Many look at Bitcoin (BTC) as a very volatile asset, unattractive for traditional investors looking to diversify their portfolio. Yet digital assets seem to drastically improve the Sharpe ratio, a measure frequently used to quantify the performance of a portfolio in contrast to risk.

In the first few days of 2021, bitcoin (BTC) price reached a new all-time high of about $42,000, fell back by $10,000 to increase again to $38,000 at the time of writing. This episode depicts what bitcoin is to many investors: an attractive but volatile asset.

With this backdrop, is there any benefit to add bitcoin, and more generally, digital assets in a traditional portfolio? We tackle this question and conclude that digital assets improve the Sharpe ratio significantly. We show that investing in bitcoin leads to doubling the initial Sharpe ratio. Investing in several digital assets instead of bitcoin-only improves the initial Sharpe ratio even more, by a factor of 2.6.

The benefit of digital asset diversification is important even for small allocation. For example, for a portfolio having a 4% allocation to digital assets, the Sharpe ratio increases between 50% and 90% according to the digital asset index used. The portfolio achieves the highest Sharpe ratio when the allocation is around 20%. The conclusion remains unchanged regardless of other assumptions (high correlation between digital and traditional assets).

Digital assets – a new asset class

An asset class is a set of investable assets that share similar fundamental value drivers. For instance, equity is an asset class whose fundamental value drivers are firms' cash flows, the risk-free rate and the equity risk premium. This asset class differs from the fixed income asset class whose drivers are coupons, maturity, and credit risk. For digital assets, fundamental value drivers are the network, the monetary policy (issuance of tokens), and the token economics (how value is captured and distributed among stakeholders).

Thanks to the variety of value drivers, the combination of different asset classes in a portfolio improves its quality and resilience. It leads to a better risk-return profile as measured by the Sharpe ratio.

The Sharpe ratio

According to the modern portfolio theory, the Sharpe ratio is an appropriate measure to compare portfolios. Essentially, it measures portfolio outperformance per unit of risk. The Sharpe ratio of a portfolio, S(p), is defined as the expected portfolio outperformance over the risk-free rate, E(R(p)-R(f)), in terms of portfolio risk, sigma(p).

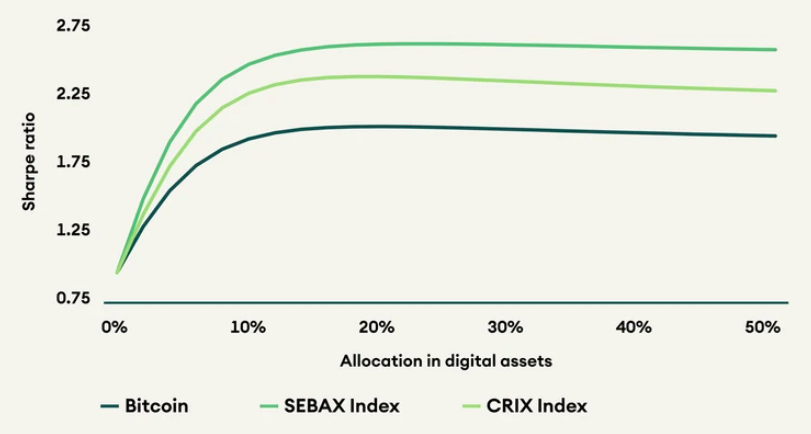

To visualise the impact of investing in digital assets as seen through the Sharpe ratio lens, we have simulated a continuum of portfolios using data starting in November 20151. We use data from November 2015 onwards to compare the benefits of diversification in bitcoin-only and broader digital asset baskets such as CRIX and SEBAX indices.

The CRIX Index is a broad market index, including the top 20 digital assets by market capitalisation. The SEBAX Index is a dynamic, risk-optimised index, including a basket of digital asset weighted according to a modified risk-parity approach.

We consider a base portfolio consisting of 40% equities, 50% fixed income and 10% commodities. Figure 1 starts with a Sharpe ratio of 0.98 corresponding to 0% allocation in digital assets. The horizontal axis represents the percentage allocation to digital assets, and the vertical axis measures the corresponding Sharpe ratio. Portfolio rebalancing is proportional to the base allocation. To invest, say, 10% in digital assets, the new portfolio would have 36% equities, 45% fixed income, 9% commodities and 10% digital assets.

The addition of digital assets significantly improves the Sharpe ratio as all the three lines show. Adding bitcoin only, potentially doubles the Sharpe ratio. Interestingly, investing in a basket of digital assets instead of bitcoin-only provides an additional significant improvement in the portfolio Sharpe ratio. It means there is a considerable diversification potential within digital assets.

Figure 1: Sharpe ratio and digital asset allocation

Figure 1 indicates first that diversifying into digital assets is beneficial even for small allocations. For instance, a 4% allocation to digital assets improves the Sharpe ratio by more than 50% with only bitcoin, by 75% with the CRIX index, and by more than 90% with the SEBAX index. Second, it shows that the optimal allocation in digital assets is about 20% of the portfolio, resulting in Sharpe ratios of 2.04, 2.41, and 2.64 with bitcoin, CRIX index, and SEBAX index respectively in comparison to an original Sharpe ratio of 0.98 without any exposure to digital assets.

How do digital assets improve the Sharpe ratio?

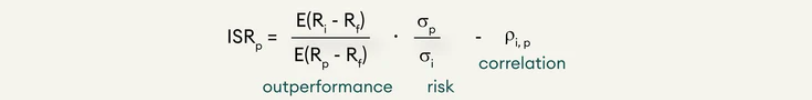

To understand why investing in digital assets improves the Sharpe ratio, we propose to play with the formula. One way to grasp this intuition is to look at the incremental Sharpe ratio (ISR), which is how Sharpe reacts to introducing a new asset. The ISR of portfolio p, noted ISR(p) is

The first factor is the ratio of expected outperformance of the new asset i relative to the current portfolio p. The second factor is the ratio of the risk of the new asset to the overall portfolio. And the last factor is the correlation of returns.

To capture the maximum improvement in the Sharpe ratio is equivalent to get the highest ISR. Ideally, the additional asset has a high expected return R(i) to increase the outperformance, a low volatility sigma(i) and a low or negative correlation rho(i,p). While digital assets do not fulfil all three criteria, they improve the Sharpe ratio thanks to outperformance and low correlation.

Outperformance

As far as outperformance is concerned, digital assets' history shows that the performance has been massive. According to the data used for our analysis, bitcoin's average annual return is about 146%, versus 11.7% for equities, 4.8% for fixed income and 0.9% for commodities. View from this angle alone, it makes no doubt that adding this asset class improves the Sharpe ratio.

However, past performance is not an indicator of the future, and no one knows at what price bitcoin will trade in five years. Nonetheless, we have good reasons to believe that the gradual adoption of blockchain technology in the economy and digital assets in individual and institutional portfolios will continue to support this asset class in the future.

Notice that the digital asset class is broader than bitcoin, even though it represents approximately 70% of the total market capitalisation. The SEBAX index outperformed bitcoin by 80% per year on average, clearly indicating there is merit in evaluating assets other than bitcoin.

To sum up, there is good reason to believe that digital assets will continue to deliver strong future performance. To construct a portfolio today is, first of all, an exercise consisting of imagining the future in terms of asset class expected returns. Thus, the question is about the relative expected returns of equities, fixed income, commodities, and digital assets in the context of low growth, low inflation, low yield, stretched valuations, and high debt.

Volatility

The second factor in the ISR formula is the ratio of risk. The lower the volatility of the new asset relative to the portfolio volatility, the better it is. In this regard, the elevated volatility of digital asset does not speak in their favour. Bitcoin’s average volatility is 76.0%, 88.0% for SEBAX, 74.9% for CRIX, versus 15.6% for equities, 13.0% for commodities and 4.7% for fixed income.

However, the second factor does not come alone as it has to be seen in conjunction with the outperformance factor as a multiplication sign links the two. Combining the first two factors is equivalent to comparing the Sharpe ratio of the new asset to the Sharpe ratio of the portfolio. The selection criterion to add a new asset is whether the portfolio's Sharpe ratio with the new asset is higher than the existing portfolio. As digital assets have a high Sharpe ratio, adding them to a traditional portfolio makes the new portfolio superior.

Correlation

Finally, an essential element of portfolio diversification is the correlation with other asset classes. In the March 2020 Coronavirus market sell-off, bitcoin price plunged with equities. Critical voices said bitcoin did not prove to be the safe asset it pretended. We see bitcoin price drop due to a flight to liquidity more than a flight to safety as we wrote shortly after this event. More generally, during high-stress episodes, the correlation between assets tends to increase even for long-established asset classes.

This episode is now over, but the correlation has remained elevated since. The 12-month correlation between equities and bitcoin that was historically hovering around zero is now just below 0.40 (figure 2). As we have seen, a positive correlation harms the Sharpe ratio as it reduces the diversification potential.

Figure 2: 12 month rolling correlation between bitcoin and global equities

Why has the correlation remained elevated in the wake of the coronavirus shock is an open question. Whatever the reason behind this possible regime shift, we acknowledge the higher correlation between equities and digital assets that may well be the new environment.

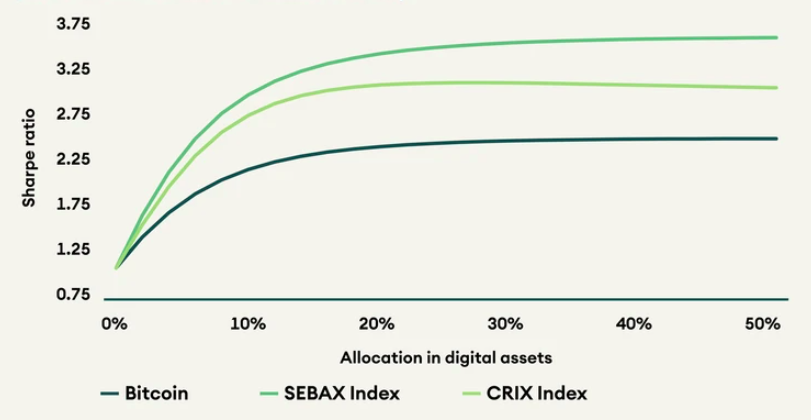

We have re-run the Sharpe ratio simulation using the last 6-month variance-covariance matrix and correlation while using the whole period's return. The results are presented in figure 3.

Figure 3: Sharpe ratio and digital asset allocation

Under the new assumptions, the message remains the same. Adding digital assets in a traditional portfolio improve the Sharpe ratio even for small allocation. The Sharpe ratio is even higher with this alternative set of assumptions than before.

Using a 20% allocation for comparison, Figure 1 and 3 show that Sharpe ratios increased from 2.04 to 2.44 with bitcoin, from 2.41 to 3.12 with the CRIX index, and from 2.64 to 3.47 with the SEBAX index. Even if the new environment of high correlation would last, investing in digital assets is beneficial.

This encouraging result shows that the Sharpe ratio analysis is robust to significant regime shift.

Conclusion

We have analysed the effect of adding digital assets in a diversified portfolio of traditional assets. We showed that investing in bitcoin leads up to a doubling of the initial Sharpe ratio. We also showed that investing in several digital assets instead of bitcoin only improves the initial Sharpe ratio by a factor of up to 2.6.

The benefit of digital asset diversification is essential even with a small allocation. For instance, an allocation of 4% increases the Sharpe ratio between 50% and 90% according to the index use. The Sharpe ratio reaches its peak when the allocation is around 20%. The conclusion remains unchanged even when we use an alternative set of assumptions (high correlation between digital and traditional assets), and the results are even better.