PricewaterhouseCoopers International (PwC) has published a comprehensive report on cryptocurrencies. The study provides an overview of how hedge funds and asset managers are dealing with the new asset class on a global scale.

The PwC group has published its third annual report examining the global crypto hedge fund landscape. This is based on data from research conducted in the first quarter of 2021. The study was also produced in collaboration with the Alternative Investment Management Association (AIMA), and offers insights into how traditional hedge funds view cryptocurrencies.

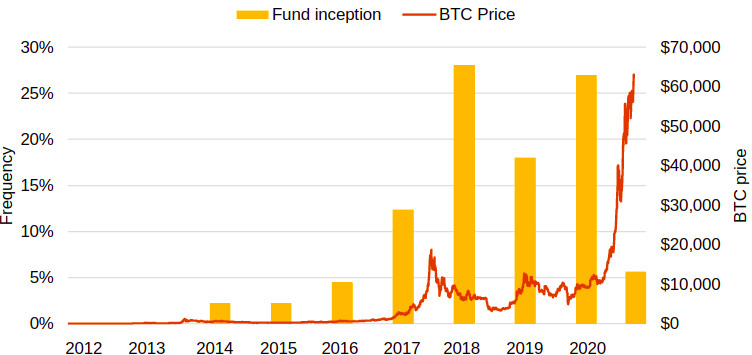

Number of crypto hedge funds correlated with Bitcoin price

The launch of actively managed crypto funds correlates strongly with the price of Bitcoin (BTC), according to PwC. The price rise in 2017 appears to have been a catalyst for more crypto funds, while the price collapse the following year led to a decline. 18% of survey participants started their funds in 2020, when prices rebounded.

PwC estimates that the total assets under management (AuM) of crypto hedge funds rose to more than $3.8 billion in 2020, up from just over $2 billion the previous year. A majority of hedge funds are active in market making, arbitrage, and algorithmic trading. About one-fifth take only long positions.

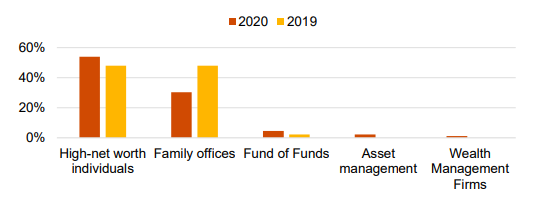

Individuals and family offices as primary investors

According to the study, the largest investors in crypto hedge funds are high net worth individuals (HNWIs). More than half of the funds surveyed described them as the most common investor type. Family offices take second place with 30%.

Although institutions are aggressively entering cryptocurrency markets, PwC said that they are not yet prevalent investors in crypto hedge funds. Going forward, the authors of the study expect this investor base to gradually mix, given institutional interest.

Decentralized financial applications (DeFi)

Decentralized financial applications (DeFi) had exceptional growth in 2020, and were the buzzword of the year. DeFi protocols aim to create peer-to-peer financial services. They are designed to enable cryptocurrency trading, loans and interest accounts without the use of traditional banks and traditional financial intermediaries.

Last summer, DeFi began to boom, and between April 2020 and April 2021, trading volume on these platforms grew more than 90-fold, with the decentralized exchange (DEX) "Uniswap" accounting for half of DeFi market volume in April 2021. The data shows that a full 31% of crypto hedge funds actively used decentralized exchanges.

Traditional hedge funds and cryptocurrencies

About one-fifth of traditional hedge funds invested in digital assets. The average percentage of their total assets under management in this regard is 3%. More than 85% of these hedge funds intend to invest more capital in the asset class by the end of 2021.

Of those not investing in digital assets, 58% of responses are from larger hedge funds (with total assets under management of more than $1 billion). About a quarter of these are generally interested in the asset class or are at a late stage of investment planning. Lastly, about half are not looking to enter the industry in the next three years.

Regulatory uncertainty as the biggest hurdle

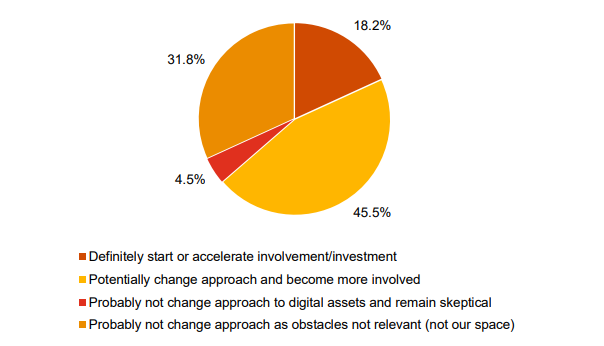

In terms of the main barriers to investment, regulatory uncertainty is by far the biggest issue (82%). Even those already investing in digital assets cite it as a major challenge (50%). Client reaction or reputational risk is also high (77%), as is the fact that some digital assets fall outside the scope of current investment mandates (68%). What was interesting, according to PwC, was how they'd react if these hurdles were removed.

About two-thirds of respondents said that if the main barriers were removed, they would either actively accelerate their investments in digital assets or change their approach and become more involved. The remainder (32%) do not think removing the barriers would have an impact on their current approach. The reason for this is that investing in digital assets remains outside their mandate.