After a promising recovery in September reaching a high of $66,000, Bitcoin is now facing a downturn due to geopolitical tensions and market-wide liquidations. This recent drop has led to increased uncertainty and market fluctuations.

This analysis from Bitget Research dives deeper into current price movements as well as the outlook for both Bitcoin and select altcoins like Solana and Cardano. Bitcoin has grown to become a global asset, one whose market valuation is impacted by global events. The ongoing crisis in the Middle East has derailed Bitcoin's recovery in September. For October, historically considered a positive month for the market, Bitcoin has fallen by 4.8% to $60,683, with current volatility showing that a further plunge might be ahead.

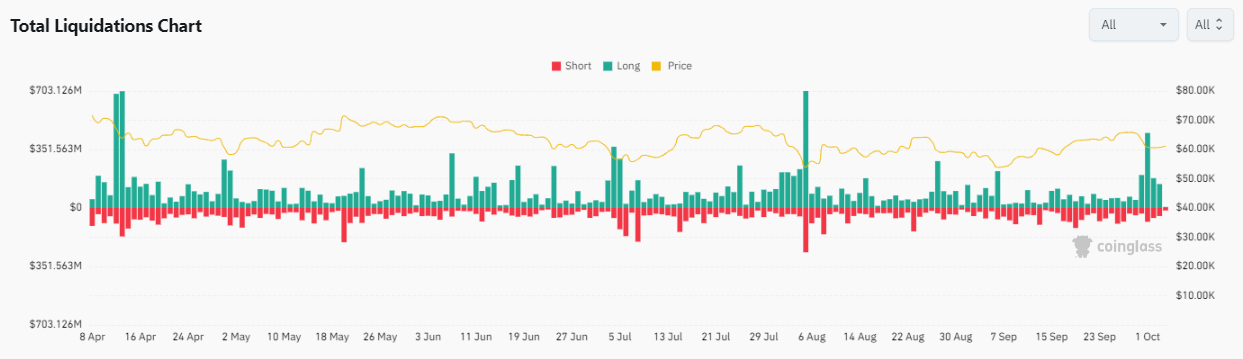

Insights into bitcoin liquidations

Over the past few days, a very intense liquidation followed this event. Market data shows that more than $700 million has been liquidated thus far in October, with BTC taking a sizable chunk of the figure. Generally, these liquidations might be considered an avenue for market reset, as most traders were over-leveraged before now.

It might be too early to judge the trend for the rest of the month as most investors are largely reactionary to macro events. A look at some of this performance data, like the 16% drop in trading volume, shows dwindling sentiment. This reaction is explainable, as investors will prefer not to get caught up in a macroeconomic situation that will tie down their capital.

Despite the general downturn, institutional investors continue to buy digital currency at a rate at par or higher than the quantity mined daily (as per data observed on Cryptoquant). Currently BTC has sustained over the $60,000 support level and may fluctuate in the $72,000 range, the anticipation for fed interest rate cuts and market rebound may come from Bitcoin’s historically optimistic Q4s.

Outlook on altcoins

Altcoins generally maintain a deep correlation with Bitcoin. Out of the lot, Solana and Cardano, exhibit an intriguing technology that has made them stand out to the community. Beyond the current price outlook, both are building a robust and diversified ecosystem that will continually relate to their native tokens.

Solana, for instance, has continued to compete for a share of the DeFi market. With a $10.5 billion TVL, more than 77 million SOL have been locked, creating a scarcity that can prop up prices in the long term. Beyond DeFi, Solana is making waves as a hub for retail transaction push, with memecoin and DePIN growing quickly. Looking at the bigger picture, SOL will continually be in high demand, and it’s only a matter of time before it breaches the $260 ATH milestone.

Cardano is considered one of the most developed blockchain protocols in the market. But for $0.34, many believe it is undervalued, considering its latest advances. Cardano has recently entered the spotlight as one of the few protocols with decentralized governance. Through the Chang hard fork, the community now has a say in the protocol’s affairs, guaranteeing inclusion overall. This will make Cardano more attractive, placing more demand on ADA in the long term. As such, the price of ADA may easily scale the $1 mark soon.