A summarizing review of what has been happening at the crypto markets. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko.

Bitcoin tumbled in tandem with equities on rising fears of a hard landing after weaker than expected US economic data. In other news, Morgan Stanley will allow its financial advisors to advise Bitcoin ETF investments starting this month. This week we explore:

- BTC recent sell-off

- Bitcoin miners after the halving

- Coinbase retail revenues fall

Fears of hard landing drive a sell-off in risk assets

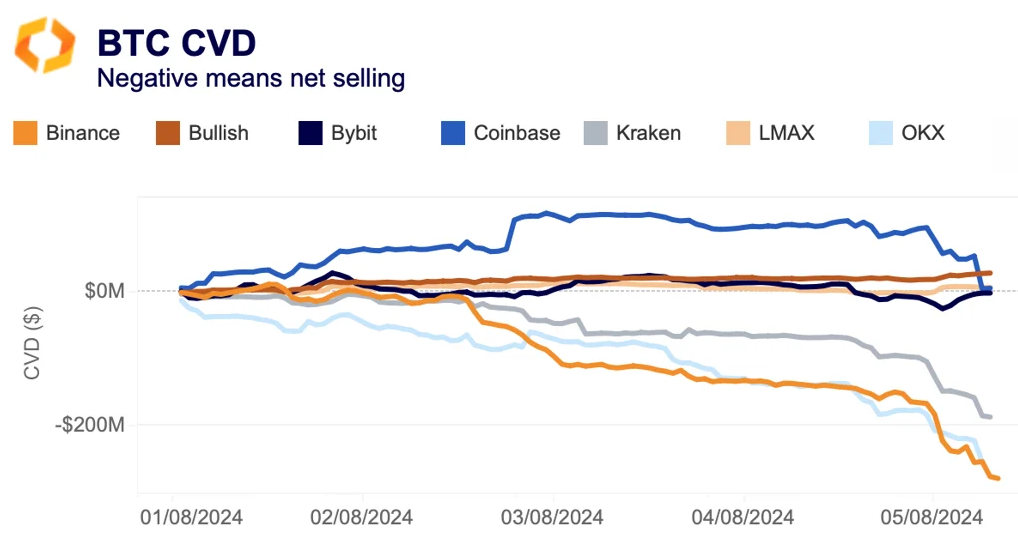

August is historically a bad month for crypto markets. Last year, we had one of the largest deleveraging events on Aug. 16-17, this year is no different. Bitcoin sold off in tandem with US equities last week after poor economic data fueled fears of a hard landing. The U.S. added fewer jobs than expected, and manufacturing activity contracted faster in July. Interestingly, while offshore exchanges such as Binance and OKX saw strong selling since Friday, BTC's cumulative volume delta (CVD) on most US platforms remained positive, suggesting that some traders bought the dip.

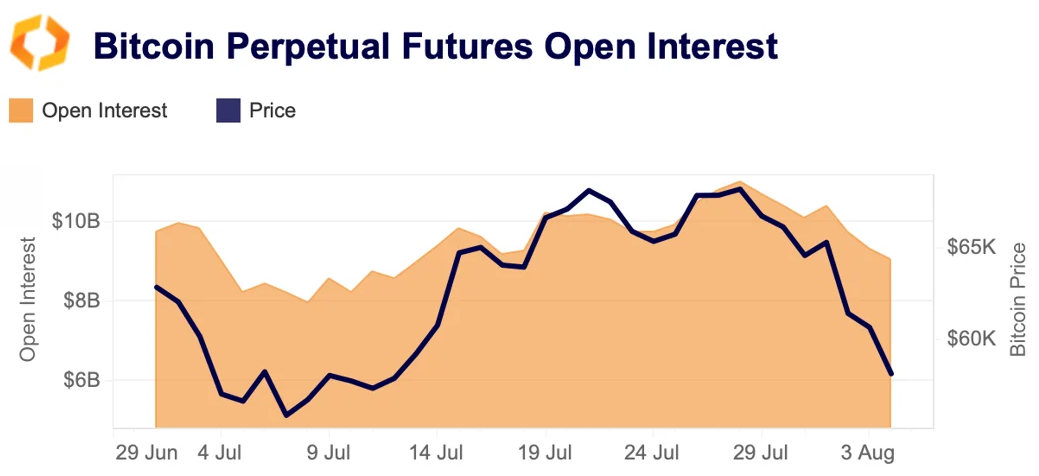

BTC perpetual futures open interest, which indicates the total number of open contracts at any given time, soared to near all-time highs in the lead-up to the crash. Growing open interest suggests that more traders are actively trading the market and that new capital was entering the markets before the crash. Open Interest on Binance, Bybit, Bullish, and Kraken rose to over $11 billion on July 28. It has since fallen to around $9 billion as traders were liquidated during the fall in prices.

Bitcoin Funding Rates Amid Political Turmoil and Economic Shifts

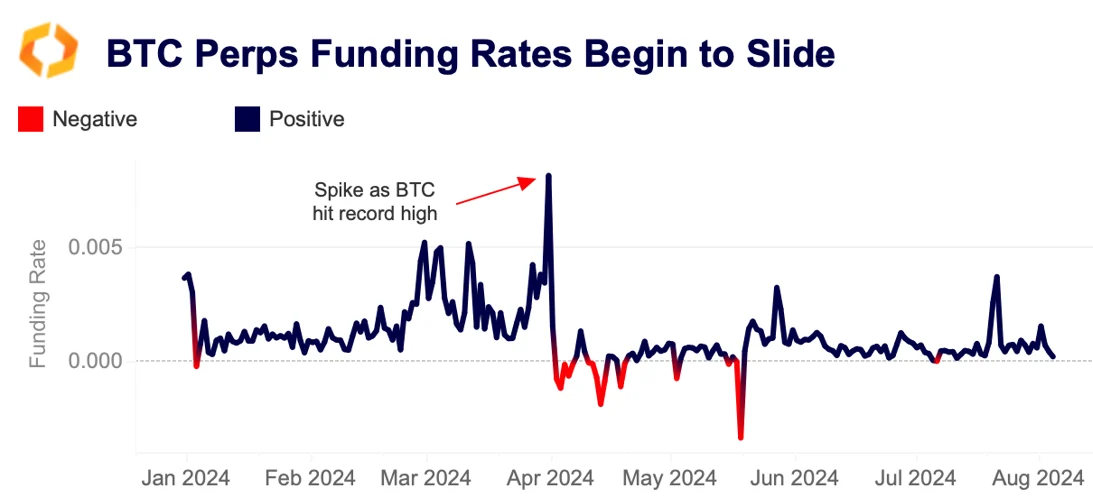

Funding rates briefly spiked on July 21 following the assassination attempt on presidential candidate Donald Trump, but they have otherwise remained relatively flat since May. This trend in funding rates suggests that traders are using perpetuals to hedge their positions. However, considering the ongoing sell-off in spot markets since the price drop, one might wonder: how long can we expect Bitcoin perpetuals funding rates to remain positive? Once the funding rate turns negative this means more traders are short than long.

Taking a step back now to consider what has driven this sell-off, it appears to have been largely due to macroeconomic reasons.

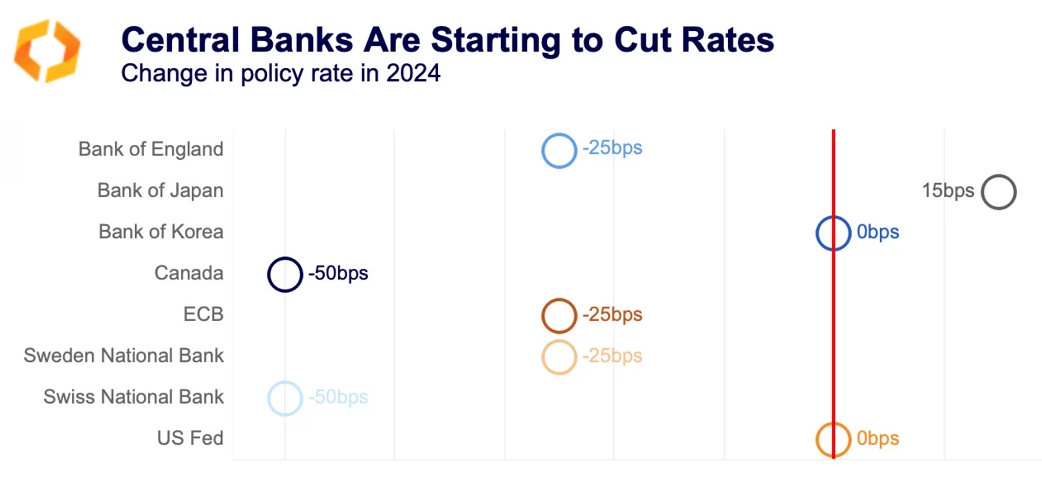

The US Fed signaled a potential rate cut in September during its Wednesday FOMC meeting but kept rates unchanged. However, fears of a policy mistake swayed the market after poor economic data on Thursday and Friday. These fears were likely exacerbated by recent rate cuts from the Bank of England and other major central banks, including the Bank of Canada, the ECB, and the Swiss National Bank.

The risk-off mood was further intensified by the Bank of Japan (BoJ) shifting to tighter monetary policy. The BoJ raised its policy rate to around 0.25% from the previous 0%-0.1% range and announced plans to halve Japanese bond purchases over the next few years. Although real rates remain negative in Japan, the shift is significant as the BoJ has maintained low domestic borrowing rates for over two decades. The move toward higher domestic yields could impact global asset allocation, potentially unwinding the carry trade, where investors borrow cheaply in Yen to invest in high-yielding bonds and equities.

Miners look elsewhere to plug revenue gaps

Since the fourth halving in April, some Bitcoin miners have come under increasing pressure. The halving cut block rewards from 6.25 to 3.125 BTC, making life more difficult for inefficient miners with older equipment.

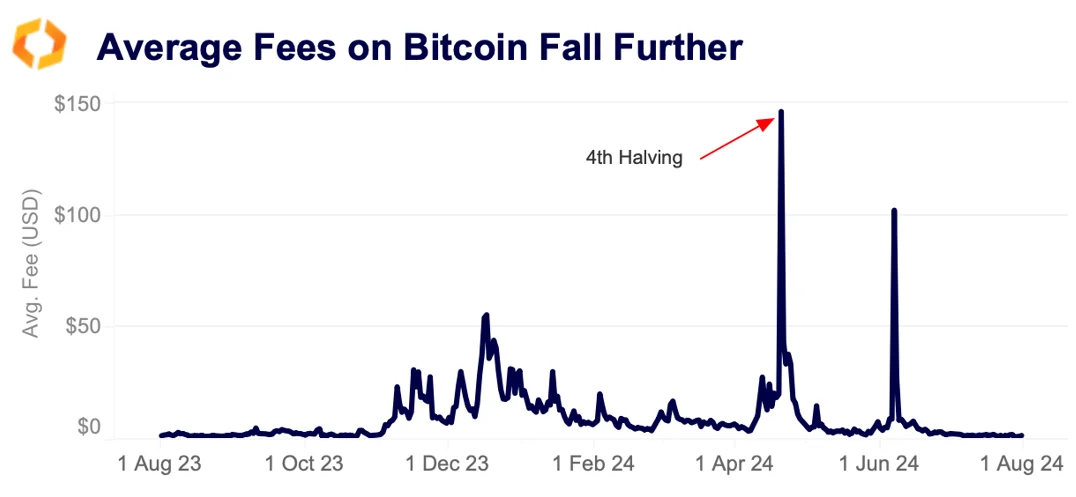

Network fees spiked immediately after the halving, following the launch of the Runes protocol. However, this was short-lived, and fees have since trended lower. The average network fee is currently $2, well below the $143 post-halving high.

While Marathon Digital recently announced a $100 million Bitcoin purchase, other miners have been less fortunate. Many miners sold holdings ahead of the halving, with selling accelerating since April as pressure on firms increased. On-chain data shows miners' Bitcoin holdings have been declining since the late 2023 bull market began, as miners progressively sold their holdings.

As miners adapt to the new mining environment, some firms are looking beyond crypto to boost revenues. Notably by courting Artificial Intelligence (AI) firms. Miners have access to energy and infrastructure that can aid AI firms' expansion. For instance, bitcoin mining leader Core Scientific converted part of its infrastructure to provide data center services for AI startup CoreWeave, having exited bankruptcy earlier this year as rising prices improved revenues.

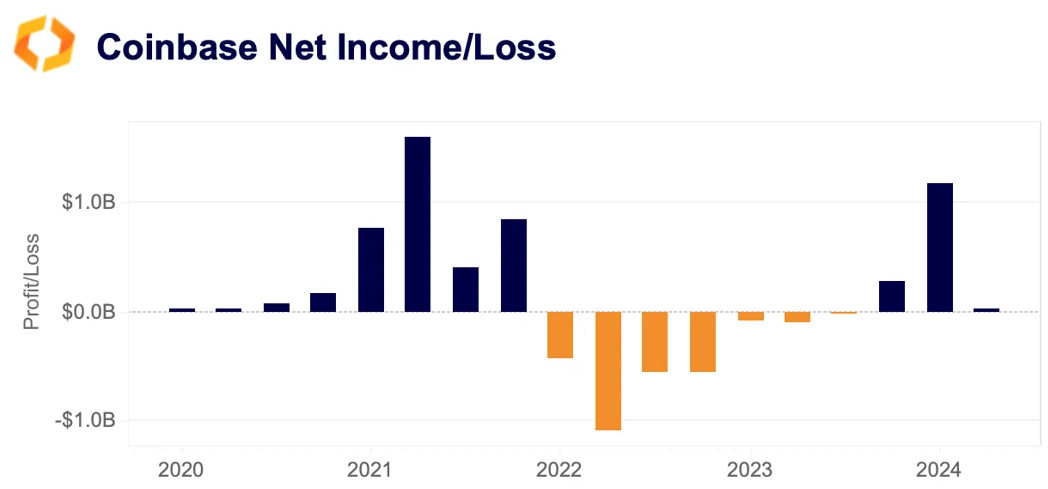

Coinbase profit plummets amid falling retail volume

Last week, Coinbase reported a $36 million profit in Q2, substantially down from the $1.2 billion registered in Q1. While revenues exceeded market expectations, they were lower than estimated. Trade volume dropped by 28% to $226 billion, with retail volume declining faster than institutional volume. The results sent COIN down 16% for the week, despite an improving U.S. regulatory outlook in recent months.

The exchange still derives most of its revenue from retail transaction fees and altcoins, which account for about 40% of its spot trade volume. Income from consumer fees fell by 29% to $665mn in Q2. Additionally, Coinbase faces growing competition from cheaper ETF offerings and platforms like Robinhood in attracting retail users.

In contrast, revenue from Coinbase's institutional Prime platform—which includes income from custody, institutional trading fees, and interest and financing fees—remains relatively low, accounting for just 12% of net income.

ETH correlation with BTC resumes decline since May

Since the end of May, the 60-day correlation between ETH and BTC has been trending downward. Historically, Bitcoin and Ether have been strongly correlated, but their correlation has been volatile since the start of the ETF-driven rally in October 2023, oscillating between a multi-year low of 0.64 and a high of 0.86.

Bitcoin outperformed earlier this year due to rising institutional demand and an improved macro environment. While it is unclear if spot ETH ETFs will see similar demand as BTC ETFs, their recent approval in the US could boost ETH's institutional adoption and increase its correlation with BTC in the short term.

However, despite both offering diversification benefits, Bitcoin and Ether are fundamentally different. Bitcoin is viewed as a store of value, similar to gold, while Ethereum is a smart contract platform that uses ETH for payment and generates yield. These differences could lead to a gradual decrease in their correlation over time.

XRP share on U.S. exchanges rebounds to pre-suit levels

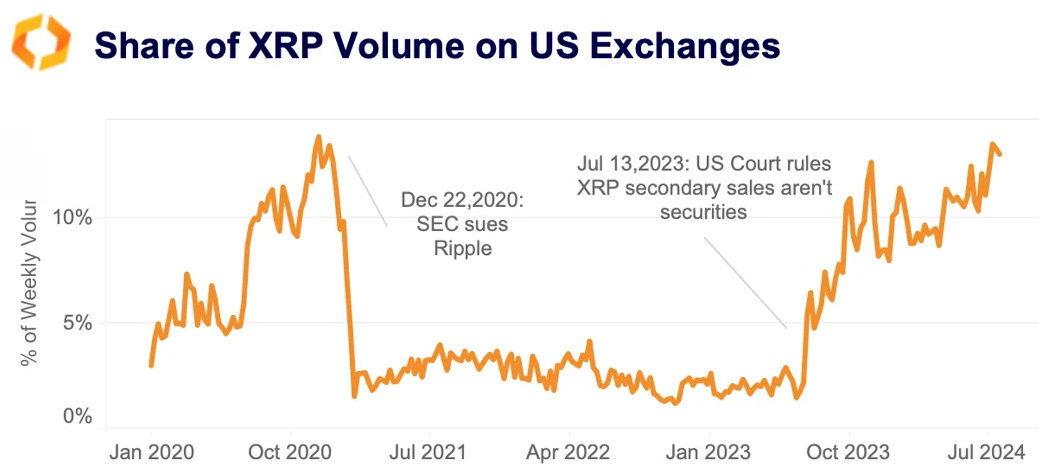

Since last year's landmark court ruling, which granted Ripple Labs a partial victory against the SEC, demand for XRP in US markets has grown steadily. The share of US platforms in global XRP volume has increased from less than 2% to 14% over the past year, matching levels from before the SEC suit.

The summary judgment stated that Ripple's XRP sales through secondary trading platforms were not securities transactions, although direct sales to institutional investors were. Following the ruling, several US exchanges, including Coinbase and Gemini, relisted XRP, releasing pent-up demand from US traders.

Ripple's ongoing legal battle with the U.S. SEC continues to fuel XRP's volatility. In July, XRP surged 35%, outpacing Bitcoin's 4% gain, amid rumors of a potential SEC settlement. Speculation grew after the SEC amended its Binance complaint and scheduled a closed-door meeting for August 1st. However, the meeting was later canceled, leading to a drop in prices.