A summarizing review of what has been happening at the crypto markets of the past week. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko.

The last 7 days in cryptocurrency markets:

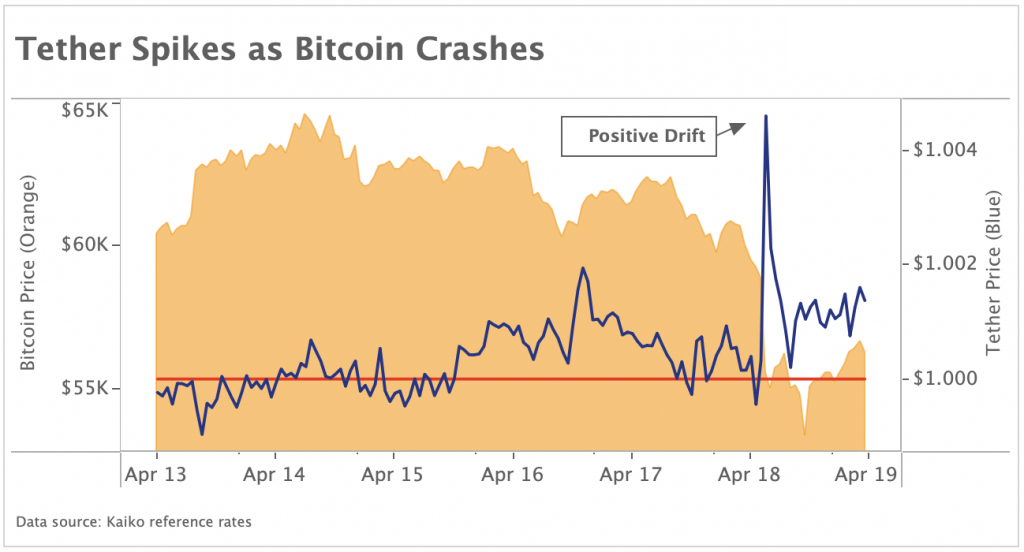

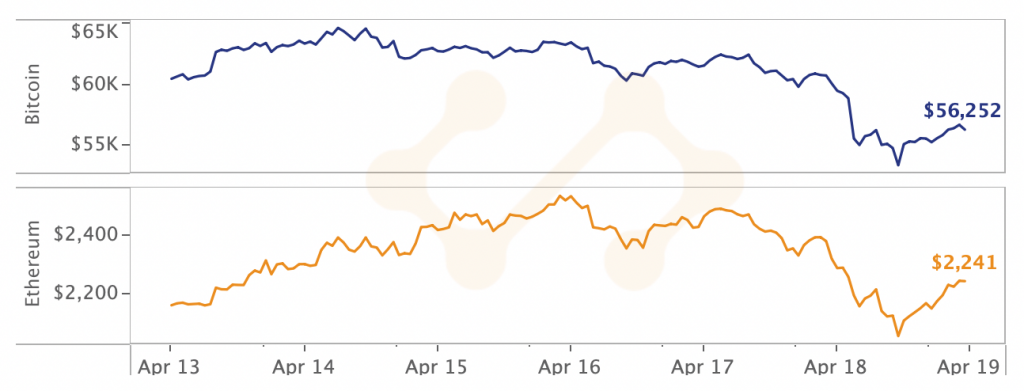

- Price Movements: Following new all time highs, crypto markets experienced a steep sell-off over the weekend with billions in forced liquidations. The volatility caused Tether to appreciate to its highest USD price in more than a year.

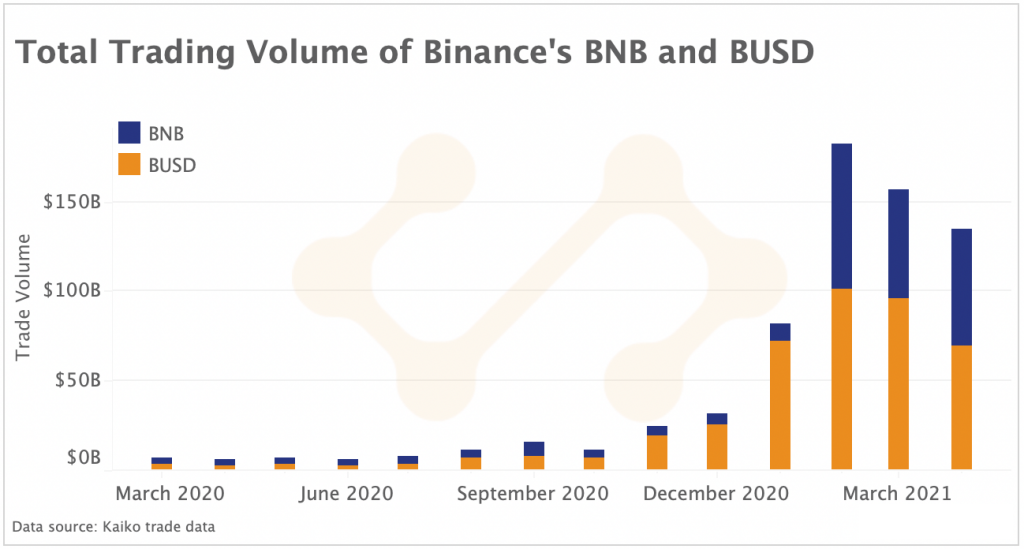

- Volume Dynamics: Binance's BNB and BUSD tokens have undergone an exponential surge in trading volume.

- Order Book Liquidity: Bid-ask spreads for top BTC-USD markets widened to their highest levels in more than a year early Sunday morning.

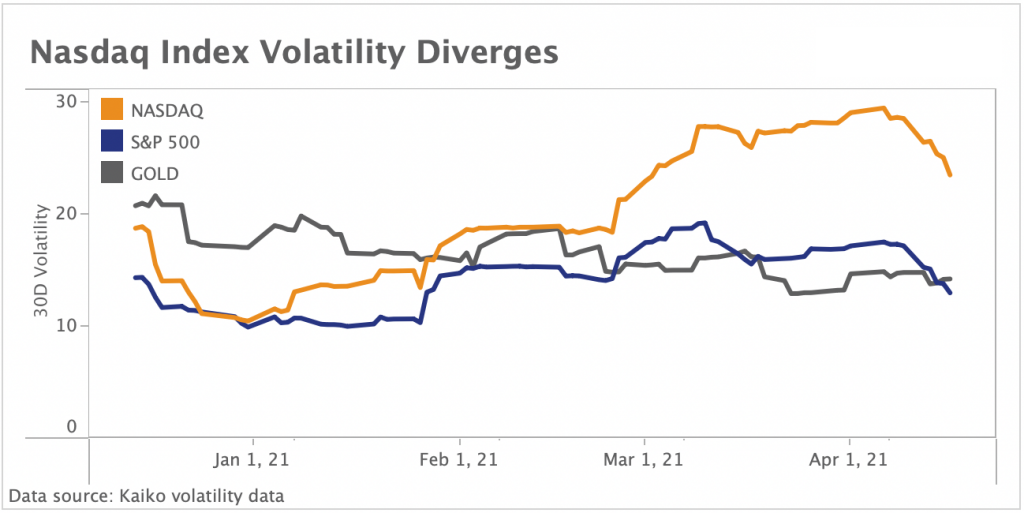

- Volatility and Correlations: The Nasdaq composite's 30D volatility curve has diverged from other traditional financial assets.

Billions in liquidations in the aftermath of Coinbase's public debut

Source: Kaiko

Source: Kaiko

Last week, Coinbase's successful direct listing on Nasdaq pushed crypto markets to new all time highs, with Bitcoin surpassing $64'600 for the first time ever. However, the frenzied momentum has since faltered, marked by a sharp weekend sell-off across cryptocurrency markets and billions in forced liquidations of over-leveraged long positions. At one point, Bitcoin crashed to as low as $53k, ultimately ending the week down more than 5%.

The market correction does not take away from the historic nature of Coinbase's debut, which closed the first day of trading at a valuation of $85 billion, far greater than what many Wall Street veterans predicted. On the same day, Congress finally approved Gary Gensler as SEC Chair, kicking off a new, more promising, era of crypto regulation.

Tether appreciates to highest USD price since March 2020

In previous Factsheets, we have explored Tether's tendency to exhibit positive drift from its 1-to-1 peg more so than negative drift, which could be linked to trading behavior during price crashes. This phenomenon was on clear display over the weekend as Bitcoin crashed from above $61k to below $54k in a matter of hours. During a crash, traders will race to sell their Bitcoin in exchange for Tether, which is similar to the U.S. Dollar in that it is recognized as a temporary safe haven amidst extreme price volatility. A sudden increase in buying pressure for Tether often has the effect of causing positive drift from the stablecoin's 1-to-1 peg. Over the weekend, the sudden Bitcoin sell off caused Tether to spike above $1.004, its highest USD price since last March's sell-off.

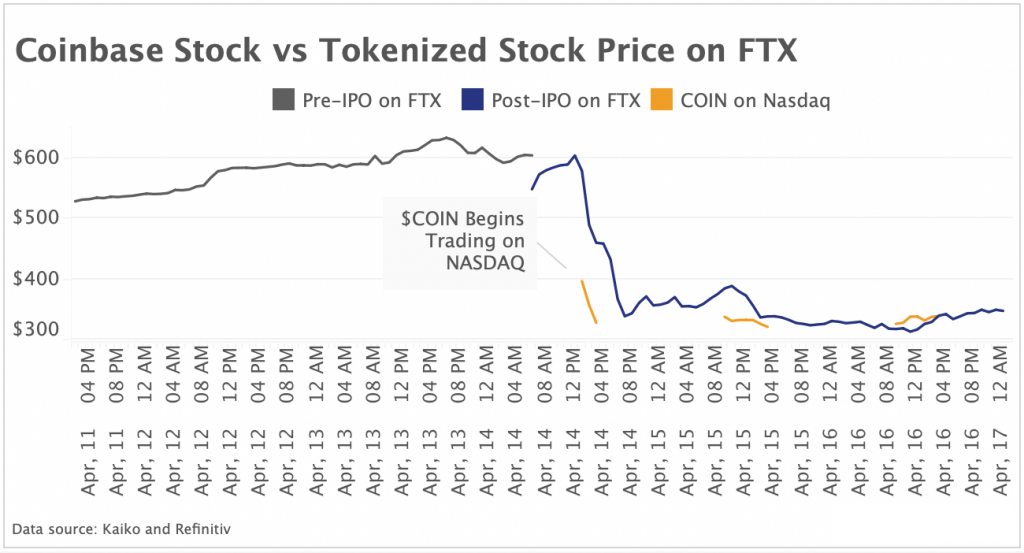

Crypto exchanges venture into tokenized stock trading

Binance made waves last week by launching tokenized stock trading for Tesla and Coinbase. However, other exchanges like FTX and Bittrex have listed tokenized equities for months. Unfortunately, Binance does not yet provide market data for their tokenized contracts, but FTX's pre and post-IPO Coinbase contracts provide an interesting comparison to price data from Nasdaq. FTX enables tokenized equities trading 24/7, while Coinbase only trades for eight hours a day on Nasdaq.

We can observe in the chart above how the price diverges considerably over the period of time that $COIN actually trades. For the first two days of trading (April 14th and 15th), there was a significant premium on FTX, which evened out by the 16th. Binance only enables trading of tokenized equities during traditional trading hours.

The rise of Binance's BNB and BUSD

Coinbase's success carried over to other centralized exchanges, whose tokens saw some of the best returns over the past week. Most notably, Binance's BNB token reached a new all time high in the days preceding Coinbase's debut. Binance is one of several exchanges that have developed their own crypto assets to be used within their exchange ecosystems. However, unlike most other exchange tokens, Binance's BNB and BUSD have seen an exponential surge in usage over the past year. By looking at total trading volume for each crypto asset (calculated by taking the sum of all currency pairs that include BNB or BUSD as either the base or quote asset), we can observe the remarkable increase that has coincided with Binance's efforts to dominate all aspects of crypto.

Binance's BNB token is currently the third largest crypto asset by market cap, having grown more than 16x over the past few months. BNB offers trading discounts and can be used to pay fees on the various exchanges in the Binance ecosystem. It can also be used as gas on Binance's own blockchain network Binance Smart Chain (BSC), which has seen a surge in activity over the past few months. However, investors often consider holding BNB as a bet on the future of Binance.

Binance has also developed its own stablecoin, BUSD. BUSD currently serves as the quote asset for 197 trading pairs on Binance, and is often more stable than its stablecoin competitors. Before November of 2020, both crypto assets were infrequently used by traders, who often opted to trade currency pairs with Tether as the quote asset. That has since changed as Binance increasingly opts to list new pairs denominated in its own crypto assets. Despite the increase in volume, there has been growing criticism over both asset's lack of true decentralization.

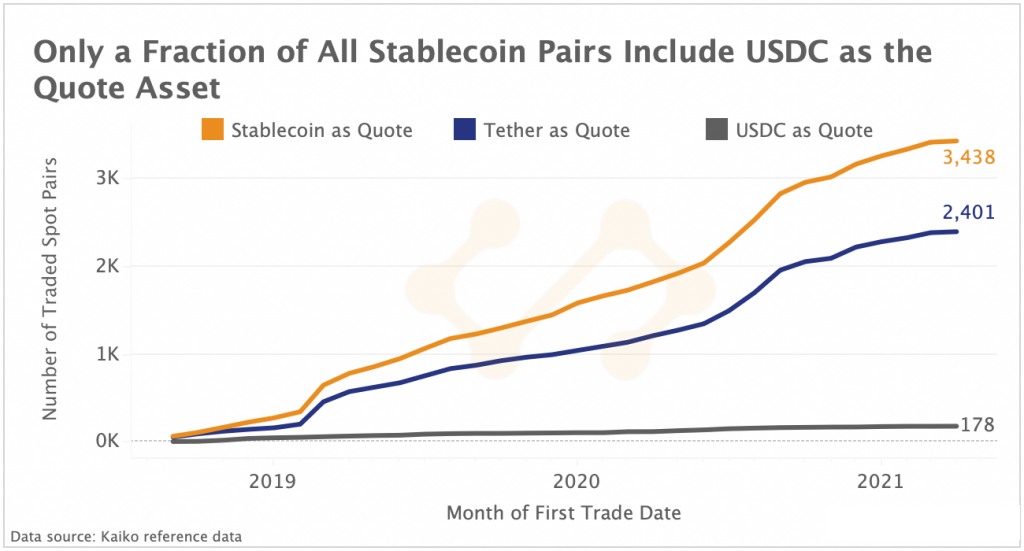

USDC trails competitor stablecoins

Stablecoins are all the rage in crypto right now as real-world use cases become increasingly tangible. However, the vast majority of all stablecoin activity still happens on centralized exchanges. Above, we charted the number of total spot trading pairs in Kaiko's collection that include a stablecoin as the quote asset, Tether as the quote asset, and USDC as the quote asset.

Circle's USDC stablecoin recently inked a landmark partnership with Visa, but its usage in crypto markets is but a fraction of Tether's, which is currently the dominant quote asset in crypto comprising 25% of all pairs and 70% of all stablecoin pairs. Tether has first-movers advantage and began trading in 2014, while USDC was launched in 2018. Improving USDC's market share is not so much about convincing consumers to trade with the stablecoin - rather, about convincing exchanges to list pairs denominated in USDC.

This is a good example of the power that exchanges hold over token projects - if an exchange is not willing to denominate pairs in USDC, then traders will be less likely to hold and use USDC. It is no surprise then that USDC has found a niche in decentralized financial markets like Uniswap, where anyone can list a trading pair. USDC is currently the third ranked crypto asset on Uniswap, while Tether ranks fourth.

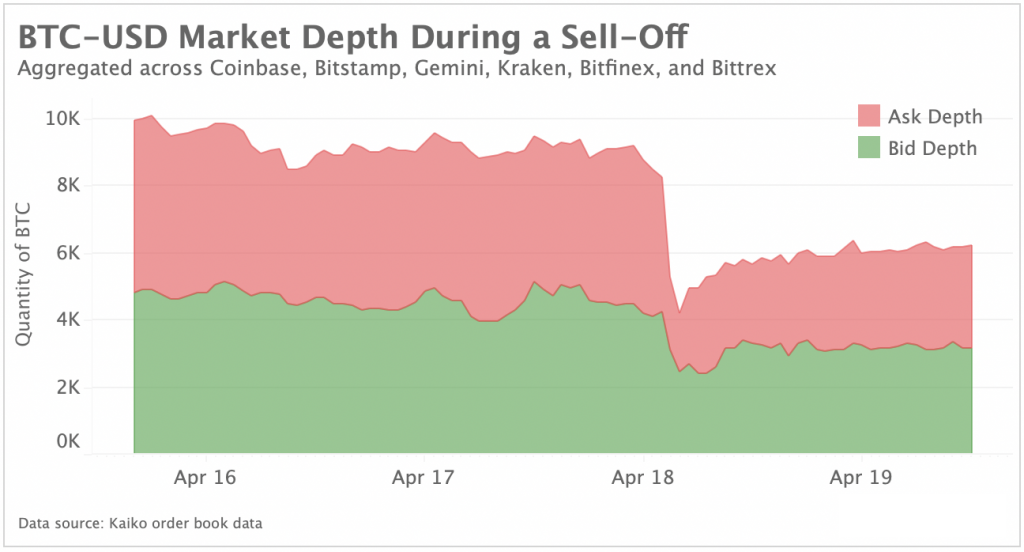

Sell-off eviscerates market depth

On April 18th, the price of Bitcoin slid more than $8k in a matter of hours. The crash was exacerbated by billions in forced liquidations of over-leveraged long positions in futures markets. A forced liquidation will occur when a trader cannot fulfil margin requirements for holding a long or short position, resulting in the automatic closure of the position. When long positions are liquidated, sell orders are executed which can put downward pressure on spot markets. We can observe a rapid decimation of market depth on spot BTC-USD order books aggregated across 6 exchanges. As of Monday morning, order book depth had not yet recovered to pre-crash levels, likely due to market makers pausing activities amidst the volatility.

Nadaq composite diverges from traditional financial assets

Traditional financial assets often experience similar volatility regimes influenced by global macro market events. However, over the past month the Nasdaq composite index has diverged from its counterparts. 30D volatility is now more than 10% greater than that of the S&P 500 index. The volatility comes as tech stocks undergo a series of corrections and recoveries. Gold and the S&P 500 now exhibit more similar volatility regimes, despite Gold's YTD performance down more than 6% compared with S&P's +11%.