Bitcoin USD daily basis

Bitcoin USD Chart Analysis - Another test of the 30,000 support zone

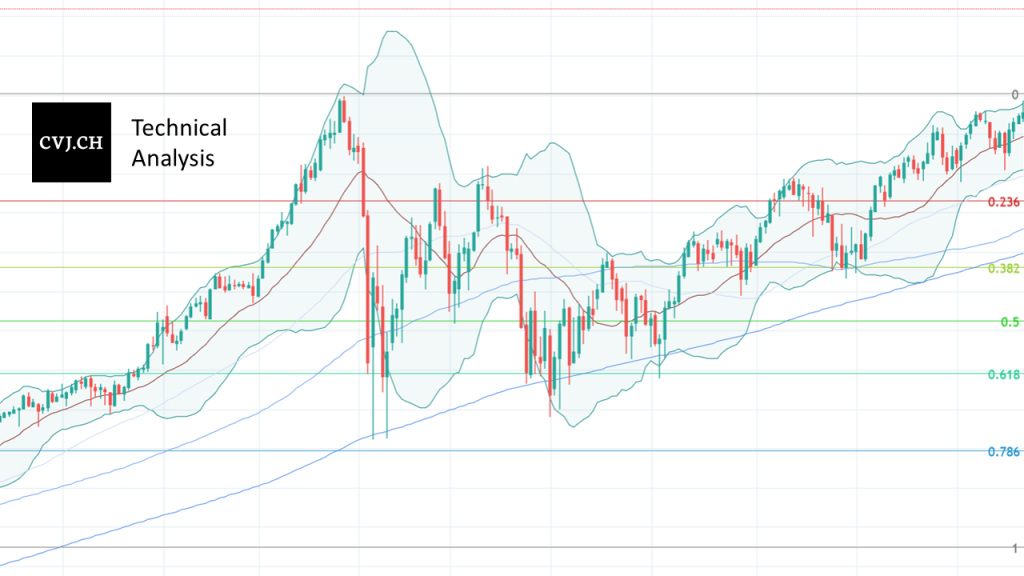

At the beginning of the reporting week, Bitcoin continued the trend of continuously lower daily closing prices, which could be observed from the middle of the previous week. Accordingly, the price once again approached the often visited 30,000 support zone. Monday started right away with the biggest price drop of the week, taking Bitcoin to 31,450 USD at the end of the day. This was followed by another decline on Tuesday, which took Bitcoin to new lows last seen at the end of January at 8,800 USD on the day’s low. As observed more often in recent times, no sustained selling pressure emerged, despite the new lows, and a significantly higher daily closing price of 32,538 USD already took place. Accordingly, on Wednesday and on Thursday, a recovery occurred, which led back to 34,654 USD. On Friday, a decreasing momentum of the positive trend of the previous days was observed and thus in the course of trading, a price loss of almost 10% led back to 31,508 USD. Although the 30,000 mark was tested again on Saturday, a recovery occurred at the weekend, with which Bitcoin was ultimately able to close the week at the level of 33,000 USD.

"Range Trading in the 30'000 - 40'000 USD Range

Review Daily Interval

After the price drop in mid-March 2020, a veritable countermovement established itself. This led to the resistance zones above 10,000 USD. After an initial rejection, and a consolidation phase lasting almost two months, a breakout through the fundamental resistance zone followed on July 27, which had been established since August 2019 and had already caused Bitcoin to fail several times to date.

The resistance zone around 10,000 USD was interesting in several respects. On the one hand, the 0.618 Fibonacci point of the entire downward movement, which was initiated at the end of June 2019 just below 14,000 USD, is located here. On the other hand, the zone around 10,000 USD simultaneously acted as a confirmation of the still bearish trend from lower highs since December 2017 (see macro view on a weekly basis). Bitcoin was able to establish itself above the newly created support in the 10,000 USD area since the end of July 2020, and provided a first confirmation of a trend reversal with the break of the resistance zone around 12,200 USD towards the end of October 2020. In the following weeks, the positive trend accentuated, and led Bitcoin through the 14,000 resistance in early November 2020 and close to the then all-time highs around 20,000 USD for the first time in early December, which remained untouched for 158 weeks since the bull market in 2017.

Since the breakout through the important 14,000 resistance at the beginning of November, it has been blow by blow. The breakout through the old all-time high at 20,000 USD saw a strong accentuation of the uptrend, which saw the Bitcoin price mark its new all-time high just below 65,000 USD on April 14. The rapid upward movement was so far characterized by 3 corrections, each of which found its low point around the 50-day average (light blue line). However, the fourth correction led clearly below it for the first time, and thus it also came to a violation of the trend line, which has served as support since the beginning of the year, formed by the respective daily lows. In recent weeks, this resulted in an accelerated downward trend, which led below important support zones. As a result, the price consolidated in the corridor 30,000 - 40,000 USD.

Outlook

After the recent price decline, the Bitcoin price is consolidating in the range of 30,000 – 40,000 USD. The price action is now taking place below the 50-day average as well as the 200-day average. The latter has not been undercut since April 2020. The bullish structure is battered, but not yet completely broken. The 30,000 zone remains interesting, which served as the bottom of the current sell-off for the time being. This area also represents the 0.618 Fibonacci point between the start of the rapid uptrend since late October and the all-time high of mid-April.

Although Bitcoin was able to break a series of lower highs that had lasted for 24 days recently, the subsequent countermovement failed again at the resistance zone above 40,000 USD. This resistance area, consisting of historical price action from January as well as the 200-day average, serves as a competent indication of a return of bullish momentum. Currently, the selling pressure near the 30,000 USD zone is limited. A break of the trend line of the lower daily highs formed since May is seen as a first indication of a return of the bulls, while a renewed undershooting of the 30,000 USD area makes a visit to the old all-time high of 20,000 USD seem likely.

Notable cracks in the fundamentals

Review Weekly Interval

Bitcoin was able to set a higher high above 10,000 USD for the first time in the weekly interval in 2020, which broke the prevailing bearish trend since December 2017. This broke the series of lower highs that lasted for 135 weeks (1).

Since this first overcoming of the bearish trend, the signs for a valid trend reversal became stronger. With the push through important resistance zones, and a continuous development above the 21-week average (2), the probabilities for a renewed reaching of the all-time high created in 2017/18 increased visibly. This was accomplished in mid-December 2020. This was followed by a strongly accentuated price discovery above this historical mark, which produced a new all-time high of 65,000 USD in mid-April. A consolidation initiated since then ended in a veritable price slide, which brought Bitcoin back to the 30,000 USD mark in just two weeks.

Outlook

With the price movements in the past year, a good foundation was created to sustainably climb new spheres beyond the all-time highs reached in 2017. The break of the 20,000 USD mark impressively demonstrated the strength of the upward movement that had been established since October. The rapid price increase was now abruptly interrupted with a price drop, which even brought Bitcoin below the 21-week average (2) that has defined reliable bull or bear market phases in the past.

It remains to be seen how sustainable the current sell-off wave will be. Bitcoin had equally experienced setbacks of >50% in bull phases in the past. Depending on the point from which one calculates the Fibonacci retracements (start bull market - ATH 65k or breakout old ATH 20k - ATH 65k), we are currently in the interesting zone 0.5 or 0.618. A recapture of the 21-week average is necessary over the next few weeks for a positive picture and would also mean a break of the historical resistances from 48,000 USD. Setbacks to lower levels carry the risk of a forming shoulder-head-shoulder formation, which should be viewed negatively.

Disclaimer

All information in this publication is provided for general information purposes only. The information provided in this publication does not constitute investment advice and is not intended as such. This publication does not constitute and is not intended as an offer, recommendation or solicitation to invest in any financial instrument, including cryptocurrencies and the like. The contents contained in the publication represent the personal opinions of the respective authors and are not suitable or intended as a basis for decision-making.

Risk notice

Investing in cryptocurrencies, is fundamentally associated with risk. The total loss of the invested capital cannot be excluded. Cryptocurrencies are very volatile and can therefore be exposed to extreme price fluctuations in a short period of time.