A summarizing review of what has been happening at the crypto markets. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko.

Bitcoin's market cap surpassed $1tn last week for the first time since November 2021 as prices rose above $52k. In other news, Franklin Templeton applied for a spot ETH ETF, U.S. CPI came in above expectations and a coalition of banks called the SEC to change its crypto guidance. This week we explore:

- Bitcoin's ongoing rally

- Binance's rising dominance on derivatives markets

- Coinbase's return to profitability

Breaking down Bitcoin's post-ETF rally

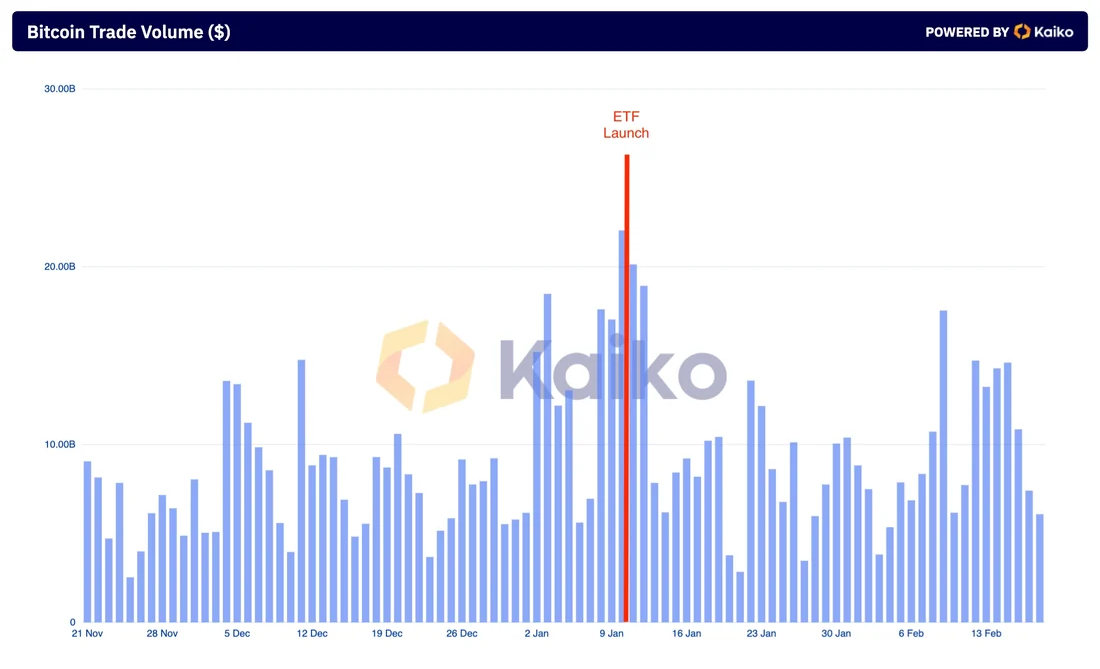

Bitcoin ETFs just had the largest weekly inflows on record at $2.45bn, helping propel the asset's market cap past $1tn for the first time since 2021. Today, we take a look at BTC liquidity across 33 of the largest centralized exchanges. BTC daily trade volume averaged more than $10bn in the second half of February. However, volumes have not yet surpassed 10-month highs hit on January 10th, the day before the ETF launch.

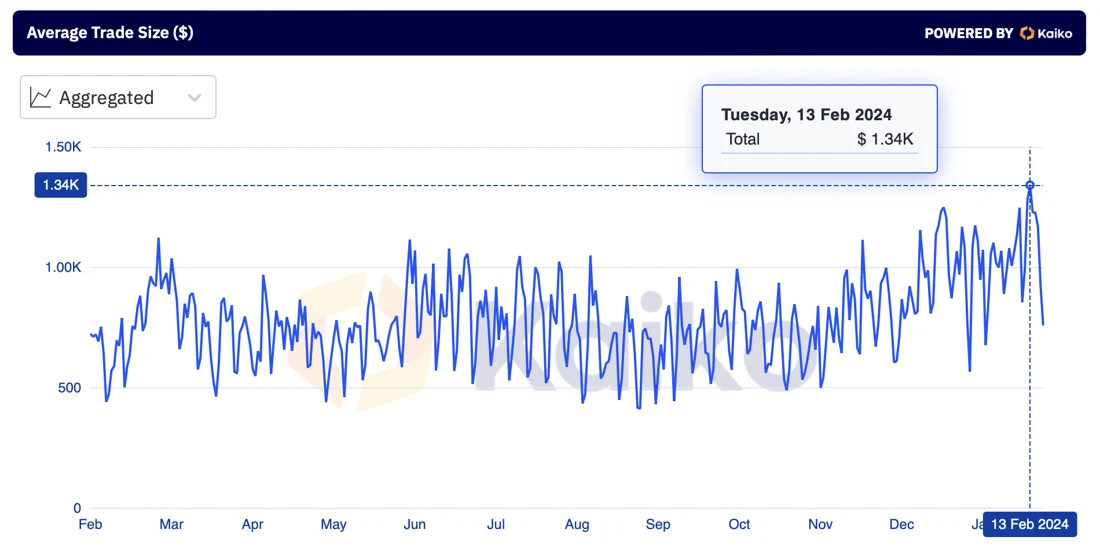

Bitcoin's average trade size across 33 exchanges, which could be seen as a proxy of institutional participation, hit its highest level in a year on Febuary 13 and has consistently exceeded $1k since the start of 2024.

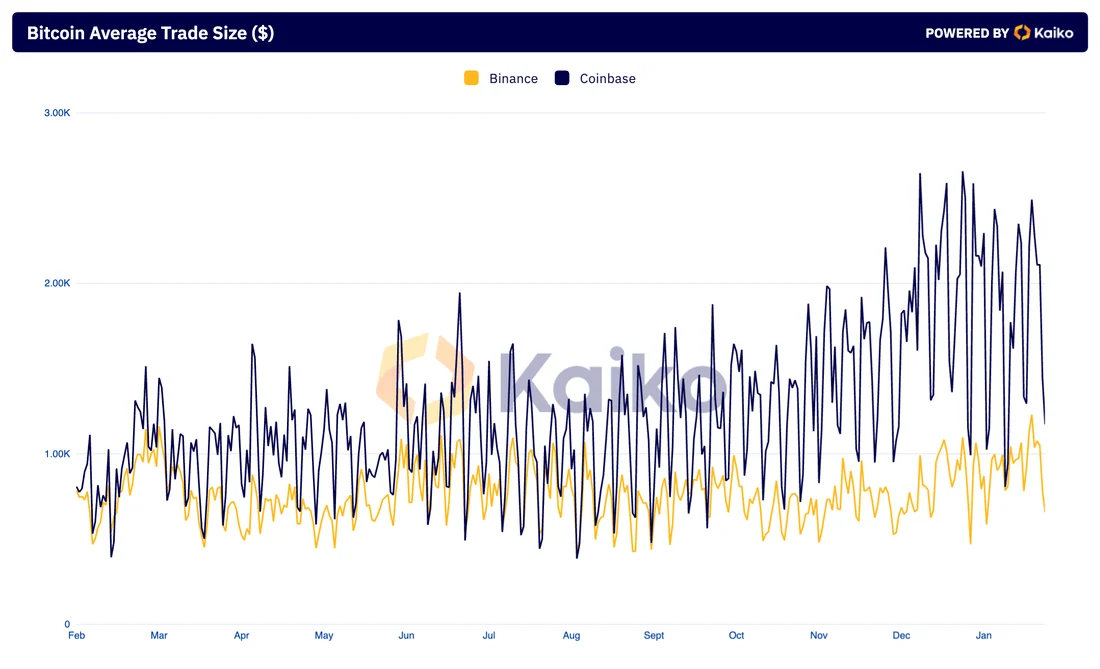

If we break it down by exchange, we can see that Coinbase's average trade size has increased at a much faster pace than Binance's over the past year, which reflects its role in the spot ETF listings.

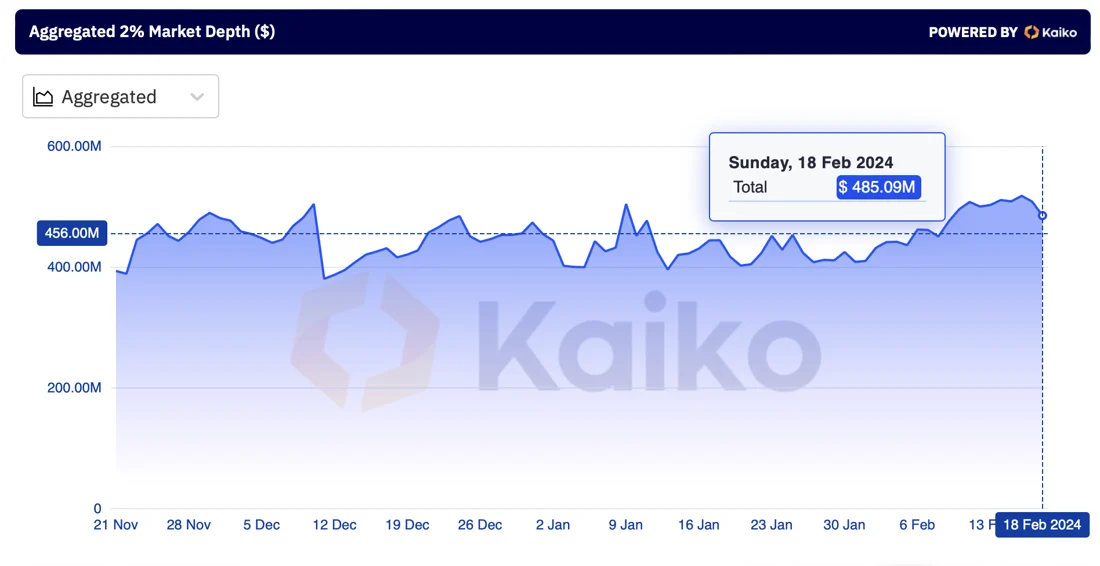

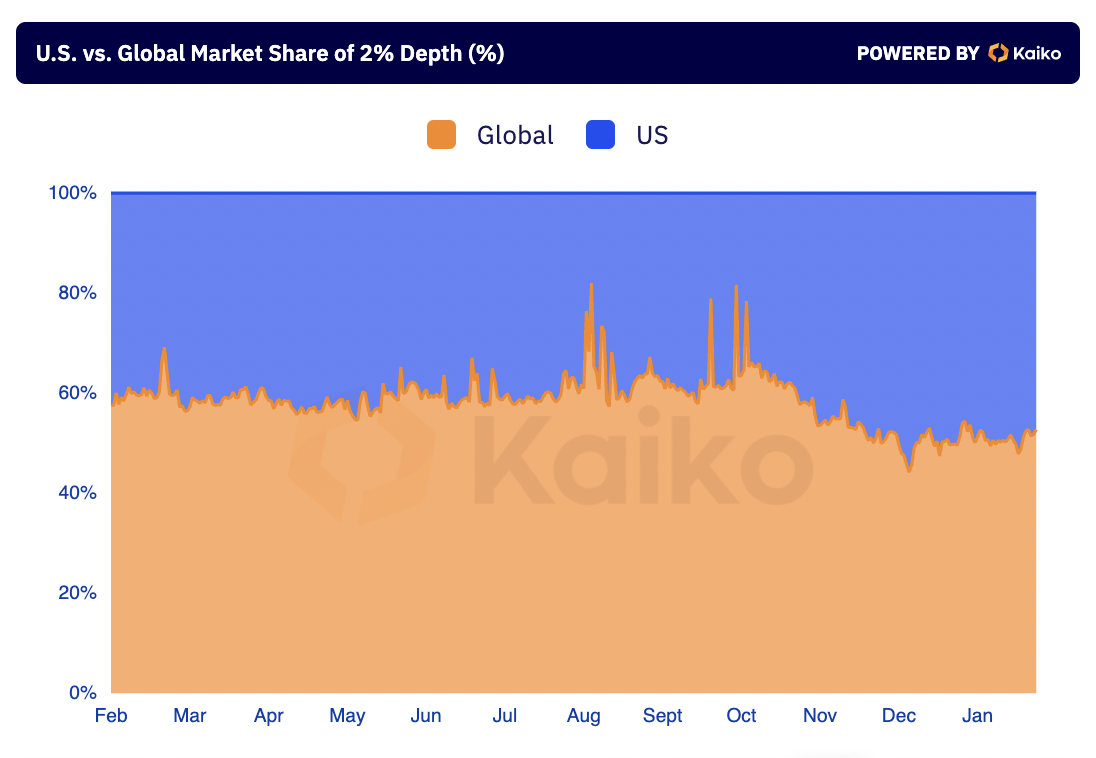

Bitcoin 2% market depth, which measures the aggregated bids and asks on BTC order books, has also been improving, suggesting market makers are starting to return. Market depth is up 23% since end-November and by 30% year-over-year to $485mn. However, this increase can also be attributed to price effects.

The increase in liquidity has been driven by U.S. platforms and is likely linked to the spot ETF approvals. The market share of BTC market depth on U.S. vs. global exchanges has increased consistently since November, exceeding 50% since late 2023.

Binance derivatives take the lead

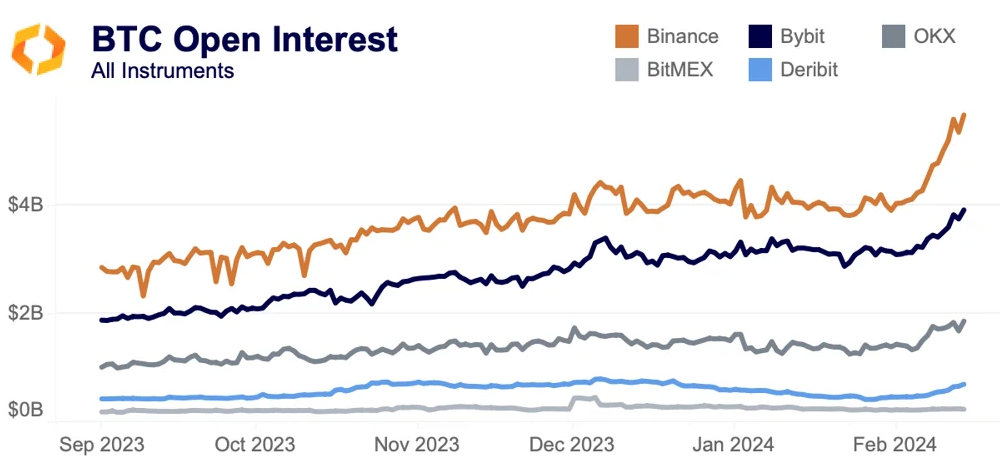

Last week, open interest surged to new highs as BTC crossed $52k. The bulk of these gains was driven by Binance, which jumped from $4bn at the start of February to $6bn. Bybit maintained its hold on second, rising from $3bn to $4bn, trailed by OKX at $2bn. While much of this movement can be attributed to price effects, OI in BTC terms shows that new contracts were indeed being opened. Amidst this flurry, Binance reached its highest market share since the start of the broader crypto rally last year.

Meanwhile, funding rates finally began to tick upwards after remaining slightly positive for most of the year. Funding rates steadily increased beginning in October, reaching a peak in late December and early January, before falling back to near-neutral levels around the time of ETF approvals. The increase in funding rate combined with open interest suggests that new contracts have been opened with a skew towards longs.

New tokens contribute over $8bn in spot volume

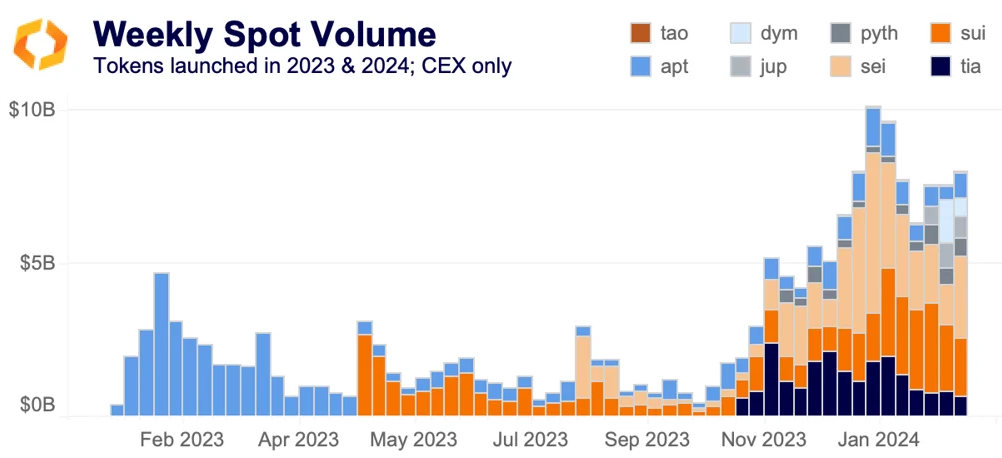

Some of the best performing tokens of this mini-bull rally have been those launched in 2023 and earlier this year. Layer 1 tokens SUI and SEI have registered around $2bn in volume each week since the start of the year. Celestia (TIA) peaked in volume a few weeks after its launch but has continued to register nearly $1bn per week in February. Meanwhile, Aptos’s (APT) volume has bounced back from the summer doldrums but still pales in comparison to early last year.

PYTH and JUP have relatively low CEX volumes, as they are primarily traded on Solana DEXs. Bittensor (TAO) is perhaps the most interesting; it has continued to surge on AI hype even as its CEX trade volume remains very limited. The token is listed on few centralized exchanges and primarily trades on Uniswap as wrapped TAO (wTAO).

Bitcoin hits all-time high against the JPY, NGN and TRY

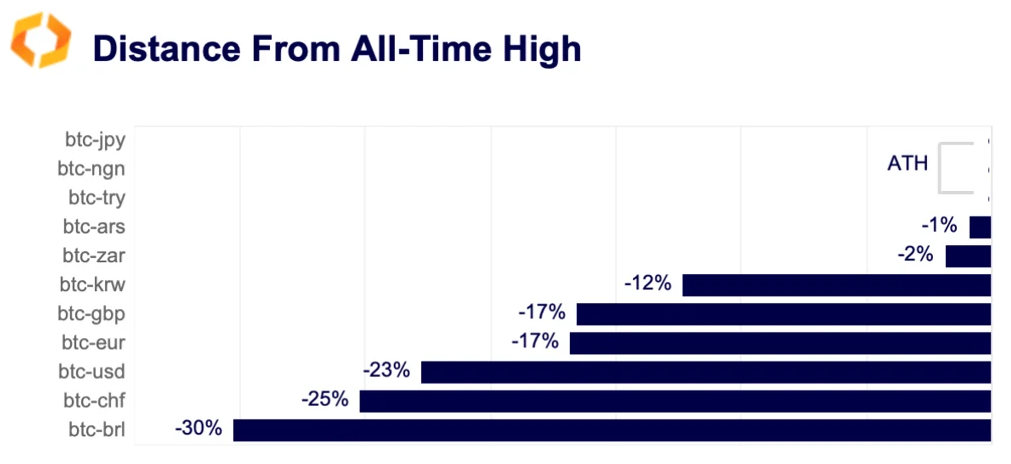

Last week, hotter than expected U.S. inflation data boosted the appeal of the U.S. Dollar relative to its peers, spurring a wave of FX volatility. As a result, the cost of buying Bitcoin when using the Japanese Yen (JPY), the Nigerian Naira (NGN) and the Turkish Lira (TRY) – some of the world’s worst performing fiat currencies this year— rose to an all-time high.

Both Turkey and Nigeria continue to battle with double-digit inflation rates despite hawkish monetary policy and capital control measures. On the other hand, the Bank of Japan (BoJ) has maintained accommodative monetary policy, which makes the Yen less attractive compared to high-yielding currencies such as the USD and the EUR. As of the end of last week, Bitcoin was still down more than 23% relative to its peak of $67K against the U.S. dollar and 25% relative to its ATH in Swiss francs.

Coinbase returns to profit amid ETF hype

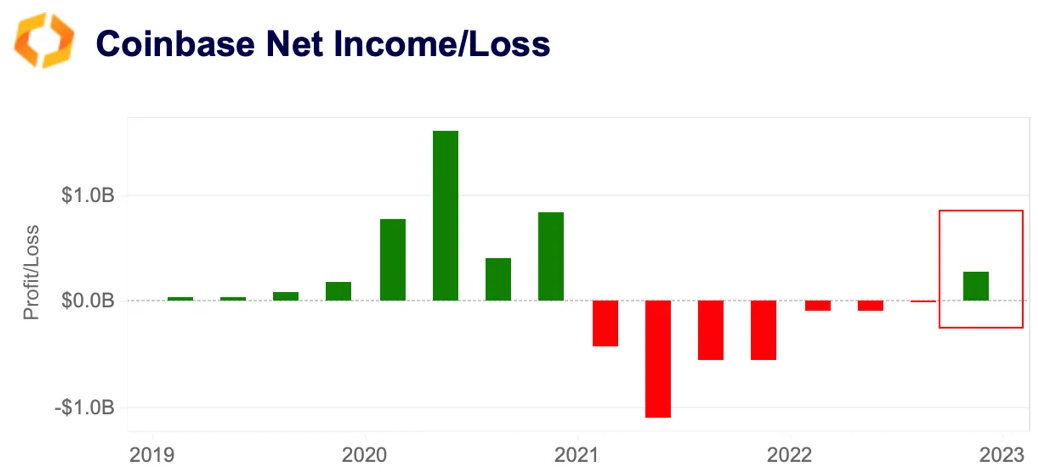

Coinbase's earnings call last week showed that the exchange returned to profit in 2023 for the first time since 2021, on the back of rising trade volumes. The result came above market expectations sending COIN shares near two-year highs on Friday.

Transaction revenue grew by more than 83% to $529mn in the fourth quarter of 2023 relative to the previous quarter, surpassing 50% of Coinbase's net income for the first time since end-2022. Income from custody, institutional trading and financial services – which are the main services offered under Coinbase’s institutional Prime platform — accounted for just 10% of the total annual net income in 2023. However, its share is expected to rise because Coinbase is the custodian for eight out of eleven spot BTC ETFs, controlling 90% of the $36bn in BTC spot ETFs assets.

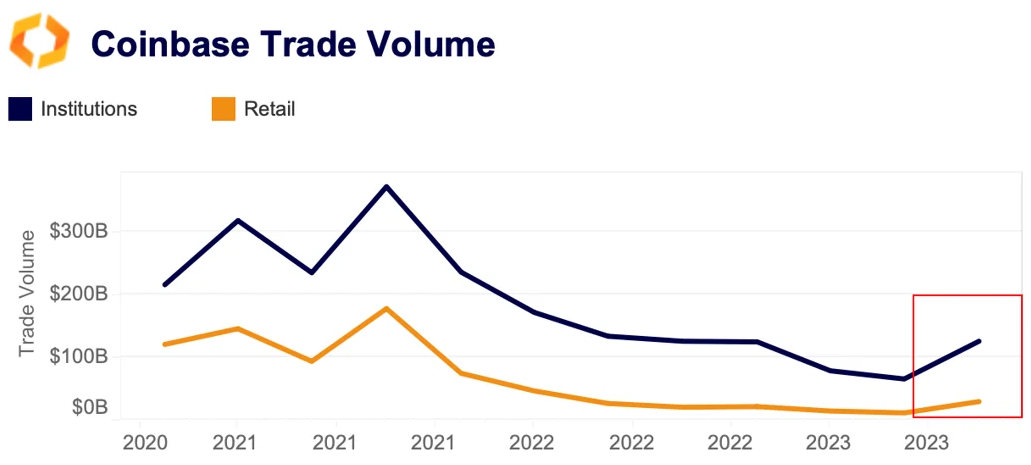

Rising market participation due to ETF related enthusiasm and improving macro environment boosted both institutional and retail trade volumes.

Interestingly, the increase was primarily driven by altcoin transactions, which accounted for 42% of the total trade volume, while the share of BTC and ETH declined to 31% and 15% respectively.