The US strikes on three Iranian nuclear sites over the weekend, the Iranian retaliation on Monday, the announcement of a ceasefire by US President Donald Trump, and the subsequent attack on Tehran by Israel raise the question of how the crypto markets react in general to such geopolitical events.

For investors who are not just buying and holding crypto for the long term on an unleveraged basis, getting a better grasp of the return drivers in these markets is essential. In the popular narrative, BTC has sometimes been designated “digital gold” and is seen as a currency debasement hedge. At other times, it is described as a risky asset, much like the S&P 500 or even the Magnificent-7 tech stocks. The narrative around return drivers for ETH and other altcoins has been limited to risky assets for the most part. Let’s dive a bit deeper into this topic.

Comparative scale of crypto, gold, and S&P 500 markets

The global cryptocurrency market today stands at approximately 3.4 trillion USD, making it a fraction of the size of traditional asset classes. For context, the gold market is valued at around 20.8 trillion USD as of March 2025, while the S&P 500’s aggregate market capitalization soared to 54.5 trillion USD in January 2025. This stark difference underlines that, while crypto has grown rapidly, it remains a much smaller asset class compared to gold and major equity indices.

Geopolitical issues, such as wars or sanctions, typically impact traditional markets-like equities and commodities-first and most directly. In the long run, cryptocurrencies, by contrast, are generally affected predominantly when these events intersect with the digital asset ecosystem, such as the use of crypto to bypass traditional financial channels or facilitate cross-border donations.

For example, during the onset of the Russia-Ukraine conflict in February 2022, both global stocks and crypto markets initially dropped. However, as sanctions tightened and traditional financial channels were restricted, there was a surge in crypto trading volumes-particularly in BTC/RUB and BTC/UAH pairs - as individuals sought alternatives to move and store value. Reportedly, over 136 million USD in crypto donations were sent to Ukraine, primarily in Bitcoin and Ethereum, with donations peaking shortly after the conflict began. This resulted in an instant 25% uptick across major cryptocurrencies. This episode demonstrates that crypto can experience short-term, event-driven rallies when it becomes a tool for financial circumvention or humanitarian aid.

Correlation with equities and commodities

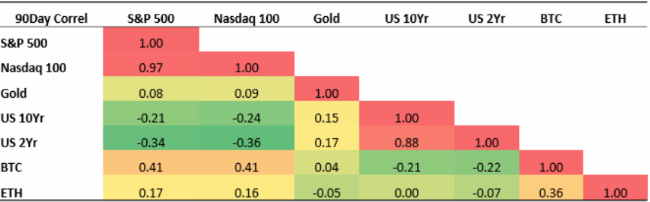

Despite its unique characteristics, cryptocurrency as an asset class has shown a moderate correlation (typically 20–40%) with equities. This is likely because many investors treat cryptocurrencies similarly to tech stocks, responding to broader market trends and risk sentiments and a necessity to close leveraged long positions in times of market turmoil. Consequently, we have seen sharp, although short lived corrections in the prices of BTC and ETH on Trump’s tariff Liberation Day on April 2 and last weekend. In contrast, crypto’s correlation with commodities like gold remains weaker, reflecting their differing roles in portfolios - gold as a traditional safe haven, and crypto as a speculative or growth asset.

Crypto-specific market drivers

Unlike traditional assets, cryptocurrencies are heavily influenced by sector-specific events, which can have outsized impacts on prices and sentiment. Key drivers include:

- Bitcoin halving: Occurring roughly every four years, this event reduces the rate at which new bitcoins are created, often leading to increased scarcity and, historically, price appreciation if demand holds steady.

- ETF launches: Approval of spot Bitcoin or Ethereum ETFs did bring new institutional capital and legitimacy to the market.

- Major network upgrades: Upgrades like Ethereum’s Merge (transition to proof of-stake) or the recently implemented Pectra upgrade did affect both utility and investor confidence.

- DeFi and stablecoin growth: The expansion of decentralized finance and stablecoins has also opened new use cases and liquidity channels for cryptocurrencies.

- Regulatory developments: Changes in regulation, whether positive (clarity, acceptance) or negative (restrictions, bans), also drive significant volatility.

Ceasefire

Besides the understanding of crypto currencies as a growth asset, the other big question for investors is whether the hostilities between Iran on the one side and Israel and the US on the other side are truly over.

On a more fundamental level, one has to ask: Did the bombing raid achieve the claimed goals and has it “obliterated” the targeted sites as Trump claimed? Are Israel or the US in a position to assess this already? Should the assessment about Iran’s nuclear programme change, would this trigger another attack by the US, and would this be the end of it?

Despite an additional bombing raid by Israel on Tehran after Trump’s announcement, it seems that the ceasefire is holding for now. So, a lasting end to the hostilities may still be in the cards.

Exposure management

“Buying the dip” whenever the Trump administration shook up the markets with policy announcements or in this case military action, has worked well for investors. However, high profile leaders in finance warn of an “extraordinary amount of complacency” in the markets. Even if the Trump administration is looking to limit the negative market impacts of their actions, it may not always be in their hands to fix things. The latest Israeli air raid being a case in point.

Historically, cryptocurrencies, such as BTC, have been subjected to long-term and significant drawdowns when the market turns. It may make sense to keep that in mind when increasing one’s investment exposure during corrections.

Summary

In summary, the cryptocurrency market is still dwarfed by gold and equities, and while it occasionally reacts to global geopolitical events - especially when cryptocurrencies are preferred over traditional financial channels - it remains primarily driven by sector specific developments. Its moderate correlation with equities suggests that, for now, crypto is treated more like a risk asset than a true safe haven, with its unique market cycles and innovation-driven catalysts shaping its trajectory.