A monthly review of what's happening in the crypto markets enriched with institutional research on the most important topics in the industry in cooperation with the Swiss digital asset specialist, 21Shares AG.

Crypto’s market cap declined by 6% over the past month. The main reason for this drop is the market’s low volatility, following Curve’s $62M exploit on July 30, until August 17. A combination of events could have influenced this sell-off, including a possible upcoming interest rate hike, the Ripple case getting longer, and rumors about SpaceX liquidating its Bitcoin holdings. Bitcoin and Ethereum fell by 6.62% and 8.19%, respectively, over the past month. The largest decentralized exchange by total value locked (TVL), Uniswap, suffered the most in August, declining by 29.05%. On the other hand, Curve’s TVL rebounded, growing by 19.78% over the past month, indicating that the 65.9% recovered funds remain on-chain.

Largest liquidations since FTX

In late August, the crypto market experienced approximately $1.04 billion in liquidations, with around $833 million from long positions. Various factors fueled the chain of liquidations, notably the Fed's minutes emphasizing ongoing inflation and the potential for more interest rate hikes. This, combined with elevated US long-term bond yields and a hawkish Fed stance, prompted short-term risk aversion that impacted both the crypto and stock markets. This relationship is highlighted by Bitcoin's renewed positive correlation with S&P 500 and Nasdaq, reaching 0.8 and 0.72, respectively, and implying that the three markets are once again moving in tandem.

The downturn was also exacerbated by erroneous reports of SpaceX liquidating its Bitcoin holdings. While many speculated about a potential sell-off, it's important to note that write-downs are a standard accounting practice and do not necessarily imply that the investments have been sold or liquidated. In addition, global markets experienced a mild shock due to news of Evergrande's bankruptcy filing under US Chapter 15, raising concerns about its impact on the global real estate market.

Finally, the SEC's ability to appeal specific judgments about the Ripple case added to the negative sentiment, which we will briefly touch on next. Although August’s events pale in comparison to the gravity of the FTX debacle, Bitcoin's annualized volatility recently hit its lowest level in over five years, which indicated an anticipated market breakout. That said, the market modestly rebounded on the news of a Federal Appeals Court ruling siding with Grayscale in their case against the SEC on converting GBTC into a spot ETF.

Ripple continues saving grace

On August 18, the SEC filed an interlocutory appeal against the inconclusive summary order in the Ripple case issued by Federal Judge Analisa Torres on July 13. The appeal primarily objects to the court’s view that the programmatic sales of XRP (on exchanges) are not considered securities, highlighting a disagreement among district courts regarding the controlling issues.

In response, XRP fell by around 30% over the past month. Ripple has until September 1 to submit a response to the SEC’s appeal. There are no definite dates for the trial yet; Judge Torres suggested that the court would be in session later in the second half of 2024. Until then, we expect XRP to experience speculation to drive its price movement while Ripple continues to secure strategic partnerships to enforce its value proposition as a crypto-native software solution for players in traditional finance.

Paypal launches their own stablecoin

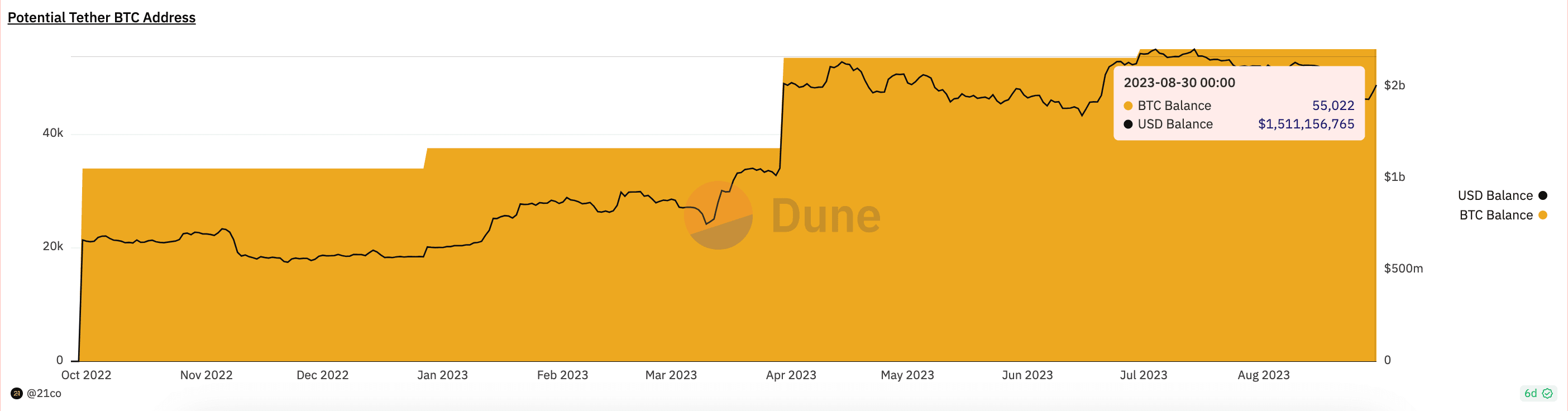

The issuer behind the biggest US-dollar stablecoin is now the 11th-largest holder of Bitcoin. Following their announced plans to convert profits into Bitcoin, Tether has amassed 55K BTC (~$1.6B). The latest attestation report shows a ~$800M rise in excess reserves in Q2, reaching $3.3B. This significant development enhances demand for Bitcoin’s role in corporate treasury management. Conversely, Tether should convert surplus BTC and profits into cash to fortify the company’s resilience against unforeseen issues.

For context, Tether’s cash reserves dropped from $5.3B in December 2022 to $90M in Q2 23, a concern for an $85B stablecoin, despite access to liquid instruments like US treasuries, and REPOs. Finally, although not confirmed by Tether, the wallet holdings align with the issuer's quarterly holdings. That said, Tether's thriving business endeavor might have piqued the curiosity of traditional financial behemoths cautiously entering the stablecoin landscape.

On August 7, Paypal partnered with stablecoin issuer Paxos to launch their own USD-pegged stablecoin, PYUSD, built on Ethereum and fully backed by U.S. dollar deposits, short-term U.S. treasuries and similar cash equivalents. According to the press release, eligible U.S. customers will be able to pay for their purchases using PYUSD in the same manner that Gnosis Pay announced it will empower European customers to pay for their purchases with Monerium’s euro-pegged stablecoin (EURe) via its Visa card, with a convergence mechanism running in the backend.

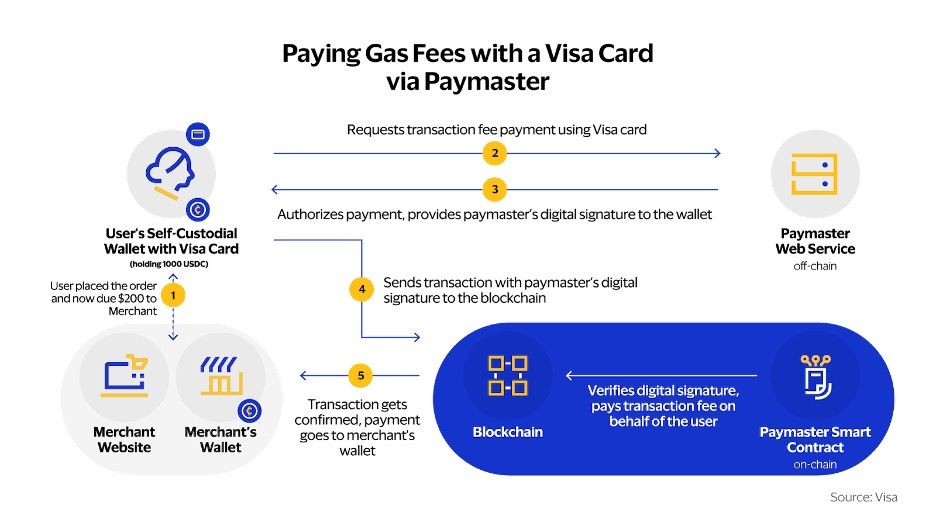

Visa’s experimentations to abstract the complexity of crypto

After Visa initially announced their experiment utilizing Account Abstraction (AA) to streamline crypto native payments on top of Ethereum back in May, the financial services giant revealed the piloted project’s latest updates. Namely, leveraging the ERC-4337 standard, more commonly known as AA, Visa abstracted the process of paying gas fees in ETH using a credit card.

As AA allows for asset conversion in the backend, users will not have to worry about holding the right native token to pay for transaction costs. Thus, users would be met with the flexibility of paying with their cards or any other ETH-based token, and the AA smart contract will simply trigger the conversion via what’s known as a paymaster smart contract that sponsors transactions on users’ behalf. That said, Visa’s experiment has the power and potential to transform the crypto native ecosystem and make them more accessible using the average users’ traditional financial instruments, and could, thus, catalyze the adoption of native blockchain applications without users necessarily becoming aware of the technical intricacies.

The debut of Friend.tech

Friend.tech, a novel social app launched on Base network, letting users tokenize and trade Twitter account shares. Share prices scale with availability; more shares mean higher prices with a 10% tax split - 5% for the protocol and 5% for the Influencer, while shareholders access private chats, exclusive content and deepen social ties with their influencers.

Despite early glitches, Friend.tech’s arrival is noteworthy. It employs Base’s Account Abstraction tech for a smooth on-chain user experience, letting users join with web2 credentials, deposit without a wallet setup, and trade shares fee-free. A web app model also evades Apple/Google limits, facilitating mobile deployment. Finally, Friend.tech integrates finance into social networking, reshaping the relationship to offer both financial and social gains and reflecting what is known as Social Finance (SocialFi).

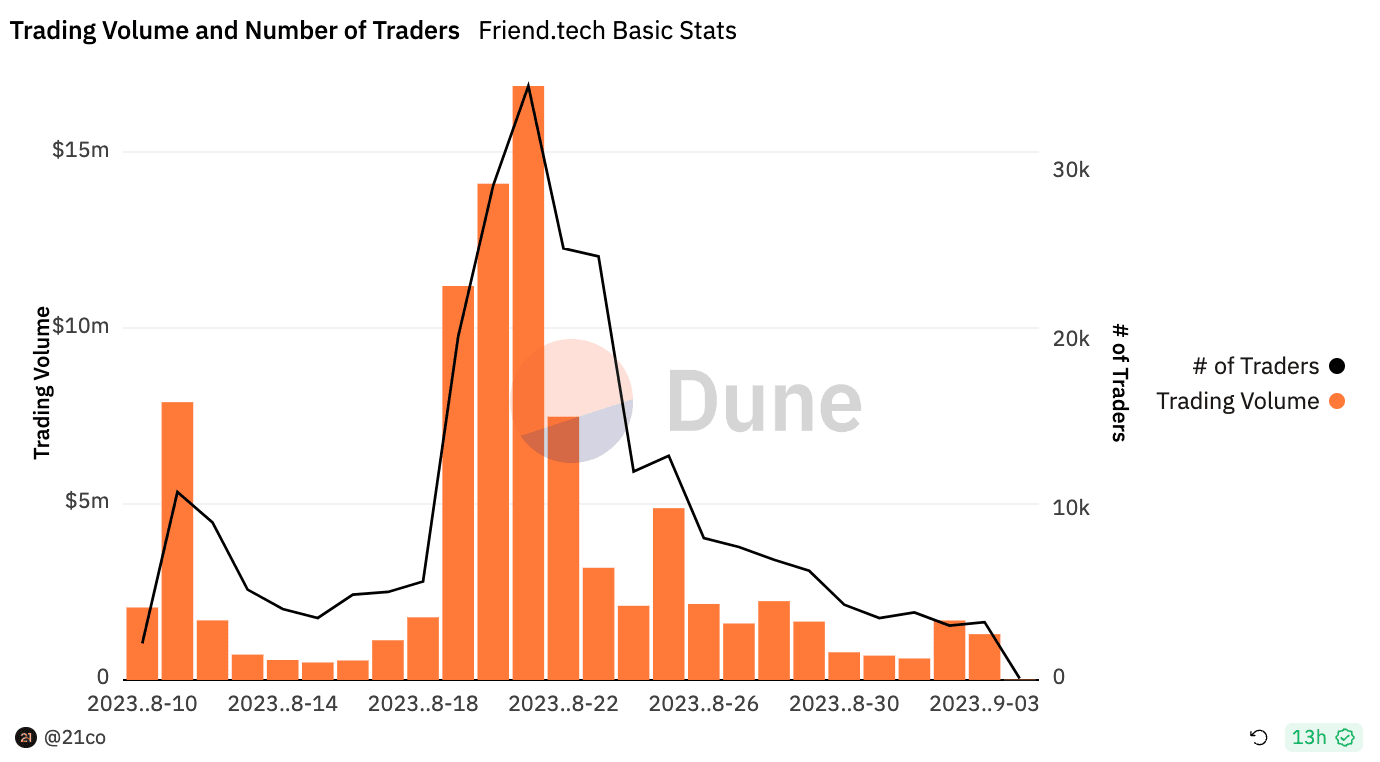

Impressively, Friend.tech surpasses rivals like Lens protocol, achieving significant visibility in the social vertical. In 10 days, it traded ~$60M worth of shares, with up to $3M in daily fees, exceeding smart-contract platforms in peak hype. Remarkably, at the depth of the bear market, the application drew nearly 127K users, although some were possibly driven by the prospect of an airdrop while being amongst the rare crypto apps capturing the attention of external figures. High-profile personalities like NBA player Grayson Allen, CEO of Y Combinator Garry Tan, and even gaming influencers like FaZe Banks all joined the platform.

In summary, Friend.tech could bring untapped web2 innovations into SocialFi, aligning with web3's empowerment goals by converging social relationships with financial opportunities. However, pricing and wallet privacy need to be enhanced for trust. Vulnerabilities like linking wallets to Twitter emphasize the exigency for robust privacy safeguards within SocialFi applications to protect the technology’s integrity. Regulatory risks could also arise driven by expectations of user profits and revenue sharing. That said, Friend.tech's is still worth monitoring as a blueprint for future crypto apps in terms of abstracting crypto’s complexity.

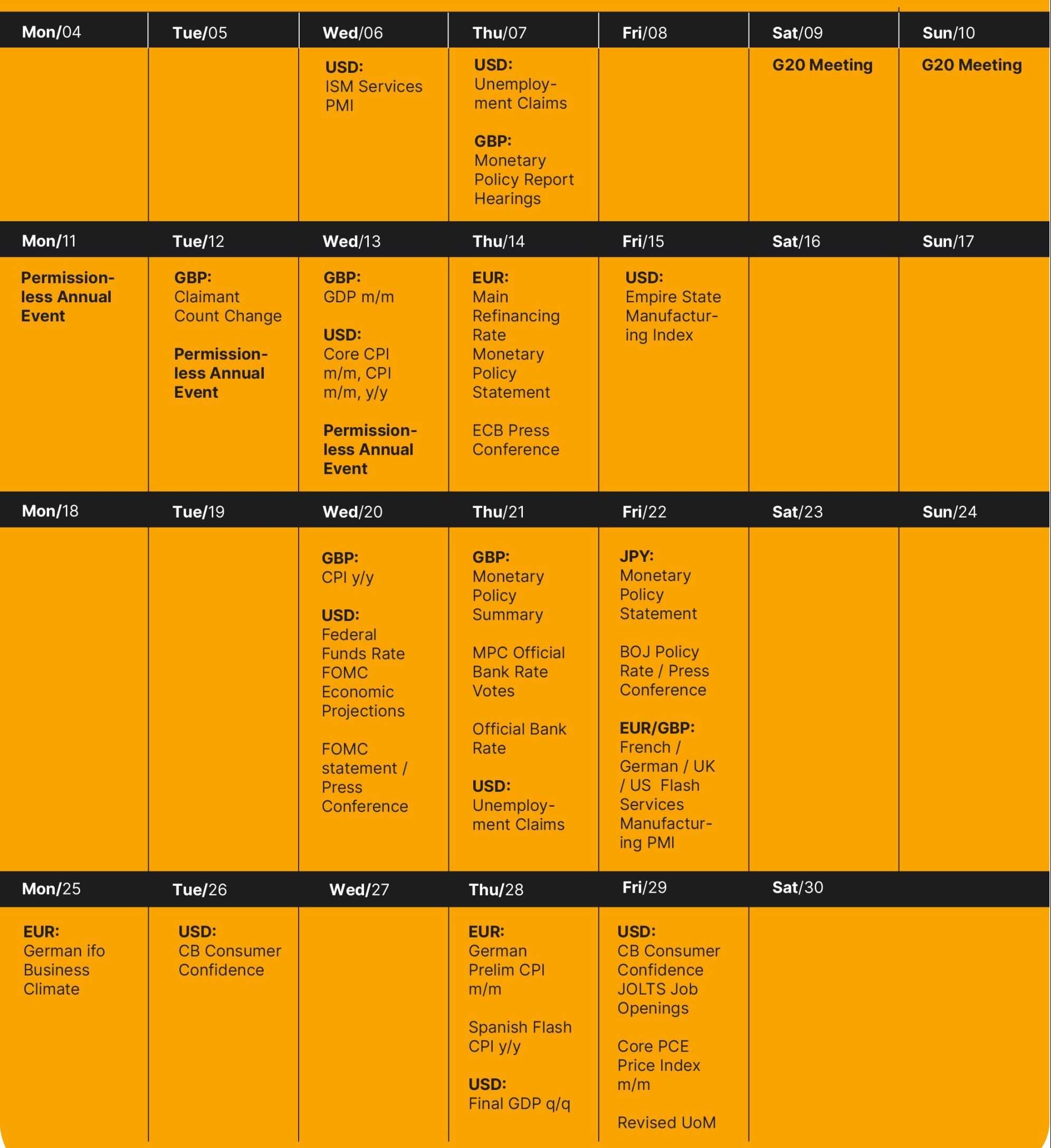

Next Month’s Calendar

These are the top events we're closely monitoring in September.

- September 20-22: Messari Annual Event

- September 30: Optimism Token Unlock (3.37%)