The Halving is a major event in Bitcoin's life. Every four years, the rewards miners earn for adding a block to the chain are divided by two. Interestingly, the halving plays a central role in the Bitcoin price's multiyear seasonality as it marks the beginning of crypto summer.

In the Bitcoin universe, this crypto summer started on 19 April 2024, when block rewards were last halved to 3.125 BTC per block. Crypto summers are characterised by increasing prices and new all-time highs (ATHs). At the time of writing, the bitcoin price stands at about USD 56'500, about 14% below the price at the Halving.

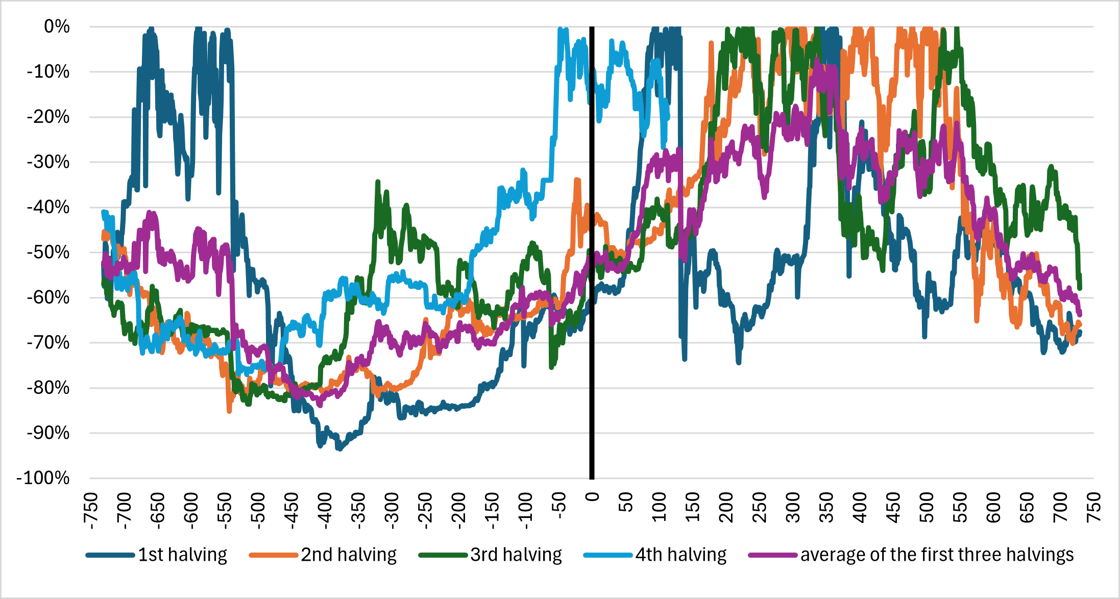

Bitcoin price cycles

To illustrate the Bitcoin Price Cycle, we updated a chart we presented for the first time some months ago in another publication. This chart shows price developments in terms of drawdowns centered around the halving date.

A drawdown is a statistic that measures the percentage decline in price since the last ATH. A 0% observation means the price is at ATH. Meanwhile, a -60% observation, for instance, indicates that the Bitcoin price dropped by 60% vis-à-vis the last ATH. The light blue line indicates that Bitcoin price drawdown is 19.5% as Bitcoin price is 19.5% lower than the most recent ATH and we are 114 days after the last Halving. While each cycle around the halving is unique, there are noticeable similarities. The purple line, representing the average of the first three halving cycles, suggests a typical seasonality around Halving.

The four seasons

Between 750 and 400 days before Halving, we usually are in crypto winter. Bitcoin prices experience significant drops, and drawdowns from the previous ATH become more pronounced. Around 400 days before the halving, the crypto winter ends as the market bottoms out, with an average drawdown exceeding -80%. Between 400 days before the halving, prices recover about half of what was lost. This marks the crypto spring phase. Notably, prices have shown a more robust recovery in the current cycle than the historical average.

Following the Halving and up to 350 days afterwards, prices rise further and reach new ATH levels. Drawdowns almost disappear during this crypto summer phase. Between 350 and 550 days after the Halving, prices enter a late summer period, referred to as the crypto autumn. Prices remain elevated; some new ATH are printed, but less frequently than in crypto summer. Finally, 550 days after the Halving, crypto winter begins again, initiating a new cycle.

An unusual summer

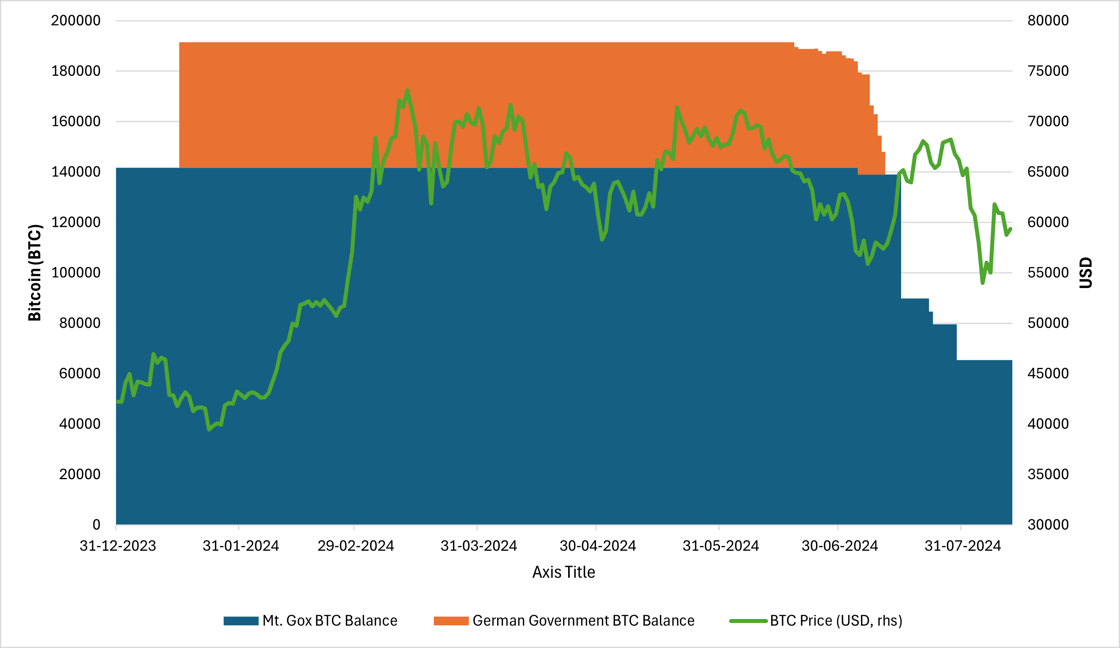

This crypto summer was unusual, starting after a boiling crypto spring. For the first time in history, an ATH was reached in spring, about 40 days before the Halving (light blue line). The launch of Bitcoin spot ETFs in the US in January is the main reason behind the rapid and consistent rise in Bitcoin's price. Overall, spot ETFs in the US manage over 900'000 bitcoins, representing more than six times the number of bitcoin mined this year!

On the flip side, there were also massive sales of Bitcoins, as the trustee of Mt. Gox and the German Government sold bitcoins. While it is worth noting that not all of the Mt. Gox bitcoins were sold for dollars, as some were transferred directly to the final holders, the volume is large and weighs on its price. These players have reduced their bitcoin holdings by more than 120,000 in about 45 days, equivalent to 280 days of mining rewards.

Finally, some of the price volatility comes directly from TradFi. Recession angst combined with Summer low liquidity led to a mini crash in Japanese stocks. The high beta NASDAQ index also corrected strongly. Bitcoin, whose behaviour closely follows tech stocks, plunged.

So, is Bitcoin's price cycle broken?

Probably not. The Bitcoin Price Cycle is unlikely to be broken because the deviations from the historical pattern are explained by a few factors, such as the launch of the spot ETFs, the unusual destocking of bitcoins and the volatility TradFi generates.

For the rest, regulatory uncertainty is declining, as the recent introduction of the European Market In Crypto Asset (MiCA) illustrates, and the number of institutions offering cryptocurrencies as investments to their clients is also increasing, signalling a solid institutional adoption.