We remain unsure as to what will happen to inflation in the coming 5 years, but we see adding real assets as a prudent measure to protect portfolios from the tail-risk that inflation runs out of control. The role of Bitcoin as a store of value and hedge against inflation.

Signs of a potential inflationary problem are beginning to reveal themselves, most notably the tightening employment conditions (and consequent rise in wages) coupled with rising producer prices across the globe. However, investors remain divided, with the outlook for inflation falling into two schools of thought: those that believe the inflation effects are more transitory in nature, and those that see inflation rising to a point where it threatens economic stability.

Measuring inflation

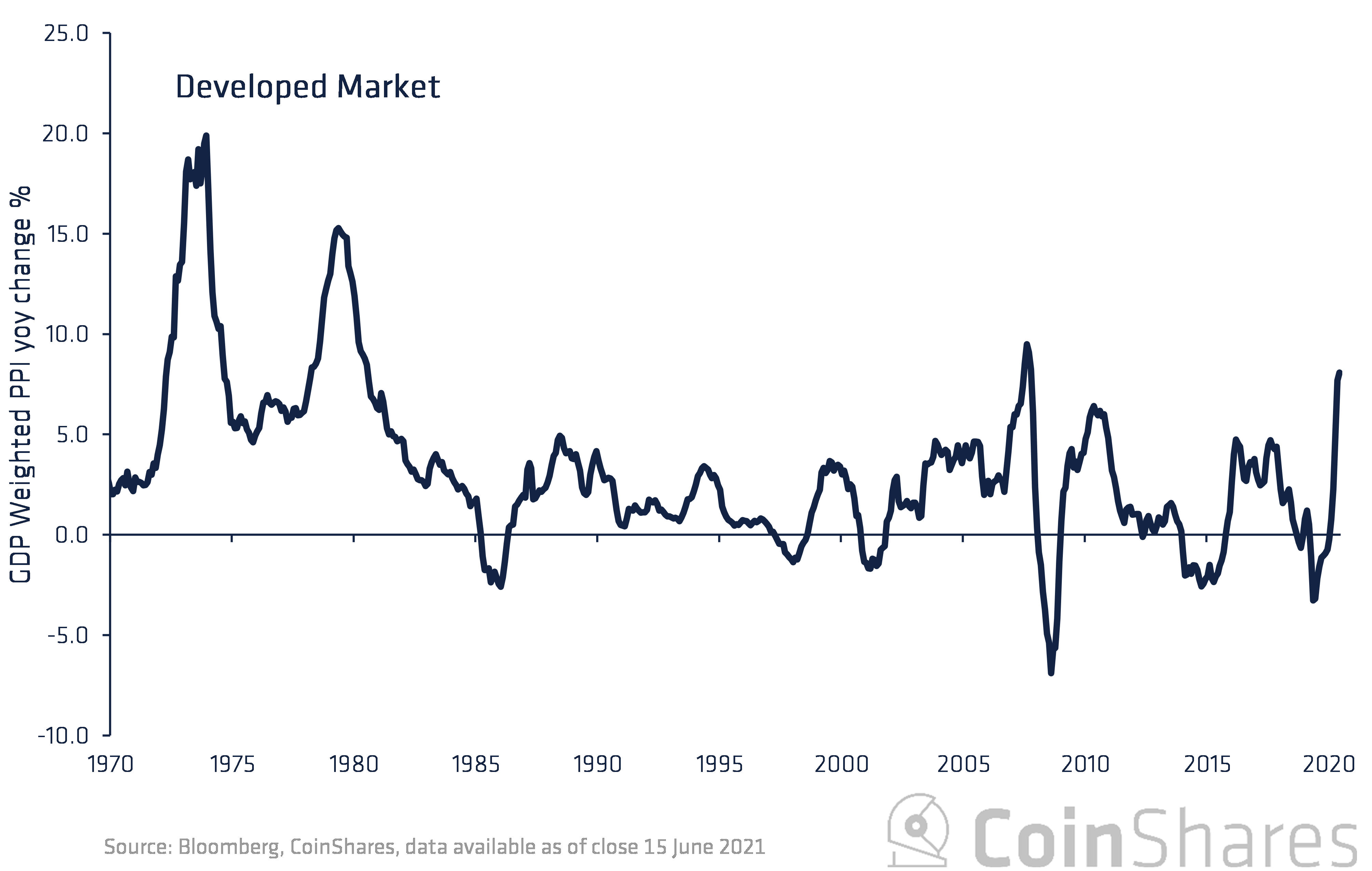

On a global scale, data highlights that in a historical perspective current inflation isn’t all that high. Current levels are similar to those observed after the 2008 financial crisis, which since 1970, only puts it in the 55th percentile. It is in producer prices, being exposed to rising commodity prices, where inflation is beginning to rear its ugly head. At 7.1% for the developed world the current figure is in the 90th percentile.

During this COVID recovery phase, unemployment is falling at a much faster rate than in the global financial crisis, implying that the labour market is beginning to heat up. In turn this infers that wage growth is likely to follow, as we have already seen in the US this year. However, while wage growth was unusually high during the pandemic, this has been distorted by lower paid workers being laid off. As these workers regain employment, it is most likely to push down wage growth in the coming months, rather than increase it.

It is therefore very difficult to determine if higher inflation really is just round the corner. There are some supply bottlenecks caused by the disruption in global shipping, broader supply chain issues and inventory challenges increasing short-term inflation, but this does not necessarily mean it will lead to longer-term inflationary problems. Therefore, we believe it remains too difficult to say exactly what will happen to inflation, although we acknowledge that the issue lies directly in the hands of central bankers, and history suggests they will be more reactive rather than proactive.

The central bankers’ predicament

We can sympathise with the predicament central bankers face. Slamming on the monetary brakes after such unprecedented loose policy is likely to cause dislocation in the bond markets, causing even more market volatility. The US Federal Reserve and other central banks are trapped by the very liquidity that was meant to alleviate market stress - it is consequently very hard to undo.

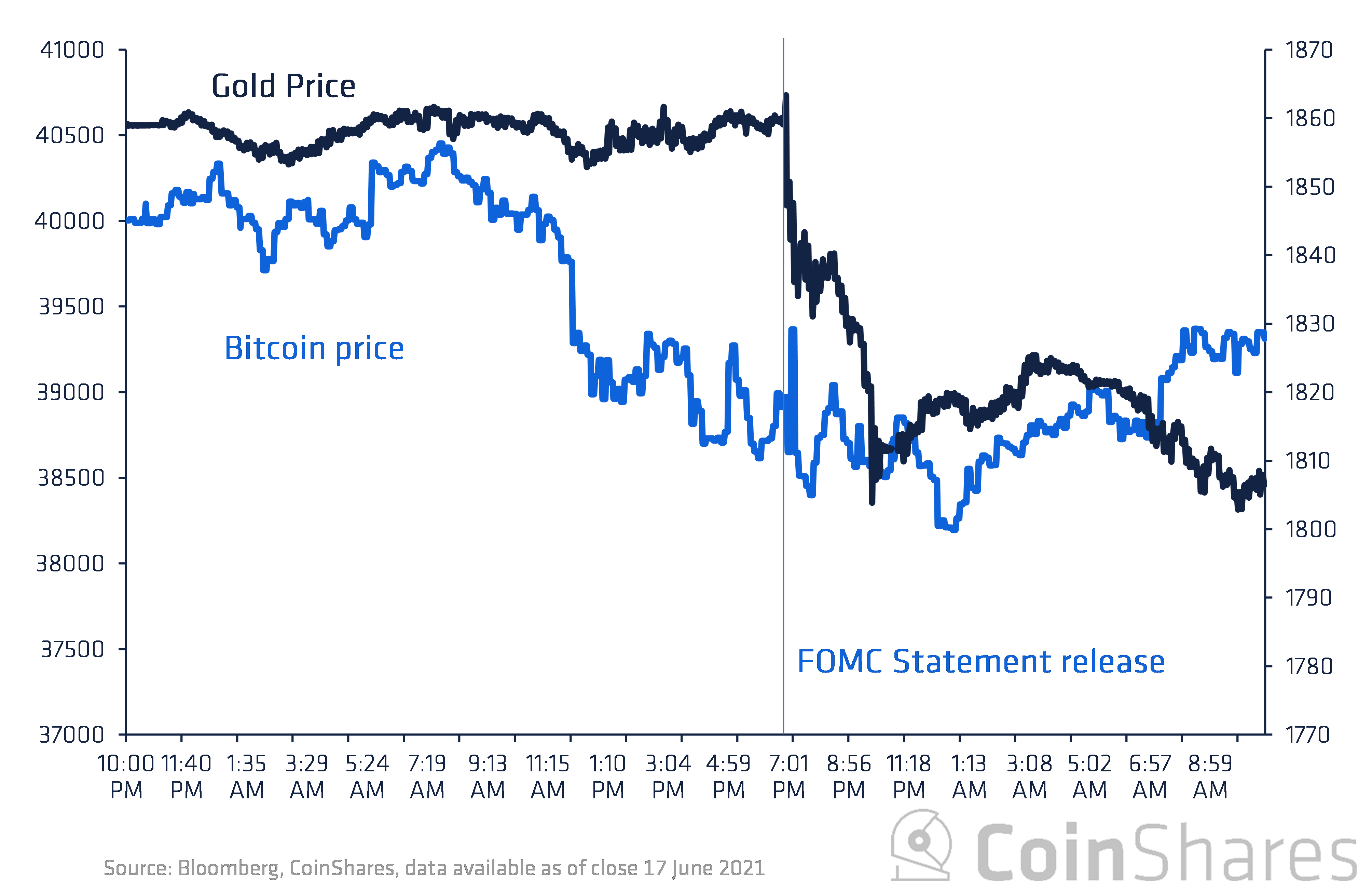

This is why markets were so focused on the recent June FOMC (Federal Oversight & Monetary Committee) statement. The minutes from the FOMC meeting, highlight that the US Federal Reserve is maintaining a very dovish overall approach (even if the minutes were unexpectedly hawkish). At the same time they are contemplating the inflationary threat by raising inflation forecasts and signalling the expectation of higher interest rates in 2023. The FOMC continues to believe that inflation is transitory in nature and is therefore happy for inflation to “run hot” for a while.

The problem is that this “outcomes-based” approach by the US Federal Reserve, also known as “we will wait for inflation to arrive before acting”, is risky. Particularly as some traditional metrics that track inflation may be unreliable given how rapidly the world economy and technology is changing.

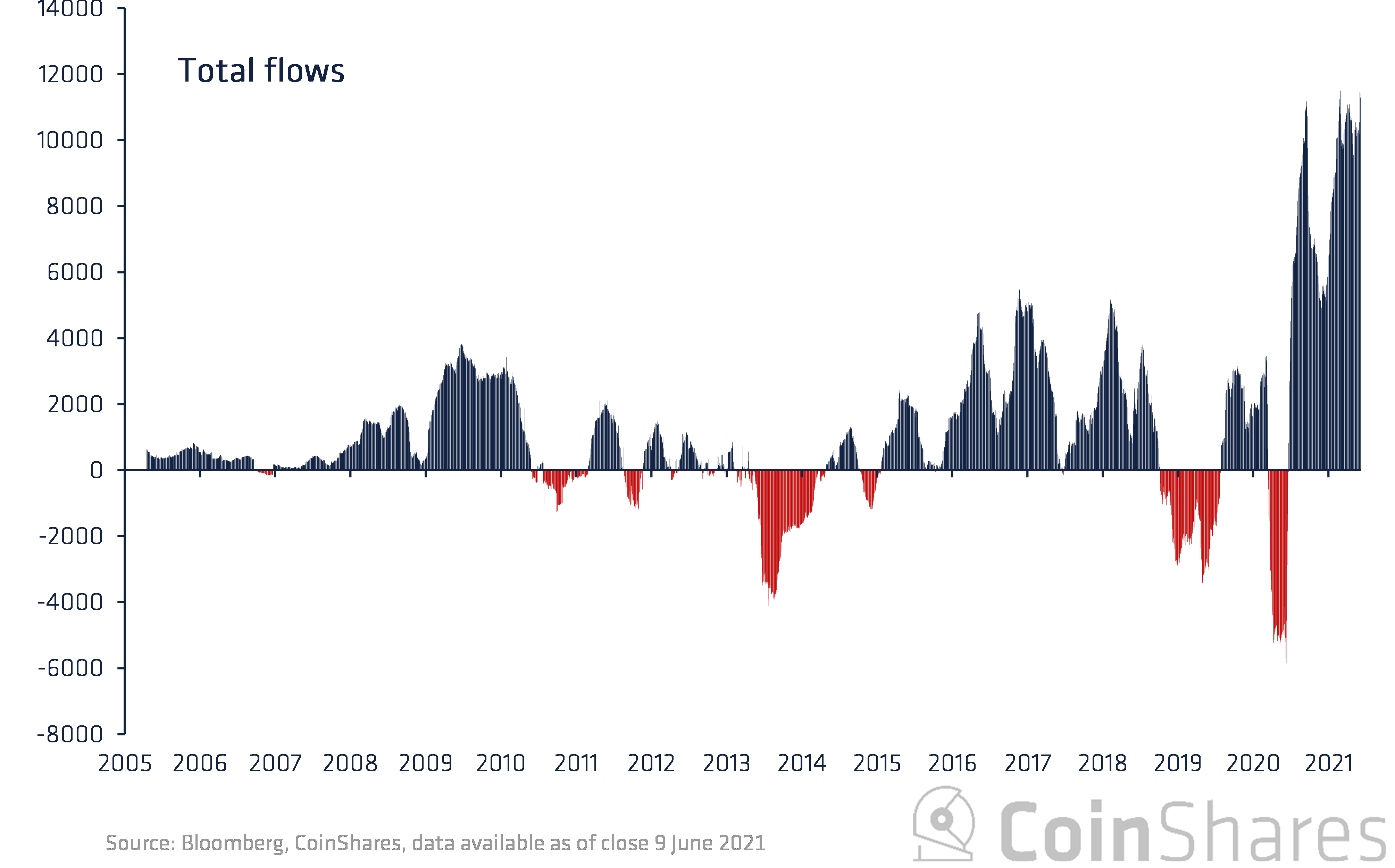

Investor behaviour also suggests that many are not convinced by the outcomes-based approach. Assets under management in inflation-protected exchange traded products have risen by 74% over the last year, prompted by a flurry of inflows since mid-2020.

These record inflows also highlight that perhaps inflationary fears are becoming the consensus rather than an outlying view. It also alludes to the point that many investors believe the US Federal Reserve and other central banks are potentially behind the curve.

Regardless of the outcome for inflation, there remains a sizeable tail risk that central bankers could lose control of inflation. Therefore, inflation hedges are becoming increasingly popular, as highlighted by the aforementioned fund flows. There is a small selection of hard assets that should outperform during a bout of inflation, and we believe bitcoin is one of those.

Bitcoin as an inflation hedge

Conceptually, it makes sense that Bitcoin (BTC) would be a hedge against inflation. It is what an economist would call a “real asset” - an asset of limited and predictable supply that is often priced in US dollars. Therefore, if the supply of US dollars is rising, or that of any other fiat currency, then it is likely that bitcoin will appreciate against those currencies, even if its purchasing power were to remain stagnant.

Data suggests that bitcoin is beginning to fulfil this inflation hedge role. Observing its price changes relative to changes in inflation over two-year periods since it was created in 2009, highlights that the relationship is improving, with a current R2 of 0.30 (since 2019). Incidentally, the relationship between bitcoin and inflation is currently better than between inflation and gold.

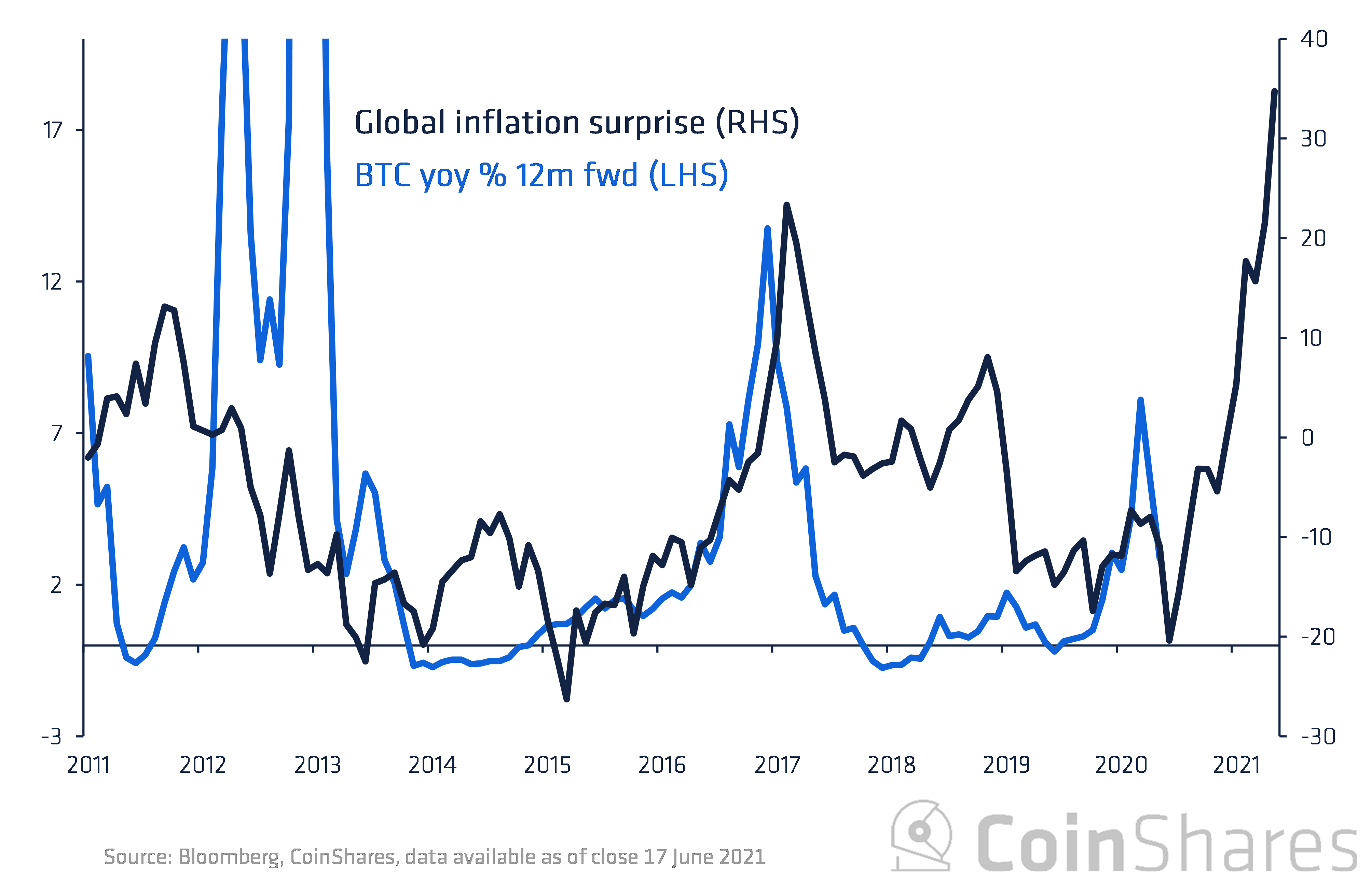

Citi compiles an index that tracks unexpected, or "surprise" inflation, by measuring inflation forecasts versus delivered results. At levels above zero, inflation is higher than expected. Bitcoin also has an early but potentially compelling relationship with unexpected inflation. Our analysis highlights that bitcoin does appear to react to unexpected inflation, rising when delivered inflation figures are higher than expectations.

We appreciate that bitcoin’s relationship with inflation is most likely inconclusive at this juncture as the sample size is quite low. That said, it is interesting to note that as time has progressed, the relationship has been steadily improving, adding credence to the concept that bitcoin is a real asset.

Bitcoin is maturing as an asset

There is increasing evidence that bitcoin is maturing as an asset. After the most recent FOMC statement (16th June) where an unexpectedly hawkish tone was expressed, prices moved in a very similar way to gold. This is highlighting that bitcoin is behaving as investors would expect from a real asset, by appreciating when the US dollar declines and vice versa.

We remain unsure as to exactly what will happen to inflation over the coming 5 years, but we see adding bitcoin and other real assets as a prudent measure to protect portfolios from the tail-risk of out-of-control inflation. What was originally a conceptual idea of bitcoin having inflation protection credentials, is now being proven through increasing investor participation, as evidenced by its improving relationship with consumer prices.