The largest digital asset-manager, Grayscale Investments, published a study on Bitcoin last week. In it, the asset-manager explains why they consider the largest crypto-currency to be an attractive investment and why the next "bull-run" could be imminent.

Grayscale Investments is the world's largest investment manager for digital currencies and by its own account, manages more than $5.8 billion (as of August 2020). To illustrate the importance of Bitcoin, the most recently published study begins with a dive into the monetary history of the U.S. According to the opinions of U.S. asset manager's, the current financial structure and inflation have major impacts on the demand for scarce financial assets like Bitcoin.

In the following article an overview of the history of money and inflation will be outlined:

The year 1971 and the abolition of the gold standard

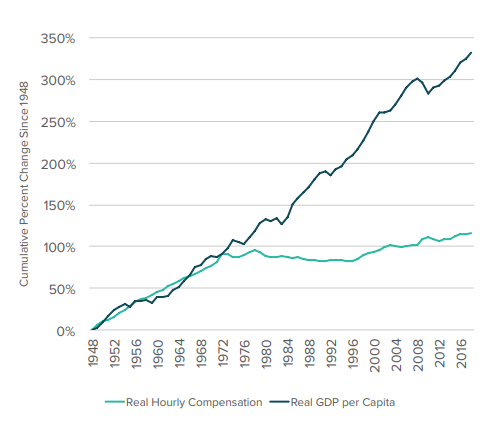

Since the United States lifted the gold standard in 1971, assets have risen sharply while wages have stagnated. This can be seen when comparing the development of gross domestic product and real wage growth. This widening gap has led to further expansionary economic policy measures, which continue to this day.

Real GDP growth and real wage growth

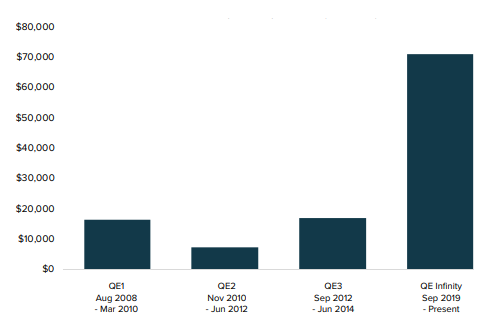

Very loose monetary policy over the last 50 years has encouraged the market to take on debt in order to acquire assets. During the 2008 recession, some of this debt had to be reduced. In addition, Quantitative Easing (QE) was implemented to halt the loss of asset-value and offer economic support. According to Grayscale, this led to the problem that cash-flows were mainly directed to assets rather than to the economy.

Between 2008 and 2014, the Federal Reserve expanded its balance sheet from USD 1 trillion to over US$4 trillion. When the economy recovered, an attempt was made to reduce the balance in 2018. In response, the S&P 500 fell about 20% in just 3 months. So it looks like QE could not be reversed without crashing the financial markets.

Figure 2: Balance sheet expansion per week (in millions of USD)

In a time of unimaginable economic stimulus programs, more and more investors are trying to protect themselves from the expanding money supply. According to Grayscale, Bitcoin could be attractive here because of its verifiable scarcity and an offer that cannot be artificially increased.

Bitcoin Rating

Many investors May agree that a scarce, digital form of money would make sense. Nevertheless, they cannot assign value to Bitcoin. Since Bitcoin does not generate cash flows, Bitcoin must be valued similarly to gold. Through the relative valuation of supply and demand.

Relative Valuation

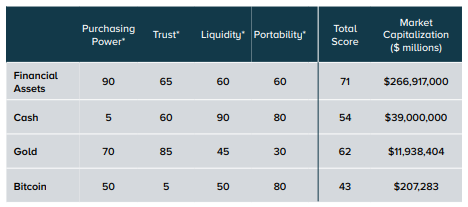

The easiest way to evaluate Bitcoin is to compare it with other value investments. In May 2020, well-known investor Paul Tudor Jones published his comparison of Bitcoin to financial assets, cash and gold:

Figure 3: Paul Tudor Jones Investment Ranking

Even if Bitcoin had the lowest score according to the investor, its market capitalization would have to be much higher. In Jones' own words:

"What surprised me was not that Bitcoin was ranked last, but that it performed so well. Bitcoin had a total score of almost 60% of the total score of financial assets, but has a market capitalization of 1/1200 of that. Bitcoin earned 66% of the value of gold as a store of value but has a market capitalization equal to 1/60th of the outstanding value of gold. Something seems to be wrong here and I suspect it is the price of Bitcoin." - Paul Tudor Jones

So there is much upside potential for Bitcoin if the remaining hurdles such as regulation, trust, adoption, etc. can be overcome.

Supply and demand

Grayscale lists a lot of Bitcoin metrics and explains their meaning, we will limit ourselves to the most important ones here:

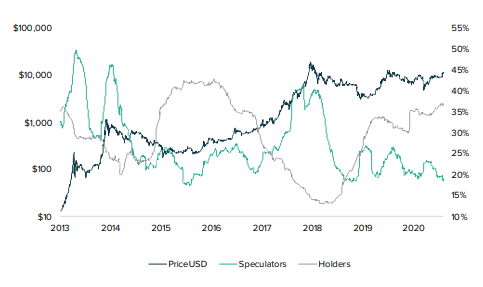

Active Coins

Since the Bitcoin network is completely transparent, a good overview of the market structure is possible. In the following figure, coins that have not been moved for 1-3 years are assigned to "Holders". Coins that have been moved in the last 90 days belong to speculators. An increase in holders means accumulation (bullish indicator) and an increase in speculators means distribution (bearish indicator). Similar to early 2016 (before the historic bull run), the number of holders is currently increasing compared to the relatively few speculators.

Figure 4: Holder vs. Speculators Index

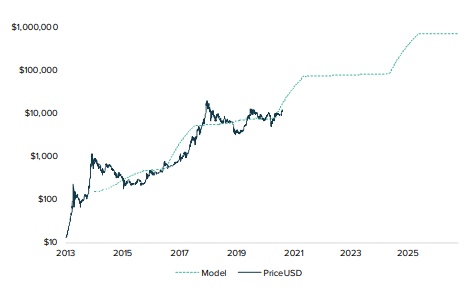

Stock-to-Flow Model

With the stock-to-flow model, investors try to measure the scarcity of goods. It is calculated by dividing the existing quantity by the annual increase in production. Goods with high stock-to-flow values (gold, silver, bitcoin, …) have historically been used as a store of value (or money). The model is also often applied to Bitcoin.

Figure 5: Stock-to-Flow Model

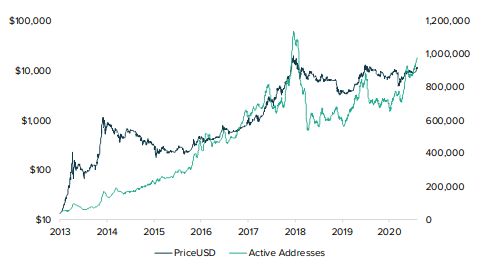

Apart from the fact that Bitcoin services are supported by more and more traditional financial institutions, demand is also growing directly on the Bitcoin block chain. The metric "Daily Active Addresses (DAA)", i.e. the total number of addresses that perform a Bitcoin transaction in one day, can provide an overview of network growth.

Investors typically want to see price growth as a result of increased activity. The next figure shows that the DAA level is at its highest level since the 2017 Bitcoin boom. This could mean that adoption has continued to rise and we are at the beginning of a new market cycle.

Figure 6: Daily active addresses (DAA)

Conclusion of the study

As the demand for value retention is expected to increase during the current monetary expansion, Bitcoin could be well positioned as a limited digital asset. The current economic environment is attracting investors to scarce assets such as Bitcoin and offers a compelling opportunity to embed Bitcoin as part of a resilient portfolio.

Although many people still cannot attribute value to Bitcoin, almost all metrics show a similar market structure to 2016, the year before the historic Bull Run. Bitcoin demand is steadily increasing, while supply cannot be increased. In contrast to 2017, the necessary infrastructure is in place to meet demand.