A summarizing review of what has been happening at the crypto markets. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko.

Last week saw significant regulatory developments in the cryptocurrency space. The U.S. Securities and Exchange Commission (SEC) charged Cumberland, one of the oldest liquidity providers in crypto, with operating as an unregistered broker-dealer. In a separate case, the SEC, in conjunction with the Department of Justice (DOJ), took action against several companies and individuals allegedly involved in wash trading. This week, we will explore:

- The increasing traction of MiCA-compliant EUR stablecoins

- Crypto.com files lawsuit against the SEC

- The impact of the SEC's enforcement action on Bitcoin's liquidity

MiCA reshapes the EUR stablecoin market

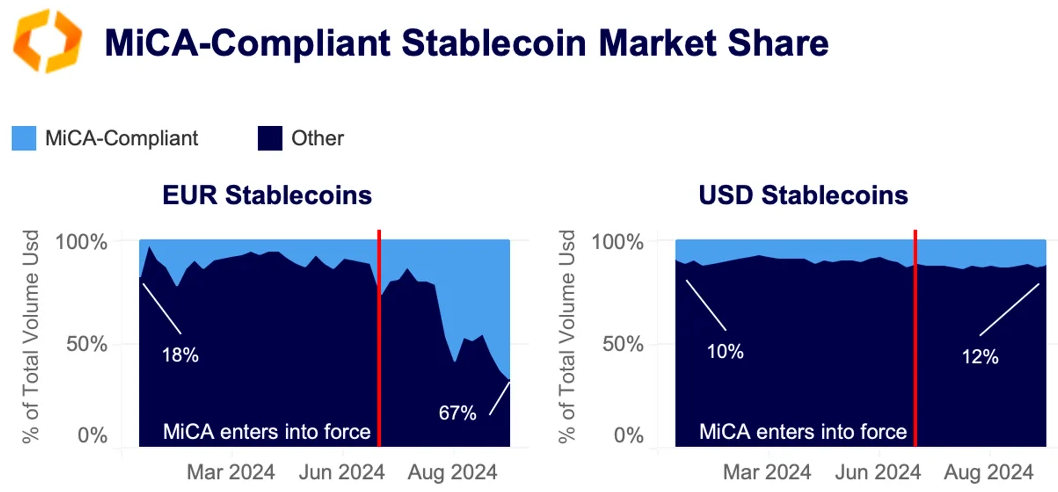

The landmark European Markets in Crypto-Assets Regulation (MiCA) went into effect at the end of June, spurring a wave of stablecoin delistings and product offering tweaks across major exchanges. In early October, Coinbase announced it would delist USDT for European users by the end of the year, following similar actions taken by several other major centralized exchanges.

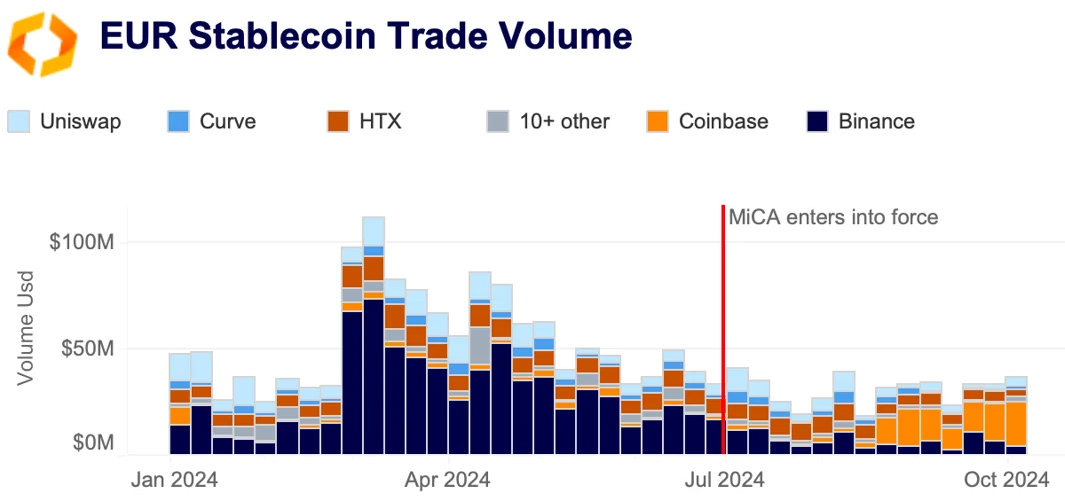

Three months into MiCA implementation, we explore how it has reshaped stablecoins market share. Unsurprisingly, the most pronounced effects have been on EUR-stablecoin markets. The market share of MiCA-compliant EUR stablecoins, including Circle's EURC and Société Générale's EURCV, reached an all-time high of 67% last week. This shift was primarily driven by Coinbase, which overtook Binance as the leading market for EUR-stablecoins in August. Meanwhile, Binance has been mainly promoting non-compliant euro stablecoins for non-european users through its zero-fee model.

Looking at USD-backed stablecoins, USDC, which is currently the largest MiCA-compliant USD-backed stablecoin, has also seen its market share increase, albeit more moderately, from 10% to 12%.

Overall, weekly trading volumes of EUR-backed stablecoins have remained relatively steady at around $30 million since MiCA's implementation, notably lower than the $100 million levels seen in March. This indicates that there has not been a significant increase in demand for EUR-backed stablecoins despite the regulatory changes. Instead, the shifts in market share are primarily due to exchange delistings forced by MiCA compliance.

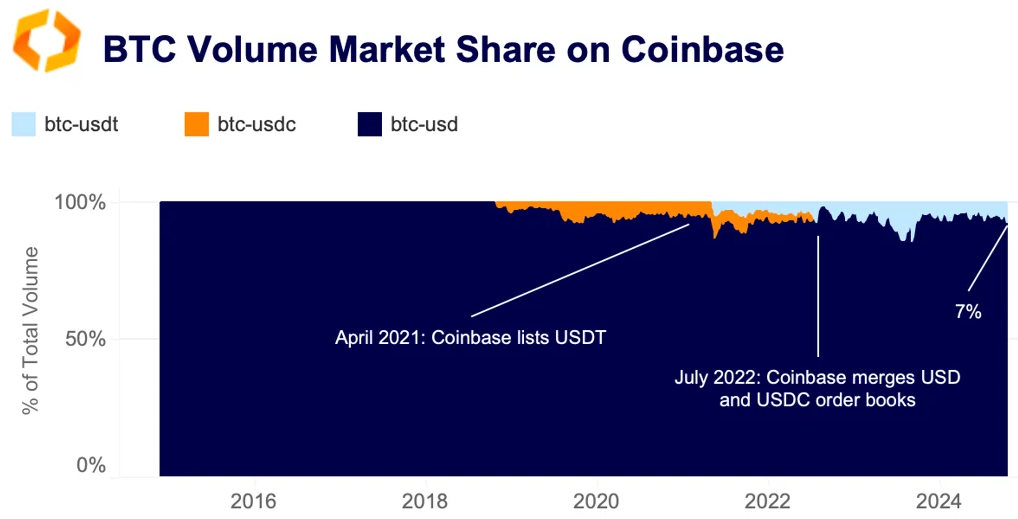

Can we expect a shift in market share for USD-backed stablecoins? The upcoming delisting of USDT for European users on Coinbase may boost regulated USD-backed stablecoins. Historically, USDT (non-compliant with MiCA) has seen rapid global adoption. Listed on Coinbase in 2021, USDT's share of BTC-USDT volume rose from 1% to over 5% within weeks, surpassing BTC-USDC by the end of 2021. Despite Coinbase merging its USD and USDC order books in July 2022 to enhance liquidity, USDT's market share remained significant, at around 10% in Q2.

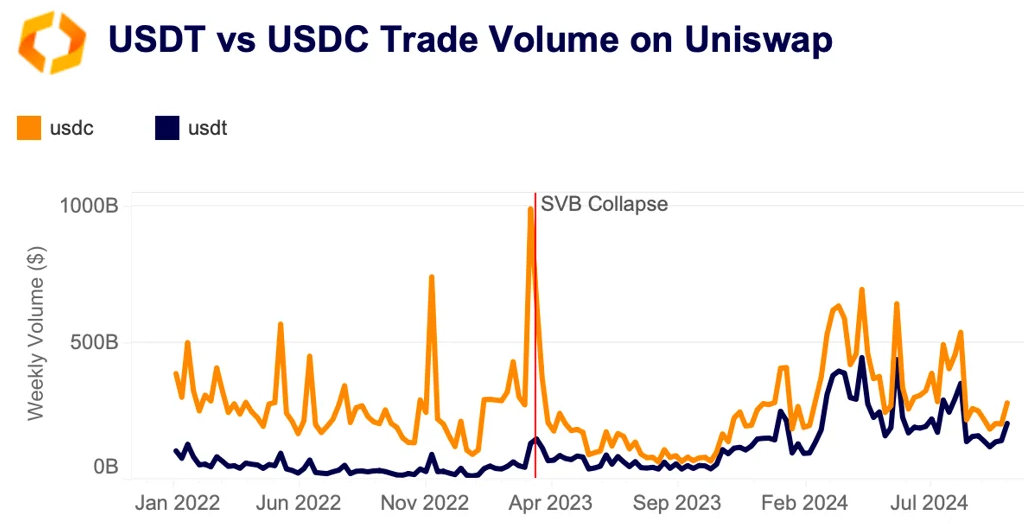

MiCA could also impact the ongoing battle for stablecoin dominance on decentralized exchanges (DEXs). Since DEXs are not regulated under the new rules, they allow for USDT trading, which could attract traders seeking liquidity - as USDT remains by far the most liquid stablecoin in the market.

This could provide an additional boost to USDT's growing usage in DeFi. The trend has been evident since the US banking crisis, with USDT gaining traction on the largest Ethereum DEX, Uniswap.

In contrast, USDC’s dominance on Uniswap has dwindled significantly after it experienced a sharp depeg following the collapse of one of Circle’s major banking partners, Silicon Valley Bank (SVB). USDC market share on Uniswap has fallen from nearly 90% in 2022 to around 55% as of last week.

Crypto.com squares off against the SEC

Last week, Crypto.com became the latest exchange to sue the SEC. CEO Kris Marszalek announced the lawsuit on Tuesday, revealing that the exchange has been under investigation since February 2023 and received notice of potential enforcement action in August 2024.

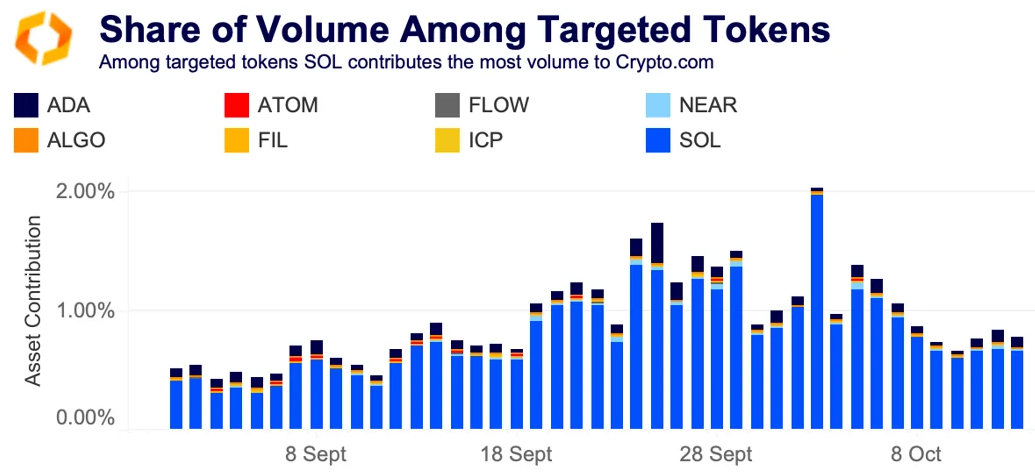

The SEC's argument, similar to its cases against Coinbase and Kraken, is that certain cryptocurrencies are securities. These include SOL, ADA, BNB, FIL, and FLOW, among others. Of the tokens still actively trading on Crypto.com, only SOL significantly impacts overall volumes.

Crypto.com argues that the regulator has overreached in its investigation and established an 'unlawful rule' that results in nearly all trades being considered securities transactions, regardless of how they are sold.

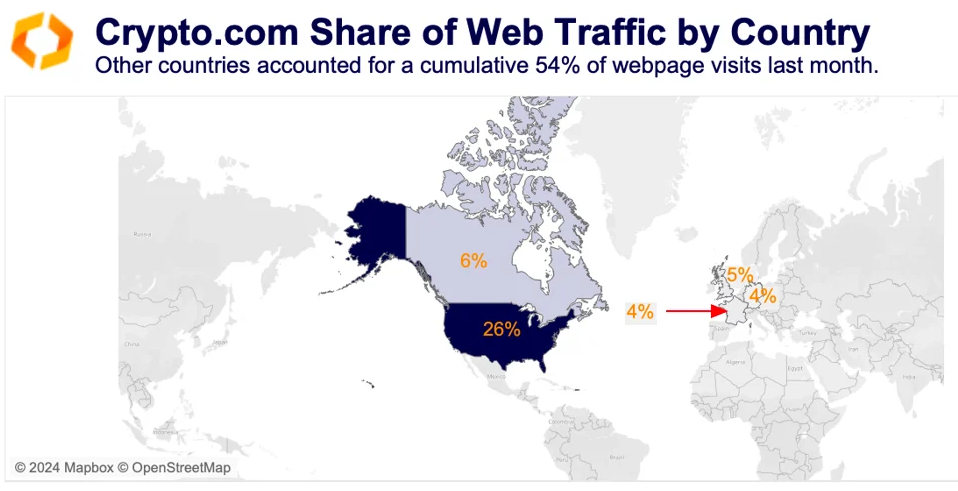

The US is a significant part of the exchange's business, with over 26% of web traffic last month coming from the US—which can be used as a proxy for users' location. App store downloads reinforce this, with most downloads coming from the US, UK, and Canada, according to Sensor Tower.

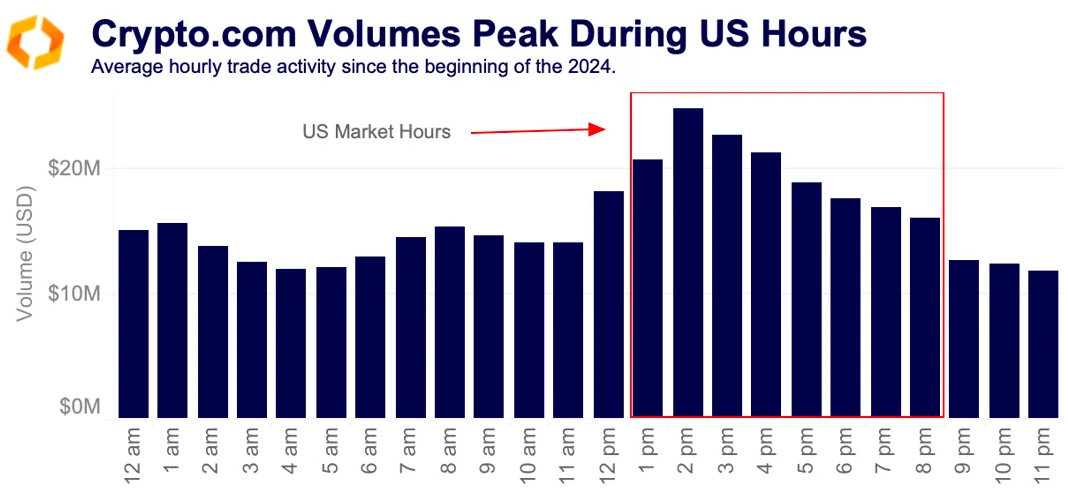

Furthermore, the pattern of trading activity on Crypto.com suggests that the majority of users are active during US hours. Average hourly trade volumes increase during US market hours, peaking around 2 PM UTC (10 AM EST).

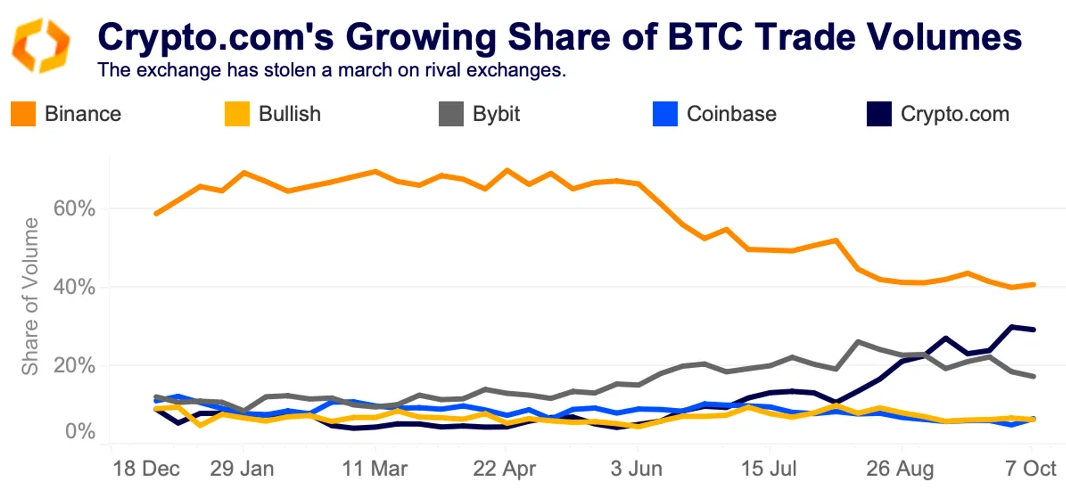

The lawsuit comes at a critical time for the exchange, which has been stealing a march on competitors both in the US and abroad this year. Crypto.com has increased its share of BTC trade volume among the largest exchanges to just under 30%. The exchange has eclipsed Bybit in terms of BTC volume—with its share change increasing significantly since the August 5 crash—and is now close to challenging Binance.

Crypto.com ranked third in our latest exchange ranking, registering the highest liquidity score among its competitors.

What does China's equities volatility means for crypto?

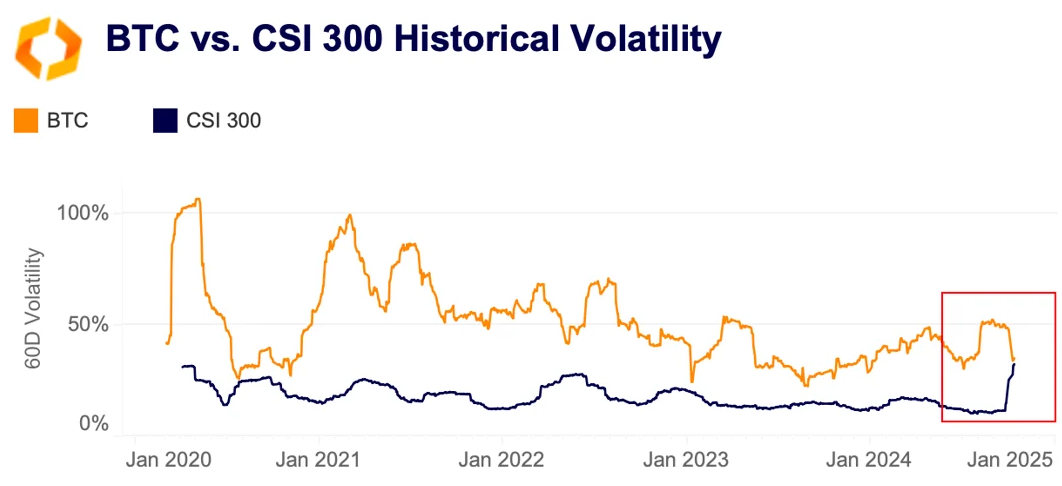

China's stock market has experienced significant volatility in recent weeks, with the blue-chip CSI 300 index recording its highest annualized 60-day volatility since 2016, nearing the levels typically associated with Bitcoin (BTC).

The CSI 300 surged by over 20% following the central bank's announcement of new stimulus measures, including a 500 billion CNY ($71 billion) direct swap line, which allowed securities firms, fund companies, and insurers to borrow against eligible collateral to purchase Chinese equities. However, this upward trend reversed last week due to concerns about the pace of stimulus measures, leading to a daily drop in the CSI 300 since 2020.

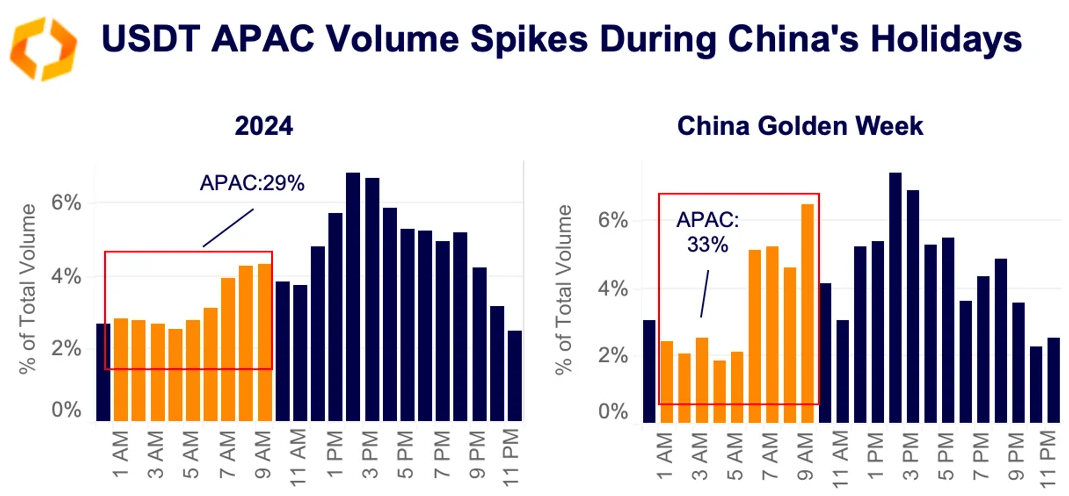

The initial surge in Chinese stocks reportedly triggered FOMO (Fear of Missing Out) selling of crypto assets, as investors rushed to capitalize on rising equity prices. This trend was likely exacerbated by the Chinese Golden Week holiday.

Historical analysis of the USDT-fiat trading pair, USDT-USD, suggests that during this period, trading volume is concentrated during APAC opening hours, indicating that more Asia-based traders may be liquidating crypto holdings into fiat to fund their holiday expenditures.

Overall, the correlation between Bitcoin and the CSI 300 over the past four years has been very low suggesting different price drivers. However, a revival in Chinese consumer confidence could benefit both asset classes, potentially unlocking significant cash from both institutional and retail traders currently sitting on the sidelines.

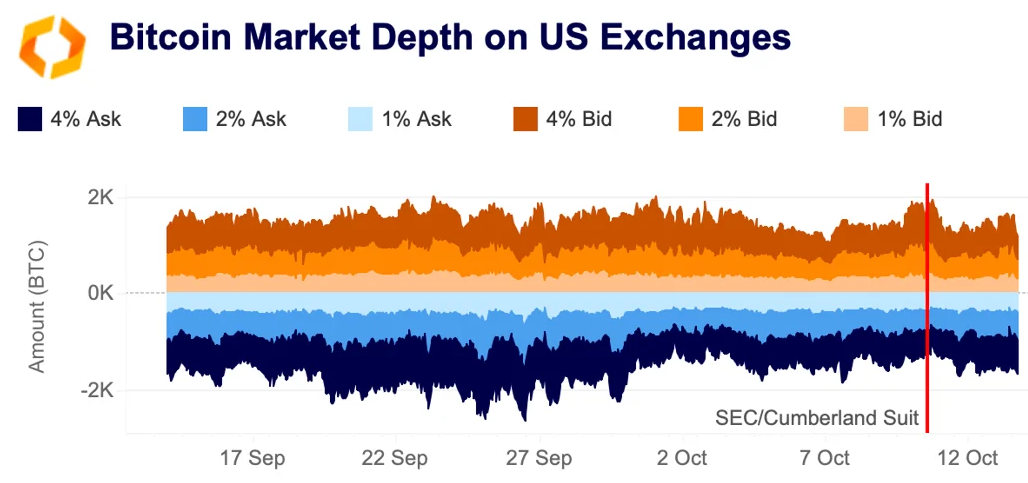

Bitcoin market depth drops after Cumberland charges

On October 9, U.S. regulators, including the SEC and DOJ, took action against fraudulent crypto market makers and trading firms. This was followed by charges against Cumberland on October 10 for operating as an unregistered broker-dealer. While Bitcoin liquidity initially increased after the October 9 suit, the market reacted negatively to the charges against Cumberland, one of the oldest liquidity providers in the industry.

Coinbase's 2% BTC depth began to decline around 6 PM UTC on October 10, falling by 46% within a few hours from 492 BTC to 267 BTC. Liquidity recovered in the following days to around 400 BTC. Notably, the ask depth (sell orders) dropped, while bid depth (buy orders) increased, indicating that market makers had readjusted their positions, possibly anticipating a price decline. Kraken saw a smaller reduction in depth, although the decline began a few hours earlier (around 9 AM UTC), suggesting that some market makers may have been anticipating the enforcement actions.

Overall, liquidity on U.S. exchanges remained below pre-lawsuit levels, which could indicate persistent market uncertainty.