A summarizing review of what has been happening at the crypto markets. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko.

BTC surged above $67K following a massive global IT outage, Joe Biden ended his reelection bid on Sunday night, Indian exchange WazirX halted trading at it experienced a $230 million hack. This week, we'll be exploring:

- Market positioning ahead of the launch of spot ETH ETFs.

- Shifting rate cuts expectations.

- The collapse of the Kimchi Premium.

Will the launch of spot ETH ETF be sell the news event?

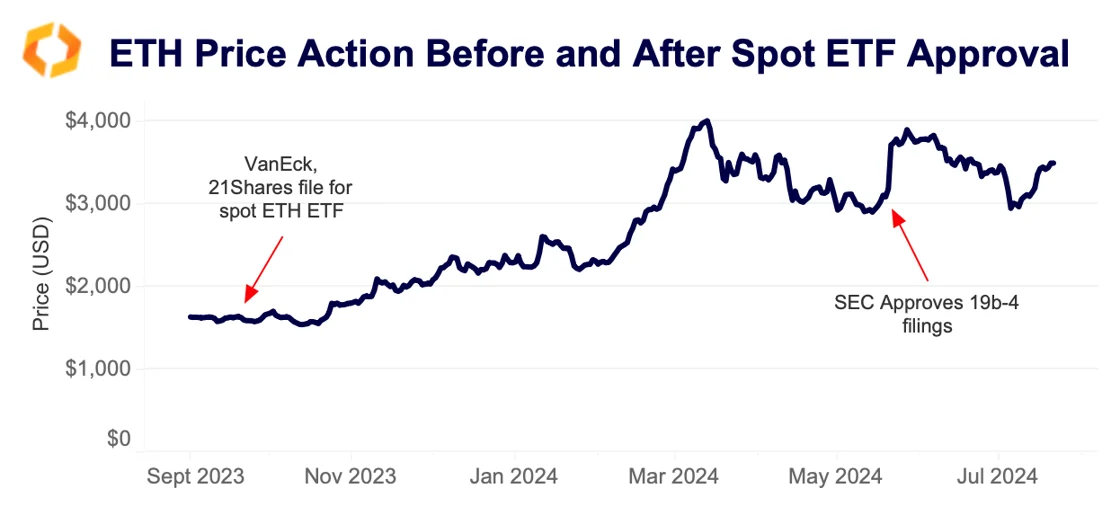

Spot ETH ETFs are slated to launch on July 23, just over two months after the SEC approved a rule change for exchanges to list these funds. ETF issuers have spent the intervening period working out the finer details with the SEC. Last week’s final S-1 filings revealed the fees issuers would charge, which included some surprises.

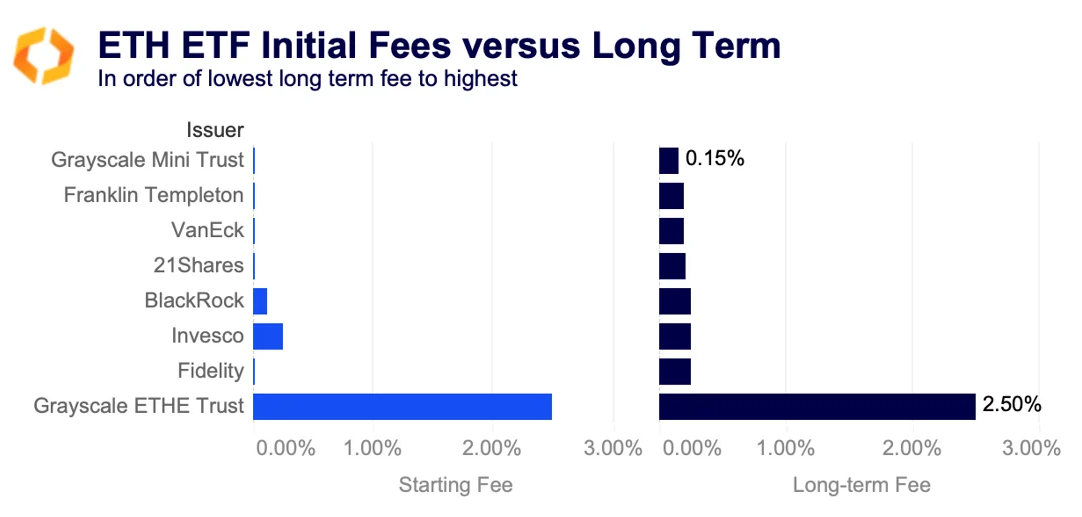

Grayscale will convert its ETHE trust into a spot ETF as well as launching a mini trust which will be seeded with $1bn from the former fund. In a similar fashion to its BTC ETF decision Grayscale kept ETHE’s fee significantly higher than competitors, at 2.5%.

Similar to BTC ETF launches most issuers have opted to launch with fee waivers. The waivers vary from no fees for 6 months to a year or until assets reach between $500mn or $2.5bn. The fee war is an indicator of how competitive the market is. Issuers are operating within tight margins, which might explain Ark Invests decision to withdraw from the ETH ETF race.

Long term Grayscale will simultaneously have the highest fee and lowest fee on the market. The asset manager’s decision to keep its ETHE fee at 2.5% could lead to outflows from the fund, mirroring the performance of GBTC post-conversion to a spot BTC ETF.

ETHE’s discount to net asset value closed over the past few weeks, after widening between February and May as hopes of approval waned. The narrowing discount suggests traders bought ETHE below par and will redeem these shares at NAV price on conversion to realize profits.

Other than potential outflows from Grayscale’s ETHE, the outlook for spot ETH ETFs is less clear. Previous launches might shed some light on initial demand.

Will Cai, head of indices at Kaiko, said: "The launch of the futures based ETH ETFs in the US late last year was met with underwhelming demand, all eyes are on the spot ETFs' launch with high hopes on quick asset accumulation. Although a full demand picture may not emerge for several months, ETH price could be sensitive to inflow numbers of the first days."

ETH trended lower after briefly spiking in May following 19b-4 approval. It previously tested levels around $4,000 in March as BTC hit record highs.

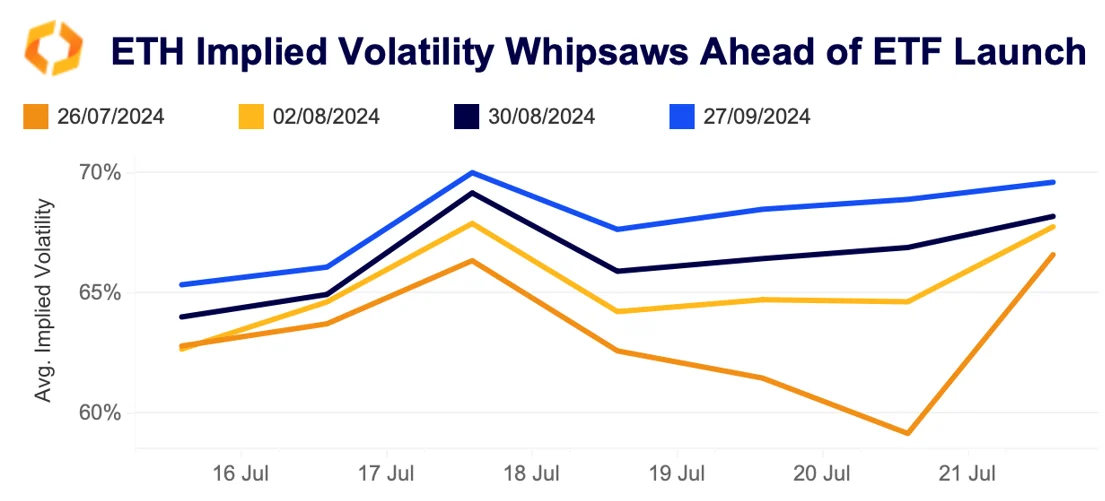

ETH implied volatility spiked over the weekend. The nearest contract to expiry, July 26, shot up from 59% to 67%. Again this suggests less conviction around the ETH launch, as traders are willing to pay higher premiums to hedge bets.

This was prior to US President Joe Biden withdrawing from the election so the spike is likely tied to ETH ETF launches tomorrow and not political uncertainty. IV on contracts expiring in August all remain above 65%, while September 27 is at 70%.

Korean exchanges' volumes dip ahead of key regulation

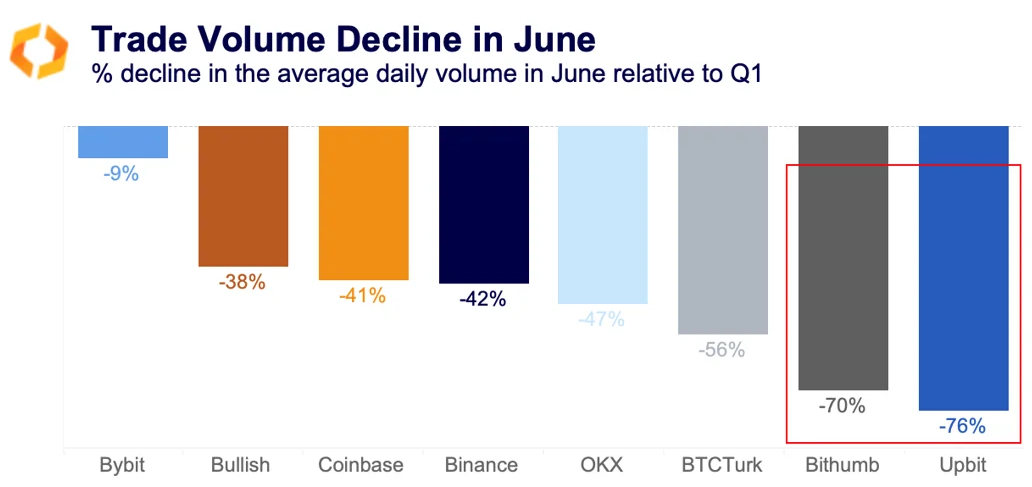

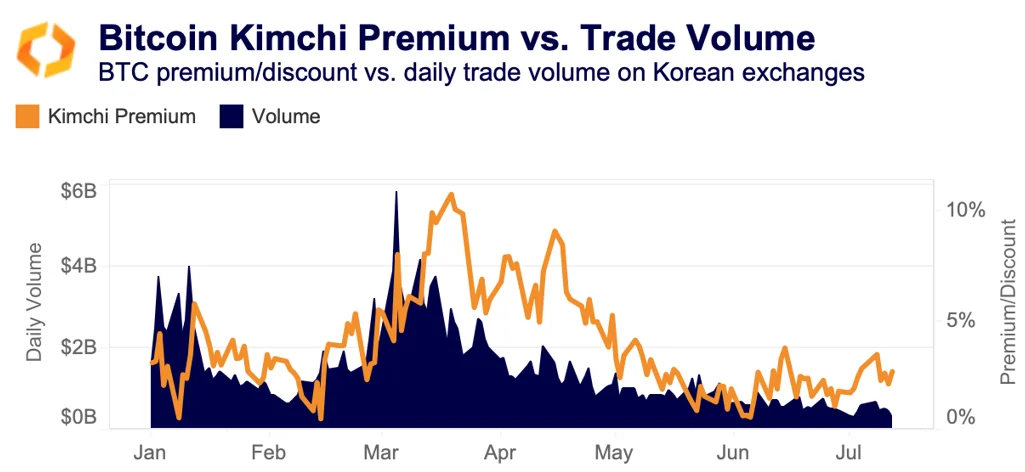

Korean exchanges experienced a more significant drop in trade volume than other platforms in June amid souring risk sentiment. The average daily volume on Upbit fell to $890 million, a whopping 76% decrease compared to Q1. Bithumb also reported a 70% decline in volumes. In comparison, Coinbase's volume dropped by 40%, Bullish experienced a 38% decrease, while Bybit performed the best, with an average daily volume decline of only 8%.

One factor contributing to the sharp decline in trade volumes on Upbit and Bithumb is the recent implementation of the Virtual Asset User Protection Act and raising concerns about potential mass delisting. This has been mirrored by a sharp drop in the Bitcoin Kimchi Premium - the price difference between BTC on Korean and global markets. The premium hit a multi-year high of 14% in March before collapsing to just 3% in July, suggesting demand has cooled off significantly.

Competition in the Korean market has intensified in recent months, with both Bithumb and Upbit aggressively listing new assets. Bithumb volume hit an all-time high back in January after launching a five-month zero-fee campaign between October 2023 and February 2024. The exchange managed to retain some of its gains post-promotion with its market share rising to 30% in June, up from just 11% a year ago.

Is institutional demand rising in July?

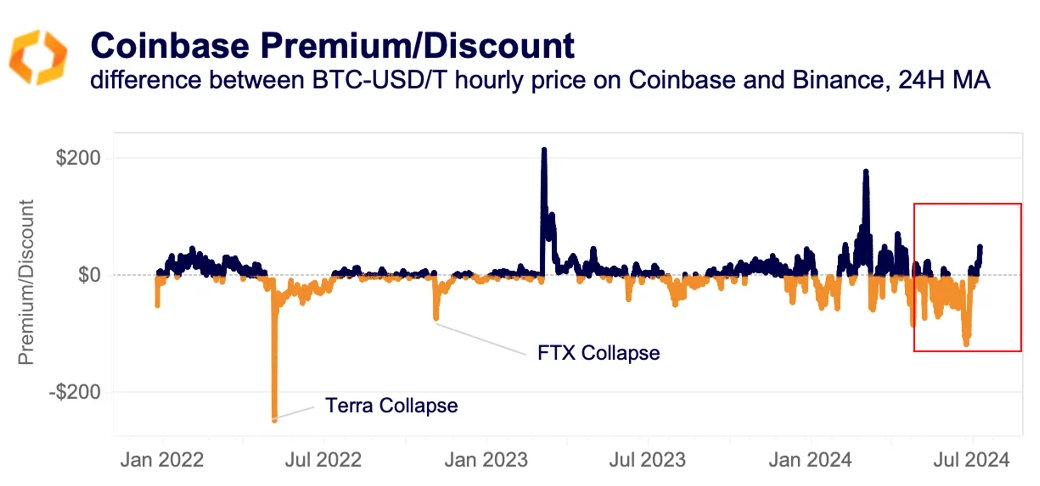

The Coinbase premium, defined as the difference between hourly Bitcoin prices on Coinbase’s BTC-USD pair and Binance’s BTC-USDT pair, turned positive in early July after hitting its lowest level since the collapse of Terra in 2022 at the end of June.

This metric is sometimes seen as a gauge of institutional sentiment because institutional trading volume accounts for over 80% of trading activity on Coinbase, while Binance has a strong retail reputation.

The Coinbase premium has historically moved in tandem with major market events, such as the collapses of Terra and FTX. These events led to a significant decrease in institutional demand for Bitcoin, causing the premium to turn into a discount.

However, the recent rise in the Coinbase premium may have been exaggerated by the increased volatility of Tether's USDT. This volatility coincided with the implementation of the European Union's Markets in Crypto-Assets Regulation (MiCA), which enforced strict requirements for stablecoin issuers.

Tether, which currently does not comply with these regulations, faced restrictions for European Economic Area (EEA) users by major cryptocurrency exchanges. As a result, at the end of June, USDT lost its peg to the USD. Although it managed to recover by early July on most exchanges, it continued to struggle on less liquid exchanges, such as Binance.US.

Shifting rate cuts expectations

Rate cut expectations have dramatically improved over the past four weeks. The US monthly inflation rate fell in June for the first time since the pandemic in 2020. This encouraging data has been reflected in improved interest rate cut expectations.

Markets are now pricing in a near 92% probability that the central bank cuts rates 25 basis points at its September meeting.

This marks an increase from June and could be a potential tailwind for BTC, as risk assets generally perform better when interest rates are lower. In low interest rate environments investors are more incentivised to search for higher returns, which leads to inflows into risky assets, like BTC.

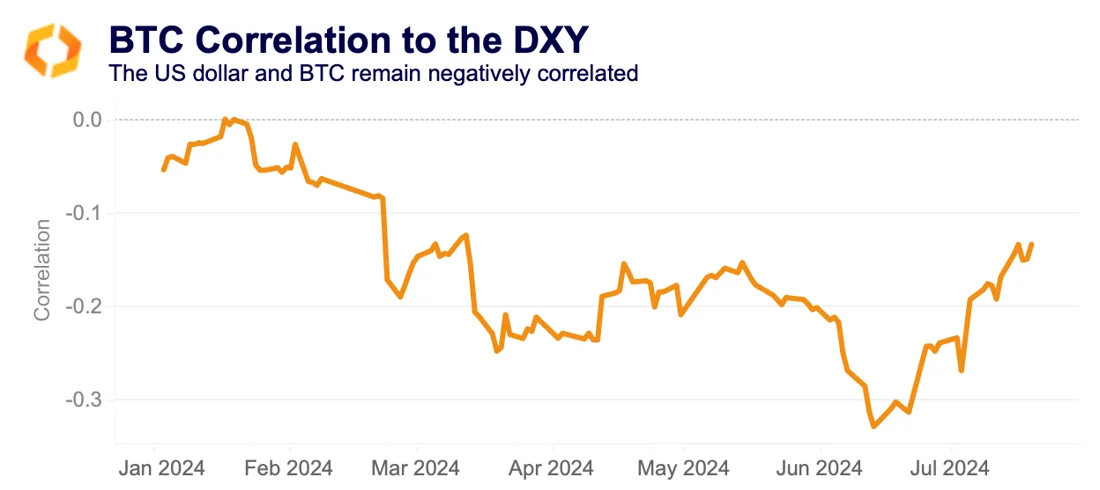

Another benefit of lower interest rates is a weaker dollar. BTC and the US dollar have an negatively correlation, meaning they move in opposing directions to one another. The dollar index has fallen 1.34% over the past month, as rate cuts were priced in. BTC climbed over 5% as the DXY fell.

While it has been historically negative, this correlation could shift should former President Donald Trump gain traction, as he is widely perceived as a pro-crypto candidate.

Competitions heats up among US exchanges

The crypto exchange landscape in the US has been going through its own shift over the past year. This has led to the emergence of new competitors, as crypto exchange Bullish commands more market share and even challenges Coinbase on some assets.

When it comes to BTC and ETH trading Bullish now has comparable trade volumes to Coinbase. The relatively newer exchange has even eclipsed Coinbase BTC and ETH volumes at times this year.

Bullish, which was launched at the peak of the last bull market in 2021, has seen consistently high trading volumes for BTC and ETH over the past year. The exchange gained market share after market makers fled Binance.US in June of last year amid regulatory scrutiny.