Today, private investors around the world have a variety of opportunities to become involved in digital assets. For institutional investors, this is a somewhat more difficult undertaking. An overview of current hurdles and available instruments.

Particularly in Switzerland, which has been a global leader in innovation and regulation of crypto-currencies and blockchain since 2015, trading of digital currencies has been commonplace for some time and is easily accessible to individual investors. For example, a private investor can open an account at an international crypto exchange and thus directly buy Bitcoins or other crypto-values. If local access is preferred, specialized banks and financial institutions that already have digital assets in their portfolio are a good option. In this area, Switzerland has seen a number of new entrants in the last two years. There is indeed a wide variety of different ways in which private investors can access Bitcoin & Co.

Hurdles for institutional investors

In recent months, we have also seen an increase in demand from institutional investors, with the aim of exposing part of their portfolios to this emerging alternative asset class. Even a 1 - 3 percent allocation in bitcoin not only completely changes the risk/return profile of a multi-asset portfolio, but also ensures a largely uncorrelated portfolio addition.

Thus, if an institutional investor wants to expose himself to this alternative asset class, he can theoretically access the above-mentioned solutions for retail customers, but in practice there are some hurdles to overcome:

- Crypto exchanges are unregulated. There is also a counterparty risk.

- The purchase and subsequent safekeeping of bitcoins and other digital currencies is only possible with extensive technical know-how. In the worst case, an error in implementation can lead to the loss of the digital assets.

- The acquired Bitcoins are not automatically shown as assets in the asset statement. This results in a lack of compliance with reporting and compliance regulations.

Any portfolio manager who has ever wanted to dip his toes into this new asset class should be aware of these problems. Whether in discretionary mandates or in a UCITS fund, physical bitcoins present great challenges - both in trading and in custody and valuation.

ETP, Certificate or Crypto Fund?

There are now various financial products on the market that allow professional investors to gain access to Bitcoin&Co. There are basically three categories of financial products that allow professional investors to participate in the price of Bitcoin and other crypto currencies:

- Exchange Traded Products (ETPs)

- Certificates

- Crypto Hedge Fund

Let's start with the hedge funds. There are now a handful of crypto-funds in Switzerland and dozens of others in the rest of the world. The two main differences between funds are their investment strategy and costs. Funds almost exclusively use an active investment strategy. This is usually associated with a performance fee, which is not seen in passive investment products, ETPs and certificates.

Most funds use a mix of arbitrage and market making strategies, which is not easily scalable above a certain size. According to a PWC study published in 2019, over 60% of crypto funds manage less than USD 10 million (AUM). They also show a high correlation between bitcoin and the rest of the digital assets.

Passive investment strategies

If no active investment strategy is sought, passive structures are a good option. Exchange traded products (ETP's) listed on traditional stock exchanges are common in this country. ETPs listed on the SIX generally have the following features.

- They are 100% collateralised at all times. This means that the counterparty risk is very low. In the unlikely event of insolvency, the independent administrator would step in, liquidate the ETP and investors would get their share back.

- They are exchange traded. With one ISIN, in multiple currencies (including CHF) and with intra-day liquidity. Therefore, they can be shown together with other stocks and bonds in the portfolio.

- An issue/redemption mechanism is applied. Through the use of professional market makers, there are no premiums in such open-end structures and clients can purchase the underlying assets at intrinsic value.

Exchange Traded Products (ETPs) are a type of securities that represent underlying assets, an index or other financial instruments. ETPs trade on traditional stock exchanges in the same way as shares. However, the prices of ETPs are derived from the underlying investments they represent.

ETPS listed on the SIX are secured, non-interest-bearing bearer bonds. They replicate the performance of an underlying asset on an unchanged or leveraged basis. These financial products are not investment funds and are therefore not subject to the Federal Act on Collective Investment Schemes (CISA). In most cases, the collateral (securities or precious metals) is deposited with a third party. The underlying assets are usually individual securities, but may also include baskets, indices or other asset classes.

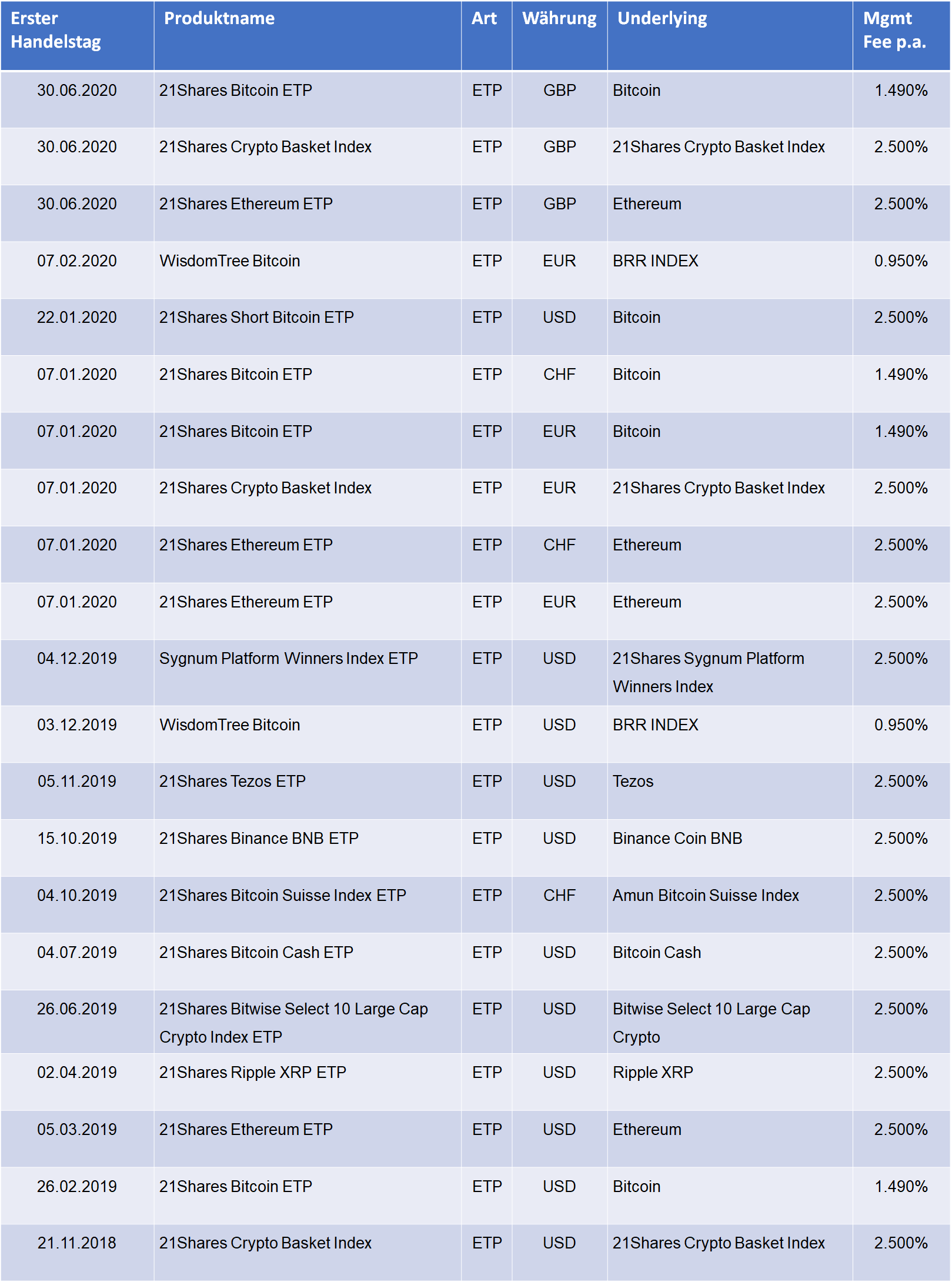

ETP's listed on the Swiss Exchange SIX / Source: SIX

ETP's listed on the Swiss Exchange SIX / Source: SIX

Meanwhile, ETP's and structured products in crypto-currencies are already available on various European exchanges. The structure of an ETP can vary depending on the stock exchange and issuer. In case of doubt, please read the small print.

Another relevant financial instrument that professional investors can use to build exposure to digital assets is certificates. In Switzerland, there are some issuers who issued structured products at a very early stage, which can be used to bet on the price increase of Bitcoin, Ethereum and other digital currencies. The disadvantage of a certificate - compared to ETPs - is the lack of collateralisation. Certificates are not required by regulatory authorities to collateralize the underlying assets. Therefore, there is an increased counterparty risk (i.e. if the issuer becomes insolvent, the end customer has no claim on the assets).

Furthermore, certificates are not necessarily traded on the regulated market. It should also be noted that closed-end certificates are not subject to the issuance/redemption mechanism mentioned above and may therefore be affected by price premiums.

Each structure has its specific advantages and disadvantages. Due to their construction, ETPs are most likely to be suitable for professional investors seeking easy and secure access to this new asset class.