What is DeFi? How is it relevant to the crypto industry? The field of decentralized financial applications seemingly emerged out of nowhere. Now, a broad ecosystem of decentralized, transparent, and open source protocols has formed.

The following topics are covered in this knowledge article:

Table of Contents:

The decentralization of finance is ushering in a new era of democratization of finance and commerce. Although the DeFi sector is still in its infancy, its potential is immense. DeFi users have access to all kinds of opportunities that are difficult to access or only available to large financial institutions in the traditional financial system. Buying and selling cryptocurrencies, lending and borrowing, and even participating in market-making activities are all possible in this new world. In addition, the direct interaction of market participants creates a true, unadulterated yield curve for cryptocurrencies.

The free decentralized financial world is far from perfect; risks lurk in many places, and regulation is lagging behind this rapidly growing sector. Nevertheless, the best aspects of traditional finance (TradFi) and decentralized finance (DeFi) could create a modern and more fair financial infrastructure.

Automated protocols on the blockchain

DeFi applications are primarily found on smart contract-enabled blockchains. The most common DeFi projects are on the second largest public blockchain, Ethereum, and its alternatives. Currently, over $100 billion is invested in various DeFi applications across different blockchains and protocols.

Smart contracts make it easy to run applications on the platform. Smart contracts are computer programs that automatically perform the necessary actions to fulfill an agreement between multiple parties over the Internet. This is possible through the use of blockchain technology without a central authority, legal system, or external enforcement mechanism.

Because these decentralized applications (dApps) are peer-to-peer, financial services are available to the unbanked. No central authority can exclude others from the ecosystem, and the applications are as permanent as the blockchain itself. It also makes it easier to build on top of different financial applications. Protocols can use the services of other applications and integrate them into their own projects.

The broad DeFi ecosystem

The various use cases range from a simple swapping of assets on a decentralized exchange (e.g. swapping BTC for ETH) to complex investment strategies that mirror traditional financial instruments. The most common sectors can be summarized as follows:

- DEXes: Trading platforms in form of decentralized exchanges

- Borrowing/Lending: Fully collateralized lending protocols that use cryptocurrencies as collateral

- Dezentralized investments: investment platforms with services similar to financial institutions

- Tokenisation: Representation of traditional assets (Real World Assets, RWA) on the blockchain

- Staking: Supporting the security of blockchain networks

- Bridges: Connecting different blockchains

- Insurance: Liquidity pool based insurances

In the DeFi space, there are no minimums or complex contracts that require pre-approval. Because of the decentralized nature of DeFi applications, no one can be excluded from interacting with them. However, the end user takes on full responsibility.

Decentralized Exchanges (DEX) / Automated Market Makers (AMM)

In terms of volume, decentralized exchanges (DEXes) are the most widely used DeFi applications. Unlike centralized exchanges (CEXs), DEXs do not have an order book that determines the price of a token. Instead, liquidity pools can be created for each token, allowing anyone to contribute liquidity. When a user wants to buy a particular token or exchange one token for another, they access the appropriate liquidity pool.

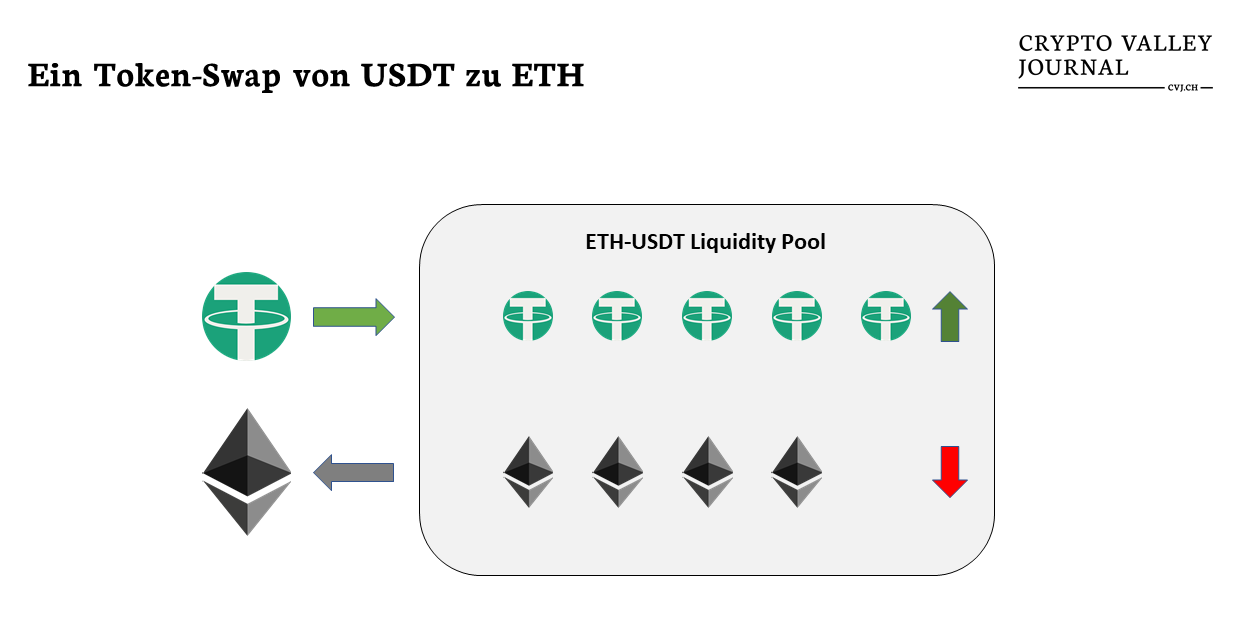

In the example, a DeFi user buys ETH with USDT. This action automatically adds Tether (USDT) to the liquidity pool while removing Ether (ETH) from it.

The transaction price is automatically adjusted by the protocol, without a third party, based on the token reserves in the liquidity pools. In addition, external oracles can verify token prices to ensure they reflect current market conditions. Liquidity Providers (LPs) are rewarded with a share of transaction fees. To decentralize decision making, most DEXes have governance tokens that allow users to vote on important aspects of the protocol, such as distributing additional incentives to specific liquidity pools or creating a reserve that accumulates a portion of all protocol fees.

INFO: DEX liquidity pools allow anyone to participate in trading volume by providing liquidity and earning fees, unlike traditional market making typically reserved for large institutions. Automated Market Maker (AMM) algorithms democratize market making. For example, any user can contribute USD and ETH to a liquidity pool and earn trading volume and fees, similar to traditionally contributing USD and Nvidia stock to Nasdaq pools and earning trading volume fees.

Credit Markets on the Blockchain

In addition to decentralized exchanges, lending and borrowing protocols are a significant part of the DeFi market. Depositors can deposit digital assets in a lending protocol and earn interest on those assets. Interest rates fluctuate based on market conditions and loan demand.

For example, if a protocol is low in USDC (a US dollar stablecoin) liquidity and many people want to borrow USDC, the interest rate for depositors will increase to incentivize deposits. Conversely, if the demand for credit is low and there is ample liquidity, the interest rate for depositors will be lower. For depositors, it’s a way to earn passive income, often with higher returns than traditional banks, reflecting the unadulterated supply and demand of the market – without the influence of a central bank dictating interest rates.

A general overview of the Aave DeFi protocol, as well as an interview with founder and CEO Stani Kulechov.

In DeFi lending protocols, anyone holding a digital asset such as Ether (ETH) can act as a borrower in need of liquidity in the form of a loan (e.g. stablecoins) without selling their tokens. Using DeFi protocols, it’s possible to deposit an asset and use it as collateral to secure a loan up to the value of the collateralized assets. If the value of the collateral falls below a certain threshold, the position is automatically liquidated and the loan is repaid using the deposited asset. All of this happens without centralized authority, fully automated through smart contracts.

INFO: Similar to DEXes, access to DeFi lending protocols is instantaneous for everyone. Both borrowers and lenders can deposit digital assets as collateral. Exclusively collateralized lending is efficient, processed in seconds, with 24/7 collateral monitoring and immediate liquidation in the event of a breach. Compared to traditional margin lending, the blockchain system offers greater flexibility and transparency.

Liquid staking democratizes access to yields

Blockchains use various consensus mechanisms; bitcoin’s proof-of-work (PoW) and Ethereum’s proof-of-stake (PoS) are among the most common. PoW requires solving complex mathematical puzzles through computationally intensive mining. PoS selects validators (“stakers”) who lock up a portion of their cryptocurrency to secure the network, so called staking. The more assets a validator stakes, the greater his chance of validating transactions.

However, PoS mechanisms pose decentralization challenges. A few validators with large stakes-such as centralized exchanges-can suddenly dominate a network without costly computation. In addition, Ethereum’s model imposes a high barrier to entry, with a minimum requirement of 32 ETH (over $100,000 USD).

Liquid staking derivatives (“LSDs”) aim to address these challenges by democratizing staking. Protocols like Lido create staking pools that are tokenized with a derivative cryptocurrency. Users can buy and sell liquid staking tokens on DEXes or redeem them directly from the staking contract, eliminating minimum requirements and broadening access to staking returns. The integration of these tokens into other DeFi protocols opens up new opportunities, as approximately one third of all staked ETH is involved in such protocols.

DeFi vs. traditional financial markets

The potential for a transparent, efficient and decentralized financial system – without intermediaries – is significant. Even the Federal Reserve Bank recognizes this potential, suggesting that DeFi could lead to a more open and transparent future. Decentralized systems have no single point of failure, which increases security. By replicating existing financial services openly and transparently, DeFi can eliminate intermediaries and their additional fees. In addition, smart contracts facilitate the easy integration of different financial applications.

Early adopters should be aware that they are, in a sense, beta testing and assuming risks typically managed by banks. Most DeFi implementations are limited to Ethereum’s ERC-20 tokens and rely heavily on price oracles and third-party protocols. Problems with smart contracts or oracle manipulation can have far-reaching consequences across multiple applications and end-users, as evidenced by past protocol attacks that resulted in significant losses.

Summary

- Dezentralized finance applications (DeFi) enable a new era of finance and trade through its democratization, where users have unrestricted access to financial services, previously reserved for established institutions.

- DeFi projects utilize smart contracts running on blockchains such as Ethereum and Solana to provide peer-to-peer financial services without central authority, thereby reaching people without access to traditional banking.

- Decentralized exchanges (DEXes) utilize liquidity pools instead of order books to automatically determine token prices. Liquidity providers are incentivized with fees, while governance tokens enable decentralized decision-making.

- In addition to decentralized exchanges, lending protocols dominate the DeFi market by offering interest to depositors and enabling borrowers to take loans using digital collateral without central authorities.

- Liquid staking democratizes access to staking returns through protocols like Lido that create pools that are converted into liquid staking tokens, eliminating high barriers to entry and making participation more accessible to a broader audience.

- Last bietet DeFi aims to be a transparent, efficient and decentralized financial system without intermediaries. But we are still in the early stages. Errors in smart contracts and dependence on price oracles pose new risks.