Non-fungible tokens (NFTs) are unique and cannot be replicated. As such, they are often used to digitally represent artwork on a Blockchain. The NFT market has been gaining momentum, especially in recent months, but there still exists much untapped potential.

The market saw amazing growth last year, and not just by expanding use cases. Buyers and sellers outbid each other, and many artists and distributors made big profits. At least that's according to the 140-page annual report published by NFT analytics firm NonFungible.com and foresight firm L'Atelier.

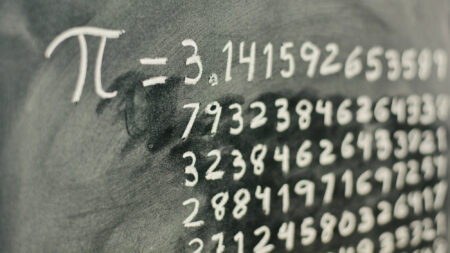

Taken into account are transactions of selected NFT tokens on the Ethereum Blockchain. These are heavily dependent on the Ethereum price, as this is what transaction fees are calculated from. The problem of high fees maybe could be solved with the controversial Ethereum Improvement Proposal 1559.

What is an NFT anyway?

Non-fungible tokens (NFTs) contain unique information recorded in their smart contracts. As such, they cannot be directly replaced by another token. They are unique because there are no two identical ones. With some exceptions, non-fungible assets are also not divisible. They are meant to exist and be traded as a whole. These unique tokens have effectively become the gold standard for assigning ownership on the Blockchain.

In contrast, Bitcoin is a fungible token. The value can change depending on how much time passes between Bitcoin exchanges. However, the quantity remains the same. One Bitcoin can be divided into 100 million Satoshi’s, as such tokens are divisible. But they can be easily exchanged like banknotes. As long as they have the same value, there is no difference for the owner. The origin does not matter either.

Digital Property

True ownership is one of the critical key components of NFTs and the digital economy. It is a means by which users can prove ownership of goods - whether physical or virtual - via the Blockchain. There is no doubt that uniquely identifiable tokens will play a central role in bringing the digital and physical worlds closer together.

Several paths are currently emerging in tokenization. Security tokens, for example, will digitize share certificates. They will only be traded on controlled exchanges and may not be exchanged without an intermediary. In a controlled area such as real estate, ownership and usage rights can be implemented autonomously and automatically.

Art and Collectibles

According to the annual report, the virtual art segment saw the strongest growth, accounting for 24% of the market. Revenue increased from $456'885 in 2019 to $12.9 million in 2020. Real artworks are fragmented into ownership shares. Their owners hope to get a share of the increase in value. They do not want to marvel at the actual work, nor do they want to own it on their own. However, they take advantage of the opportunity to share in the price gain.

The digital space is also experiencing a renaissance in virtual art. Diverse protocols allow artists and creators to easily create the tokens. They differ in their types and functions. In the beginning, they were flashing GIFs. Today, they are graphics or programmed artworks. Living art created to change with time.

The equivalent of the paper trading cards of yesteryear is becoming digitally controllable and quasi-interoperable. A bad series can be visibly scarce by the vendor. The unsold pieces are simply destroyed. This can be checked in the block explorer. Personalized tokens enable subscription models and loyalty programs. So the possibilities are very versatile.

Decentralized and unstoppable

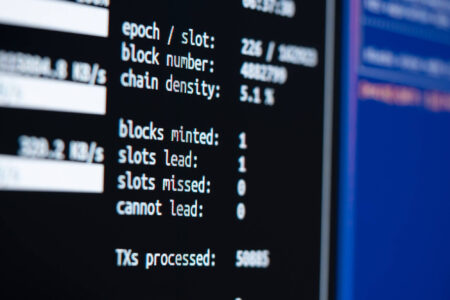

The NFT tokens themselves are as indestructible as the Blockchain on which they reside. Ownership is governed by the specific smart contract. Often, portions of NFTs' digital assets, metadata, and code are stored off-chain. At best, this information is injected into the perma-web, but remains exposed to some risk there as well.

Without their associated data and assets, such as digital graphics for an NFT-based artwork, NFTs themselves become functionally worthless to the end user. Operators, artists and owners minimize the risk of loss by operating their own decentralized infrastructure. In doing so, they not only secure their own works, but also contribute to the global security of the network. The distributed network of the future depends on such nodes.

Digital Worlds

The metaverse refers to parallel digital universes that provide users with a variety of unique experiences. The virtual worlds are accessible via a computer, virtual reality headset, or smartphone. A digital world where players can explore, interact with others, buy virtual properties, and even start their own businesses.

The content of these worlds is created and shaped by users. In both senses. The virtual items, clothes, and properties are created by an increasing number of creators. In the process of minting, the creator decides on the type and functions.

Currently, it is a collective mania shared by a growing number of crypto investors. When a buyer paid $1.5 million for nine virtual properties, another NFT record was broken. Digital real estate is now officially more expensive than the real thing.

Domain Names for the Decentralized Web

Unlike traditional web domains, decentralized domains are controlled only by the domain owner. They are (mostly) not subject to renewal fees or price increases. There is no central authority controlling the individual user's domain that could be abused by a third party.

The decentralized web does not rely on IP addresses to deliver content and log the relationship between server (content provider) and user (content request). The envisioned permaweb looks like the regular Web, but all of its content - from images to full Web apps - is permanent, quickly retrievable, and decentralized - forever. Just as the first web connected people over long distances, the permaweb connects people over extremely long periods of time.

Until now, access to Blockchain domains was only possible through an additional browser plugin. Cloudflare integration, which uses DNS over HTTPS, increases the accessibility of Blockchain domains. Browsers can now handle Blockchain domains the same way traditional domains are handled worldwide.