A summarizing review of what has been happening at the crypto markets. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko.

January 10th marks the final day that the SEC can take a decision on Ark's spot ETF and no matter the outcome, there will likely be more volatility. BTC was one of the only crypto assets to close the week up after a dramatic price crash that triggered hundreds of millions of liquidations. This week we explore:

- What happened in the days before Wednesday's crash

- Solana's rapidly growing market share

- The state of Paypal's PYUSD stablecoin

What caused last week's crypto crash?

Bitcoin – and the rest of the market – suffered a flash crash last week, with some blaming the pullback on an analyst's report speculating that a spot ETF would be denied. However, in the days before the flush, the market had showed signs of wobbling.

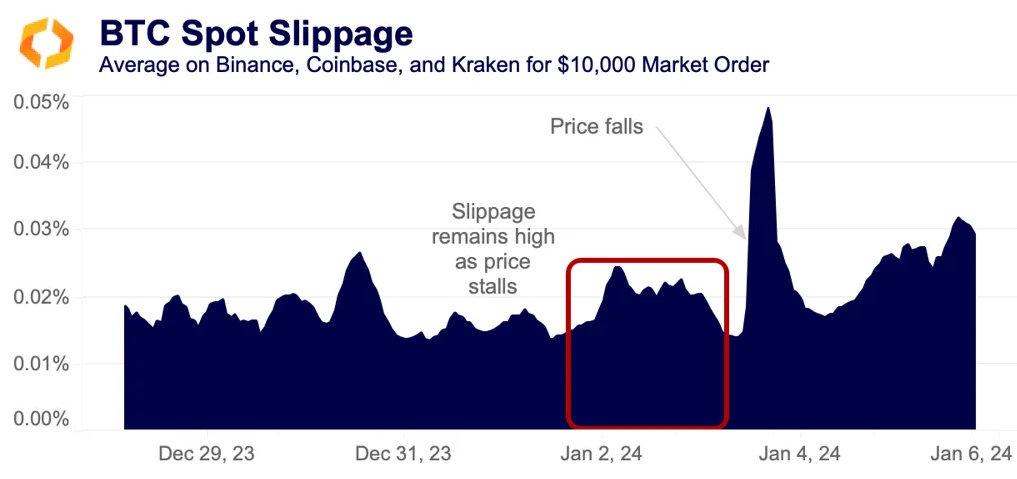

One of the lesser known indicators is price slippage: the difference between the expected price at the time of a market order and the price at which the order actually executes. Our chart shows the average slippage for a hypothetical $10,000 market order on Binance, Coinbase, and Kraken.

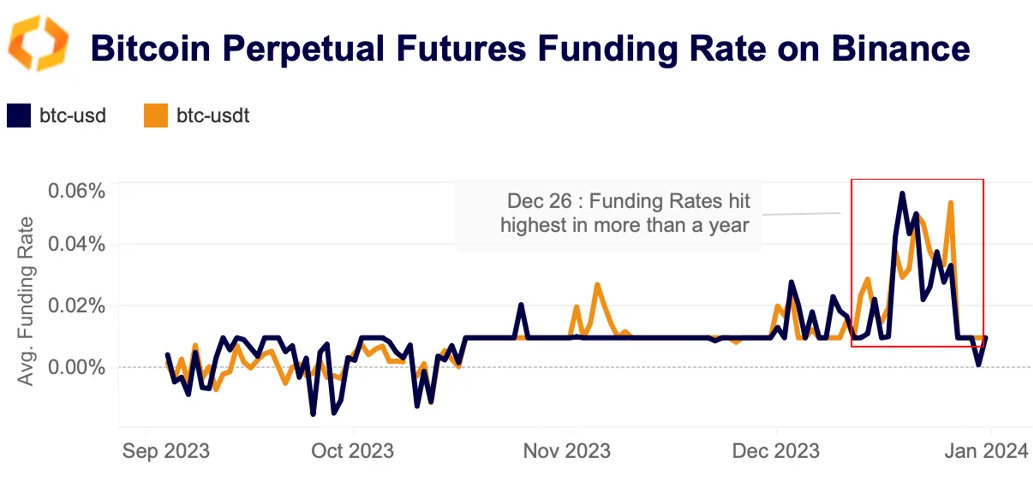

In the days leading up to the sell-off, slippage rose and fell, as is normal. However, on January 2, it rose above 0.02% and remained there for over a day, suggesting that liquidity had deteriorated even as price stalled in the $45k range. Futures markets also showed signs of overheating, with virtually all perpetual futures on Binance running hot with elevated funding rates.

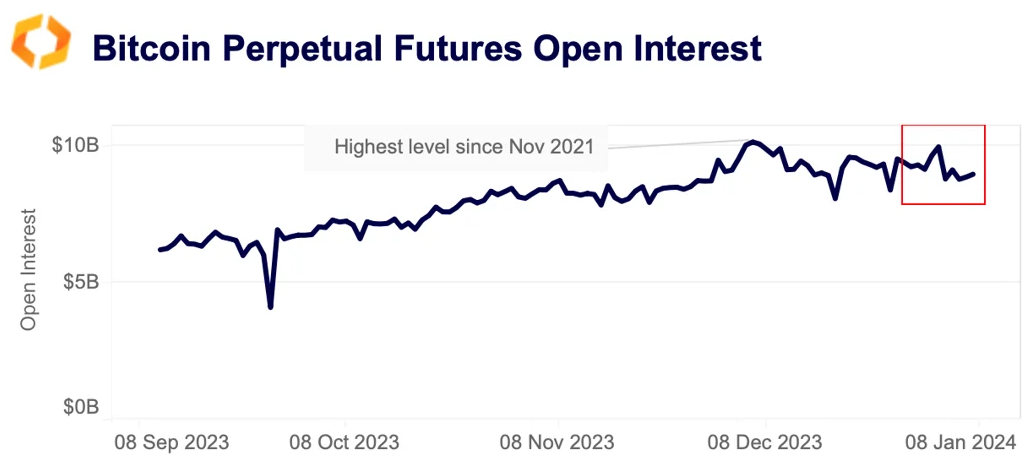

BTC perpetual futures open interest in USD terms hit $10bn in early December, its highest level since November 2021.

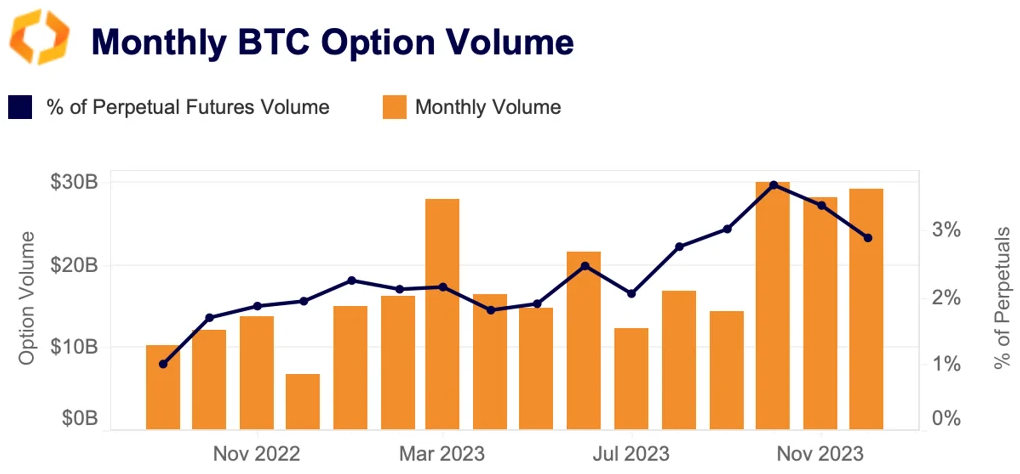

Options markets also saw high volumes as traders anticipated volatility ahead of a spot ETF decision. Monthly BTC options volume on Deribit had been hovering around a multi-year high of $30bn since October.

While the BTC option market remains small, with option volumes accounting for just 3-4% of perpetual futures trade volumes, this will likely change as more sophisticated traders enter the space. Last week one of the largest BTC miners -- CleanSparks --reported plans to open an in-house option trading desk.

Overall, there were subtle signs that crypto markets were over-heating in the run up to last week's sell-of. The volatility will likely continue until the ETF decision.

SOL market share endures as rally cools

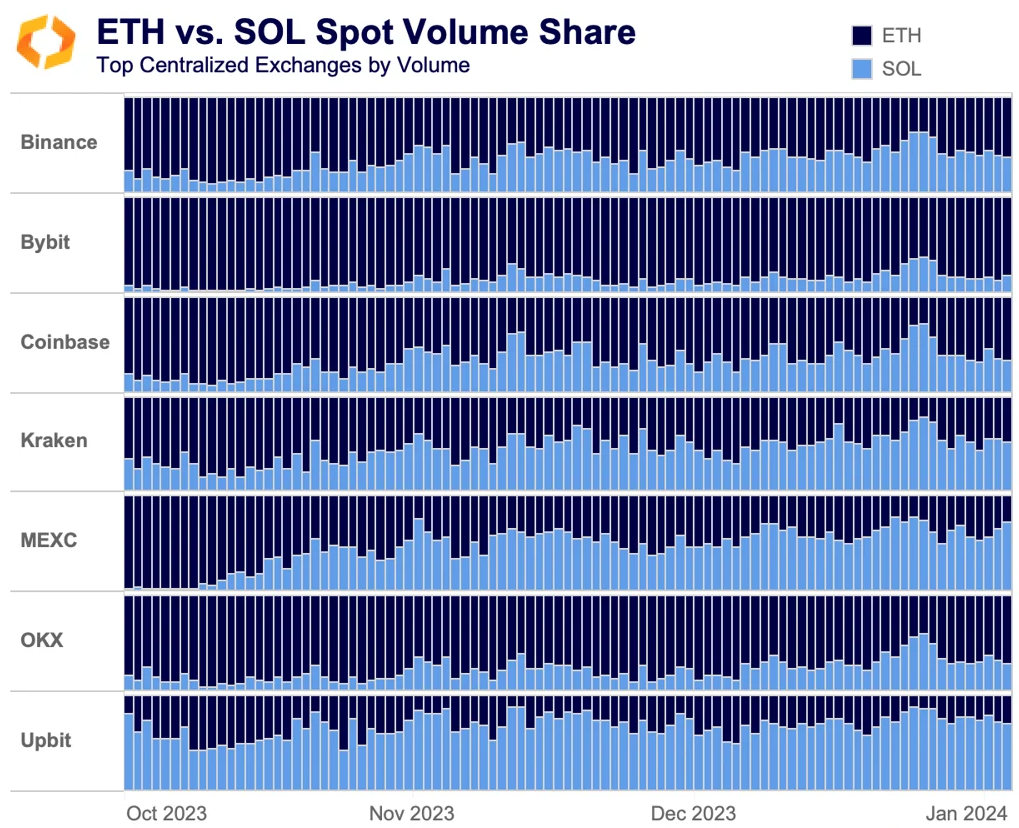

The days surrounding Christmas brought a virtually unprecedented event: an altcoin’s volume surpassing the combined volume of BTC and ETH on multiple exchanges. This altcoin was, of course, Solana (SOL), which has rallied to levels not seen since Terra’s collapse. While this phenomenon was short-lived on most exchanges, possibly the more striking trend is SOL’s volume relative to ETH alone.

On most exchanges, especially the largest ones, ETH has been the unquestioned #2 in volume. However, starting back in November, we saw SOL volume start to flip ETH volume on MEXC and Upbit, though this isn’t uncommon for the latter. ETH’s share relative to SOL surged on Kraken at this time, from under 15% to a high of 70% in November; on Coinbase the figures jumped from 8% to a high of 63%. Binance reached a high of just over 50% in December.

While this may have seemed to be a flash in the pan, this trend has continued, and in some cases strengthened. In the new year, SOL has done more volume than ETH a majority of the days on MEXC, Upbit, and Kraken.

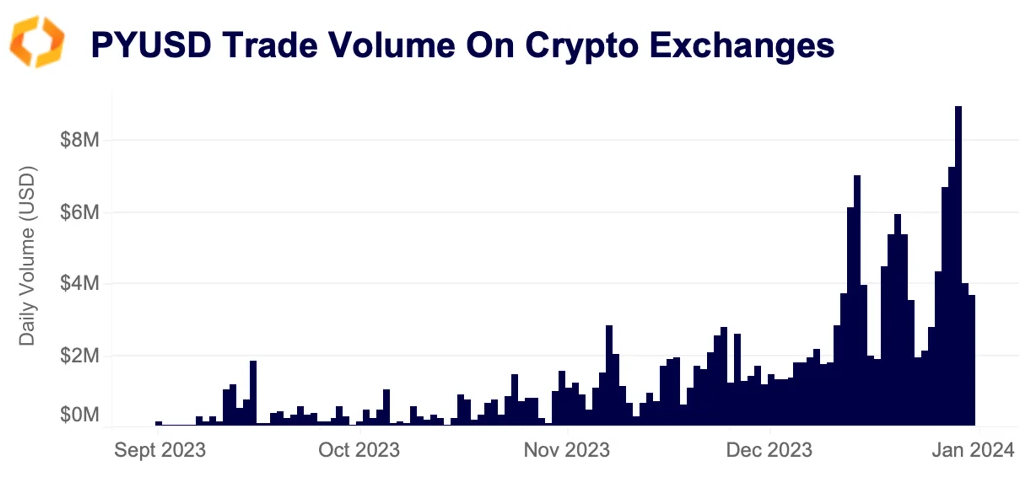

PYUSD trade volume is off to a slow start

Back in August, Paypal became the first major payments provider to launch a dollar-backed stablecoin. PYUSD is marketed as a stablecoin to be used in payments and within the Paypal app, thus having a slightly different use case compared to more crypto-native coins like USDT or DAI.

However, PYUSD is listed on several centralized crypto exchanges, which suggests Paypal would also like the coin to be used for crypto trading activities. Paypal does not provide market data, so it is impossible to know the volume of transactions done using PYUSD within Paypal or for payments.

We can track its volume on crypto exchanges, though, and can see that across 7 exchanges that list the coin, volume has remained relatively low. Trade volume hit a high of ~$9mn at the end of December, which is an increase from September, but relative to a stablecoin like Tether, next to nothing.

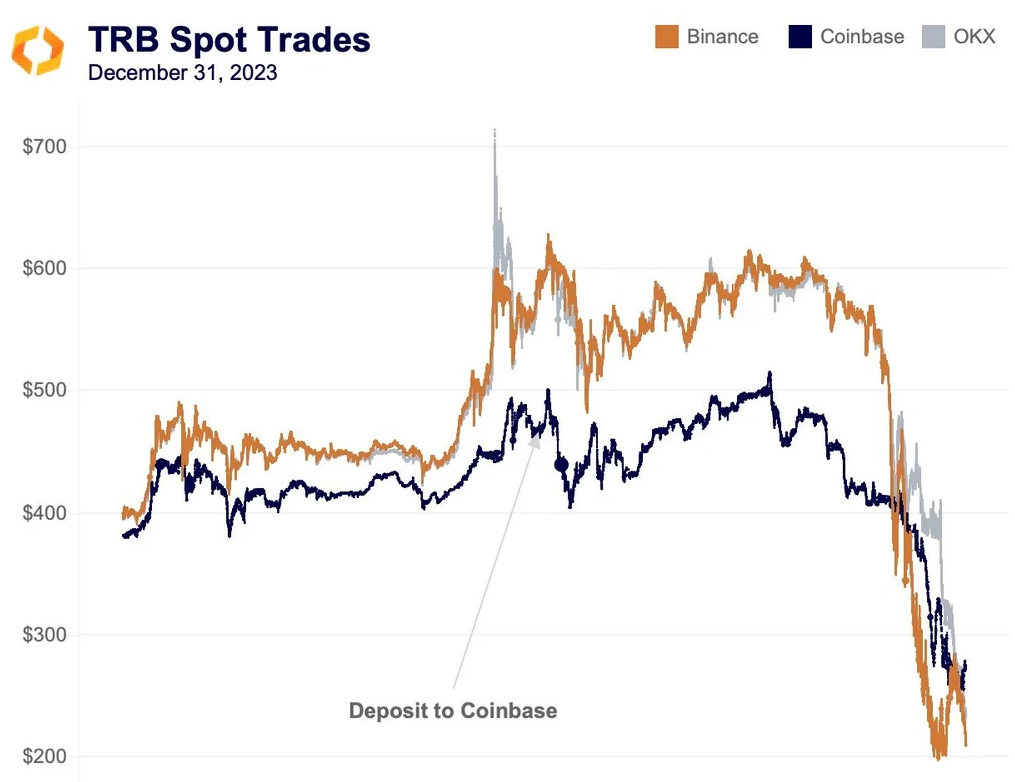

Tellor’s wild ride ends in a crash

Previously under-the-radar oracle project Tellor (TRB) was thrust into the spotlight on New Year’s Eve as its price exploded to nearly $600 before dropping back to $150 in the span of just two hours. Much like other rallying tokens over the holidays, TRB began to show significant price dislocations across exchanges after days of aggressive spot buying.

As the rally peaked, Coinbase showed $500, while Binance showed $625 and OKX over $700. In the hours leading up to the peak, open interest in native units fell from 725k to 450k and funding rate turned sharply negative, suggesting that long traders were quickly closing their positions.

To add to the drama, a wallet linked to the Tellor team deposited millions of dollars worth of TRB tokens to Coinbase just before price crashed. However, cumulative volume delta shows that the selling leading to its crash started minutes earlier on Binance than on Coinbase, as is shown with Binance’s rapid drop just before 11pm UTC.

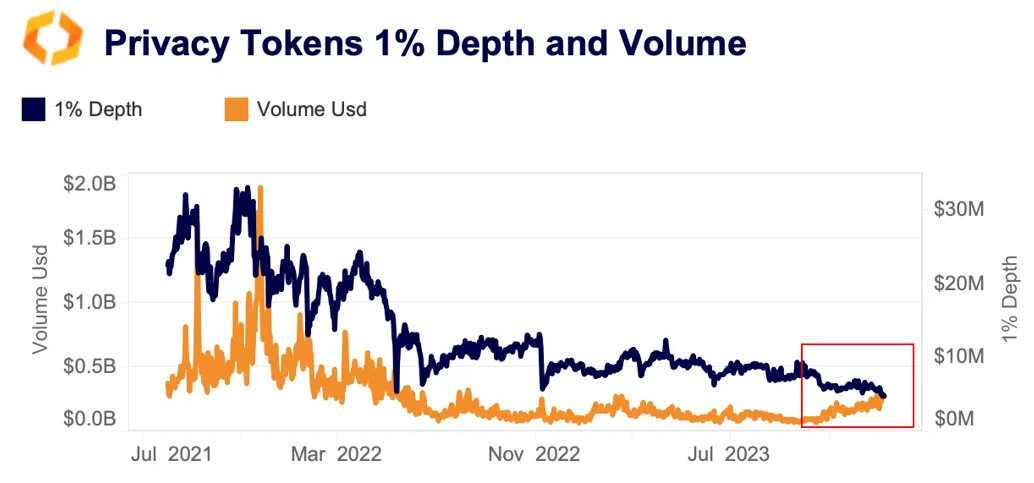

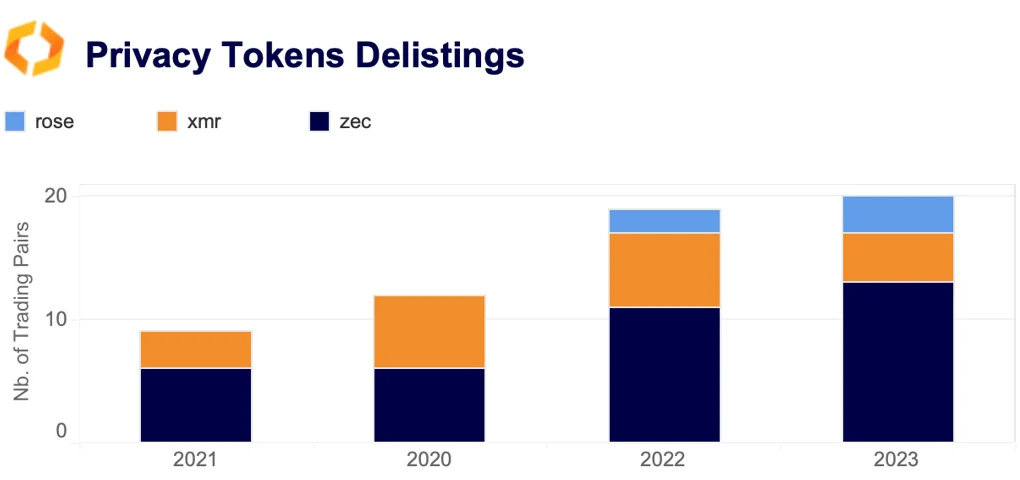

Privacy token liquidity hits all-time low

Privacy token liquidity — as measured by 1% market depth — for Monero (XMR), Zcash (ZEC), DASH and ROSE hit an all-time low of just $5mn last week after OKX delisted several trading pairs for failing to meet listing criteria. While trade volumes gradually increased since October, they are still well below their 2021 levels.

Over the past two years, privacy tokens, which are designed to obscure transaction details, have increasingly been delisted by major platforms due to regulatory pressure. This has helped to exacerbate the decline in liquidity during the crypto bear market. Both XMR and ZEC are currently at risk of being delisted on Binance.

ZEC has been the most delisted privacy token over the past two years. This has lead to a greater fragmentation of the market, with XMR dominating on large exchanges, while ZEC and DASH are mostly traded on smaller, unregulated venues.

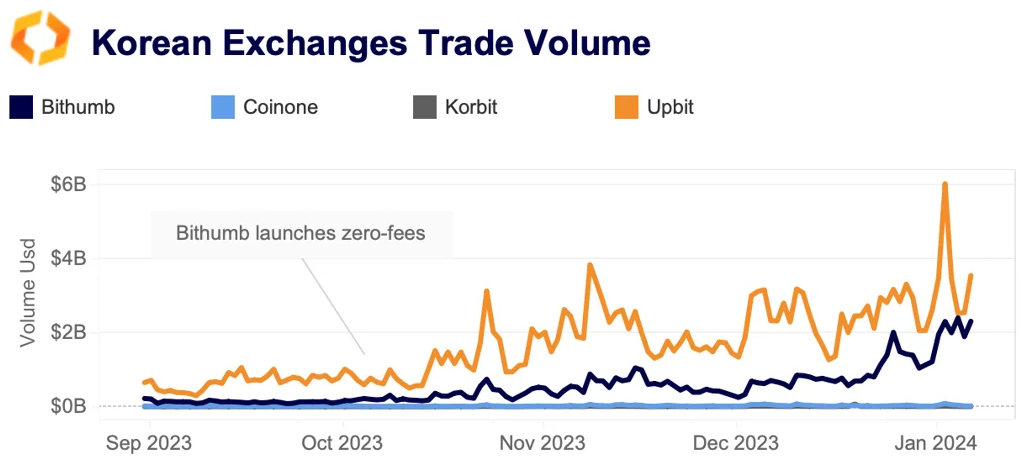

Korean exchange trade volume hits multi-year high

Trade volume on Korean exchanges hit its highest level since March 2022 during last week’s selloff. Interestingly, while altcoins typically account for more than 80% of trade volume on Korean markets, their share dropped to less than 70% last week while BTC's rose to 32% for the first time since 2020.

Bithumb and Upbit both gained market share, with Bithumb's briefly spiking to 48%. The exchange launched a zero-fee promotion back in October, though its initial impact has been muted, with volumes starting to increase markedly only at the end of December.

During the recent rally, the Korean won (KRW) has been dominating in crypto-to-fiat trading, surpassing the US Dollar as the largest fiat trading pair in crypto. It accounted for 40-50% of fiat transaction volume compared to 30-40% for USD. The last time the KRW dominance was this high was during the 2021 bull run.

The recent recovery comes while South Korea’s financial regulator is ramping up its efforts to regulate the crypto industry, proposing new rules to protect users on crypto exchanges and to ban crypto purchases with credit cards.