A summarizing review of what has been happening at the crypto markets. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko.

Altcoins joined the rally last week after China announced its largest stimulus package since the pandemic, boosting risk-on demand. In other news, BNY Mellon has received approval from the US SEC to offer crypto custody. This week, we will explore:

- Bitcoin options volumes

- Altcoins rally post China stimulus

- BTC's growing use case as a treasury asset

Options activity heats up ahead of jam packed Q4

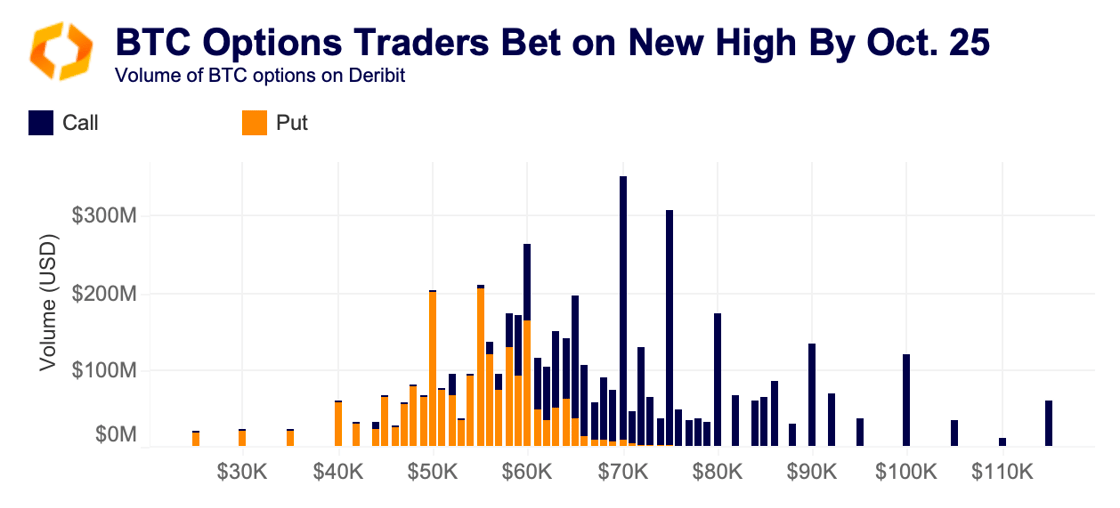

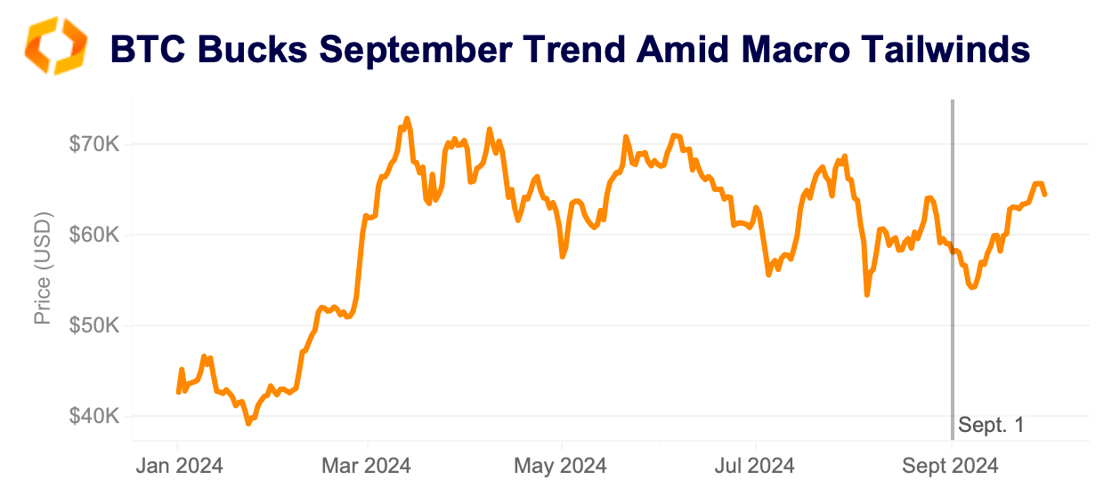

Options volumes have increased over the past few weeks as markets shift to a risk-on mindset. Traders are positioning themselves to capture upside price movements ahead of what is historically BTC's best trading month. BTC's price has only ended October down twice since 2013.

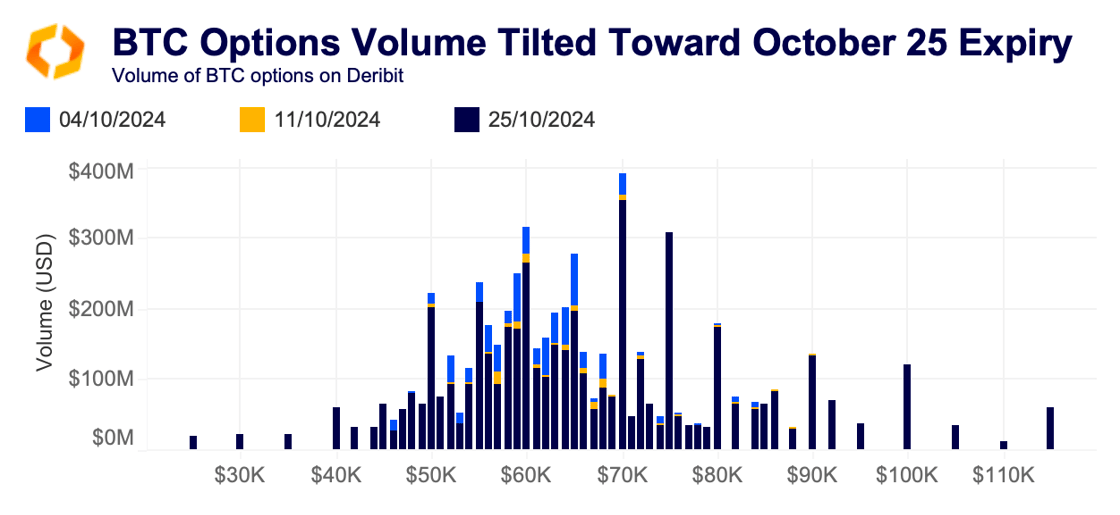

Looking at the three expiries in October, we can see that most of the volume is focused on the BTC options expiring at the end of the month. Typically, the front-month contracts would have more volume and liquidity.

However, several factors make this year different. First, the US central bank began a rate-cutting cycle this month, shifting its monetary policy. The Fed’s jumbo rate cut has already boosted risk-on sentiment. The central bank has signaled two more cuts before the year's end, prompting speculative trades on December 27 contracts with significant volume on strike prices above $100k.

What hasn't shown up in the markets yet is the effect of cheaper dollars and the eventual easing of the Fed's quantitative tightening measures, which removed liquidity. Global liquidity lags the markets, so the effects of the Fed's easing cycle will take longer to appear.

The US election is likely driving increased speculation among traders. Democratic candidate Kamala Harris recently shifted her approach to digital assets, while former President Donald Trump pledged his support months ago. We explored this dynamic in our recent deep dive on implied volatility.

While focusing on election-driven speculation might seem trivial, what’s important is who is making the trades. Spot BTC trade volumes were $10bn in September, double the volume for the same month in 2023. However, volumes fell month-on-month and remain well below the $16bn seen in September 2022. This is all while BTC registered its best ever September in terms of returns. With volumes slow to take off in spot markets, while traders pile into options markets, it suggests this recent rally is driven by more sophisticated traders.

The improved sentiment extends beyond BTC derivatives and spot markets, as we will show in more details below.

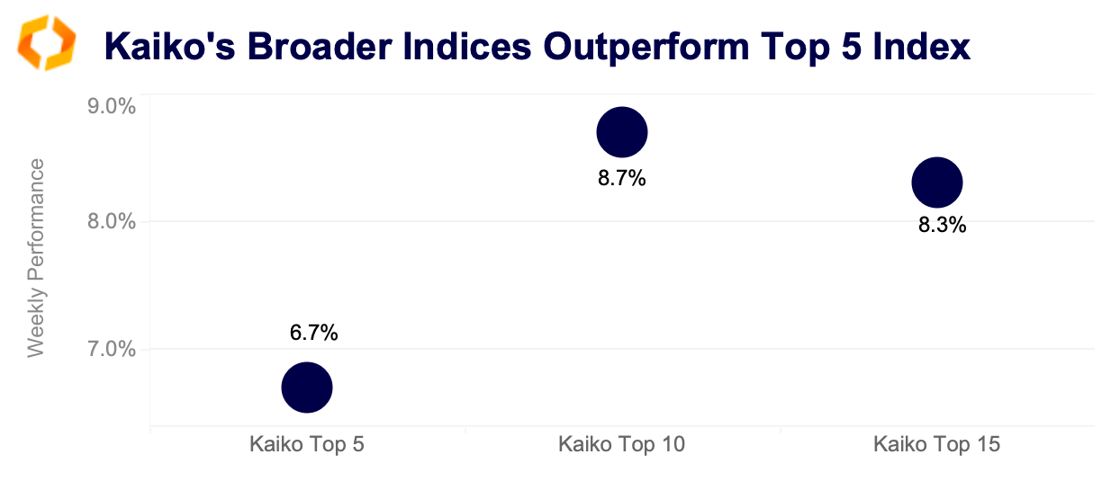

Altcoins perk up following China stimulus

Altcoins have also benefited from the risk-on mood in markets over the past few weeks. As a result, most major altcoins have outperformed BTC and ETH in the past week. This outperformance is reflected in Kaiko's Top 15 market index, which reached its highest point since the end of July over the weekend. While BTC and ETH account for 60% of the weighting in this index, altcoins such as SOL and XRP make up 10% and 9%, respectively.

The remaining 19% of the weighting is spread across the following altcoins: LINK, DOGE, MATIC, ADA, AVAX, LTC, TRX, SHIB, DOT, BCH, and XLM. As a result of altcoins' improved performance, both Kaiko's Top 10 and Top 15 indices outperformed the Top 5 index over the past seven days.

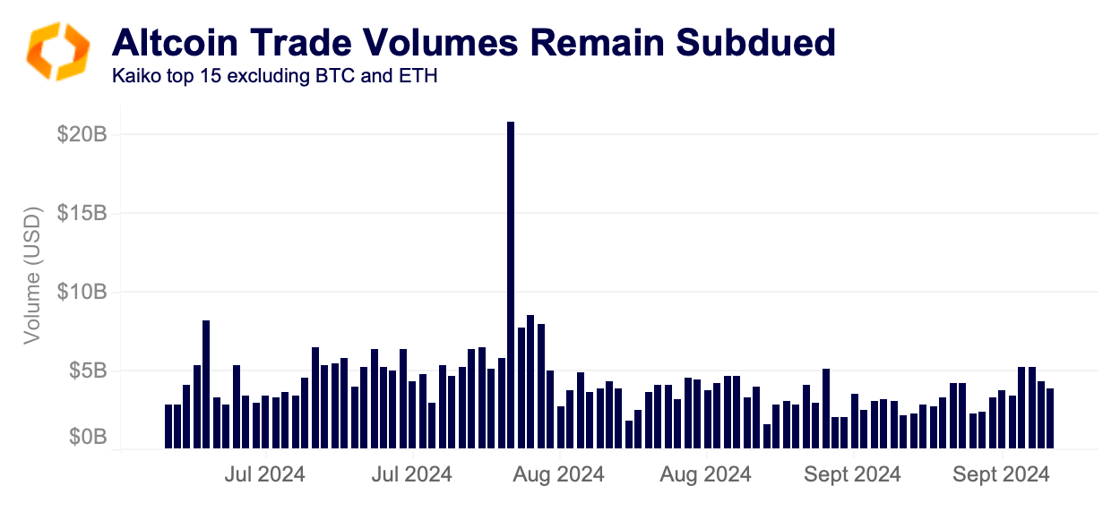

Liquidity for these tokens has yet to improve substantially, despite improving prices and market sentiment. Volumes have been flat. Apart from a spike in August—amid broader market volatility—volumes remain below July levels and well below the yearly highs seen in March.

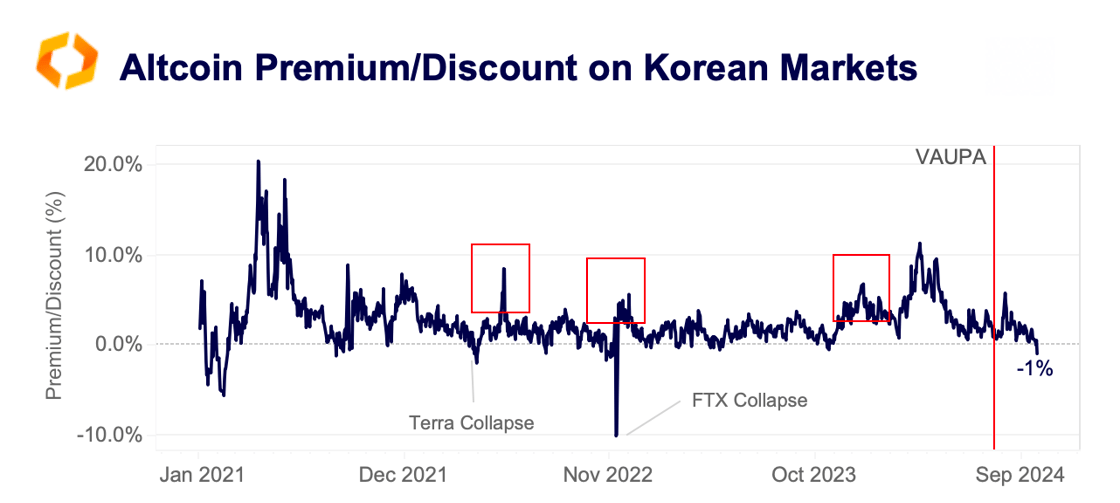

Furthermore, despite last week’s rally, the average altcoin premium on Korean exchanges has flipped into a discount, hitting its lowest level since the FTX collapse. This suggests that Korean traders may have taken profits after two months of declining prices. Historically, such a shift often precedes a surge in buying activity and a spike in premiums. The premium is measured as the percentage difference between altcoin prices in KRW on Korean exchanges and their USD market counterparts.

Korean traders are known for their high-risk tolerance, with the altcoin premium serving as a key indicator of demand for riskier assets. After peaking at 11% in March, the premium has steadily declined due to weakening global risk sentiment and new local crypto regulations. In July, South Korea introduced the Virtual Asset User Protection Act (VAUPA) to safeguard users and prevent unfair practices like insider trading, contributing to a slowdown in speculative trading. Increased demand could also come from Chinese traders following stimulus measures made last week. This could benefit altcoins in the long run, as Chinese traders are known for their high-risk tolerance.

Last week, China announced policy measures aimed at improving consumer confidence and domestic demand. The country’s investment-led growth model, driven by infrastructure and real estate, has faced challenges due to the housing crisis. Other growth drivers, like consumption, have failed to take off due to post-COVID uncertainty and worsening demographics. While past monetary policy measures haven’t reversed this trend, the positive market reaction to this latest round of stimulus shows optimism, as Chinese stocks registered their single best trading day since 2008 on Monday.

Will Bitcoin catch up to gold?

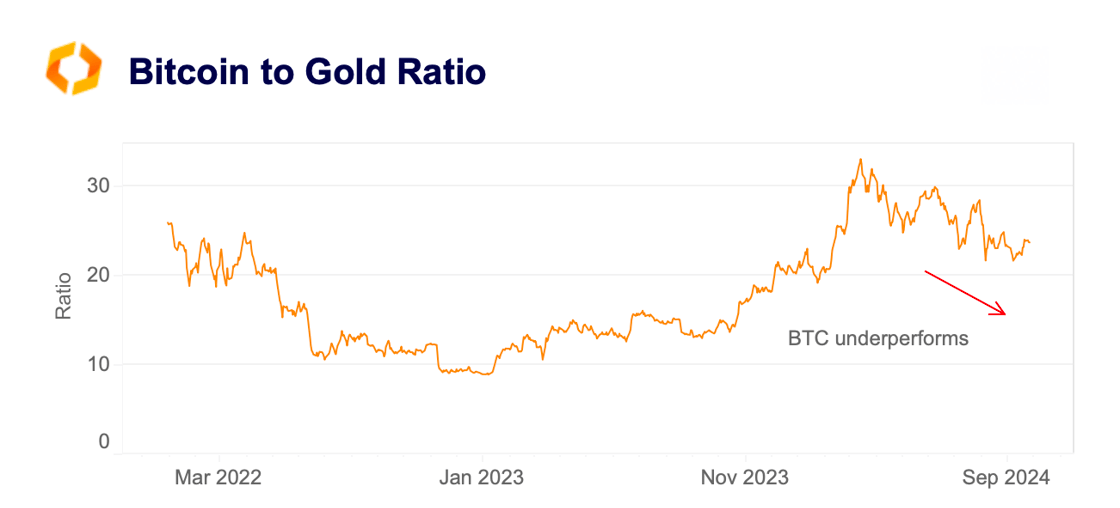

Bitcoin has underperformed gold in recent months, closely mirroring risk assets during the August selloff. The BTC-to-gold ratio has fallen from 33 ounces per BTC in March to 24 by last week. Meanwhile, gold broke all-time records in nominal terms between March and August, driven largely by demand from emerging central banks. This reflects a diversification strategy away from dollar-denominated assets, offering robust support to gold prices despite a high-interest-rate environment, which typically dampens gold's appeal.

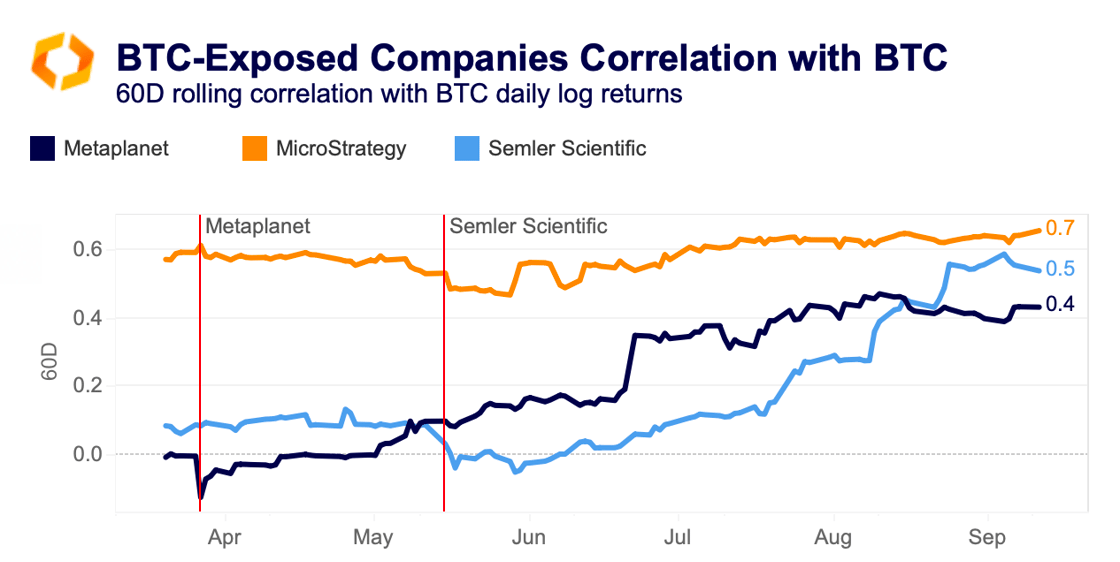

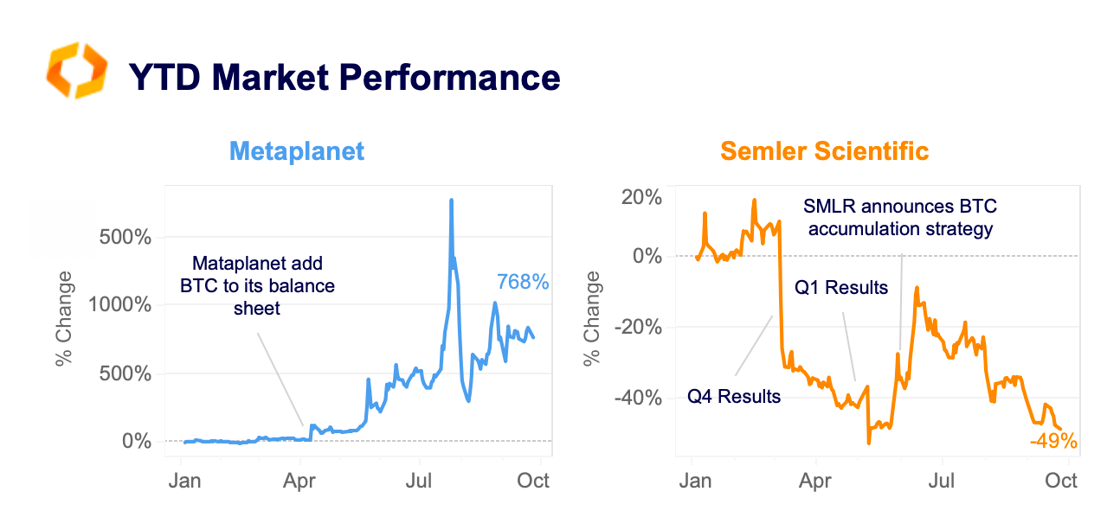

While central banks are far from considering holding Bitcoin due to its volatility, interest in BTC from corporates as a strategic treasury asset has grown. Companies like Japanese investment firm Metaplanet and U.S.-based Semler Scientific followed MicroStrategy’s lead, adding Bitcoin to their treasuries to hedge against global instability. Both firms plan to use debt to fund their BTC purchases. The correlation between BTC and their stock prices has increased since their announcements: Metaplanet's correlation with BTC jumped to 0.4 and Semler's to 0.5, although both remain lower than MicroStrategy's 0.7.

Despite the rising correlation, their price performance has diverged. Metaplanet surged by over 700% YTD, while Semler Scientific's stock dropped by 50%. This suggests that adding Bitcoin to a company's balance sheet is not a guaranteed path to positive stock performance, at least in the short term. Other factors, such as company fundamentals, earnings reports, or sector-specific challenges, continue to play an important role.

This growing interest in BTC as a treasury asset has been mirrored by increased demand from some governments and could represent a new structural bid akin to central banks' demand for gold. Since April, Metaplanet has acquired 38,464 BTC, increasing its holdings during market selloffs, while Semler currently holds 1,012 BTC.