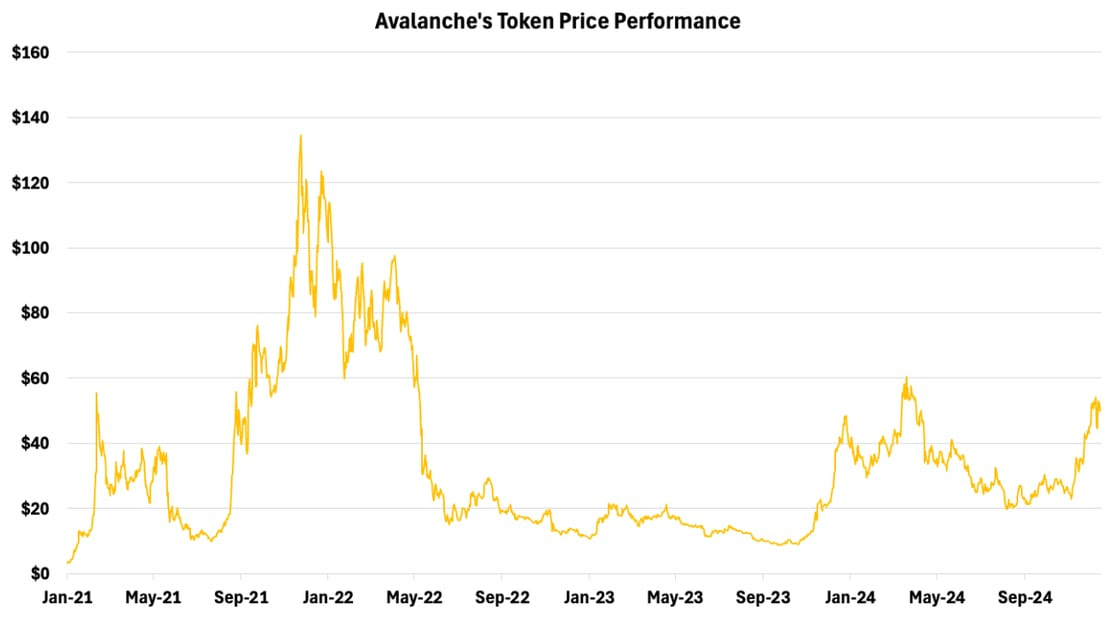

The prices of many smart contract platforms – existing and new – have reached all-time highs in this ongoing bull run. That said, one lagging platform is undergoing a crucial upgrade that just redefined the game, promising unmatched scalability, cost-efficiency, and decentralization: Avalanche.

From dramatically lowering validator costs to enabling fully sovereign L1 blockchains, is Avalanche’s new upgrade too good to be true? Let’s break down the blockchain that supports a host of decentralized applications.

What is Avalanche?

Avalanche is a leading smart contract platform, 6th by market cap. It sets itself apart by leveraging a multi-chain architecture that allows it to push the limits of its scalability. These consist of:

- C-Chain: Handles smart contracts (EVM-compatible).

- P-Chain: Manages staking and validator coordination.

- X-Chain: Processes asset transfers.

Through this architecture, Avalanche manages its unique subnet model, allowing for building permissionless/permissioned customizable blockchains that are ultimately connected to a broader public network. Subnets are customizable networks within Avalanche that can operate independently while benefiting from the security and scalability of the main chain. This makes Avalanche ideal for institutions launching specialized business-focused networks.

For instance, Evergreen Subnets on Avalanche are specialized blockchain networks tailored for institutional and enterprise use cases. These subnets provide a controlled, private environment where organizations can explore blockchain technology while adhering to compliance, operational, and security requirements. In November 2023, JP Morgan partnered with Apollo Global to run its own proof-of-concept Evergreen Subnet on Avalanche, Kinexys (previously Onyx) offering forex transactions to serve its expanding list of global clients, with users growing 1000% year-over-year. Moreover, Spruce, another Evergreen Subnet, has also attracted other major TradFi players, including T. Rowe Price Associates, WisdomTree, Wellington Management, and Cumberland.

Avalanche's versatility, subnets and EVM compatibility

Avalanche also supports a broader range of industries, from Deloitte’s federal disaster reimbursement platform—designed to improve claim speed and transparency—to gaming subnets like GUNZ, which had its first impressive game called Off the Grid, driving the creation of 10 million player wallets in just 30 days.

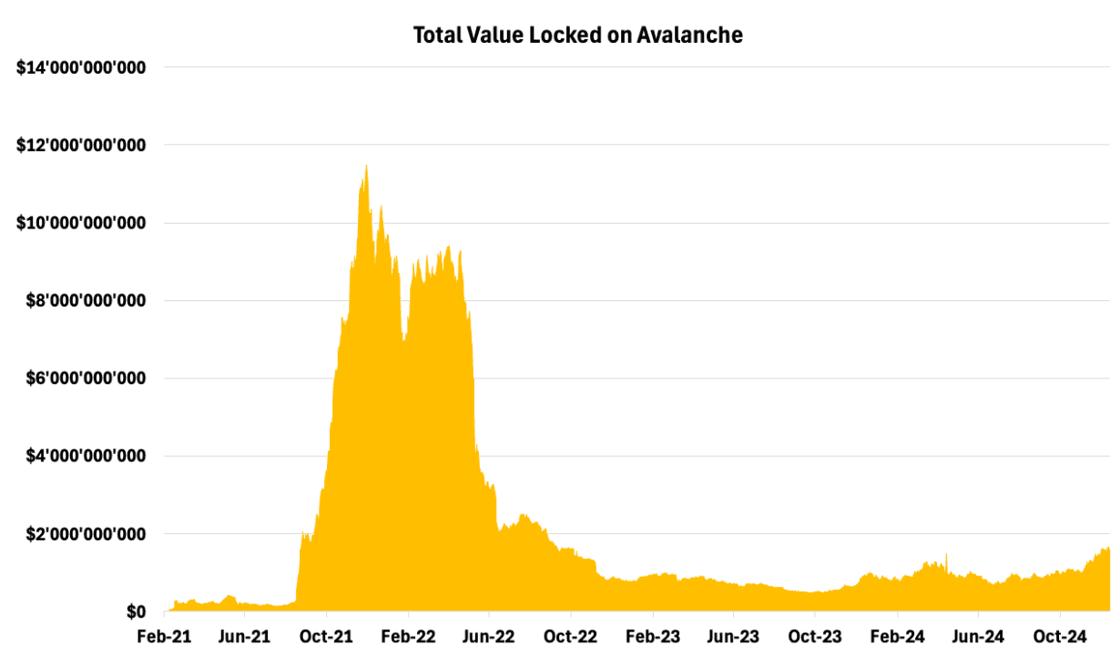

All in all, the subnets’ environment facilitates native interoperability between all the networks that end up building on Avalanche, yielding a seamless blockchain experience. However, Avalanche’s compatibility with Ethereum, enabling 100% of its smart-contract transactions via the EVM-powered C-Chain, has equally driven the growth of its diverse ecosystem. This trajectory helped Avalanche cement itself as the 10th largest blockchain by total value locked (TVL) at $1.6B, reflecting strong user engagement and confidence in its stability.

What is AVAX used for?

Avalanche’s native asset is used as a medium of exchange to transact across the network. For example, AVAX is used to secure the ecosystem through staking and for paying transaction fees. Also used as a governance token, the amount of AVAX staked by a node directly correlates to its voting power in network decisions.

What makes Avalanche stand out from other platforms offering similar architecture? Full Customizability over the following - a list:

1. The Nature of the Network

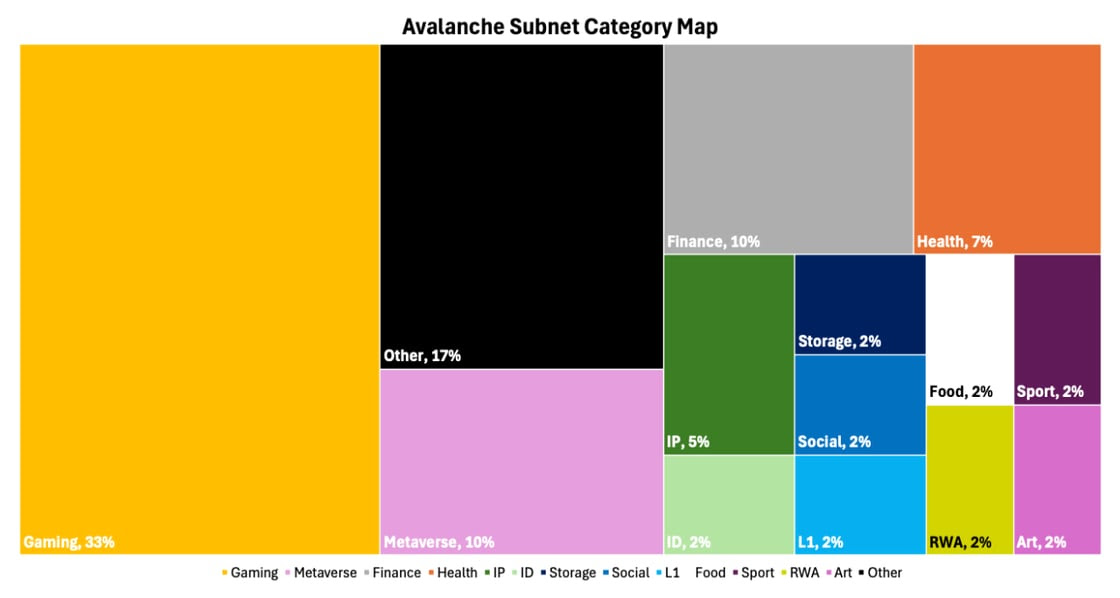

Blockchain plug-n-play frameworks on Layer 2s like Arbitrum's Orbit or Optimism's OpStack, and Layer 0 networks like (Polkadot, Cosmos) oblige businesses to build public networks interconnected with the main chain. Avalanche's subnet architecture, however, offers a unique balance of privacy and interoperability. It allows companies to create either private or public blockchains anchored to the Avalanche P-Chain, catering to strict confidentiality needs while enabling selective interaction with other chains, if desired. This flexibility has fostered a diverse ecosystem of nearly 150 subnets, including 42 highly active ones across various sectors, as shown below.

2. Customizability over Governance, Security Model, and Operating System (VM)

Subnets offer unparalleled flexibility, allowing businesses to tailor their governance approaches and security models to match their unique decision-making processes and operational needs. This adaptability means a gaming application can implement different security measures compared to a financial platform managing billions in assets, as both have disparate expectations for their security guarantees. Furthermore, companies can choose between leveraging Avalanche's high-performance Avalanche Virtual Machine (AVM) or implementing custom VMs, enabling a wide array of application environments.

3. Compliance-Centric

Avalanche subnets excel in regulatory compliance, particularly for financial applications, by integrating KYC and AML processes at the network level. They also allow for native implementation of compliance features like geofencing and whitelisting. The subnets' ability to create isolated, permissioned environments that meet specific regulatory requirements while leveraging blockchain benefits has fostered a diverse range of experiments on Avalanche, extending beyond the tokenization-focused projects common in Ethereum and Solana ecosystems.

Why AVAX underperformed the rest of the L1 verticals despite superior offering

The blockchain landscape in 2024 evolved significantly, with attention shifting from established Layer 1 networks like Avalanche to emerging "Solana killers" such as Sui, Aptos, and TON. These newcomers gained traction through innovative approaches and focusing on user-friendly experiences:

- Capitalizing on the unparalleled power of distribution of Telegram, TON leveraged the messaging app's 900M user base to build a WeChat-like super app that combines mini-apps, crypto payments, and decentralized services directly from the same interface.

- Sui and Aptos utilized the Move programming language, achieving theoretical throughput exceeding 120K transactions per second. Not only does it push the limits of scalability, but also improves developer safety, mitigating vulnerabilities inherent in earlier blockchain programming languages.

2024 also witnessed the rise of Rollup-as-a-Service (RaaS) providers like Gelato, Conduit, and AltLayer, simplifying L2 deployment on networks such as Arbitrum and Optimism. The Dencun upgrade made L2 transactions cost-competitive with alternative L1s. However, L2 proliferation led to fragmented liquidity and ecosystem saturation, potentially driving users back to unified blockchain ecosystems with consolidated infrastructure. This shift could benefit established networks like Avalanche, especially with its new upgrade.

So, what does Avalanche’s on-chain health look like?

Avalanche's evolution mirrors Ethereum's recent scaling journey, shifting from a monolithic to a distributed approach. Avalanche's subnets, like Ethereum's L2s, allow high-demand applications to operate on separate chains, reducing main chain congestion. While this fosters innovation and scalability, it potentially dilutes economic benefits flowing back to the primary chains, highlighting a common challenge in blockchain scaling: balancing ecosystem growth with maintaining the foundational layer's relevance and economic vitality.

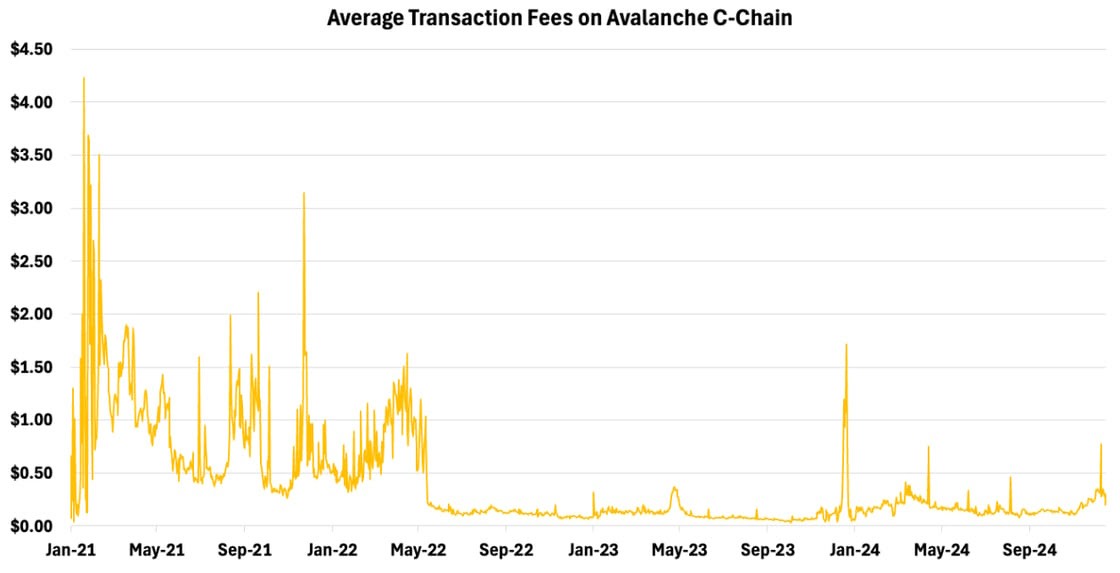

As shown below, the substantial drop in gas fees on the main Avalanche network highlights the evolving dynamics of the Avalanche ecosystem.

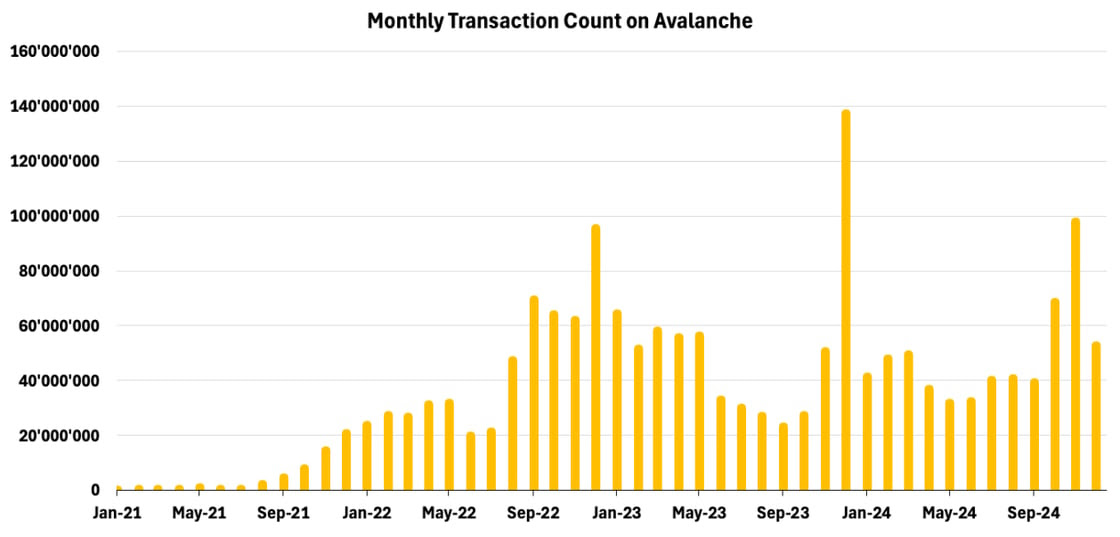

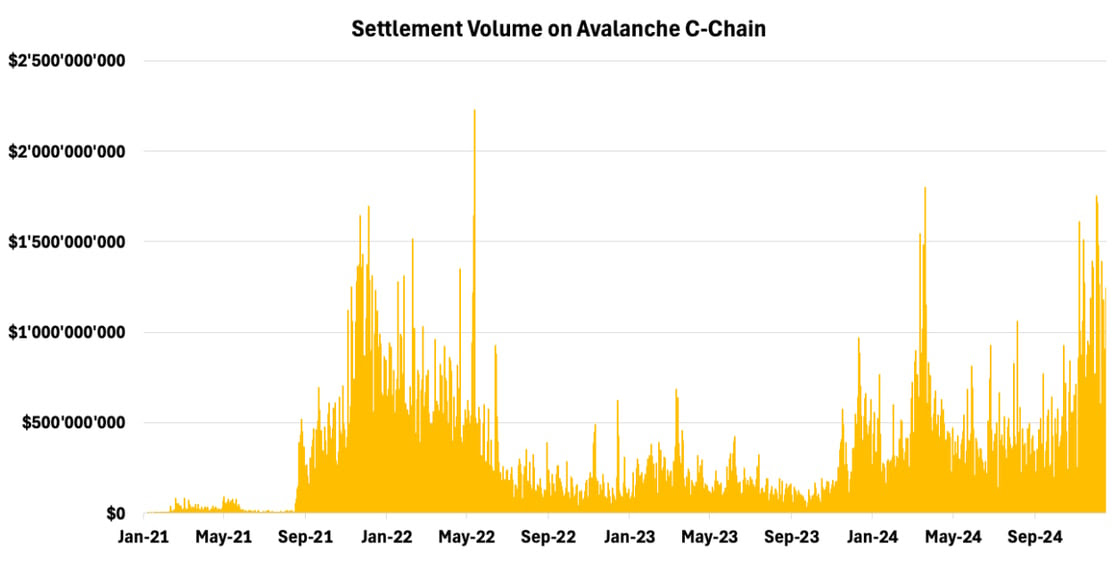

Despite declining direct revenue from C-Chain interactions, Avalanche's ecosystem continues to thrive through the proliferation of subnets, which contribute to its economy. A more telling indicator of Avalanche's growing influence is the surge in daily transactions, reaching the third highest monthly amount in its history, due to its role as the ultimate settlement layer for its subnet ecosystem—much like Ethereum's position as a settlement network relative to its Layer 2 solutions execution layer.

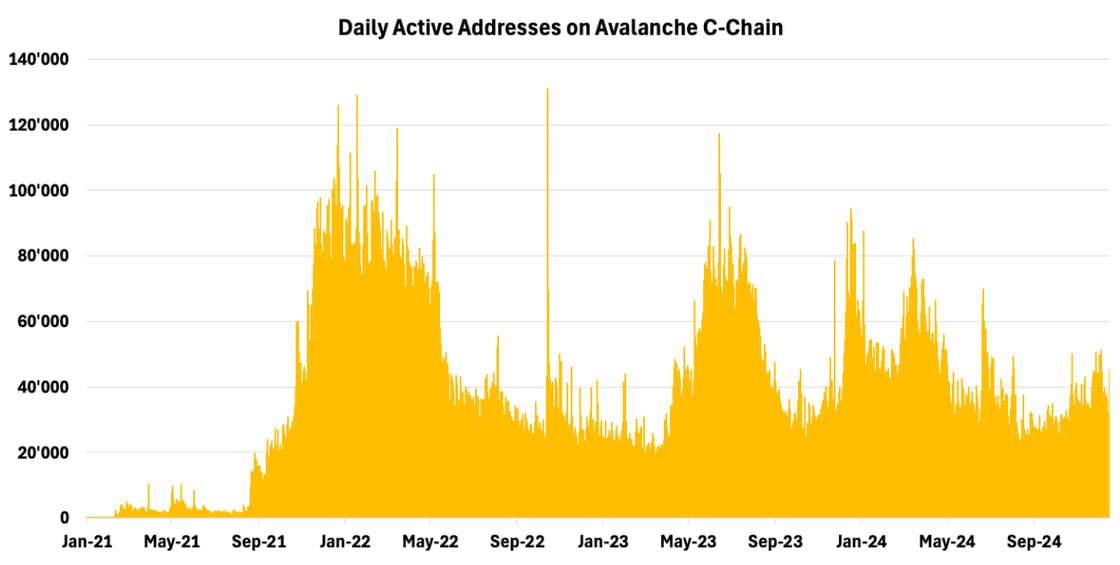

Avalanche's C-Chain user count

While Avalanche's total user count on the C-Chain remains below its 2021 peak, as depicted below, this metric doesn't fully reflect the network's utilization. In fact, the ecosystem's 150 subnets contribute an additional 100K daily active users on average, bringing the total daily active user count across the entire Avalanche ecosystem to at least over 150K.

As echoed, despite declining users, Avalanche is experiencing a consolidation of economic activity, as evidenced by the increasing value of settlements on the main network. This trend suggests that certain decentralized applications have successfully identified their product-market fit, laying the groundwork for a potential resurgence in user engagement and adoption. One proxy could be the arrival of Blackrock’s tokenized money market fund BUIDL and Franklin and Templeton’s $420M Franklin OnChain U.S. Government Money Fund represented by its token BENJI on Avalanche’s mainnet.

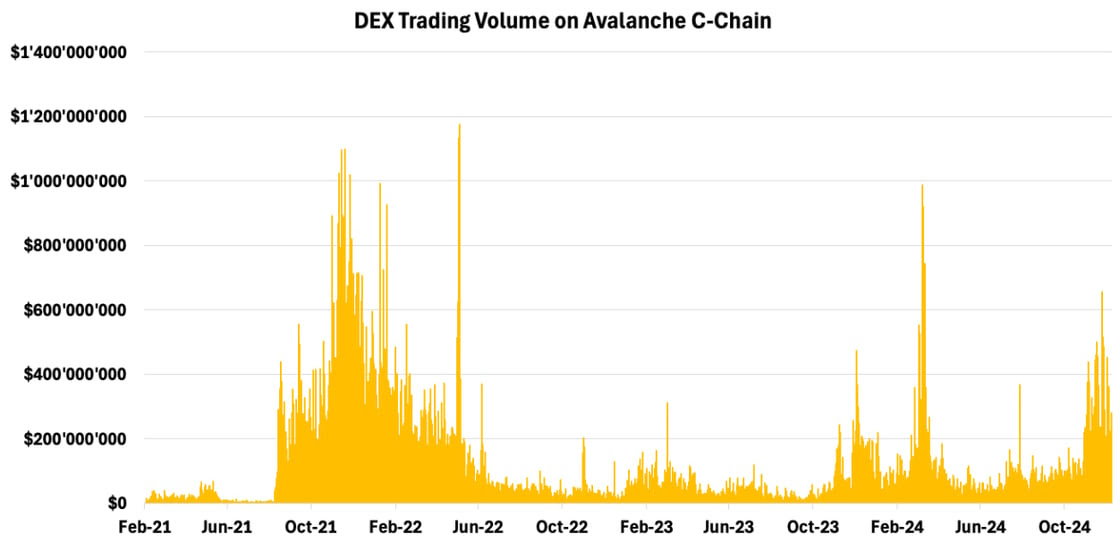

Increasing trading volumes

As illustrated in Figure 8, Avalanche's DeFi activity has declined since its 2021 peak, with Solana and Ethereum L2s capturing more retail activity driven by the memecoin speculation. However, Avalanche is poised for a resurgence due to the upcoming 9000 upgrade, which will reduce transaction costs and make it cheaper to operate DeFi-focused chains. This should all help reinvigorate Avalanche's DeFi ecosystem.

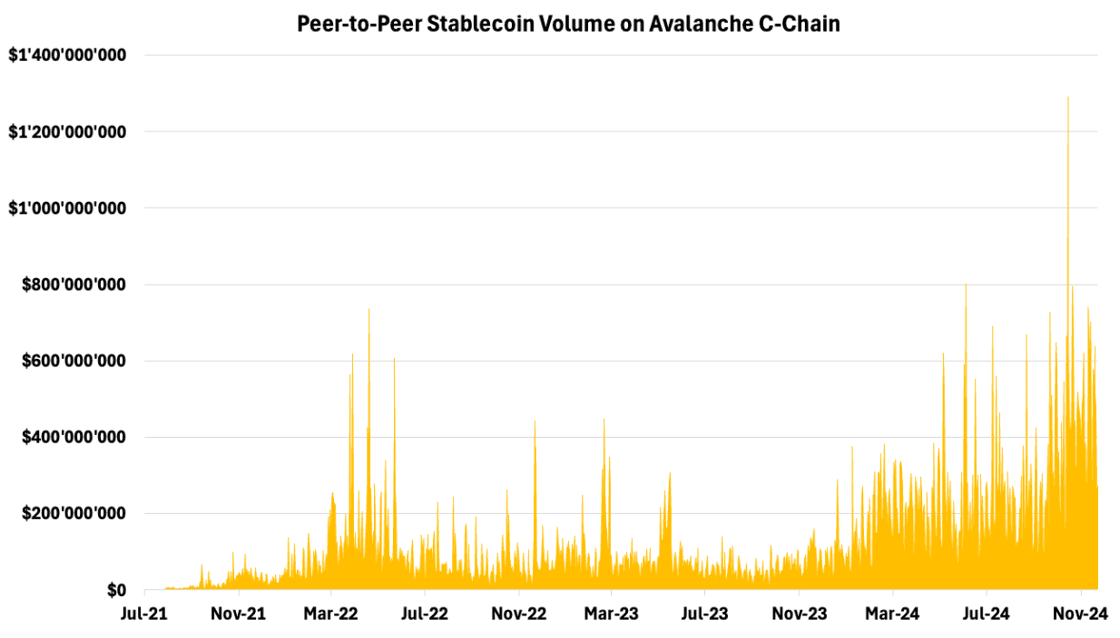

Nevertheless, there are promising signs that the network is playing a bigger role, particularly within the realm of stablecoins. As demonstrated below, the total volume of P2P stablecoin volume has been consistently growing on a trajectory of its own, adding more liquidity to the Avalanche ecosystem. The reason for this increase could be on the back of many factors, among them initiatives like the BOOST campaign, playing a crucial role in attracting liquidity to the platform. By offering AVAX token rewards, these programs have increased the supply of stablecoins within the ecosystem, indicating new capital inflows and overall growth.

The Avalanche9000 Upgrade, which went live on the Fuji Testnet on November 25, 2024, was also integrated into the Etna Mainnet on December 16, 2024.

High capital requirement for validators

Validators play a critical role by validating both the Primary Network and any subnets they opt into. This design was introduced to scale Avalanche horizontally. While this model unlocked new possibilities, it also introduced limitations that hindered scalability, cost-efficiency, and adoption across the ecosystem.

The current requirement for subnet validators to stake 2,000 AVAX (worth $100,000 at $50 per AVAX) on the Primary Network, plus additional subnet-specific stakes, creates a significant financial barrier. This high entry cost deters smaller projects and potential blockchain innovators, ultimately hindering wider adoption of the Avalanche ecosystem.

Subscription-Based Validator Model: ACP-77, introduced through Avalanche9000, replaces the hefty upfront staking requirement with a monthly subscription fee of 1-10 AVAX for validators. This pay-as-you-go model significantly reduces entry costs, enabling projects of all sizes to launch independent L1s on Avalanche. The proposal also implements a continuous P-Chain fee mechanism, enhancing cost-efficiency and sustainability in Subnet management, thus democratizing access to Avalanche's infrastructure.

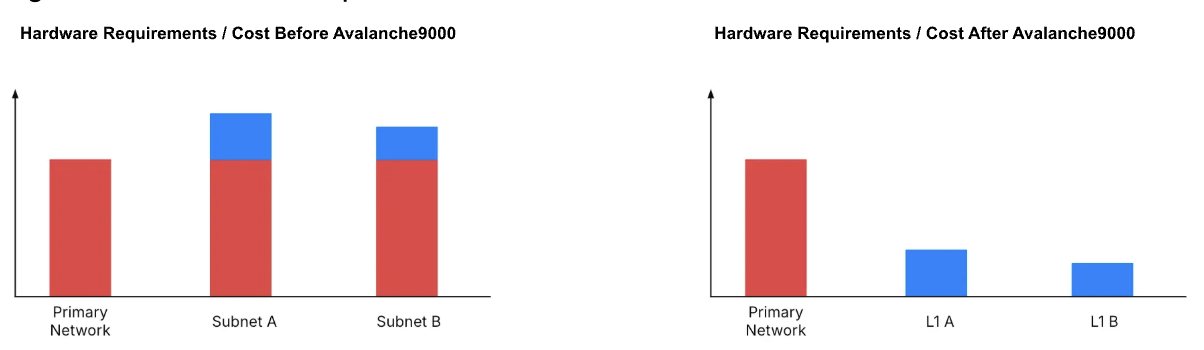

Lowering running costs for validators with Avalanche9000

The current model requires validators to support both the Primary Network and their chosen subnets, significantly increasing hardware demands and operational costs. This dual responsibility, combined with high staking requirements, often forces validators to rely on centralized hosting providers like AWS, which now hosts 38.2% of Avalanche nodes. This trend towards centralization introduces risks of single points of failure and undermines the network's decentralization goals.

Independent L1 Validation: Avalanche9000 separates Layer-1 blockchains (L1s) from the Primary Network, enabling validators to focus exclusively on their specific L1s. This upgrade introduces ValidatorManager smart contracts, giving L1 creators enhanced control over their validator sets. The result is a more streamlined system with reduced hardware requirements, lower operational costs, and decreased centralization risks. Ultimately, this fosters a more distributed, resilient, and cost-effective validator ecosystem.