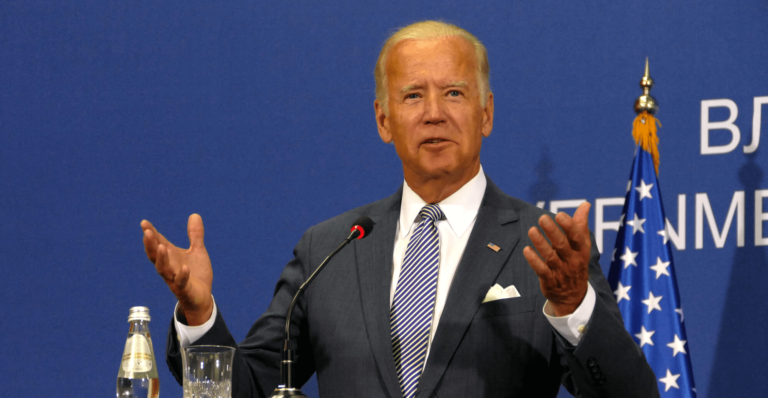

The Biden administration has just issued a framework for the regulation of digital assets, after receiving recommendations requested in the March 9 executive order. Their focus lies on the coordination between different regulatory groups and appropriate consumer protection.

According to a statement from the White House, President Biden received nine reports after requesting professional and public input in the Executive Order (EO) on Ensuring Responsible Development of Digital Assets on March 9. Based on the reports, the framework will focus on fostering greater innovation, consumer protection, and financial integration.

For instance, federal agencies have been called to invest in private sector research and development, while pursuing the enforcement of existing laws. The Federal Reserve has also been encouraged to continue its ongoing research, experimentation, and evaluation of a central bank digital currency (CBDC), with support from a newly created interagency working group led by the Treasury Department.

Focus on consumer protection

While acknowledging the benefits of digital assets, the White House statement indicated that protecting consumers, investors, and businesses was a primary consideration. Market regulators like the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC), were told to aggressively pursue investigations.

Meanwhile, the Consumer Financial Protection Bureau (CFPB) and Federal Trade Commission (FTC) were called to redouble their efforts for monitoring consumer complaints. These federal authorities were also urged to collaborate in addressing the potential risks facing consumers, which would involve agencies sharing data of consumers complaints about digital assets. In order to help consumers understand the risks involved with digital assets, the framework empowered the Financial Literacy Education Commission (FLEC) to lead public-awareness efforts.

SEC guidance

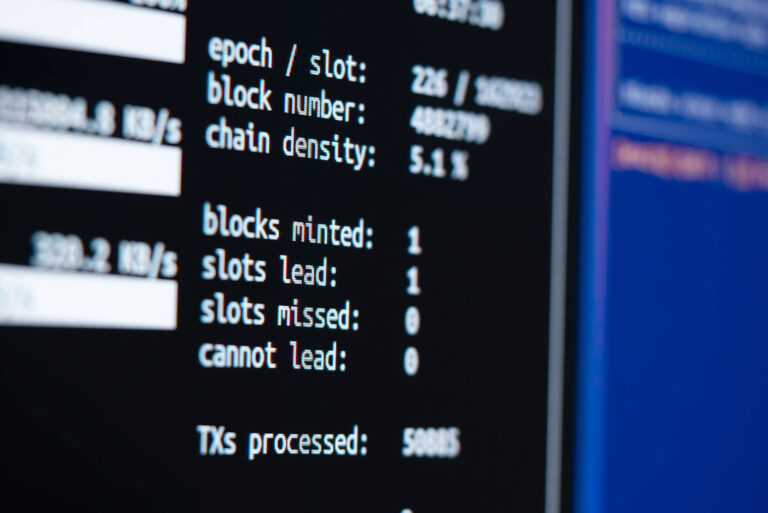

The reports also encouraged agencies to issue guidance on the digital asset ecosystem, similar to one issued by the SEC in March. According to a recent Reuters report, this guidance has made it functionally impossible for banks to offer cryptocurrency services. Having obliged the demand of their clients, the cryptocurrency projects of many major banking institutions are now in jeopardy, among them Goldman Sachs Group Inc., JPMorgan Chase & Co., BNY Mellon, and Wells Fargo & Co.

According to the guidance issued by the SEC in March, public companies that hold crypto assets on behalf of clients or others must account for them as liabilities on their balance sheets. While banks have strict capital rules that require them to hold cash against balance sheet liabilities, they typically have not been required to reflect the custody of clients’ assets on their balance sheet. However, custodied crypto assets present "unique" risks which meet the definition of a liability under U.S. accounting standards, according to the SEC’s acting chief accountant.