A summarizing review of what has been happening at the crypto markets of the past week. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko.

Volatility came back to life last week as BTC dropped 9% in under 24 hours, hitting its lowest level since June. Today we take a broader view of the market, revisiting some of the key trends shaping the market this summer.

Liquidity remains at multi-month lows

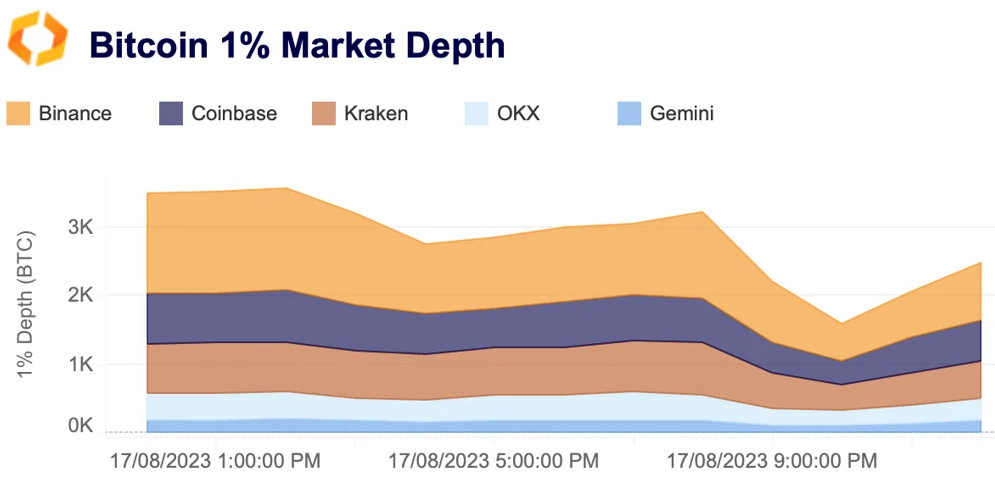

Exceptionally low liquidity, macro factors, and a flurry of bad news were among the drivers of last week's flash crash, pushing BTC to its lowest level in months and spurring a wave of liquidations across derivative markets.

While BTC 2% market depth has stabilized over the past few months at around 5k BTC, it remains more than 50% below its pre-FTX highs. As BTC prices began falling towards $25k around 8pm UTC on August 17, market depth dropped 50% to just 2k BTC. Kraken and Binance saw the strongest declines of 50% and 48%, respectively.

Market depth has become much more concentrated, with the top five most liquid venues accounting for 77% share in BTC and ETH market depth compared to 68% before the collapse of FTX. This could exacerbate price moves during periods of market turmoil.

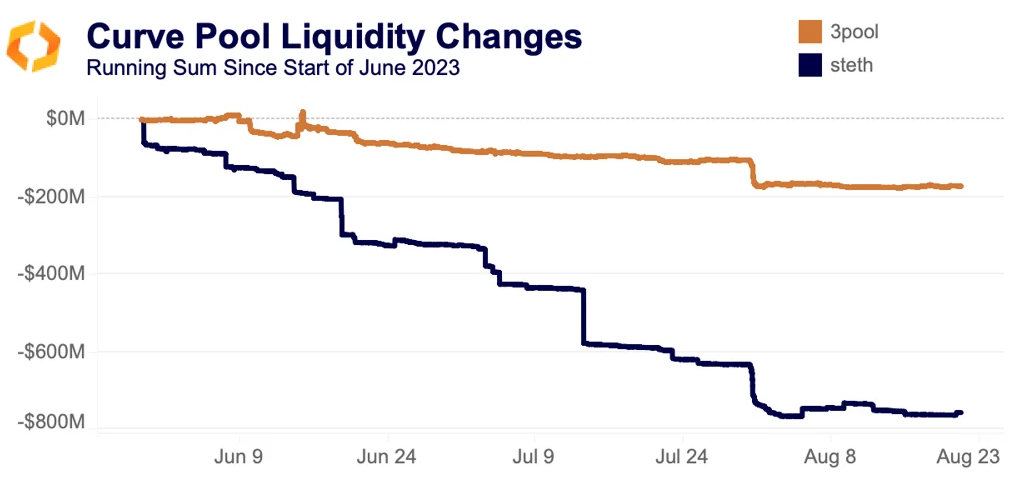

On-chain liquidity looks worse. Since June, nearly $200mn has been removed from the 3pool and $800mn worth of tokens has been removed from the stETH-ETH pool. TVL stands at $225mn and $340mn, respectively. These pools have now vacated the top spot on Curve, now held by FRAX-USDC.

The 3pool's decreasing liquidity, in combination with Tether's redemption fee, it makes small depegs more likely. The stETH-ETH pool is shrinking because Lido DAO removed LDO token incentives from the pool. The DAO felt that, because stETH staking withdrawals have been enabled, having such a deep pool of DEX liquidity was no longer necessary.

Binance dominance declines following SEC suit

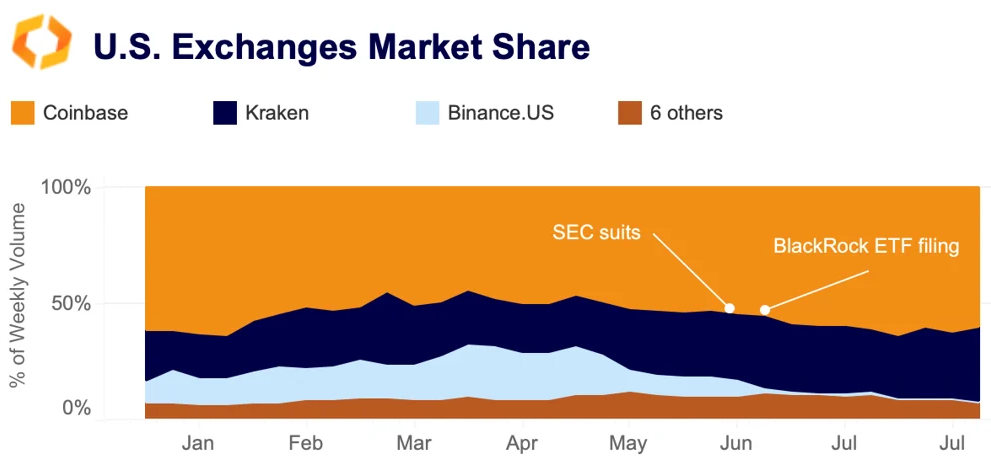

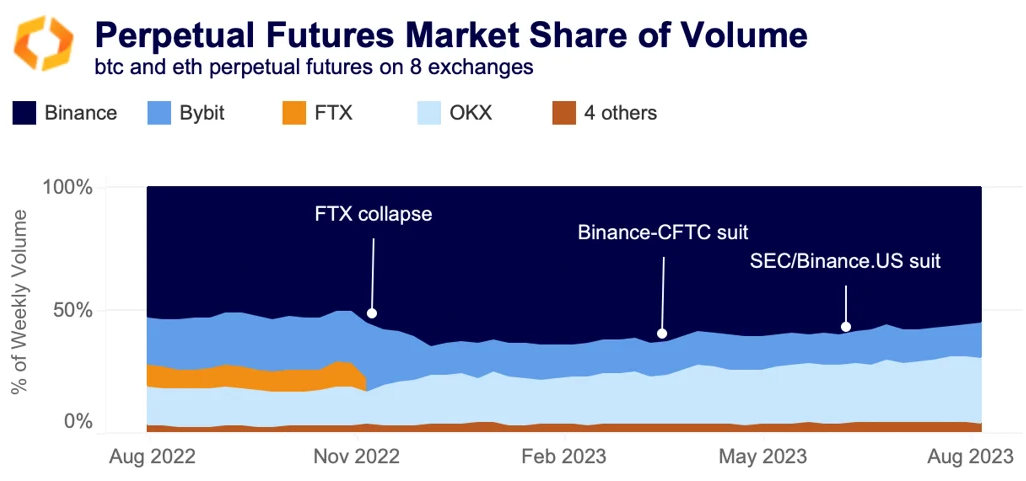

In early June, Binance and Coinbase were each hit with lawsuits by the SEC, causing volatility and an altcoin sell-off. This allegations regarding Binance.US created an exodus from the exchange as both market makers and traders left en masse. In the week after the lawsuit, Binance.US's market depth fell by 80%. Its U.S. market share has collapsed from over 20% in April to below 1% as of early August.

Despite the SEC lawsuit, Coinbase's market share has increased to 60% as BlackRock and several other major asset managers chose it as their surveillance sharing partner in spot BTC ETF filings. Binance global also faced increased regulatory pressures globally, withdrawing from Australia, the UK, and several other European markets.

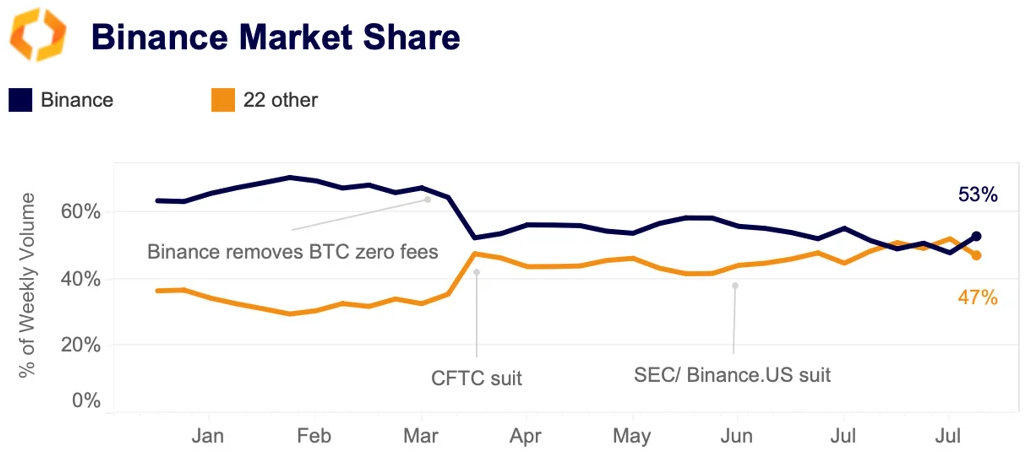

The exchange’s market share, which was already on a steady decline, fell to a yearly low of 48% in July. However, over the past two weeks, it has increased back to 53%, in large part due to a new round of trading fee promotions for TUSD and FDUSD pairs.

Binance's market share of BTC and ETH perpetual futures trade volume also fell from 64% to 55% this year. The decline has been driven by outflows from ETH markets whereas increasing hedging inflows from miners have provided support to BTC markets. OKX was the main winner as its share has increased from 18% to 26%.

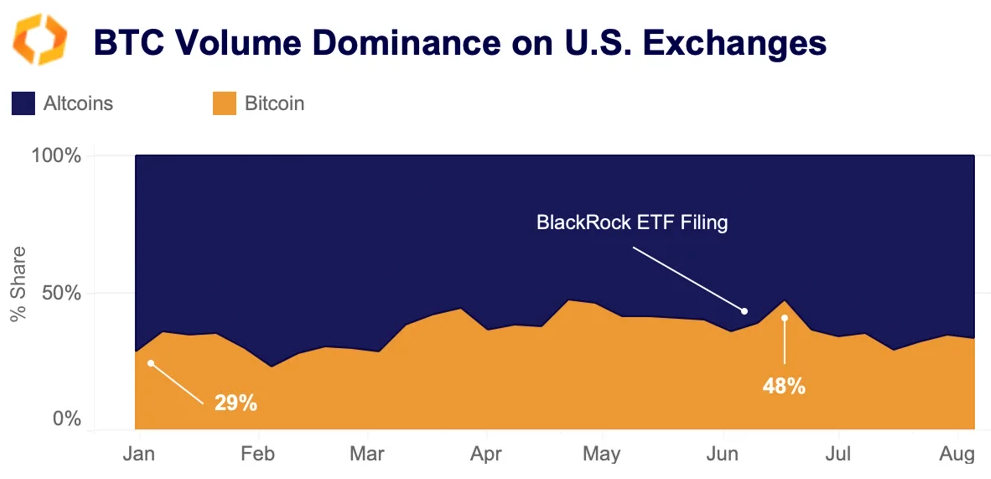

BlackRock ETF filing boosts BTC dominance

BlackRock — the world’s largest ETF issuer by AUM — applied for a spot Bitcoin ETF mid-June, unleashing a wave of spot ETF filings. While the SEC has a history of rejecting spot BTC ETFs, BlackRock put forth a novel proposal to collaborate with Nasdaq to establish a surveillance-sharing agreement with Coinbase, boosting optimism about the outcome. As a result, BTC surged by 13% in June while confidence around Coinbase improved despite its regulatory hurdles.

BTC dominance on U.S. markets briefly spiked to nearly 50% in the week after the BlackRock filing before declining again as the rally lost steam. Overall, the share of BTC traded during U.S. hours has been raising steadily this year to 44%, up from 43% in 2022 and 36% in 2021.

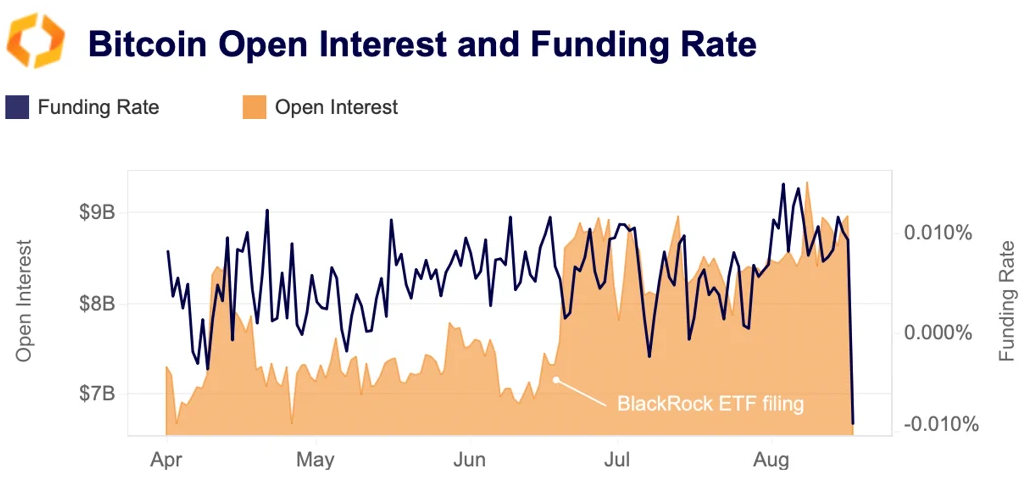

Inflows into BTC derivative markets also accelerated in the second half of June. BTC perpetual futures open interest aggregated on five exchanges hit its highest level since the collapse of FTX in July of nearly $9bn.

However, the wave of liquidations last week wiped out most of the post-ETF filing increase with the amount of open contracts dropping by 20% to $7bn on August 17. BTC funding rates also turned deeply negative, falling to their lowest level since March.

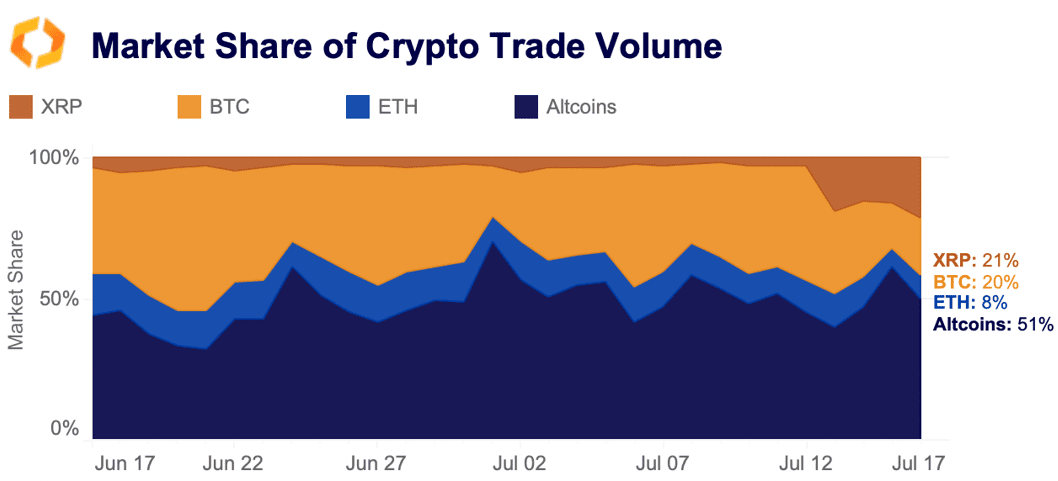

XRP soars after win for crypto industry

After years of waiting, Ripple finally got a ruling in their highly anticipated lawsuit with the SEC; it stated the company did not violate federal securities law by selling its XRP token on public exchanges. In the days after the ruling XRP soared by more than 60% while its market share briefly surpassed BTC and ETH. It was also listed on U.S. exchanges for the first time in years.

Altcoins did not rally as much as might have been expected despite the bullish implications of the ruling. The SEC is likely to appeal the ruling.

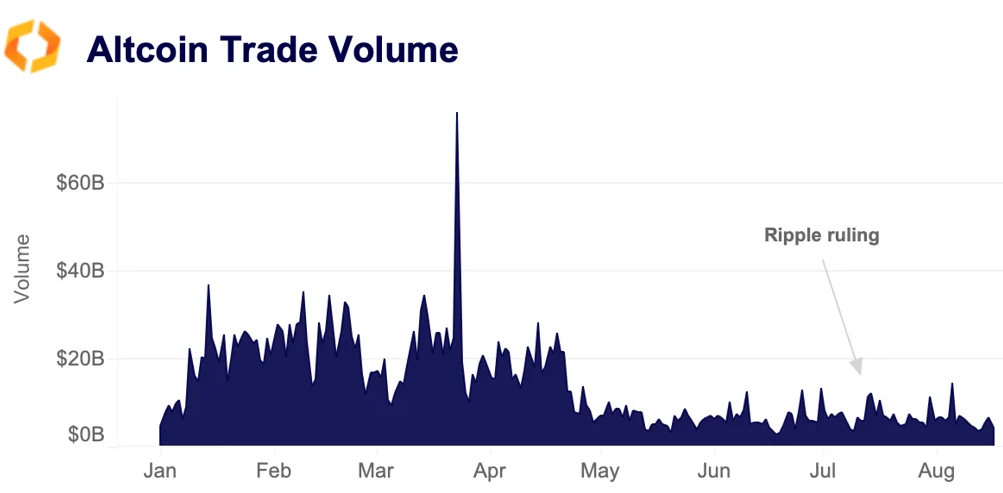

Daily altcoin trade volume (excluding XRP) barely moved after the ruling, remaining well below the Q1 average throughout last month.

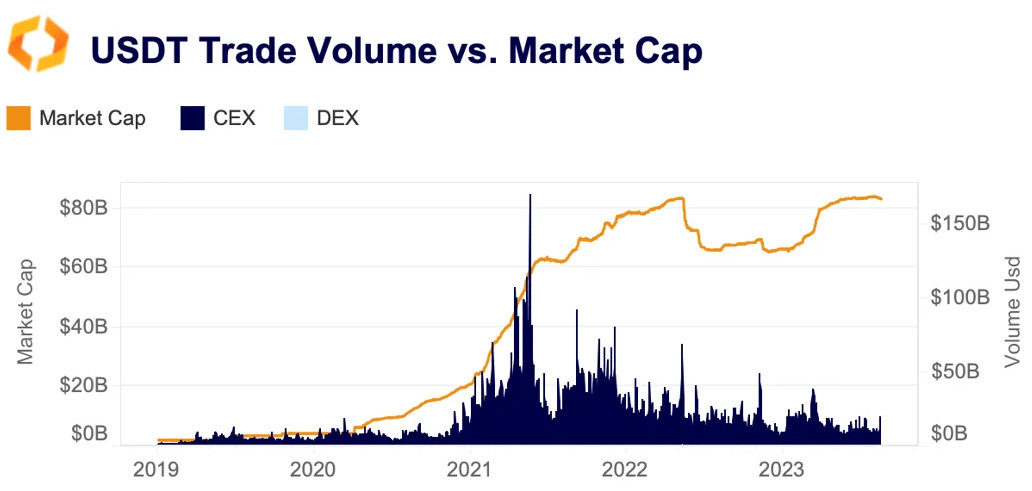

USDT market cap hits ATH despite low volumes

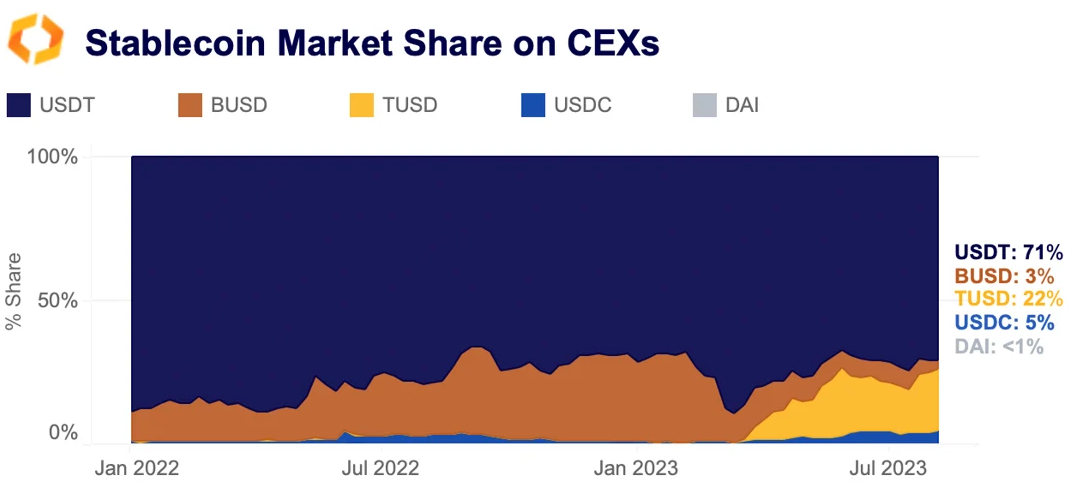

Crypto trade volume has been in the doldrums since the start of Q2, falling to multi-year lows. Yet, amid the lull, Tether’s market cap hit an all-time high of nearly $84bn. Tether’s primary use case is for trading on centralized exchanges, with more than 50% of all trades executed using USDT. On DEXes, USDC remains the dominant stablecoin but USDT still possesses a healthy market share. So why, with lackluster trade volume on both CEXs and DEXs, does Tether’s market cap continue to increase?

One could argue that the imminent end of BUSD along with USDC’s March depegging caused a rotation into USDT. Yet, the data doesn’t show any notable increase in USDT market share (as measured by trade volume) relative to other stablecoins over the past few months, in large part due to Binance’s promotion of TUSD as an alternative to BUSD.

One explanation for Tether’s climbing market cap could involve the Tron network. The majority of all USDT — $44bn — are issued on Tron, compared with $39bn issued on Ethereum. Offshore exchanges like Binance and OKX possess the largest USDT balances on Tron, which suggests market makers and whales prefer this network for its low transaction fees.