A summarizing review of what has been happening at the crypto markets. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko.

Bitcoin (BTC) closed the week in the red as stagflation fears mount in the US, trading early Monday just above $62k. In other news, Consensys sued the SEC, Venezuela chose USDT for oil payments to sidestep sanctions, and US authorities arrested co-founders of a crypto mixing service. This week we explore:

- Tether’s falling market share

- Rising ETH staking outflows

- APAC derivatives trading patterns

Tether loses market share as competition heats up

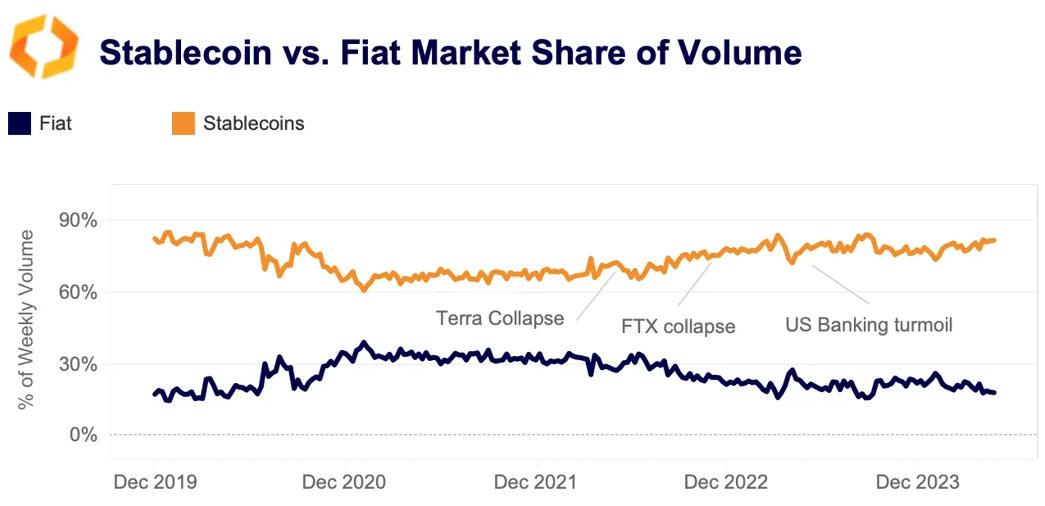

Despite several high-profile collapses and de-pegging events in recent years, stablecoins have continued to gain market share over fiat, indicating strong demand. Currently, the top USD and EUR-pegged stablecoins denominate 82% of all crypto trades, while fiat currencies hold just 18% market share.

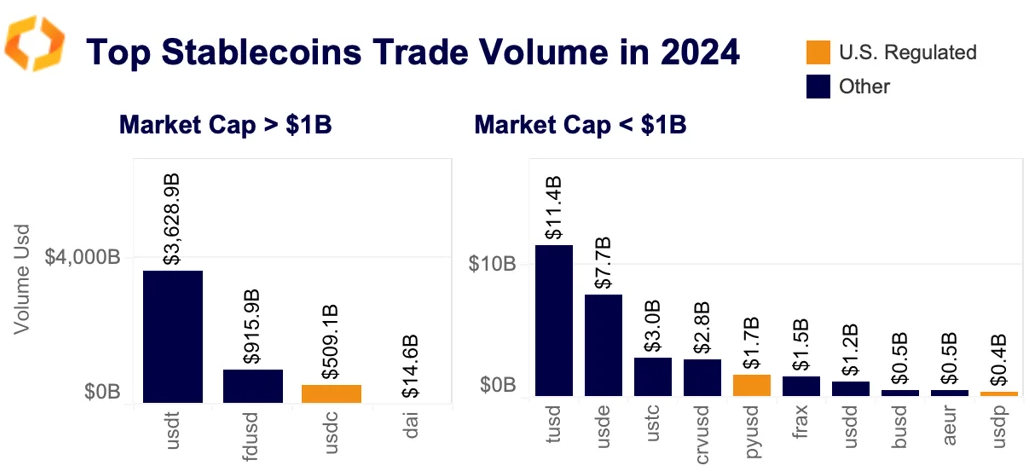

However the stablecoin market remains highly concentrated, with Tether's USDT leading the way. USDT's cumulative trade volume has surpassed $3.6 trillion this year alone, which is nearly four times larger than its nearest competitor, Hong Kong-based First Digital's FDUSD, which mostly trades on Binance.

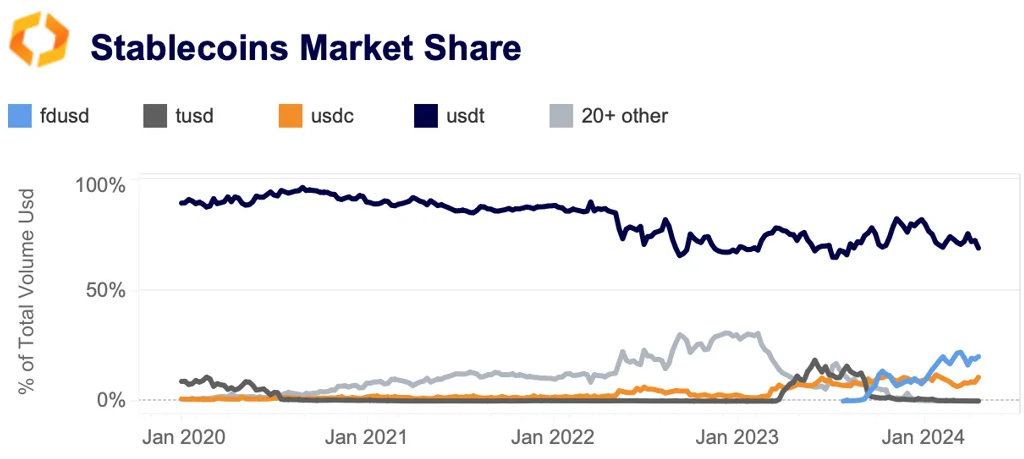

However, despite its dominant market position, USDT's market share on CEXs has been trending downwards, declining from 82% to 69% YTD. This decrease can be partly attributed to growing competition from stablecoins like FDUSD which benefit from Binance's zero-fee promotions.

USDC has also experienced a rise in its market share, signalling a growing preference for regulated alternatives. At present, stablecoins issued in the US make up 10% of the overall stablecoin trade volume. Only one of the top five stablecoins by market cap, Circle's USDC, is regulated under state US money transmitter frameworks. Nevertheless, its share has increased from less than 1% in 2020 to 11% today.

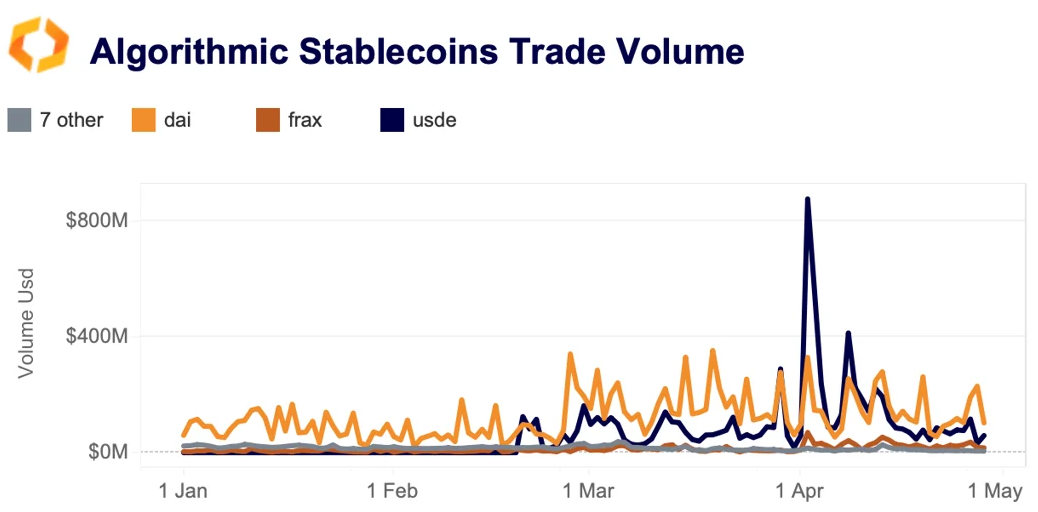

Another reason for Tether's declining market share could be linked to the emergence of innovative yield-bearing alternatives such as Ethena's USDe. Since its launch in February, USDe's volume has grown significantly, although it has retreated from April's all-time high of more than $800 million following Ethena's ENA airdrop

Overall, algorithmic stablecoins carry higher regulatory and operational risks, including a potential ban in the US if the recent stablecoin bill is passed, which could impede their broader adoption.

Traders increasingly prefer inverse contracts

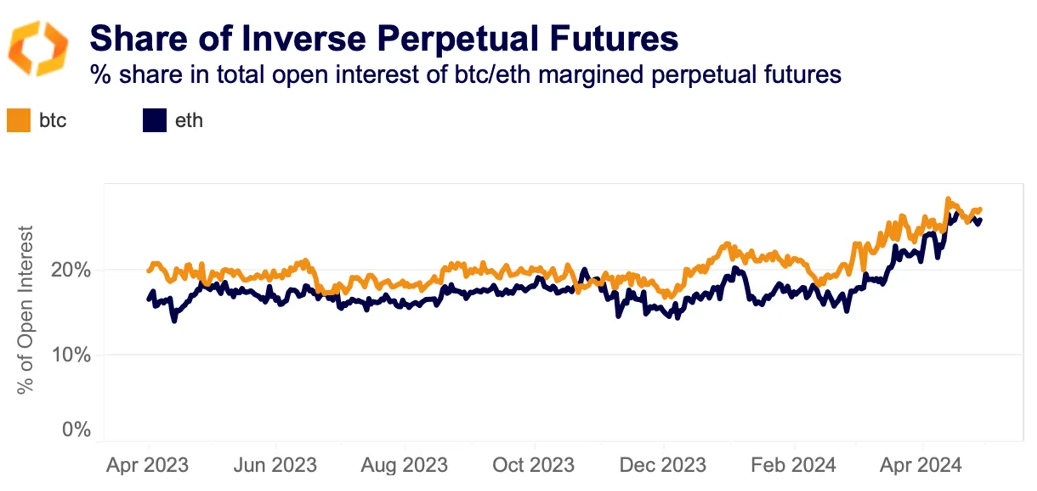

A growing number of traders are choosing BTC-margined perpetual futures — known as inverse contracts — to speculate on the market's direction.

Perpetual futures, a type of derivatives contract with no expiration date that trade in perpetuity, are especially popular among crypto traders. Part of the appeal lies in the ability to take on substantial leverage. BTC-margined perps are denominated and settled in BTC, meaning traders pay to maintain their positions using BTC, as opposed to fiat or stablecoins (hence, inverse).

Historically, traders have preferred linear contracts (margined in USD or stablecoins). However, the share of total open interest for inverse contracts rose from 18.2% in February to over 27% today.

Similarly, ETH has increased to 25.81% from as low as 16.74% in February.

The rising share of inverse contracts could amplify the impact of price volatility on derivative markets as the value of the margin varies with the asset’s price movements, making them more vulnerable to liquidations.

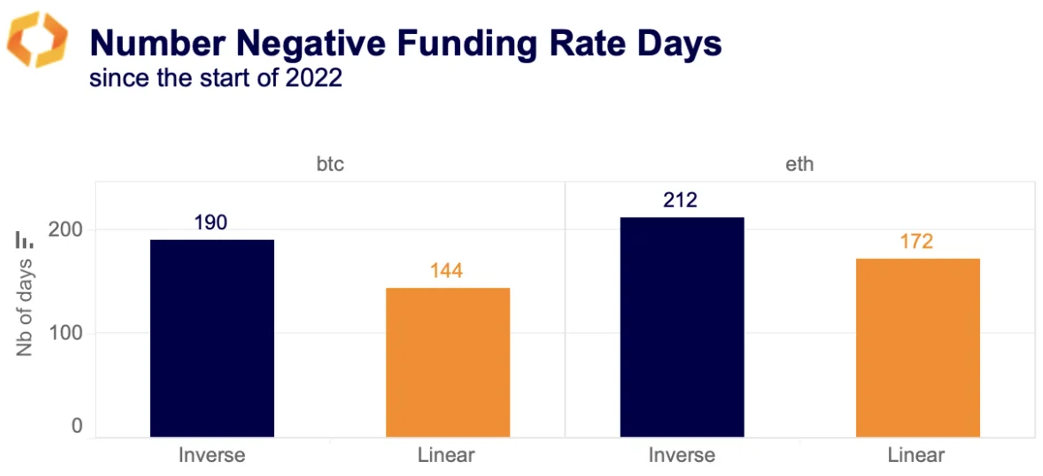

Interestingly, BTC-margined perps have had more negative funding rate days than linear perps since the beginning of 2022, according to Kaiko's derivatives data.

The funding rate refers to the mechanism by which the perps contract tracks the underlying spot price. If the rate is negative then short sellers pay a funding rate to longs, and vice versa. This could suggests increased interest for shorting using inverse contracts.

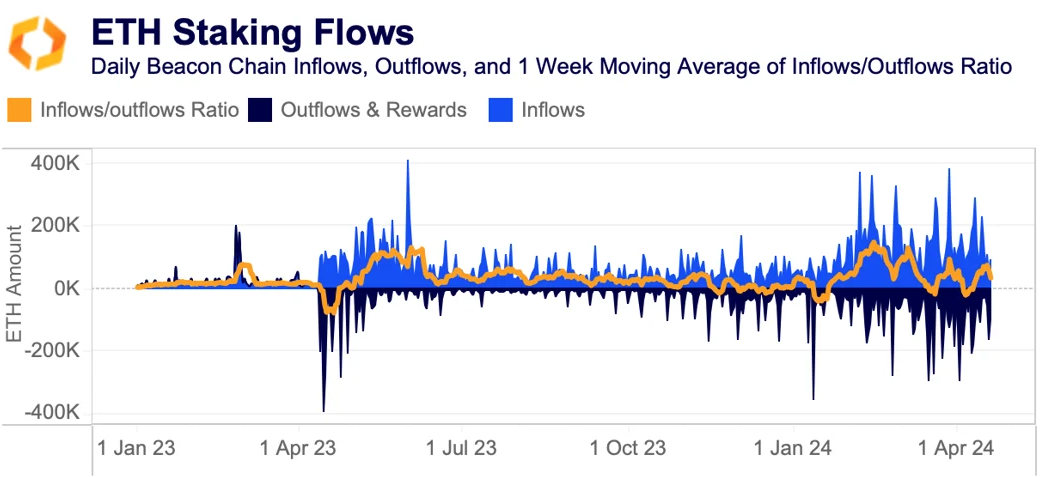

ETH staking outflows are increasing

Since the beginning of March, there has been a sharp rise in ETH staking outflows (dark blue). For a few days, there was even a negative inflow/outflow ratio (orange), which has only happened on a number of occasions since staking first became available on the Ethereum network. What explains this trend?

In January 2024, staking activity surged on Ethereum as users flocked to restaking and liquid staking protocols to benefit from new ways to earn yield. Protocols offering restaking such as Ether.Fi also announced token airdrops to incentivise users.

However, inflows (light blue) subsided following the release of airdrop eligibility criteria, suggesting some of the staking demand was driven by airdrop speculators. Both outflows and inflows seem to have moderated since.

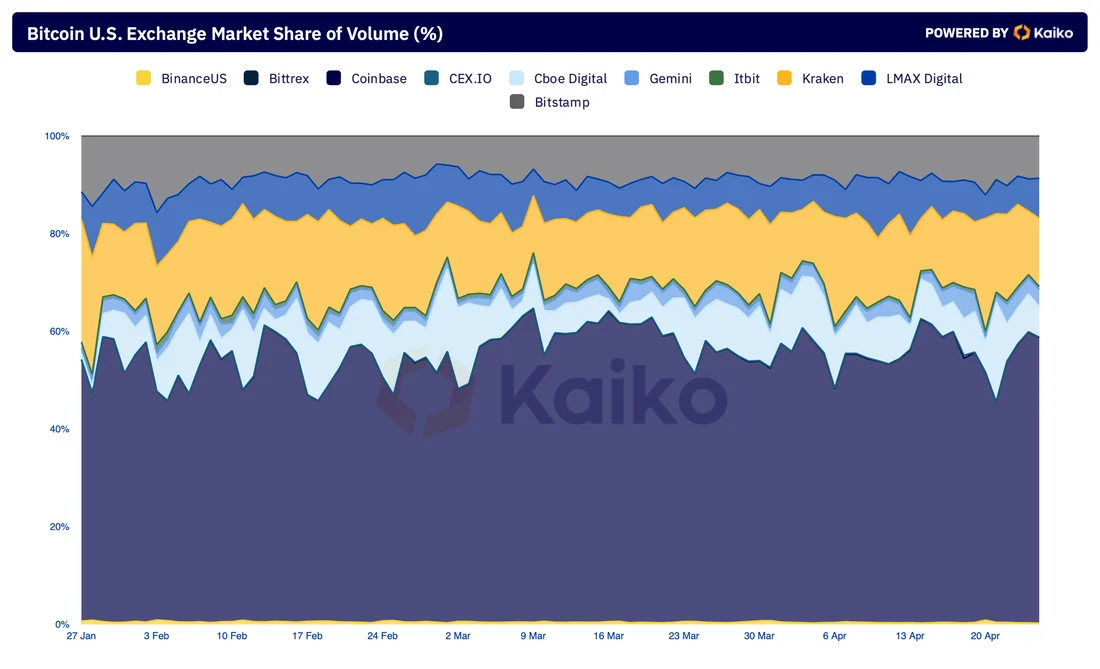

Cboe Digital winds down spot trading

Exchange operator Cboe Global Markets announced last week that it will close its spot trading business in late 2024 as part of a broader reorganization of its digital asset business. Cboe Digital, which was created after Cboe acquired ErisX in 2022, facilitated on average $150 million in daily BTC trade volume this year, up from $30 million in 2023, with volumes hitting an all-time high of $808 million in late February.

However, its daily market share has been volatile, ranging from 1% to 12%, and the exchange faces fierce competition in the US spot market, which is highly concentrated. ~10 platforms are available for trading in the US, with Coinbase accounting for 60% of total BTC volume, while the top four platforms – Coinbase, Kraken, Bitstamp, and LMAX Digital – hold nearly 90% of total BTC volume.

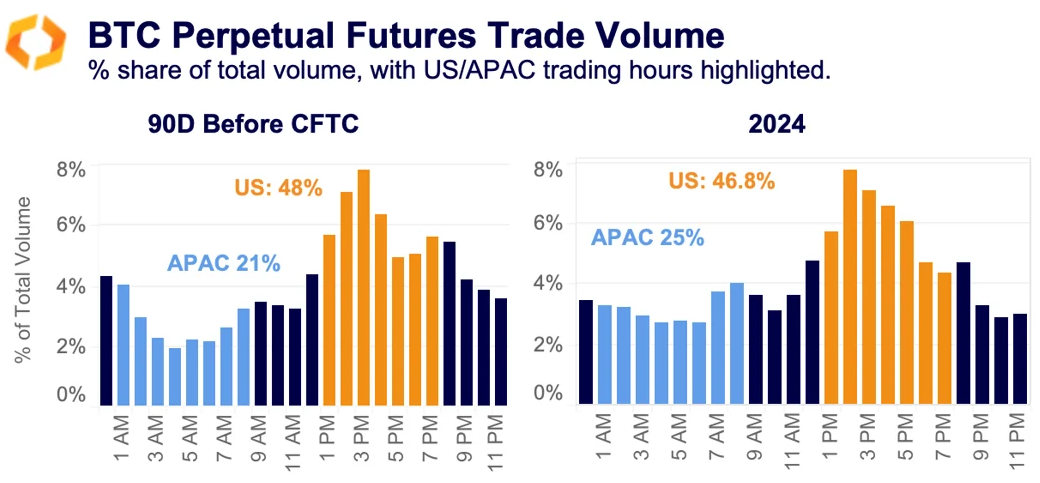

APAC sees increase in derivatives activity

The share of Bitcoin perpetual futures traded during APAC opening hours (1am-8am UTC time) has increased to 26%, up from 21% in the months preceding the CFTC’s lawsuit against Binance in early 2023. The share of trading during US opening hours has decreased slightly from 48% to 46%.

Why does this matter?

Last year, the CFTC charged Binance with intentionally circumventing federal laws and operating an illegal exchange for derivatives on digital assets, alleging that they willingly enabled US-based traders to use the platform.

We observed that the lawsuit had an immediate negative impact on trading during US hours, not only on Binance but also on other offshore derivative exchanges. While the bulk of trading still happens during US hours, the shift towards APAC suggests the growing regulatory scrutiny has had a real impact.

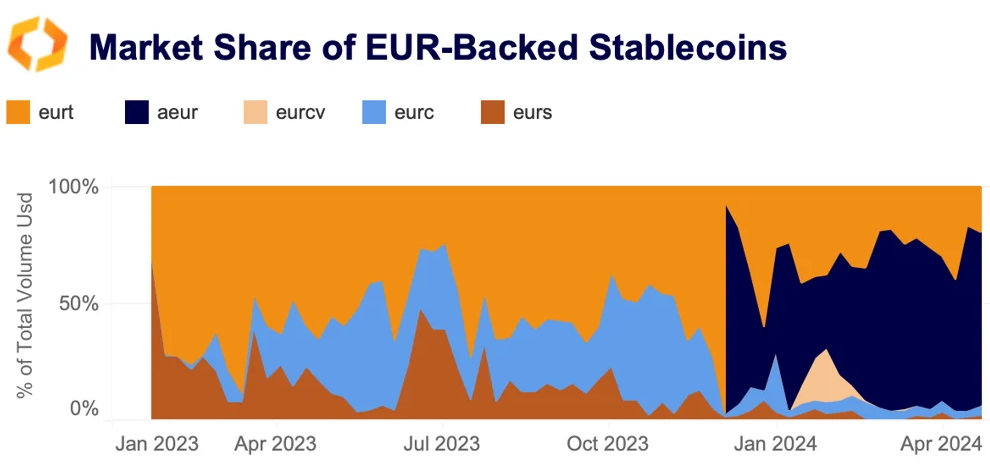

AEUR has cornered the EUR stablecoin market

AEUR, a stablecoin issued by the Swiss firm Anchored Coins, has cornered the EUR-stablecoin market despite a challenging launch on Binance in early December 2023. Its market share has surged exponentially this year, hovering over 70% as of last week. In 2024, the average trade volume for AEUR was $34 million, with nearly all transactions occurring on Binance, which offers zero-fee trading for both AEUR-USDT and EUR-AEUR trading pairs.

Overall, EUR-stablecoins have struggled to gain traction, currently representing only 1% of total trade volume in EUR. In contrast, USD-backed stablecoins are thriving, commanding a 90% market share relative to USD trading in the crypto market.