A summarizing review of what has been happening at the crypto markets of the past week. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko.

The last 7 days in the cryptomarkets:

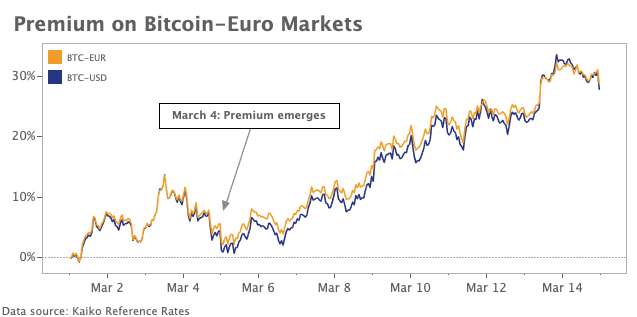

- Price Movements: Bitcoin crossed $60k, a premium emerged on BTC-Euro markets, and NFT tokens are soaring.

- Trading Volume: Binance's market share of volume continues to grow versus the exchange's biggest competitors.

- Order Book Liquidity: Market depth for BTC-USD is heavily skewed towards the sell side, which suggests profit taking preceded this morning's crash.

- Volatility and Correlations: 180D volatility reached a 6-month high.

Premium emerges on BTC-EUR markets

BTC-EUR and BTC-USD typically trade closely in line. Thus, it was notable when BTC-EUR began trading at a premium to BTC-USD starting March 4th. When comparing divergences from other reference dates (not pictured), we observed that this premium was larger and more prolonged than others over the past few months. Macro economic events have deeply influenced crypto markets over the past year, and the EU's recent ramping up of expansionary monetary and fiscal measures could have contributed to the temporary premium. However, it is difficult to assign a single underlying cause. The premium briefly turned into a discount as BTC-USD reached new all time highs over the weekend.

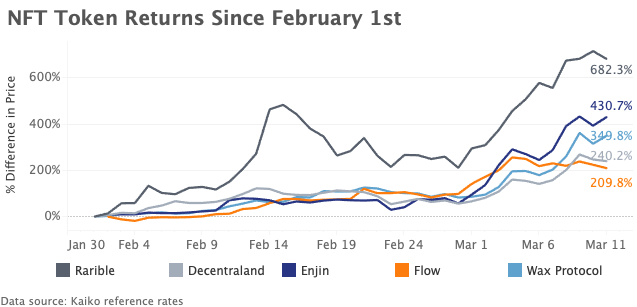

Tokens affiliated with NFT marketplaces soar

The word "NFT" has officially entered the pop-cultural lexicon following digital artist Beeple's historic sale of a non-fungible token at Christie's. “JPG File sells for $69 million” - how the New York Times phrased the event - was one of many mainstream takes on this budding sector of crypto. Our friends over at The Tie showed that NFT mentions in the media were up more than 100x since last year, and as most in crypto are aware, the more hype the better the returns.

While NFTs themselves have sold at increasingly excessive rates, tokens affiliated with NFT marketplaces have tangentially benefitted from the mania. The token Flow, a product of Dapper Labs (partner of NFT marketplace NBA Top Shot), has appreciated 209% since February 1st. Decentraland, a virtual world where players can purchase NFTs, has seen its MANA token soar 682%. These tokens serve functions such as governance, utility, and rewards, but also serve as a gauge for sentiment surrounding the NFT industry.

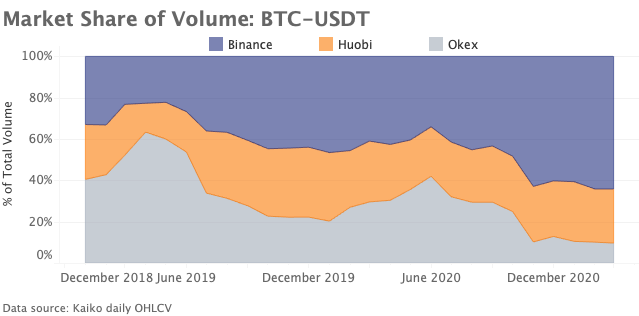

Binance's market share continues to grow

This week, we take a look at the "Big Three" of loosely regulated crypto exchanges: Binance, Huobi, and Okex. Combined, these three exchanges boast some of the largest trade volumes in the industry, and are each other's closest competitors. Over the past year, Binance's market share of volume for the BTC-USDT trading pair has grown from 41% to 64%. The huge growth came as both Huobi and Okex faced a series of internal company issues. Last fall, Okex suspended withdrawals for more than a month and Huobi suffered from rumors of internal strife, which both resulted in a big dip in market share as traders transferred funds out.

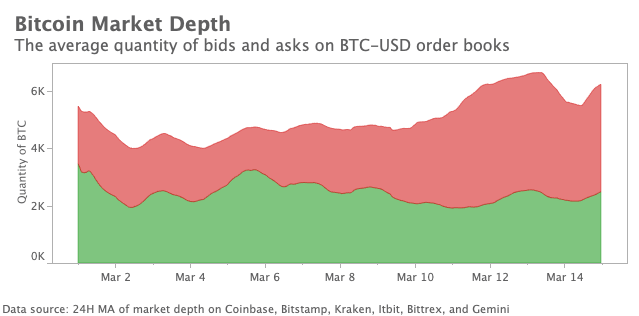

Bitcoin order books skew sell-side

The quantity of asks on BTC-USD order books has soared over the past week as Bitcoin topped new all time highs. At one point, the quantity of asks was nearly double the quantity of bids. Despite the sell wall, Bitcoin was able to break past $60k, which suggests strong buying pressure among price takers. Ask depth continued to increase following the new highs as traders prepared to take profit, which could have contributed to Bitcoin's early Monday crash.

We can also observe that total market depth has increased over the past two weeks, but the long term trend shows a significant decline in depth. Onchain data confirms a possible shortage of Bitcoin. Last week, Chainalysis noted that inflows to exchanges are lower than average which suggests a shortage of the asset for market making activities. This shortage could be due to several factors, including overall increased demand, supply sinkholes such as Grayscale, and more retail buying from platforms such as PayPal.

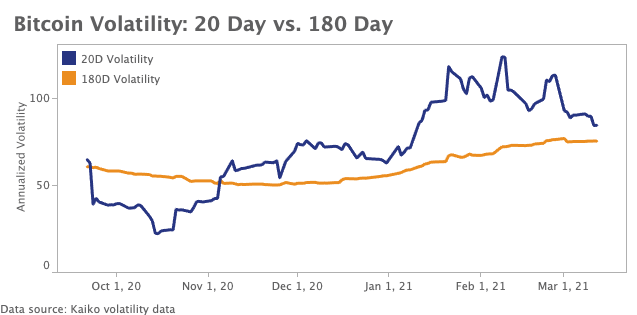

180D volatility reaches six-month high

Bitcoin's intraday volatility has been extreme over the past few months, and when looking at long term trends, we can observe that180D volatility recently reached a 6-month high. 20D volatility peaked in early February following several sharp price crashes, but since then has declined. Overall, volatility traders are benefitting from the price action that picked up around November.