A summarizing review of what has been happening at the crypto markets. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko.

U.S. inflation cooled further in June, bolstering the case for a September rate cut. Bitcoin (BTC) traded above $62K in the early hours of Monday, up nearly 11% over the past seven days. The SEC dropped its investigation into Paxos and BUSD on Thursday, while a vote to overturn President Biden's veto of the SEC's SAB 121 failed to reach the required majority in the House. This week we explore:

- ETH markets cool off ahead of spot ETF launch

- The rise of PolitiFi tokens

- BTC's growing use as a treasury asset

ETH spot market cools as wait for ETF launch intensifies

The mood in crypto markets is much changed from May, when the SEC approved spot ETH ETFs. Nearly two months on the new products have yet to begin trading, and ETH has fallen nearly 20% in the intervening period. That pullback doesn't tell the whole story though, under the hood things appear to be primed for spot ETF launches.

The ETH to BTC, which measures the relative performance of the two assets, remains elevated around 0.05. This is significantly higher than pre-approval levels of near 0.045. A stronger ratio suggests ETH could continue to outperform relative to BTC following ETF launches.

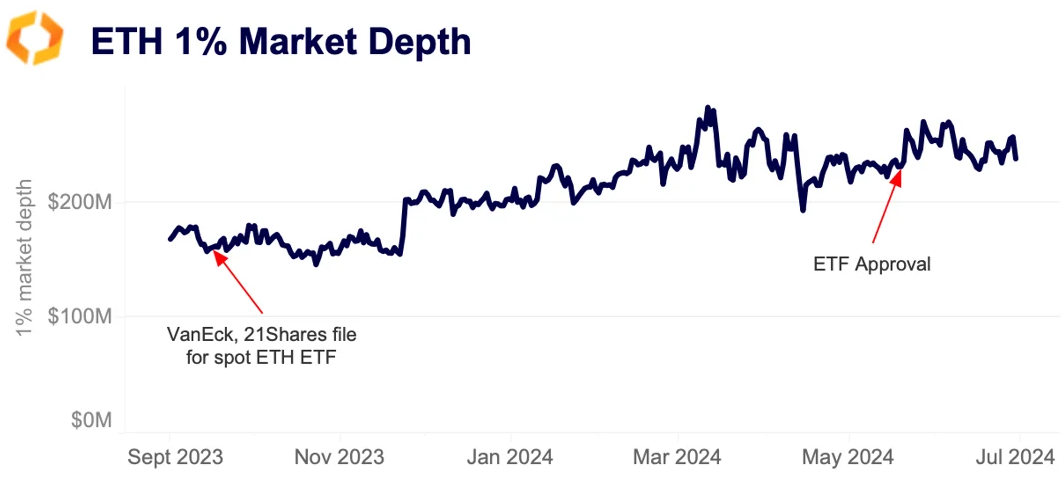

Liquidity conditions have sustained overall, despite the typical lull in trading volumes over the summer months. ETH's 1% market depth has remained consistent around $230mn since approval. It had dipped below $200mn at the beginning of May, but reverse this downtrend after the SEC green lit spot ETFs.

These ETFs could further improved liquidity conditions for ETH, as has been the case for BTC following January's launch.

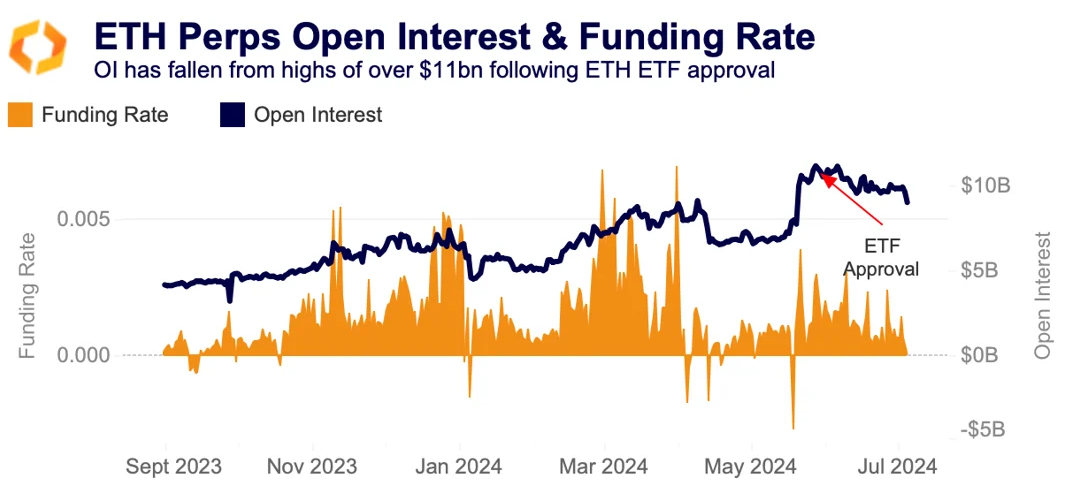

While spot markets have been largely resilent, despite the 20% drop in prices, perpetual futures have cooled more rapidly. Funding rates have halved since May, suggesting less conviction from traders as they are less willing to pay high rate to maintain long positions.

Open interest has also come down from highs of around $11bn following approval. The drop in funding rates and open interest may be linked to uncertainty over when these ETFs will launch.

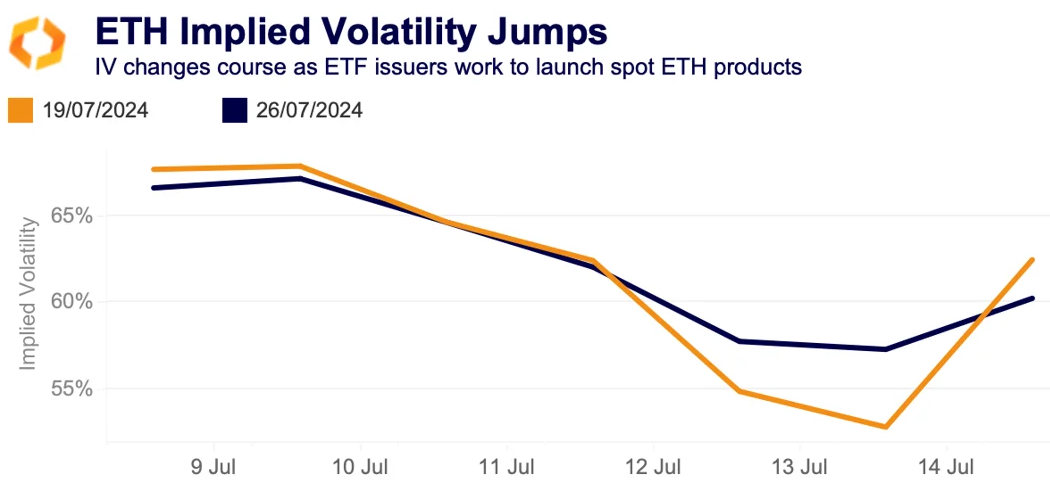

Implied volatility (IV) on near term options contracts rose sharply over the past week. Deribit ETH options expiring on July 19 and 26 experienced the sharpest changes. IV for July 19 jumped to 62% on Monday, from 53% on Saturday — rising above the longer dated July 26 contract.

The increase in IV on the July 19 contract suggests traders are willing to pay more to hedge existing positions and protect against sharp price moves in the short run. This spike in near-term contracts IV indicates a level of uncertainty among traders.

Crypto traders bet on the US election

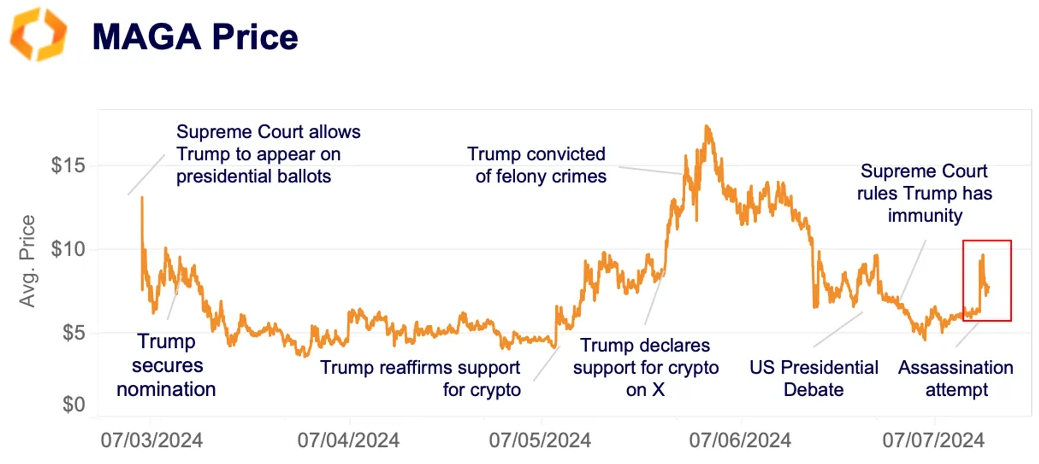

PolitiFi tokens, some of which are designed to speculate on election-driven hype, have surged in popularity this year due to the increasing significance of crypto in the US presidential campaign.

Most large-cap PolitiFi tokens are linked to former President Donald Trump and have seen significant price fluctuations based on his crypto stance and campaign news. The MAGA token surged 51% in two hours after Trump’s shooting on Saturday, though it lost some gains the following day. This rise was mirrored by an increase in shares of Trump's Media & Technology Group (DJT), indicating that some investors are betting on a potential sympathy vote.

While MAGA remains highly speculative, its weekly trading volume has also increased, suggesting growing interest from market participants. Volume surged from $10-15 million in February to a peak of $120 million in June before retreating in early July alongside prices.

So far, these tokens have shown little signs of predictive value. However, the trend suggests that a win for Trump could be pivotal for the industry, which is in need of regulatory clarity.

It's not just PolitiFi tokens that are being used to take positions on the upcoming election. Solana's SOL could be considered a bet on the presidency as well. Matthew Sigel, head of digital asset research at VanEck said his firm's SOL ETF filing was a bet on the election.

The SEC has until March 2025 to respond to VanEck's SOL ETF filing, which doesn't leave much time for a new administration to be appointed — if President Biden lost the election.

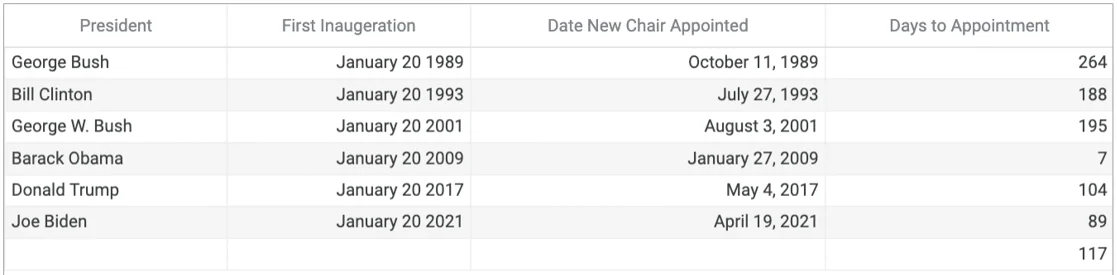

On average it has taken 117 days for new presidents to appointment a Chairperson to the SEC. While, Barack Obama broke the mould when he appointed Mary Schapiro just seven days into his first term, it was under exceptional circumstances during the global financial crisis.

BTC appeal as a treasury asset is rising

In 2024, several companies began to follow the lead of MicroStrategy (MSTR), Tesla (TSLA), and The Block (SQ) by allocating portions of their balance sheets into Bitcoin. This shift was driven by Bitcoin's increasing appeal as a treasury asset, largely due to regulatory factors.

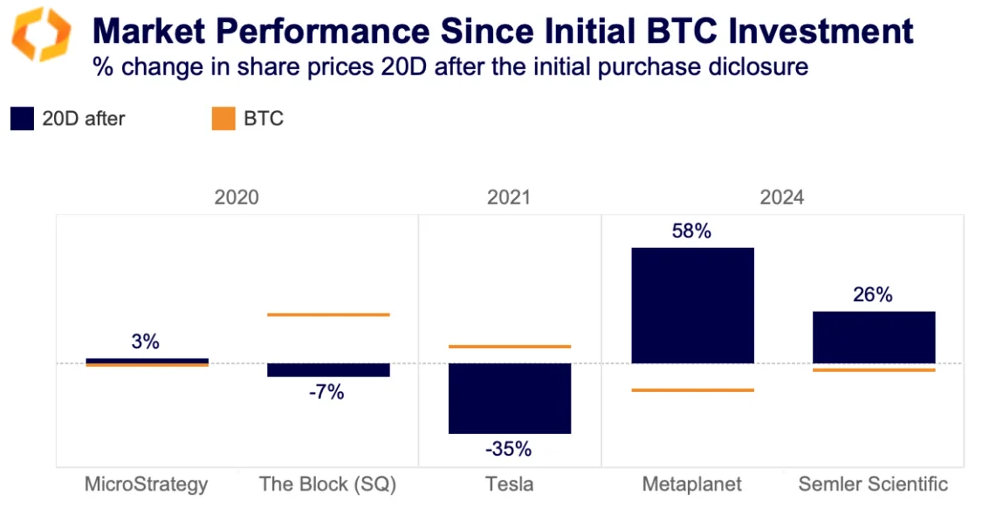

The move has yielded varied results. Some companies such as MicroStrategy, saw substantial gains, while others faced minimal impact.

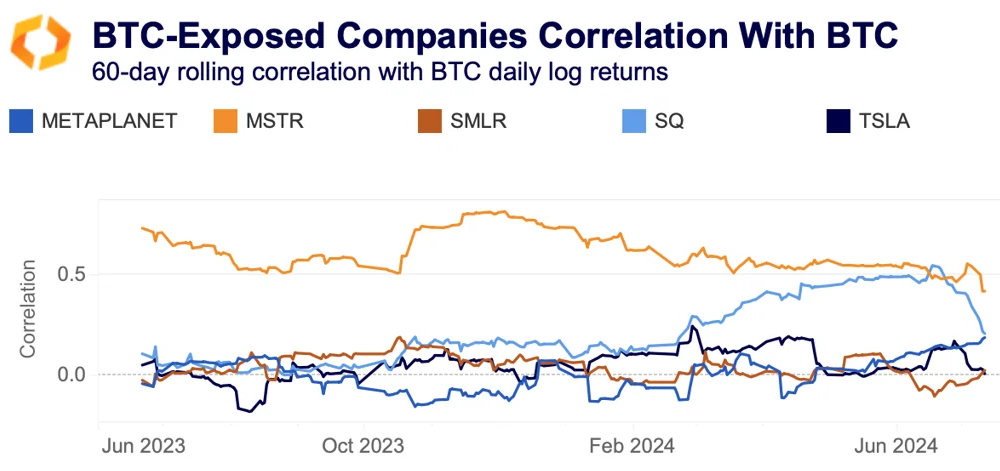

The 60-day rolling correlation of these companies' share prices with Bitcoin's daily returns varies significantly from zero to 0.4. Historically, MSTR and SQ have shown the strongest correlation with Bitcoin. Interestingly, Metaplanet's correlation has increased to a multi-year high of 0.2 since April, coinciding with the company's decision to add BTC to its balance sheet.

Overall, however, the initial impact in 2024 was more significant compared to previous years.

Metaplanet and Semler Scientific, which integrated BTC into their balance sheets in April and May 2024, saw their share prices surge by 58% and 25% respectively, even though Bitcoin's price was falling during the same period. In contrast, despite a significant rise in its value over the past four years, MSTR's share prices showed a minimal increase after its first BTC purchase, while both Square's and Tesla's share prices dipped.

This trend could be due to Bitcoin's growth since 2020, improved regulation, increased acceptance, and recognition as a legitimate investment. Additionally, the approval of spot ETFs in the US and promotional campaigns led by major asset managers like BlackRock and Fidelity have greatly increased global public education about BTC, likely amplifying the announcement effect.

BTC and ETH dominate perpetual futures markets

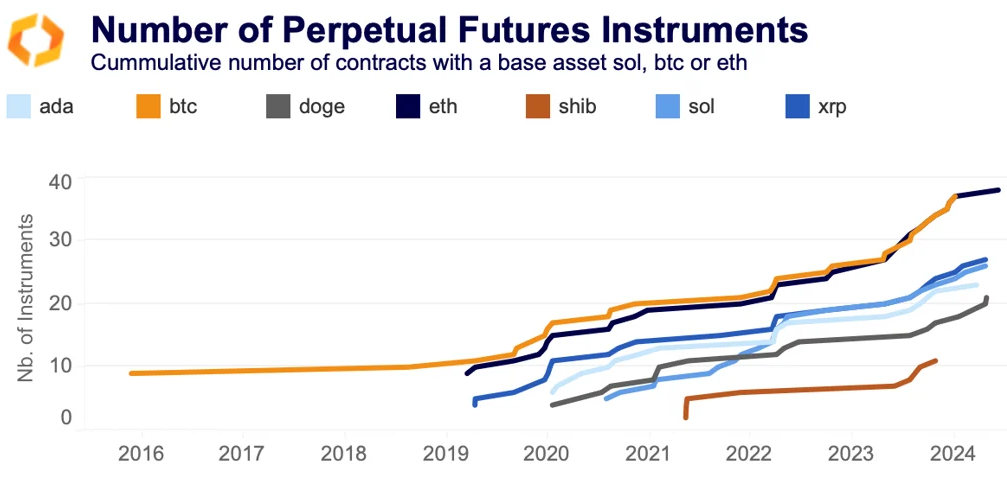

BTC and ETH continue to dominate the perpetual futures market in both volume and the number of available derivatives instruments. Perpetual futures are essential tools for traders to hedge and speculate on assets, facilitating price discovery. Over the past years, BTC and ETH have consistently maintained a higher number of available contracts compared to other cryptocurrencies.

Although large-cap altcoins such as SOL, ADA, XRP, and DOGE have experienced growth in the number of available perpetual futures contracts, the gap between these altcoins and the two major cryptocurrencies (BTC and ETH) has widened.

Exchanges have slowed the listing of altcoin perpetual futures instruments since the Terra collapse in May 2022 as speculative demand waned and market participation plummeted. However, this trend has reversed over the past year, with the number of newly listed perpetual futures instruments rising by double digits.

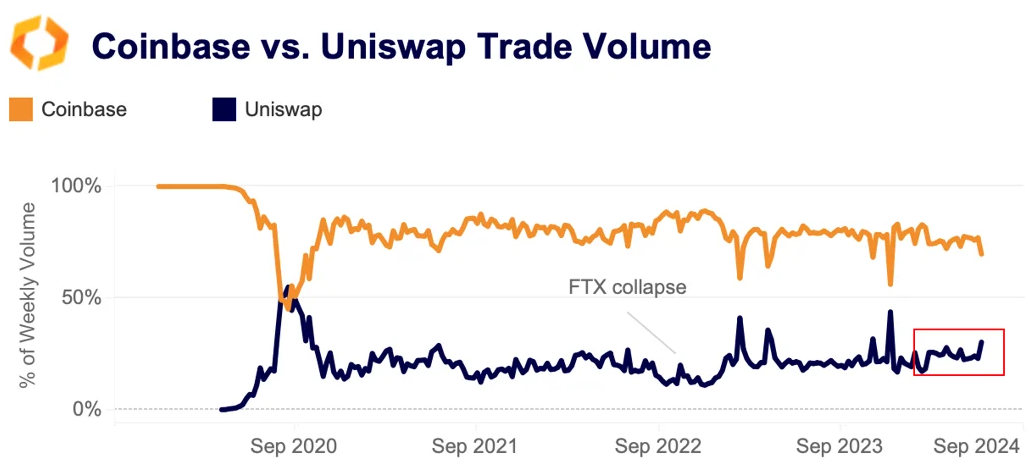

Uniswap keeps pace with Coinbase

This year, Uniswap's trading volume on Ethereum has managed to keep up with Coinbase, the largest US-based exchange, maintaining an average market share of 24%. This represents a slight increase from the previous year's share of 21% . However, Uniswap's current market share is significantly lower than its peak of 55% during the DeFi summer of 2020. One explanation for this is that Ethereum-based DEXs have lagged significantly other blockchains namely Arbitrum, Base and Solana during the recent market rally.

Overall, DEXs volumes are still low compared to CEXs as they offer less-user friendly-experience. However, demand for non-custodial trading has increased following the collapse of FTX, with Uniswap’s market share remaining consistently above 20% for the longest period since 2020/21, indicating a robust interest in DEXs among traders.