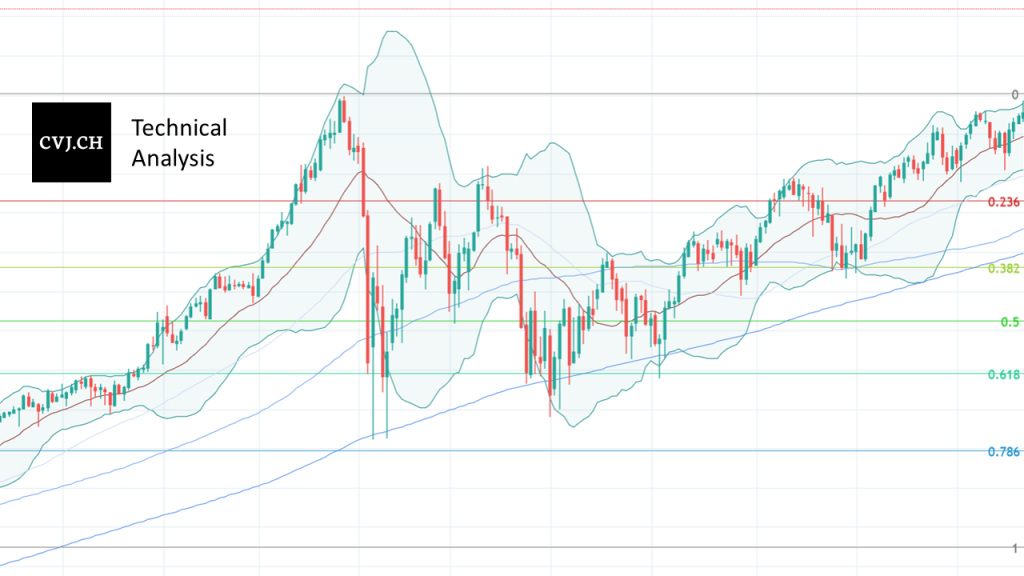

Bitcoin USD daily basis

Bitcoin USD Chart Analysis - First Defense of the 30,000 Support Zone

During the reporting week, Bitcoin managed to stabilize above the 30,000 zone and subsequently gained terrain. Monday's start was volatile with the highest price swing of the week, marking a daily low at 32,941, but managed to end the day with a daily close at $36,684. The trading range from the daily low to the daily high of a good 15% signalled a weakening momentum of the selling pressure and a preliminary turning point of the downward spiral of the previous week. Accordingly, the trading session on Tuesday was modest, which closed at USD 36,974. Encouraged follow-on buying on Wednesday took the price to USD 38,970 at the day's high, but profit-taking pulled the price back to the USD 37,000 level by the day's close. Three trading days followed, characterized by respective higher daily lows and highs, which took Bitcoin to USD 38,195 by Saturday. The subsequent consolidation on Sunday at the level of 38,000 USD let Bitcoin go close to the 40,000 resistance from the week.

Break of groundbreaking supports

Daily Interval Review

After the mid-March 2020 price plunge, a veritable countermovement established itself. This led to the resistance zones above USD 10,000. After an initial rejection and a consolidation phase of almost two months, a breakthrough through the fundamental resistance zone followed on July 27, 2020, which persisted since August 2019 and accordingly caused Bitcoin to fail several times already.

The area around USD 10,000, which served as resistance, was interesting in several respects. On the one hand, the 0.618 Fibonacci point of the entire downward movement, which was initiated at the end of June 2019 just below USD 14,000, was located in this price area. On the other hand, the zone around USD 10,000 simultaneously acted as a witness of the still bearish trend from lower highs since December 2017 (see the macro view on a weekly basis). Bitcoin was able to establish itself above the newly created support in the USD 10,000 area since the end of July 2020 and provided initial confirmation of a trend reversal of the bear market that had persisted since 2018 with the break of the resistance zone around USD 12,200 towards the end of October 2020. In the following weeks, the positive trend accentuated and led Bitcoin through the 14,000 resistance in early November 2020 and close to the then all-time highs around 20,000 USD for the first time in early December, which remained untouched for 158 weeks since the bull market in 2017.

With the breakthrough the old all-time high at USD 20,000, the trend reversal was definitely heralded. Accordingly, there was a strong accentuation of the uptrend, which brought the Bitcoin price to its new all-time high just below 65,000 USD in just over 4 months. However, the rapid upward movement was abruptly halted in mid-May 2020, taking Bitcoin back to the USD 30,000 areas. After a three-month consolidation phase, the upward movement was continued no less spectacularly after a "rounding bottom" in the 0.61 Fibonacci area, which finally ended with a new all-time high at USD 69,000 in October 2020 after a "retest" of the 40,000 zone. Since then, a strong correction phase has dominated once again, which is currently leading the Bitcoin price back to trend-determining price territories.

Outlook daily interval

The failed recapture of the seminal 50,000 resistance led Bitcoin to the trend-setting 40,000 support zone in recent weeks. The subsequent stabilization failed at 44,000 already below the 46,000 resistance and showed continued weakness. The retest of the 40,000 support was the logical consequence and finally, the last bastion of the prevailing uptrend fell without resistance.

Just 73 days after the all-time high at USD 69,000, the break of the 40,000 support zone now suggests a change of course. The bull run, which has lasted over 401 days, seems to be running out of steam. The further direction of travel could accordingly turn out to be longer sideways movements with a slightly positive trend. A trading range in the range of 30,000 - 40,000 USD, which will last for the near future, thus seems likely for the time being. A breakout from said channel will determine the further medium-term direction of travel.

The new price discovery phase shows weakness

Review weekly interval

Bitcoin was able to set a higher high above USD 10,000 in the weekly interval for the first time in 2020, which broke the prevailing bearish trend since December 2017. This broke the series of lower highs that lasted for 135 weeks (1).

Since this first overcoming of the bearish trend, the signs for a valid trend reversal became stronger. With the push through important resistance zones and a continuous development above the 21-week average (2), the probabilities for a renewed reaching of the all-time high created in 2017/18 increased visibly. This scenario was completed in mid-December 2020. This was followed by a strongly accentuated price discovery above this historical zone, which produced a new all-time high of USD 65,000 in mid-April. A consolidation initiated since then ended in a veritable price slide, which brought Bitcoin back to the 30,000 USD mark in just two weeks and even below the 21-week average (2) that has defined reliable bull or bear market phases in the past.

However, a subsequent breakout from the 10-week USD 30'000 - 40'000 consolidation area and a subsequent successful "retest" of the upper range of this channel most recently took Bitcoin above the all-time high created in April in an impressive counter-move. After the creation of the new all-time high in the 69,000 USD area in November 2021, a vehement correction phase set in again, analogous to the pattern observed in May. This initially led to the break of the 50,000 support zone, which then promptly caused a bounce in this area, which now acts as resistance. Accordingly, the last few weeks were once again characterized by the correction phase that has been dominating for two months now and even caused Bitcoin to break through the important 40,000 support zone most recently.

Outlook weekly interval

The massive bull phase, which has lasted since July 2021 and originated from the healthy 0.618 Fibonacci area, which has been calculated since the start of the bull market and the all-time high of April, has recently been put to the test. The undershooting of the 40,000 area makes a rapid continued price discovery beyond the 69,000 all-time high a distant prospect for now. The market is setting a slower pace with the risk of falling into a bear market.

The series of higher weekly lows or highs since October 2020 is intact, but significant cracks have appeared in the fundamentals as a result of the break below the 40,000 zone. The break of the trend line since the start of the uptrend and a negative looking "Head and Shoulder" formation complete the deterioration of the technical picture. The weekly RSI index (3), which showed a negative divergence with the price trend despite an all-time high, had indicated that the momentum was on weak legs. The correction in recent weeks impressively confirmed the picture of this indicator.

Since the all-time high at USD 69,000 two and a half months ago, the bitcoin price has corrected by around 50%. Historically, such price behaviour has been observed more often even in bull market phases. The ultimate decisive battle between the bulls and bears is likely to take place in the 30,000 area. In this zone is the 0.618 Fibonacci area, which has been calculated since the beginning of the bull market and the all-time high. A sustained undershooting of this zone would also undercut the price area already contested in July 2021, which would come close to bear market confirmation. For the time being, therefore, the 40,000 resistance level and the aforementioned support zone serve as indicators for the further price trend.

Disclaimer

All information in this publication is provided for general information purposes only. The information provided in this publication does not constitute investment advice and is not intended as such. This publication does not constitute and is not intended as an offer, recommendation or solicitation to invest in any financial instrument, including cryptocurrencies and the like. The contents contained in the publication represent the personal opinions of the respective authors and are not suitable or intended as a basis for decision-making.

Risk notice

Investing in cryptocurrencies, is fundamentally associated with risk. The total loss of the invested capital cannot be excluded. Cryptocurrencies are very volatile and can therefore be exposed to extreme price fluctuations in a short period of time.