The Bitcoin mining market is nearing its moment of maximum pain. The enticing economics that last year invited entrepreneurs with easy access to capital, cheap energy, and highly positive gross margins has cyclically reversed its course. A bad environment for miners.

Mining revenue is now at its lowest point in Bitcoin’s history, rising energy prices are damaging the already thin margins of hosting providers, and capital markets are turning increasingly tight. Those with weaker confidence in the future potential of industry revenues have already wound up and exited, leaving behind a surplus of idle mining machines listed on secondary markets. Despite both an overall decline in mining participants and unfavourable economic conditions, Bitcoin has set new all time highs in network-wide hashrate. This implies that the competition for Bitcoin block rewards has never been more intense.

Miner revenues have decreased to an all-time-low

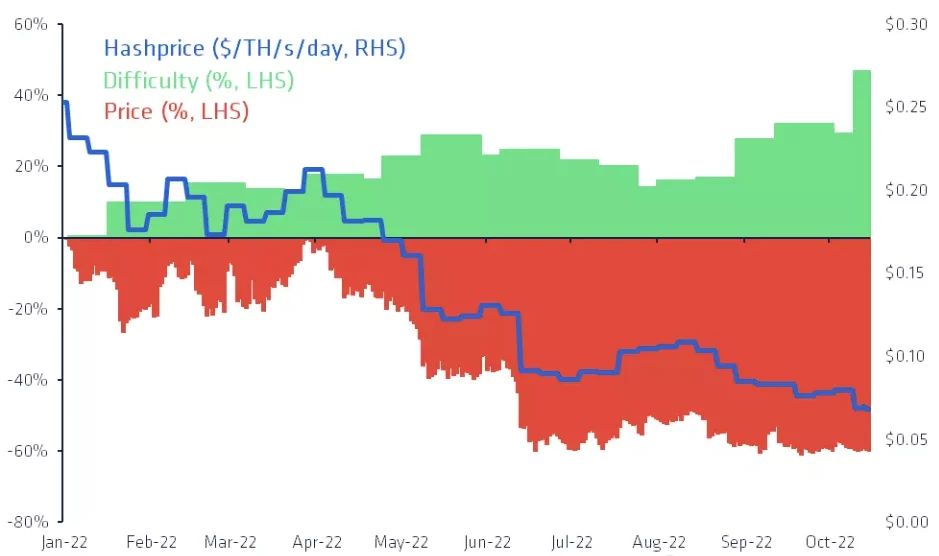

Throughout 2022, it has become both increasingly more difficult to produce bitcoin and less lucrative to sell bitcoin, forming the most challenging environment mining companies have faced to generate positive cash-flows. In the picture below, we can see that revenues available to miners (usually measured in dollars per unit of hashrate per day, called the “hashprice”) has gradually reached an all-time low.

Unfortunately, without a compensatory surge in the bitcoin price, the prospect for mining revenues through the remainder of 2022 continues to be discouraging. The factors leading to new Bitcoin hashrate and difficulty highs are mainly due to the aggressive expansion of industrial-scale miners to increase their hashrate share of the mining market despite unfavourable economic conditions. Specifically, there are three:

- Miners are deploying new generation machines that improve their operational efficiency, directly increasing their hashrate production despite unchanged levels of electricity consumption.

- Both new construction projects and supplementary expansion projects that were previously planned and likely delayed due to disruptions in the global supply chain are finally coming online, increasing power capacity and ultimately miners’ hashrate.

- Miners that previously partnered with electrical grid operators to provide largely seasonal demand response services are now redirecting their power to the Bitcoin network, causing a seasonal increase in hashrate as peaking electricity demand eases in popular mining regions, such as Texas.

The first two points noted above are expected to continue exerting pressure on hashrate to grow through the end of 2022, and are evidenced by both the build plans and machine orders disclosed by publicly listed mining companies.

High power costs displaces new miners

The strategy of maximising hashrate growth and operational efficiency has bode well for miners in past cyclical downturns. Miners that negotiate cheap electricity rates (less than 0.03 USD/kWh) and strengthen their balance sheets during the fruitful times of the bull market are well-positioned to accumulate distressed assets when the market turns over and are then typically rewarded in the next bull period.

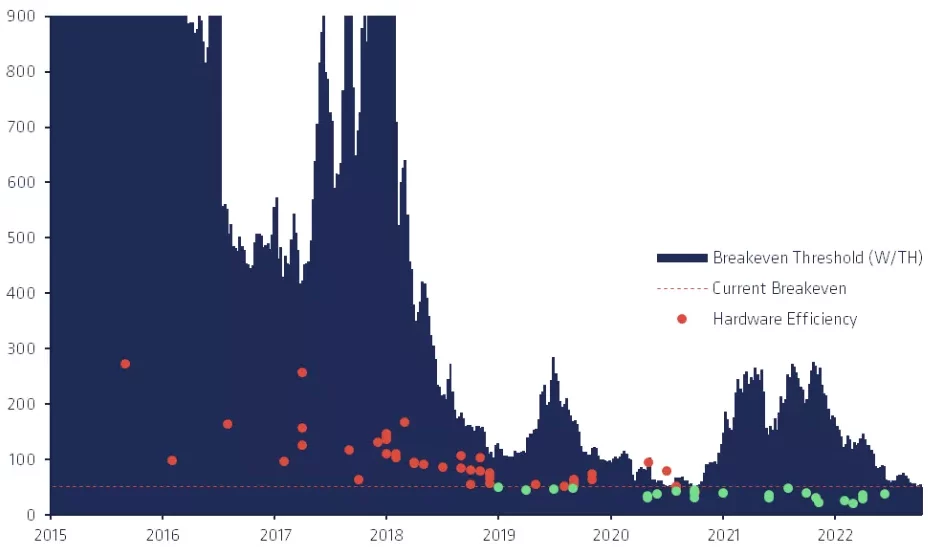

However, miners’ hashrate growth directly increases the competition for scarce bitcoin rewards and could soon be the catalyst that pushes the next tranche of marginal miners out of the market. Below we find that miners with a relatively high power cost (0.06 USD/kWh) are no longer cash-flow positive when operating machines released over four years ago (now outside the breakeven threshold). As a result, miners that have entered high power cost agreements, or choose to purchase at the local spot rate, are unlikely to operate profitably by keeping these machines online.

Different macroeconomic factors influence miner behavior

The cash-cost of running a mining machine is not the only factor affecting miner profitability, although it indeed determines whether a company will continue operating each hardware model in its mining fleet. Other significant and ongoing business costs may include hosting, depreciation, interest payments, maintenance, labour, legal, and tax. The pressure of these costs will also influence the decisions of mining companies. They can exacerbate cash flow issues and cause financial manoeuvres more common to troubled companies in traditional financial markets, such as debt restructurings, stock dilutions, layoffs, and bankruptcy.

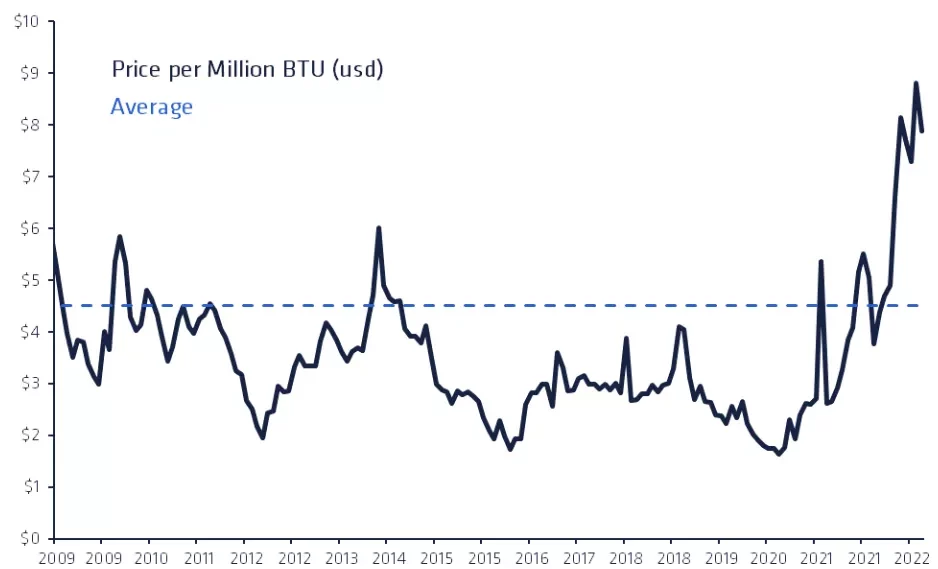

Rising energy costs, rising interest rates, and supply chain disruptions, in addition to declining mining revenues across the industry, is likely also impacting the broader mining industry from a macroeconomic perspective. Often the marginal electricity producer, natural gas has increased 46% in the United States this year, reaching the highest point in Bitcoin’s history.

The hawkish monetary policy of the US Federal Reserve and most other central banks around the world is causing lenders in all markets to reassess their risk tolerance, constraining capital and increasing borrowing costs in the process. Anecdotally, we also hear that several Mining Finance (MiFi) lenders are demanding repayment terms ahead of the next halving, expected in April 2024, due to the uncertainty around the fee rewards available to miners following the event.

The mining market capitulation moment is nearing

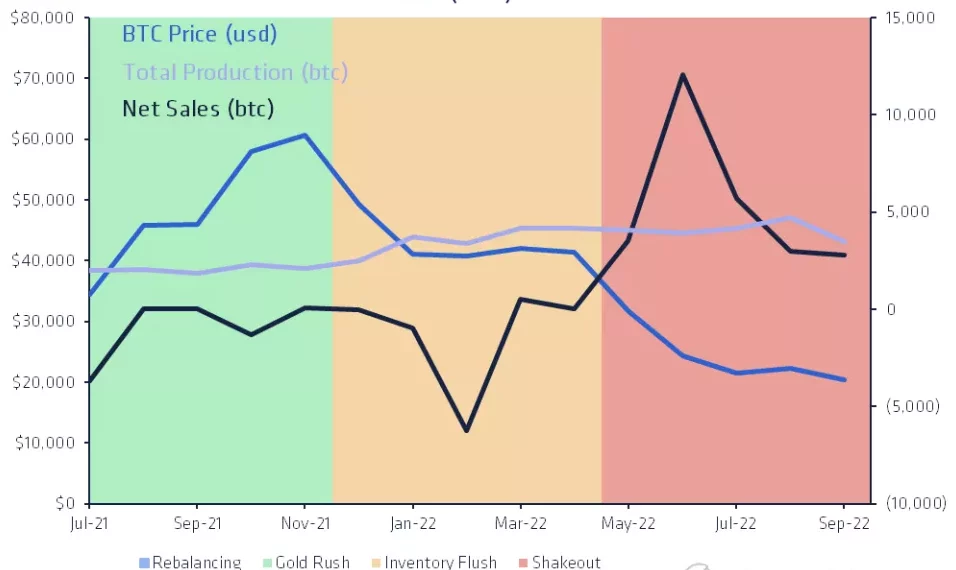

Major dips and historical floors in bitcoin price cycles tend to be characterised by unusual surges in trading volume, often fueled by the capitulation of entities holding large reserves of bitcoin that are forced to liquidation by unfavourable market conditions.

For Bitcoin miners, there are several reasons why this can happen, however it almost certainly happens when mining revenue is low. With income levels declining and spending needs continuing, selling capital assets and bitcoin holdings can become a necessary life raft to stay in business. For several miners that time has already come, but for many others the time is likely soon. While only a fraction of the entire mining industry, as shown below, publicly-listed miners have recently sold more bitcoin than they have produced. Mining machines have dropped an average of nearly 70% since the same time last year and anecdotally, we are seeing an increase in volume on secondary ASIC markets.

Together, there is a perfect storm of challenging conditions for Bitcoin miners, and something is likely to give soon: a hashrate crash or a bitcoin price rally. Once capitulation has occurred, the downward price pressure exerted by miners will be removed, easing the path towards recovery in bitcoin markets.