A summarizing review of what has been happening at the crypto markets. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko.

Crypto markets are recovering from the recent sell-off. Meanwhile, the SEC vs. Ripple case ended with a $125 million fine. Collapsed lender Celsius is suing Tether for allegedly improper liquidation of 39,542 BTC. Brazil's financial regulator approved a SOL spot ETF. This week we explore:

- How crypto liquidity fragmentation impacts prices

- BTC post-sell-off VaR analysis

- BTC underperforming gold

How is crypto liquidity fragmentation impacting markets?

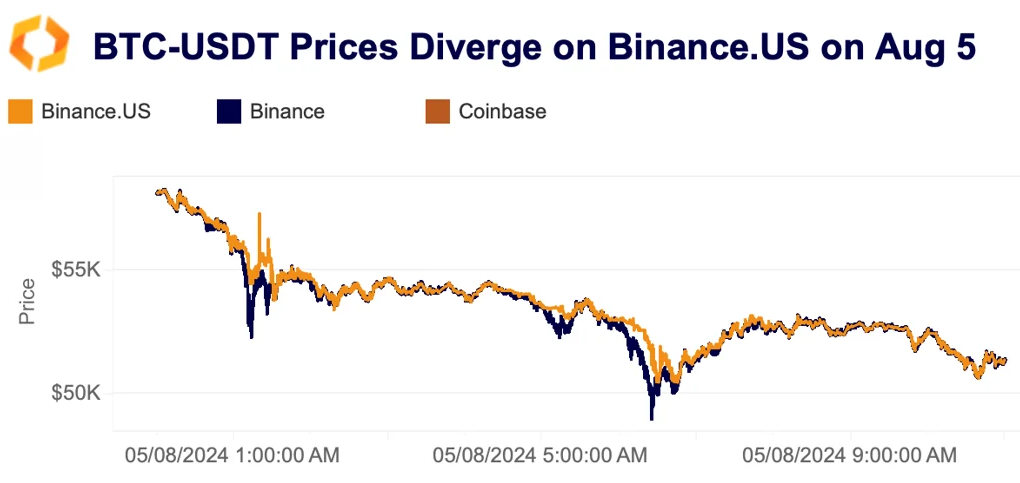

Liquidity fragmentation persists in crypto markets, and with it, price discrepancies across exchanges. Although these have decreased over time, they remain—especially on smaller, less liquid exchanges—and appear particularly during market events like last week’s sell-off. For example, on August 5, BTC prices on Binance.US diverged from those on more liquid platforms. Less liquid altcoins (not charted) experienced even greater discrepancies.

Binance.US is a relatively illiquid platform that has seen its trade volume and liquidity plummet after last year’s SEC suit in June 2023. It is currently facilitating just $20 million in daily trade volume, down from $400 million in early 2023. One of the best indicators of liquidity is price slippage—the difference between the expected price of a market order and its actual execution price. Slippage tends to spike during market sell-offs as liquidity dries up, making it more difficult to fill orders at the desired price. Kaiko data allows us to calculate the simulated price slippage for a $100k sell order across exchanges and trading pairs.

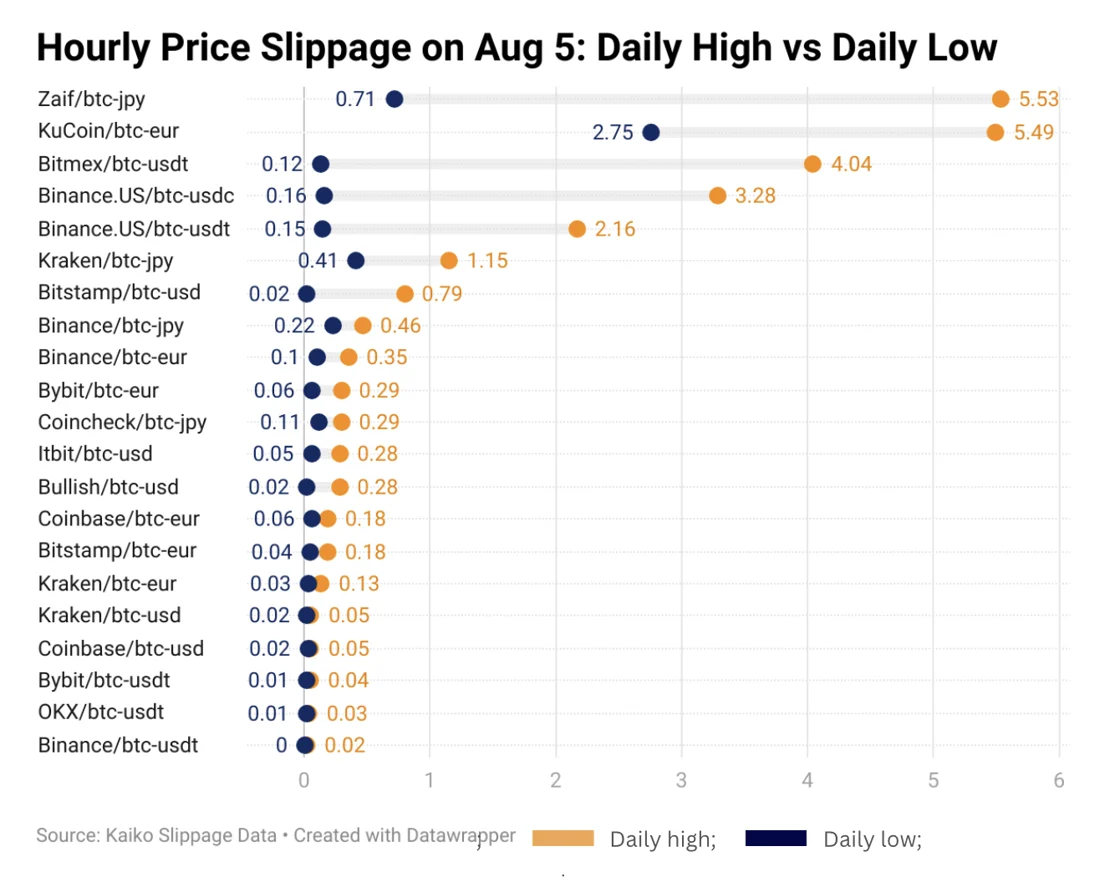

While BTC price slippage increased across most exchanges during the August 5th sell-off, the spike was much more pronounced on some exchanges and trading pairs.

Zaif's BTC-JPY had the highest slippage on the sell-off day, attributed to the Bank of Japan's rate hike. KuCoin’s BTC-EUR pair experienced similar slippage, exceeding 5% that day. Surprisingly, stablecoin-quoted pairs, including BitMEX and Binance US's USDT and USDC pairs, also saw significant increases of more than 3 basis points. These pairs are usually the most liquid on crypto exchanges.

The impact on liquidity from an event can vary not only across exchanges but also among trading pairs within the same exchange. For instance, Coinbase's BTC-EUR pair is notably less liquid than its BTC-USD pair. This discrepancy can lead to extreme volatility during heightened market activity, as seen in March when prices of Coinbase's BTC-EUR diverged significantly from the broader market and market depth plummeted.

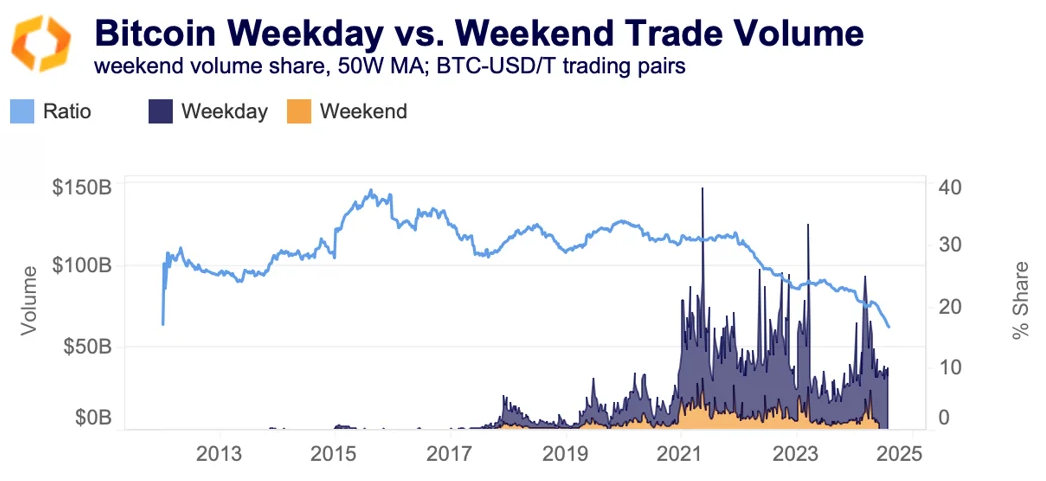

Additionally, liquidity is increasingly concentrated during weekdays, particularly in BTC-USD markets.

While this trend has been ongoing for years, it has intensified with the launch of spot ETFs in the US. Unlike traditional markets that close on weekends, crypto markets operate 24/7. This causes sell-offs that start on a Friday to worsen weekend uncertainty, amplifying price impacts.

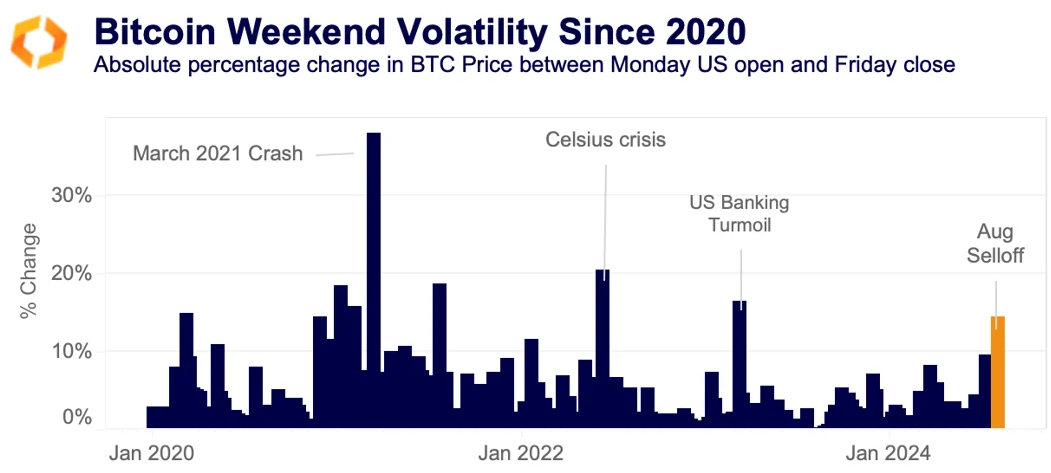

Although weekend volatility has generally declined since 2021, increased weekday trading concentration heightens the risk of sharp weekend price swings during market stress. For instance, Bitcoin moved 14% between Monday’s US open (14:00 UTC) and Friday’s close (20:00 UTC) during the recent sell-off, similar to major sell-offs since 2020.

While liquidity fragmentation remains a challenge, crypto platforms have heavily invested in infrastructure, enabling them to handle an increased number of trades without outages. This has played a positive role in lowering the cost of exploiting arbitrage opportunities between exchanges.

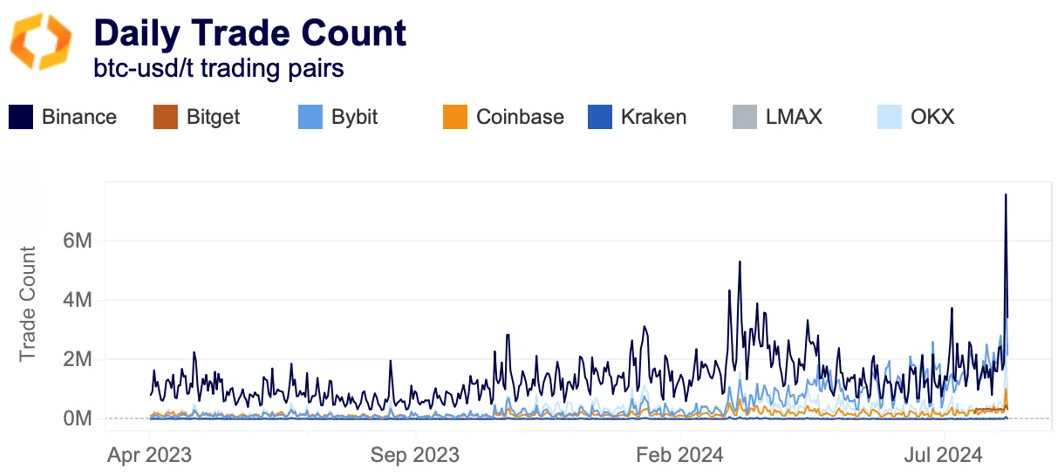

During last week's sell-off, BTC-USD and BTC-USDT trade counts hit record highs on Bybit, reached post-FTX collapse levels on Coinbase, and saw the highest activity on Kraken since June 2022.

Price plunge highlights need for unique risk indicators

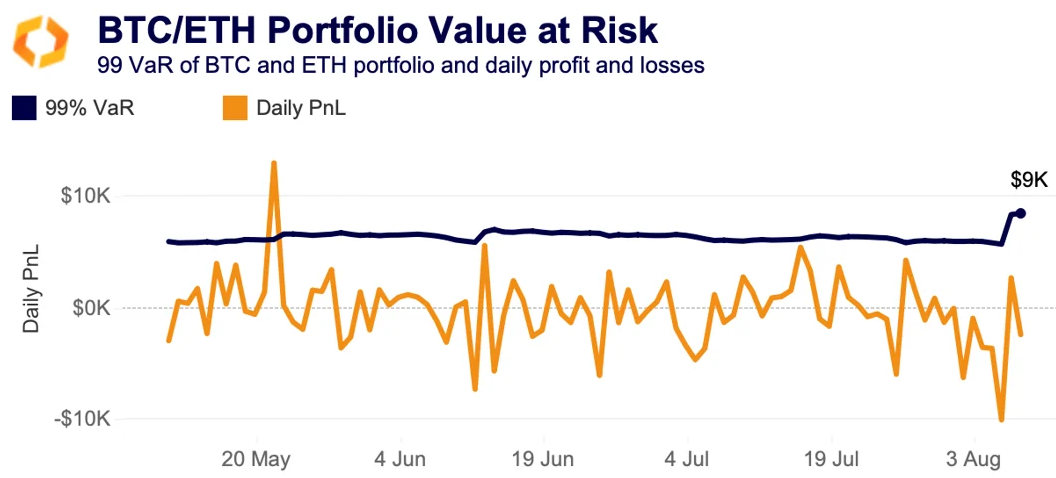

After last week's price crash, risk management is back in focus. We find Value at Risk (VaR) a highly useful tool, as it quantifies potential portfolio losses and their probability. It serves as a loss metric at a given confidence level, such as 99% or 95% VaR. Our methodology accounts for the unique nature of crypto markets, providing a more comprehensive risk profile.

Our approach prioritizes recent data over older data, often resulting in a higher VaR than traditional methods. This helps capture the volatile nature of crypto markets and provides a better understanding of potential losses.

For example, during the recent August crash, our 99% VaR for a BTC/ETH portfolio rose from $6,000 on August 1 to $9,000 on August 8. This means we statistically expect losses of $9,000 or more one day out of every 100. Our method's quick response to new data enhances real-time risk management, unlike traditional methods that rely heavily on historical data.

Heightened risk persists in crypto as equities cool off

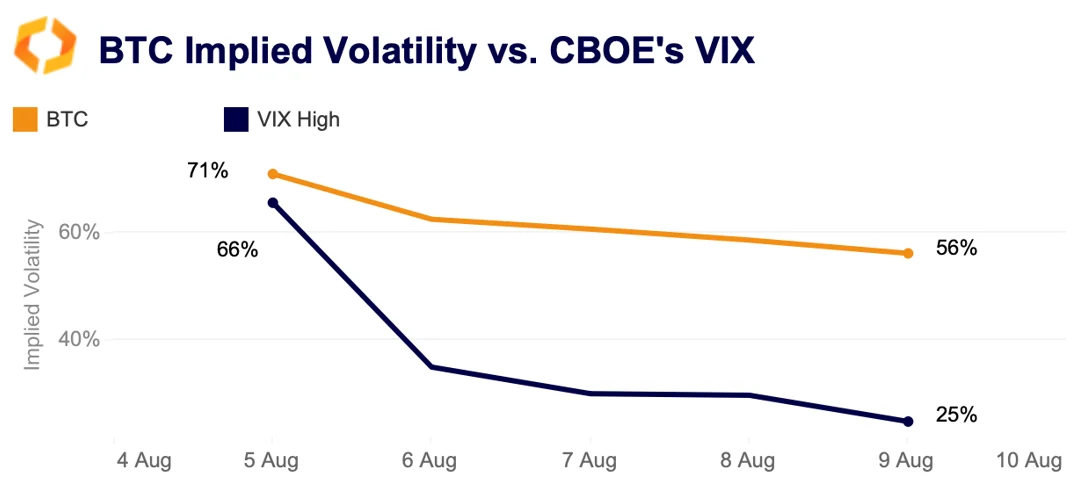

Crypto markets experienced a surge in volatility last week, driven by macroeconomic news that unsettled investors. Bitcoin's realized volatility reached its highest level since April. Meanwhile, implied volatility, which gauges expected future price fluctuations, also increased sharply. On Monday, the implied volatility of Bitcoin contracts on Deribit with a one-month expiry hit 71.

Concurrently, the VIX index, which tracks expected volatility in U.S. equities, peaked at 65.7 on Monday, a level not seen since the COVID-19 pandemic. By the end of the day, the VIX stood at 39, with Friday's high at 25, a stronger slowdown than BTC's that decreased to only 56%.

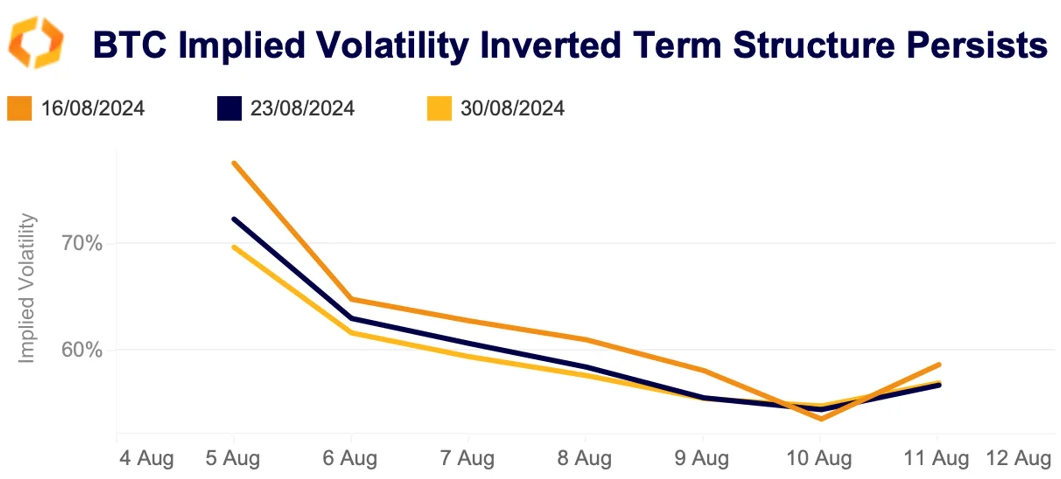

Meanwhile, implied volatility has been slower to cool off in crypto, despite falling 9 percentage points over the week; the risk of near-term volatility remains high. The implied volatility on near-term contracts remains higher than that of longer-dated contracts. This is known as an inverted term structure and suggests there's a risk of more volatility spikes in the short term.

The past few months have been challenging, with Mt. Gox repayments putting pressure on the market and ETFs losing traction despite ETH ETF approvals. In our latest quarterly report, we breakdown the decline in volumes relative to Q1, ETF flows, tokenization trends, emerging markets growth, and much more.

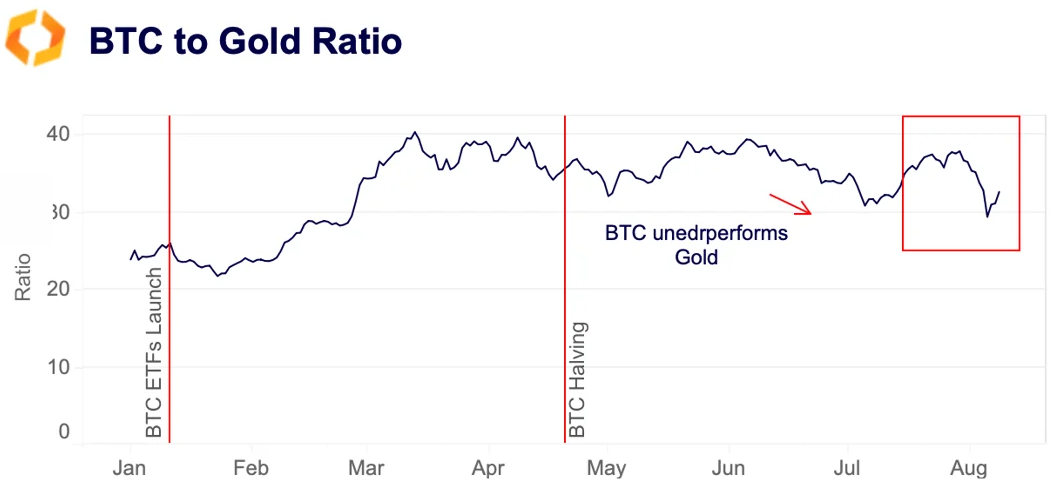

Bitcoin underperforms gold during the recent sell-off

Bitcoin has underperformed gold during the recent selloff, moving in tandem with tech equities. The BTC to gold ratio, which measures the relative performance of the two assets, dropped to its lowest level since February on Aug. 5, despite inching up slightly since then. When the ratio declines, Bitcoin underperforms, and vice versa.

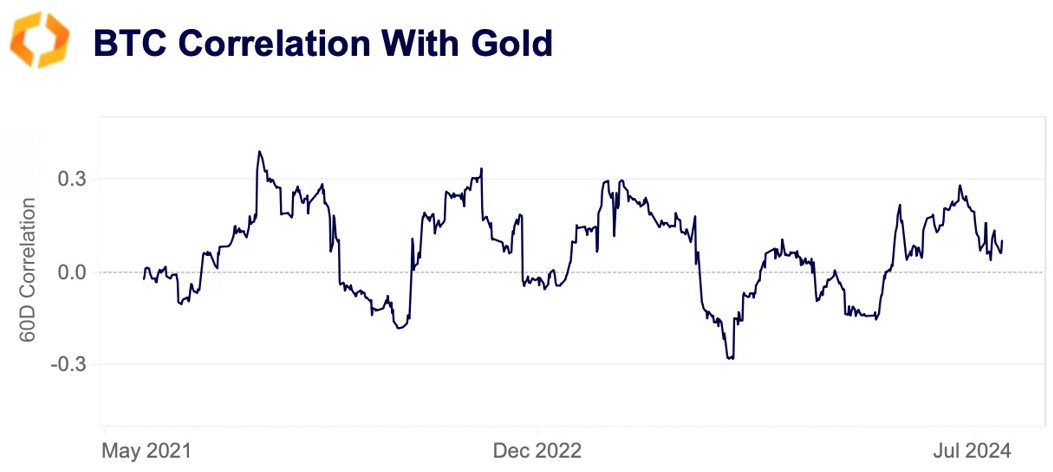

Does this recent underperformance mean that Bitcoin is losing its safe-haven appeal? While most ETF issuers are pitching Bitcoin as a complement or an alternative to gold, the two assets have different fundamental drivers. This is evident when looking at the 60-day correlation between Bitcoin and gold, which has been fairly weak, oscillating between -0.3 and 0.3 over the past two years. Bitcoin's price has been closely tied to U.S. markets and has largely benefited from increasing institutional adoption following the launch of spot ETFs in January.

In contrast, gold has shown resilience to tightening global monetary policy, boosted by strong central bank demand. Central bank gold purchases doubled in 2022 and have remained high in 2023.