A number of material factors in the digital asset industry that have not co-existed until now have emerged in the past year. Together these lead us to the question of whether we may be on the cusp of institutional bitcoin adoption. A deep dive into the three most important factors to watch.

One of the most important factors is regulation, setting the playing field for the market. Following the latest ban by China on the 24th of September, the world looked to the United States for clarity from the regulators and lawmakers over their stance towards cryptocurrencies. Treasury head Jerome Powell has been notoriously wary of digital assets and the new SEC chair Gary Gensler initially appeared to be of a similar mindset, adopting a cautious and non-committal approach to how the SEC plans to treat them.

1. Regulation in the US

In a boost for the crypto industry and associated institutional interest, both Jerome Powell and Gary Gensler stated they had no intention to ban cryptocurrencies on the 30th of September and 5th of October respectively. Couple that with the support that Gensler reiterated for a bitcoin futures-based ETF on the, along with his recent comments that Bitcoin could be seen as a "store of value" and a picture begins to emerge that the world’s most influential regulator is starting to warm to crypto (within reason).

The SEC has wrestled with allowing Bitcoin ETFs backed by physical bitcoin, given that so much of the underlying trading occurs on unregulated exchanges. The alternative is a futures-based ETF via a regulated exchange such as the CME. This addresses the concerns about market surveillance, but futures backed products are often inferior to the ones based on the spot. A raft of bitcoin futures ETFs have been submitted to the SEC recently, and two have already gotten approved. This green light was especially important for institutional investors with concerns about the regulatory pressure on bitcoin.

2. Adoption

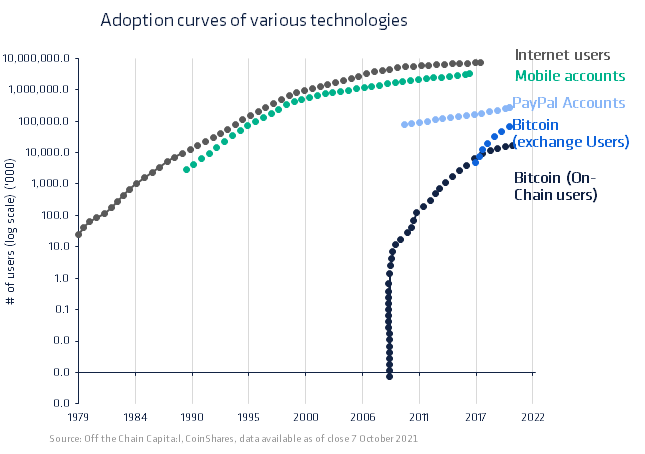

Both supporters and detractors have recently been likening bitcoin to the internet in 1997. Bitcoin has been growing at an annual rate of 113%, vs the internet’s growth at that time of 63%. Should bitcoin’s adoption slow to that of the internet’s, it would still lead to 1 billion users by 2024 and 4 billion users by 2030. With institutions such as Visa, Mastercard, Paypal, BNY Mellon, Morgan Stanley, Goldman Sachs and JP Morgan to name but a few all reversing their stance against bitcoin, that isn’t looking likely.

On the 8th of September 2021, El Salvador became the first country to adopt bitcoin as legal tender, but as newsflow, since then suggests, they will certainly not be the last. It is estimated that over 50% of the population are now using the government’s Chivo cryptocurrency wallet, compared with only around 30% having a bank account.

Banking the unbanked

According to a recent report by the World Bank, approximately 1.7 billion people remain without access to a bank account, however, 1.1 billion of those own a mobile phone. There has long existed a narrative that cryptocurrencies can provide a solution to banking the unbanked. The World Bank also reported in 2018 that the overall global remittance market had grown to $689 billion, including $528 billion to developing countries. Alongside the commission-free Chivo ATMs in El Salvador, 50 commission-free Chivo ATMs have now been installed throughout the USA, where some 2.3 million people of El Salvador descent live and work.

It is estimated that El Salvadoreans currently spend approximately $400 million in remittance fees per year. With the new ATMs allowing individuals to send fast, commission-free payments across borders, we may be witnessing the first case study of blockchain technology improving on the outdated and often expensive financial system. Ukraine also announced their plans to legalise bitcoin and cryptocurrencies. With Cuba, Brazil and Paraguay also all throwing their hats into the ring, how many more dominos fall will be key to watch in Q4 and beyond.

Established part of traditional portfolios

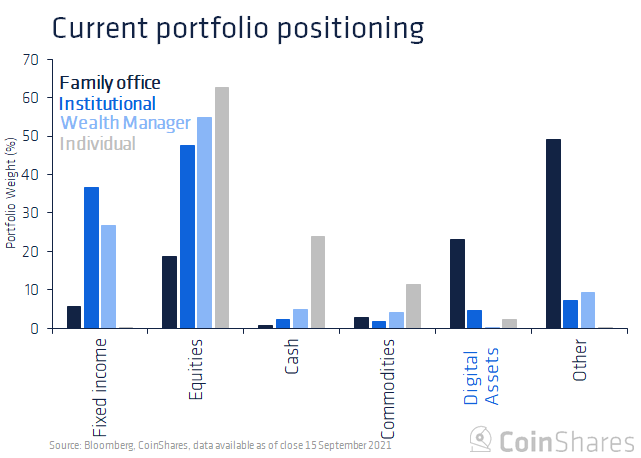

From an institutional perspective, our most recent survey representing $400bn of assets under management (AuM), highlights growing institutional participation. Average portfolio weightings in digital assets now represent 1.1% of AuM, although this varies considerably across different institutional investor types.

Of the survey respondents who said they had not invested, regulation (21%) was cited as the main reason for not investing. Closely linked to this were corporate restrictions at 19%. Volatility remains a big concern amongst investors. Encouragingly, very few of the respondents see digital assets as lacking fundamentals.

3. Macro environment

Signs of a potential inflationary problem are beginning to reveal themselves, most notably the tightening employment conditions (and consequent rise in wages) coupled with rising producer and commodity prices across the globe. However, investors remain divided, with the outlook for inflation falling into two schools of thought: those that believe the inflation effects are more transitory in nature, and those that see inflation rising to a point where it threatens economic stability.

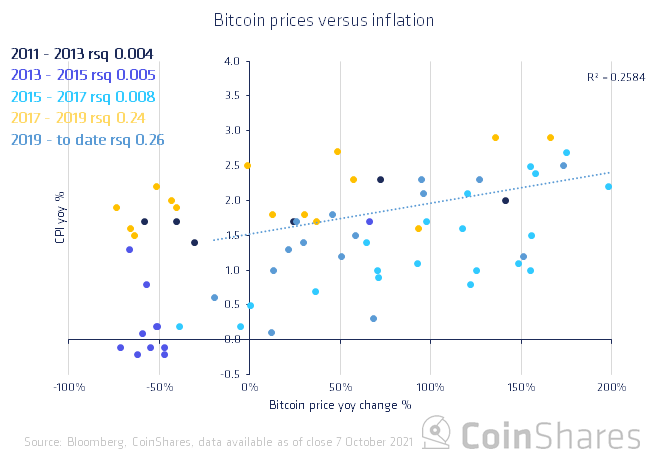

Conceptually, it makes sense that bitcoin would be a hedge against inflation. It is what an economist would call a “real asset” - an asset of limited and predictable supply that is often priced in US dollars. Therefore, if the supply of US dollars is rising, or that of any other fiat currency, then it is likely that bitcoin will appreciate against those currencies, even if its purchasing power were to remain stagnant.

Correlation between bitcoin and inflation

Data suggests that bitcoin is beginning to fulfil this inflation hedge role. Observing its price changes relative to changes in inflation over two-year periods since it was created in 2009, highlights that the relationship is improving, with a current R2 of 0.26 (since 2019). Incidentally, the relationship between bitcoin and inflation is currently better than between inflation and gold.

With energy prices rising, surging retirements from the baby boomer generation and increasing risks of further wage rises, higher inflation remains a real risk. But we remain unsure as to exactly what will happen to inflation over the coming 5 years, consequently we see adding bitcoin and other real assets as a prudent measure to protect portfolios from the tail-risk of out-of-control inflation.

Digital gold replacing the physical version

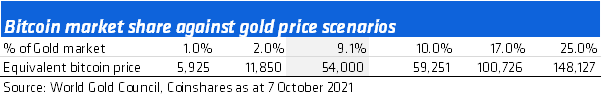

We have written extensively about the valuation of Bitcoin, but it is worth revisiting our total addressable market approach. Investment fund flows imply that Bitcoin has begun to cannibalise gold’s market share, at present Bitcoin represents 9.1% of gold’s market share.

We have recently seen SEC chair Gary Gensler acknowledge that Bitcoin is now “a store of value that people wish to invest in, as some would invest in gold”, this further establishes its identity as a real asset. As inflation threats in the near term are likely to further escalate, it’s not outlandish to see the Bitcoin price achieve US$100k, which would represent only 17% of gold’s market value.

Coming towards year-end it is clear there is a range of potentially price-supportive events such as increasing regulatory clarity, rising inflationary risks, increasing adoption and improving investor appetite - these factors are beginning to tick all the boxes for greater institutional investor participation in the asset class.