A summarizing review of what has been happening at the crypto markets of the past week. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko.

It was another low-volatility week for crypto markets, though plenty still happened. Visa expanded stablecoin settlement to Solana, the London Stock Exchange Group is exploring plans for a digital asset business, and three DeFi protocols were hit with CFTC enforcement actions.

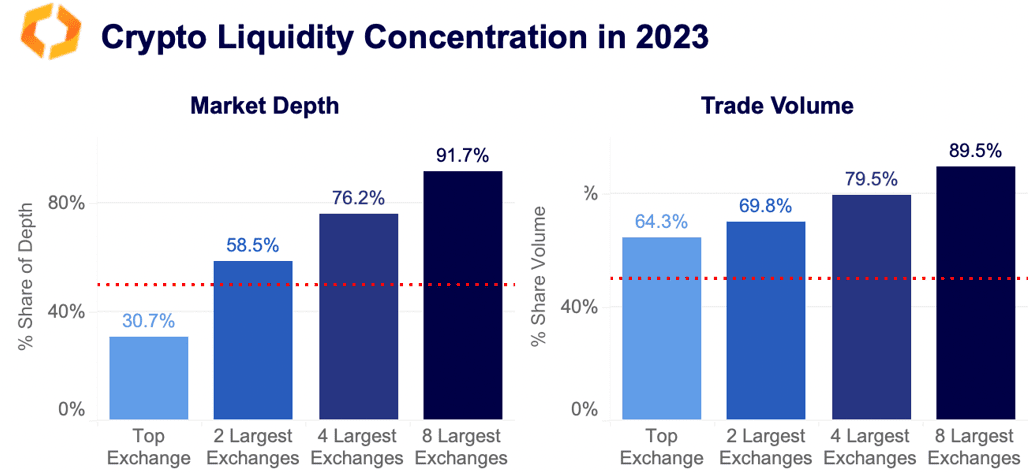

90% of liquidity is concentrated on 8 exchanges

Last week we introduced a new liquidity analysis looking at the concentration of trade volume and market depth on centralized exchanges. We found that overall, liquidity is concentrated on just a handful of exchanges, and that this concentration has increased over time. This is not unexpected, especially considering the sharp drop in activity over the past year and the benefits that liquidity concentration brings to the average trader. We found that both market depth and trade volume is highly concentrated on the top exchange, Binance.

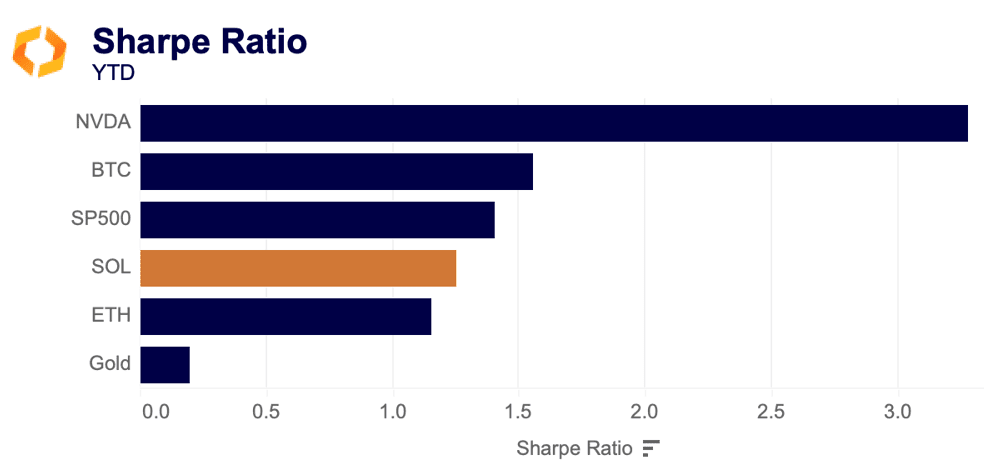

Solana comes back to life

Last week, Visa announced that it would begin a pilot to send USDC to merchants using Solana, causing SOL's price to rise past $21 before retracing down to $19.50. Despite the mild price reaction, this is yet another sign of life for a blockchain some had proclaimed dead following FTX and Alameda’s collapse. A Visa executive said the early stage of the pilot is “just giving the option to send or receive USDC instead of a bank wire.” Overall, SOL's Sharpe ratio, which measures risk-adjusted returns for the asset, has surpassed ETH and falls just behind the S&P 500.

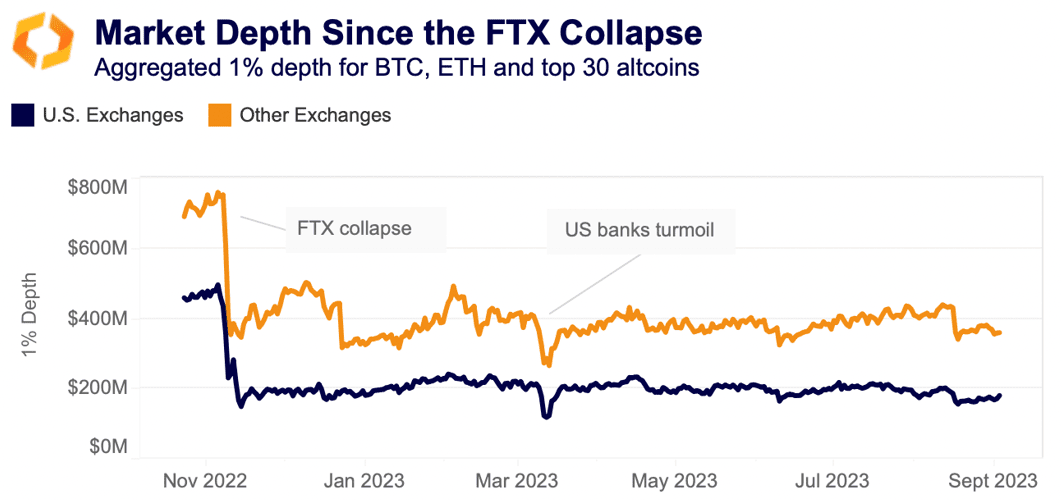

Market depth stays flat since FTX collapse

Ever since the FTX collapse, we’ve paid special attention to crypto market liquidity, focusing on market depth, which measures the amount of bids and asks placed on order books. On both U.S. and offshore exchanges, aggregated market depth for all markets trading BTC, ETH, and the top 30 altcoins has stayed mostly flat. Many of the largest market makers suffered big losses with the FTX collapse, with some winding down activities in key regions and markets. Low volume has not helped the liquidity situation either. The good news is that liquidity has stayed mostly stable without further losses.

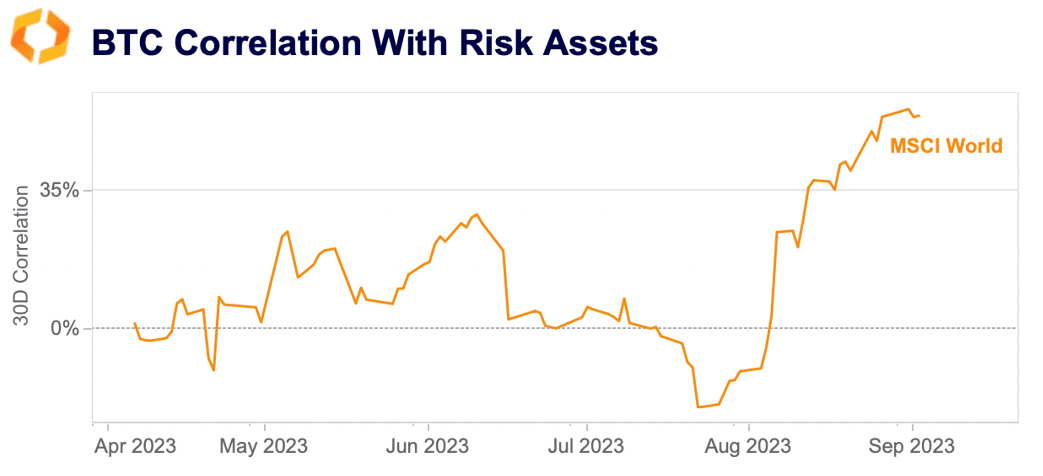

Bitcoin moves in sync with risk assets

BTC's correlation with risk assets (proxied by the MSCI World index) has risen from negative 20% to more than 40% over the past month and a half. Global risk sentiment has deteriorated after disappointing economic data from China and more recently a repricing in rate cuts expectations for next year. This has spilled into crypto, with both BTC and ETH closing last month in the red for a second month in a row.