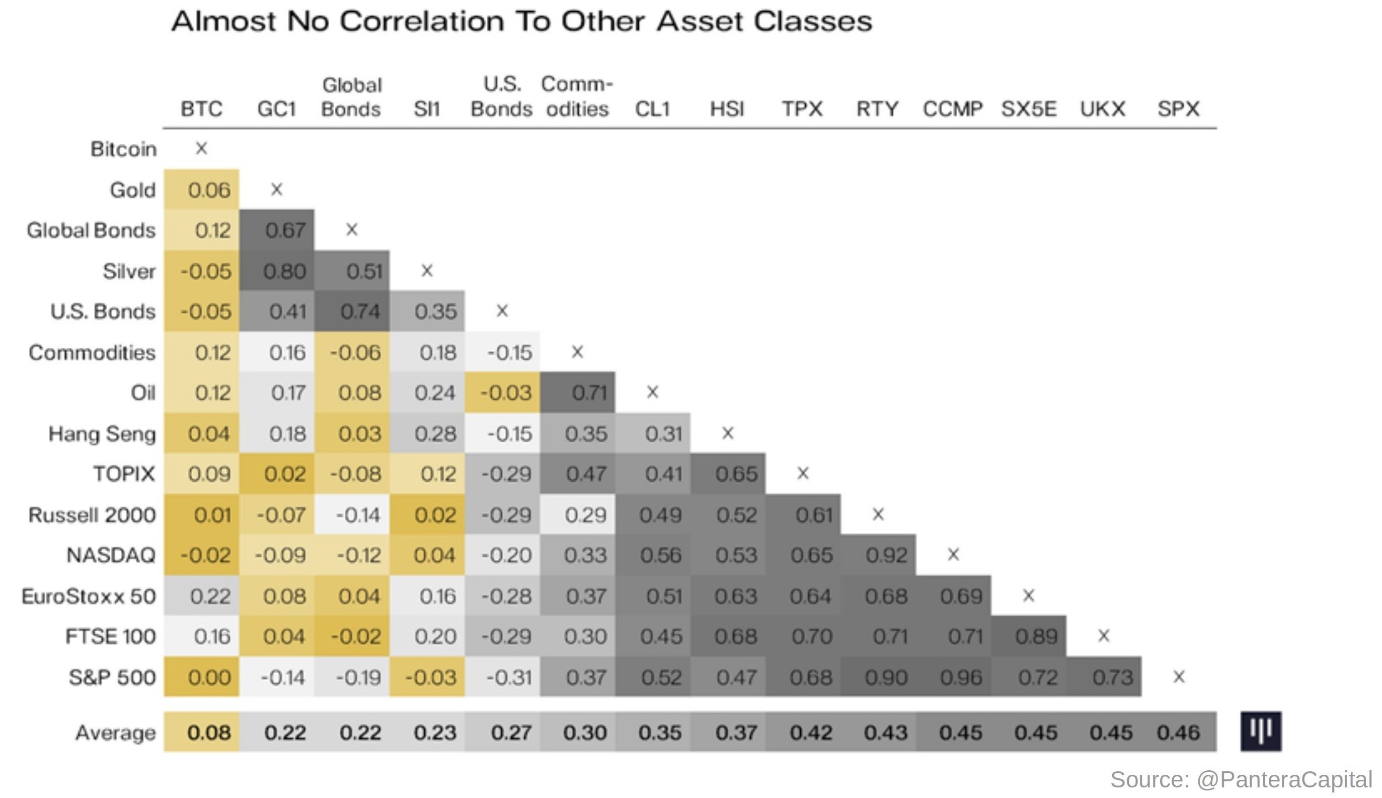

Even a weighting in a portfolio of 2% can lead to a high excess return. In the event of a total loss, 2% is manageable in an overall portfolio context. If Bitcoin, with its current market capitalization of over USD 150 billion, transforms into a valid digital gold alternative and thus a recognized alternative asset class, the possibility of a massive multiplication is clearly given. Taking into account the correlation to traditional asset classes, Bitcoin fits even better into a portfolio, as it correlates only very poorly with traditional asset classes and thus reduces the overall risk of the portfolio, while increasing the expected return.

The risk/reward ratio of Bitcoin is highly attractive. An option with no expiration. Those who do not weight Bitcoin with these characteristics in a portfolio will risk missing a potentially drastic positive outperformance.