SIX Digital Exchange (SDX) has formally received the green light from the FINMA to operate an exchange and central securities depository for digital assets in Switzerland. With these licenses, the SIX platform now offers the highest Swiss regulatory standards. Specifically, FINMA has granted SIX Digital Exchange Ltd a license to operate as a central securities depository and its affiliate SDX Trading Ltd a license to operate as an exchange. This is the first time in the Swiss financial center that a license has been granted for infrastructures that enable the trading of digital securities in the form of tokens and…

Author: Editorial Office CVJ.CH

US crypto exchange Coinbase has been warned by the Securities and Exchange Commission (SEC) about launching a product that pays customers interest on their crypto holdings through the use of DeFi protocols. According to the agency, this should be classified as a security. Coinbase intended to launch a yield product that would have gone live in a few weeks. As in traditional finance, users would receive interest on selected digital assets. After the company proactively reached out to the Securities and Exchange Commission (SEC), the SEC responded that such a product would be classified as an unregistered security. The SEC…

The month of August was as volatile as it was pivotal for cryptocurrencies like Bitcoin, Ethereum, Litecoin, and others. Mid-cap altcoins exploded in value, helping to keep more important cryptocurrencies like BTC and ETH afloat at local highs and above support. A fall into a bear market following one of the worst quarterly selloffs on record might have been narrowly prevented, and a reversal back into a bull market is still in the cards considering that a lower low was never put in on Bitcoin. The total cryptocurrency market has reentered the bull zone on the RSI, but the market…

A summarizing review of what has been happening at the crypto markets of the past week. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko. The last 7 days in cryptocurrency markets: Price Movements: Layer 1 tokens and the NFT space are dominating the recent altcoin bull run. Volume Dynamics: Despite Binance.US’s fundraising woes, the exchange has gained market share versus Coinbase. Order Book Liquidity: Price slippage fell sharply for ETH-USD pairs over the past year. Derivatives: Funding rates and open interest inched up during the first week of September. Macro…

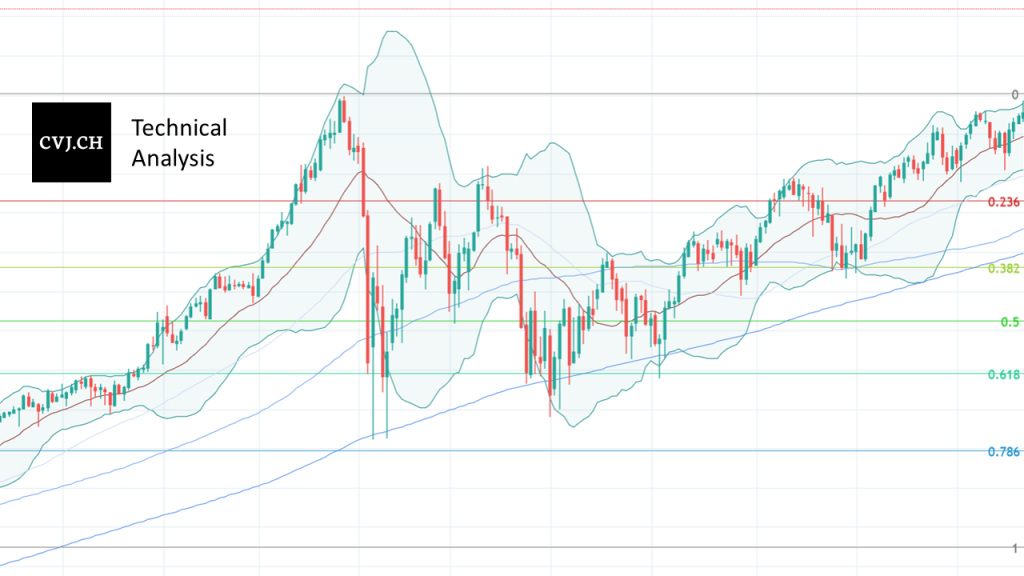

Bitcoin USD daily Basis Bitcoin USD Chart Analysis – Breaking the 50’000 mark The reporting week was initially characterized by a consolidation phase, which took place just below the significant resistance zone of USD 50’000. A similar picture emerged as in last week’s trading action. On Monday, two trading days that played out in narrow trading ranges just below the 50’000 mark were followed by a correction that led the price back to 47’000 USD. On Tuesday, however, there was no further selling pressure and so the closing price of USD 47’118 was already slightly higher than the previous day.…

Vast Bank is the first state-approved bank in the U.S. to offer the ability to buy, sell and store cryptocurrencies directly from a checking account. Following in the footsteps of big banks like JPMorgan & Co, retail banks are also venturing into the space. Customers of Vast Bank will be able to trade cryptocurrencies directly from an FDIC-insured payment account, according to an announcement. The previously unseen opportunity to buy, sell and hold digital assets within a retail bank has been approved by the Office of the Comptroller of the Curre (OCC) and discussed with the Federal Reserve, Forbes reported.…

With the EIP-1559 upgrade, miners no longer receive the full transaction fees from users – as a portion is burned. Since implementation, over $600 million worth of Ether (ETH) has been destroyed in this way. Investors are hoping this will lead to a deflationary future for Ethereum. The recent upgrade to the Ethereum blockchain included a number of features added to the network’s rulebook. The most long-awaited change was the EIP-1559 upgrade. Its implementation ensures that the network follows a different transaction pricing mechanism that introduces a base fee for each block found on the network. Essentially, the rest of…

The Crypto Valley is known to be one of the most “crypto-friendly” regions in the world. But what specifically is happening within the Blockchain ecosystem? The “Crypto Valley Roundup” aims to provide insight and highlights from selected events every two months. With the first Blockchain companies settling in the area of Zug from 2013 onwards, the term “Crypto Valley” was soon born in reference to the “Silicon Valley”. Thanks to politics and regulation, Switzerland was able to create the necessary legal certainty for a flourishing ecosystem around Blockchain and cryptocurrencies at an early stage. The local regulator has been active…

El Salvador is in for a turbulent few weeks. The country is preparing to become the first to introduce Bitcoin as legal tender on the 7th of September. Salvadorans have had no say in the tender so far, and protests accuse the government of corruption. El Salvador’s Bitcoin law is expected to take effect next week. President Nayib Bukele recently announced that the official wallet will be operational the same day, allowing users to exchange their Bitcoin for dollars and vice versa. Although Bukele wants to bring the benefits of the new asset class to the country, hundreds of protesters…

A summarizing review of what has been happening at the crypto markets of the past week. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko. The last 7 days in cryptocurrency markets: Price Movements: A discount has emerged on Korean and Japanese Bitcoin markets following an exchange hack and broader regulatory crackdown. Volume Dynamics: FTX’s spot market share is growing rapidly relative to its biggest competitors. Order Book Liquidity: Ethereum’s market depth recovered after falling to yearly lows during May’s sell-off. Macro Trends: Bitcoin’s correlation with Gold has been…

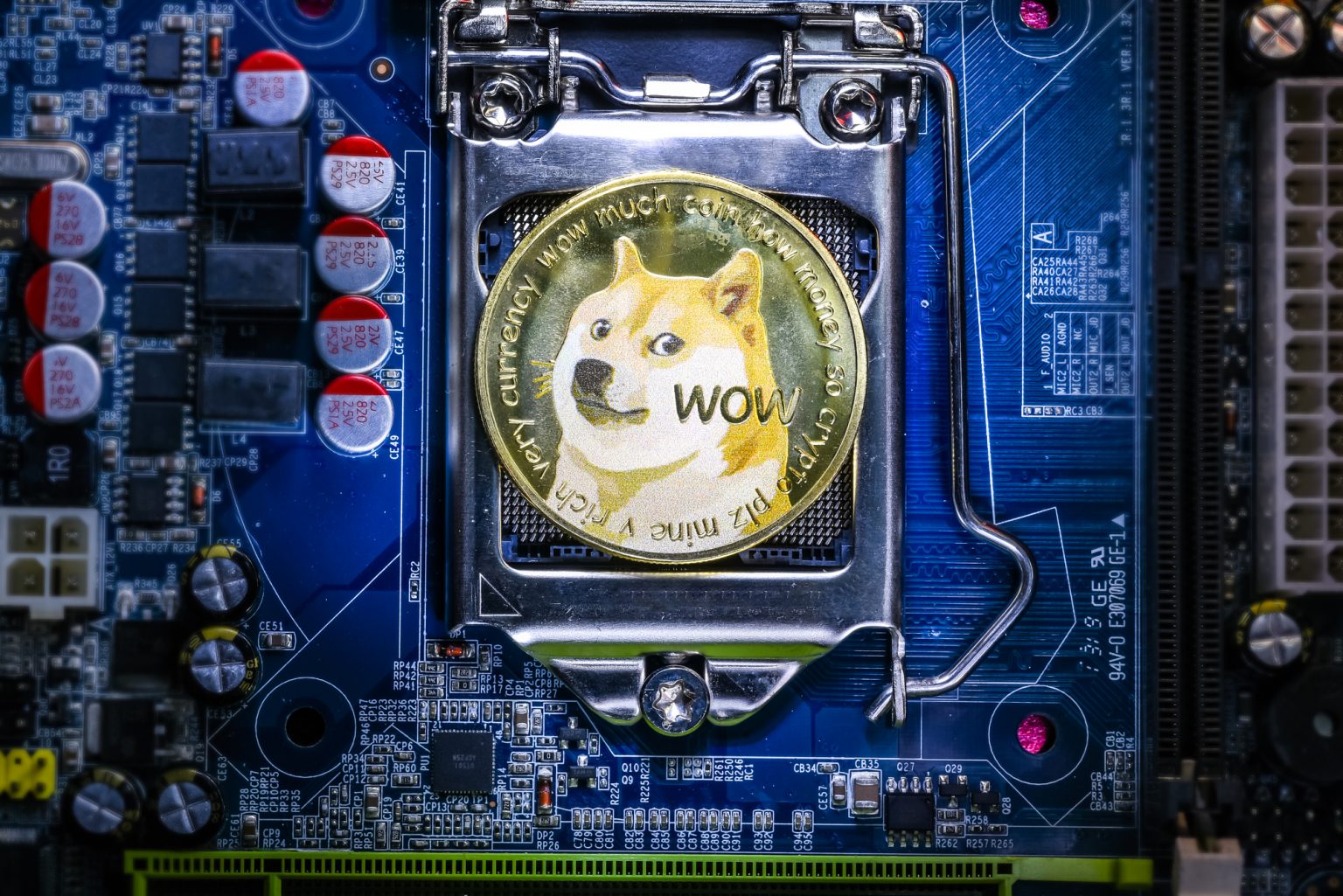

Originally conceived in December 2013 as a fun cryptocurrency and parody of Bitcoin as well as the fast-growing number of complementary currencies, the Shiba Inu-branded coin still holds its own in the top 10. This article takes a look at how Dogecoin came to be. $DOGE is the “fun and friendly internet currency,” referring to its origins as a joke. Dogecoin was created by Billy Markus, an IBM programmer, and Jackson Palmer, an Adobe programmer. The fun cryptocurrency was intended as a parody of Bitcoin. Initially designed to hold 100 billion coins, founder Jackson Palmer’s decision to remove the limit…

GameFi AG started the same way that everything else does, an idea. This idea grew from the collective consciousness of a small community of game enthusiasts. A dozen or so took the reins and began to manifest these ideas into reality. PIKA is the foundation of GameFi AG, a cryptocurrency that is running on the Ethereum network as an ERC-20 token. As PIKA developed, a core team was formed consisting of developers, marketers, designers, and intellectualists. This core team created the PIKA ecosystem, consisting of three tokens, interacting within a unique system of tokenomics and each also having individual utility.…

Eurex, the leading European derivatives exchange, announced the launch of Bitcoin ETN futures. The new contract offers clients access to the price of Bitcoin in a regulated on-exchange and centrally cleared environment. This offering will be the first regulated market in Bitcoin-related derivatives in Europe. Launch of the new contract by Deutsche Börse Group’s derivatives arm is planned for 13 September. The futures contract is based on the BTCetc Bitcoin Exchange Traded Crypto (ISIN: DE000A27Z304), which is listed on the Frankfurt Stock Exchange and has been among the most heavily traded ETF/ETN contracts on Xetra since its start in June…

Crypto Finance Group, InCore Bank, and Inacta are selecting Tezos to enable innovative, compliant on-chain digital financial products through a new token standard for asset tokenisation. Crypto Finance Group, InCore Bank, and Inacta announced they are selecting Tezos for innovative, compliant on-chain digital financial products. The companies have developed a new Tezos token standard for asset tokenisation based on the Tezos FA2 standard. Additionally, InCore Bank announced the launch of institutional-grade storage, staking, and trading services for Tez (XTZ), the native cryptocurrency of the Tezos blockchain. Tezos is an open source Proof of Stake blockchain network that offers security, reliability,…

A summarizing review of what has been happening at the crypto markets of the past week. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko. The last 7 days in cryptocurrency markets: Price Movements: Bitcoin broke $50k for first time since May, with altcoins leading the crypto-wide rally. Volume Dynamics: NFT’s and fan tokens are the latest crypto sectors to see surging volumes. Order Book Liquidity: The bid-ask spreads for Ethereum and Bitcoin markets are converging. Macro Trends: Bitcoin’s correlation with U.S. bonds turned negative for the first time…

Bitcoin Brokers in Switzerland can sell Bitcoin and send them directly to their customers’ non-custodial wallets without having to do extensive KYC on their customers. Until beginning of this year, the customer didn’t need to create an account or upload any documents if the total amount was below CHF 5’000 (~ USD 5’470) per transaction (or several transactions that appear to be linked to each other) and CHF 100’000 (~ USD 109’400) per year. If the customer is buying Bitcoin through a bank transfer, the name and address of the buyer are still visible to the broker, and the sending…