A summarizing review of what has been happening at the crypto markets of the past week. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko.

The last 7 days in the cryptomarkets:

- Price Movements: Following historic all time highs and declining intraday volatility, Bitcoin and Ethereum crashed precipitously Monday morning.

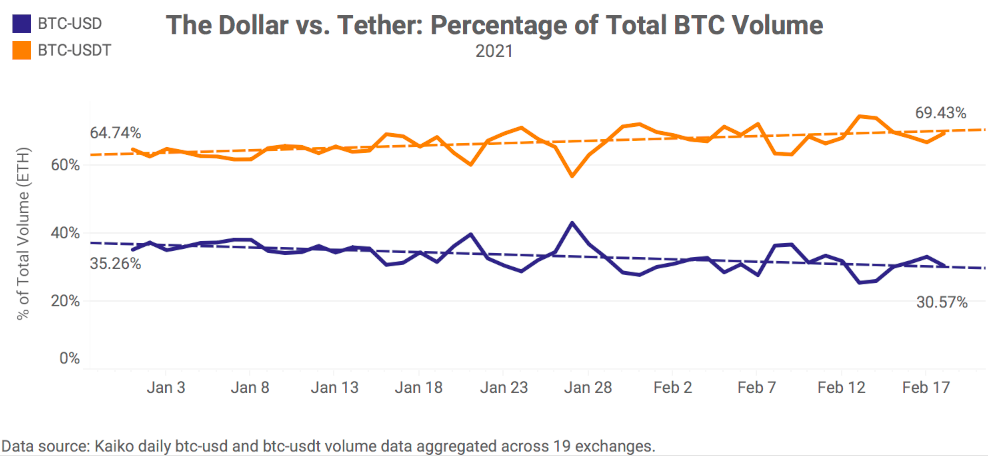

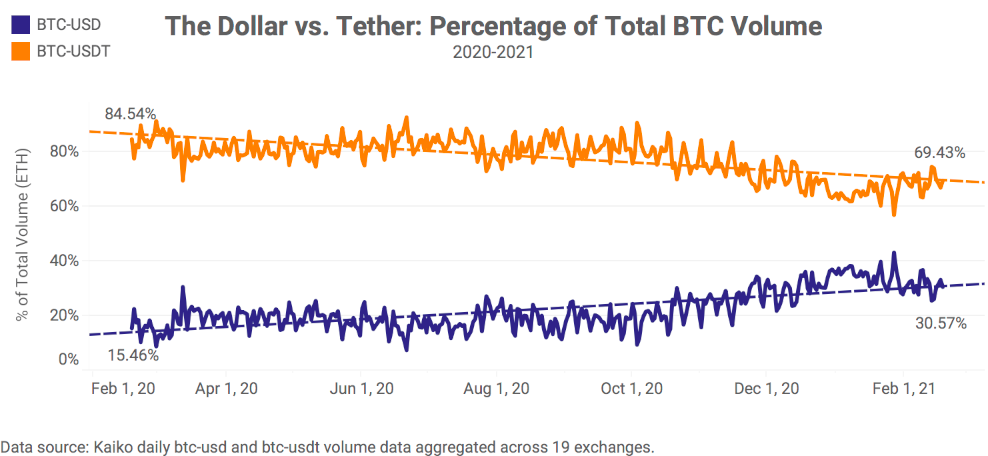

- Trading Volume: The falling ratio of U.S. Dollar to Tether volume suggests institutional traders have taken a step back in February.

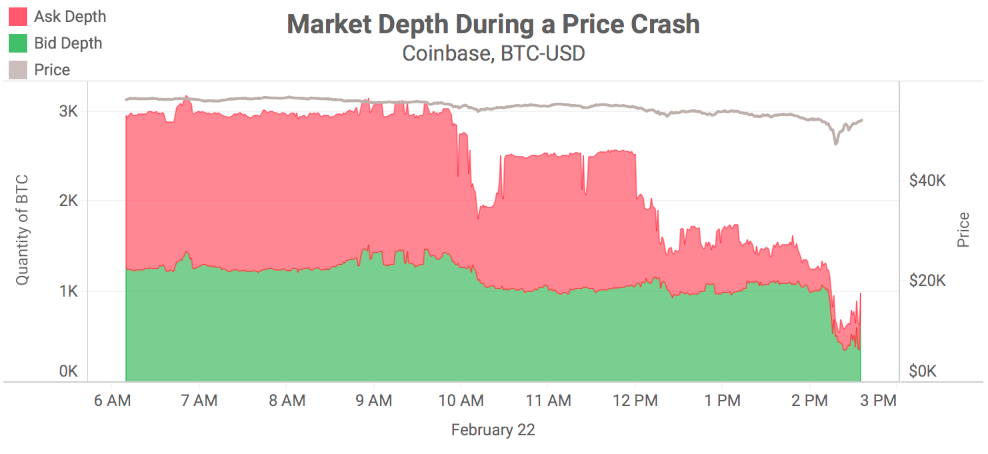

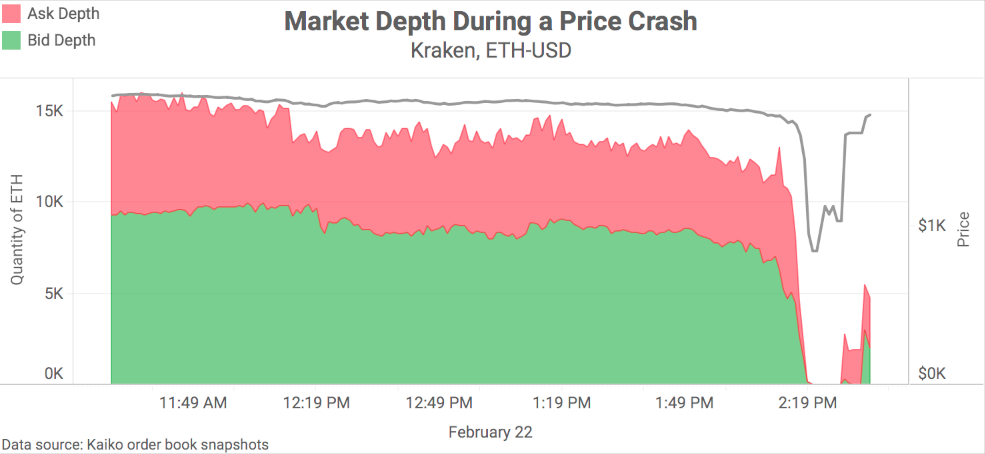

- Order Book Liquidity: Market depth plummeted during this morning's crash, briefly causing a flash crash for ETH-USD on Kraken.

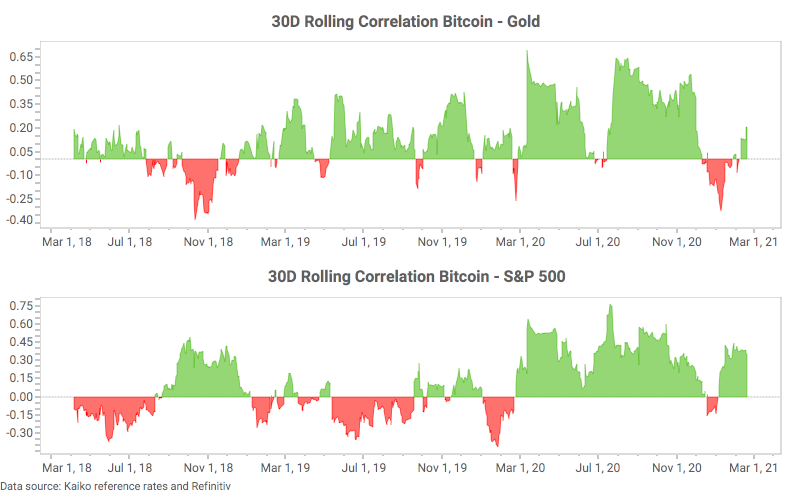

- Volatility and Correlations: Bitcoin's correlation with Gold has been mostly positive over the past 2 years.

A historic milestone followed by a sharp correction

Going to press, BTC and ETH plummeted, but the past week's noteworthy events are worth mentioning. A series of seemingly endless new all time highs propelled Bitcoin's market cap past the $1 trillion milestone, up from $178 billion a year ago. The bull run continued its spread to all sectors of the crypto industry, with Binance's BNB token experiencing the week's best returns at 107%, catapulting the exchange token to a new ranking of third largest by market cap. The question on everyone's mind is whether this historic rally can keep up, especially considering trading volumes seem to be tapering off despite the highs. This morning suggests that a correction is in the works.

Dollar volume as an indicator of institutional inflows

The ratio of Dollar (USD) volume to Tether (USDT) volume can be used as a signal of institutional participation in crypto, assuming that most institutional traders prefer to transact with fiat currencies on regulated exchange platforms. Since last year, Dollar volumes have doubled from 15% of the total Bitcoin traded to 30%. This rise corresponds closely with the wave of institutional announcements made over the past few months. USD volume peaked mid-January at more than 40% of the total.

We can also use this volume ratio on shorter timescales to determine how institutional traders are behaving. Below, we charted USD and USDT volumes over the past two months, and can observe a different trend compared with the chart above.

In the short term, the volume ratio suggests that institutional buyers have taken a pause in February, with a 5% decline in BTC-USD volume relative to BTC-USDT. Interestingly, prices have continued to rise to new all time highs despite the shift in the volume ratio towards more retail, crypto-only exchanges such as Binance. This suggests that institutional traders have played less of a role in Bitcoin's rally over the past few weeks.

Market depth dissolves during a crash

This morning, prices went haywire. From one minute to the next, Bitcoin bounced between $48k, $52k, and back to $48k. It seemed that price feeds were broken, but what was actually happening was that a complete decimation of order book depth made the process of price discovery near impossible. When there is no market depth remaining on an order book, there is nothing stopping large market orders from whipsawing the price of Bitcoin. In extreme scenarios, this can cause what is known as a flash crash, which is when the withdrawal of orders amplifies price declines.

A flash crash actually occurred briefly on Kraken this morning for ETH-USD markets, which saw the price of ETH plummet below $1k (it had traded at $1600 moments earlier). We can observe above a complete decimation of market depth, as market makers quickly pulled orders from the book. This temporarily caused prices to plummet, only to rebound once market makers adjusted their positions.

Bitcoin's correlation with gold has been mostly positive over the past 2 years

On the other hand, Bitcoin's correlation with the S&P 500 has only been consistently positive over the past year, likely due to pandemic-induced economic shocks. No matter, both correlation charts show that nearly all financial assets (gold, equities, and crypto) have benefitted over the past year, for different reasons. Bitcoin and gold are often considered hedges against economic shocks and inflation, which could explain their growth, while many believe equities have soared as a result of business-friendly fiscal and monetary policy.