A monthly review of what's happening in the crypto markets. Enriched with institutional research on the most important topics in the industry. Written in cooperation with the Swiss digital asset specialist, 21Shares AG.

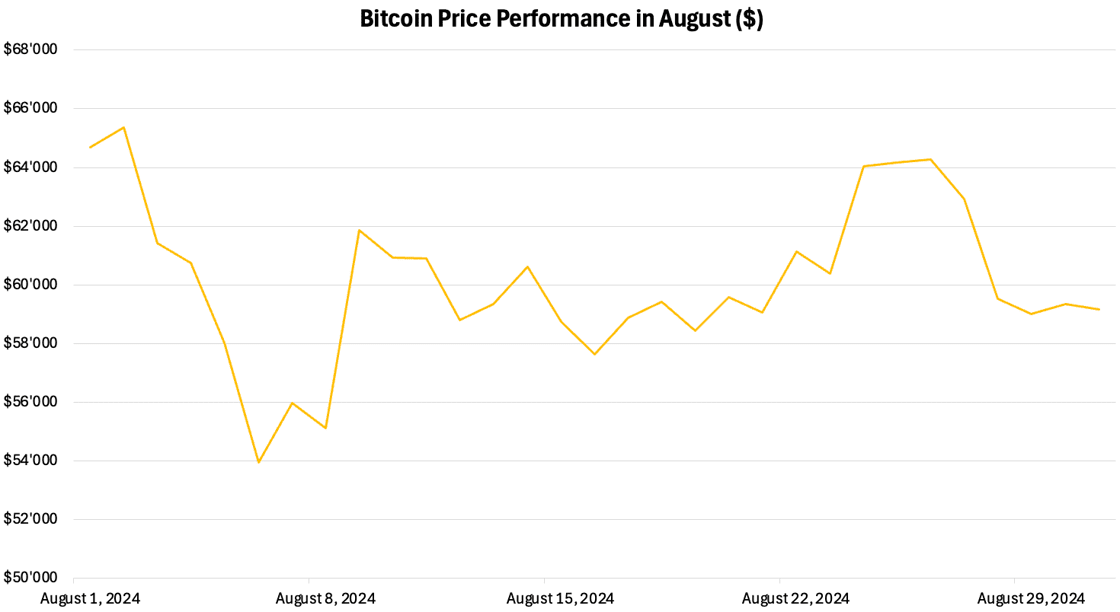

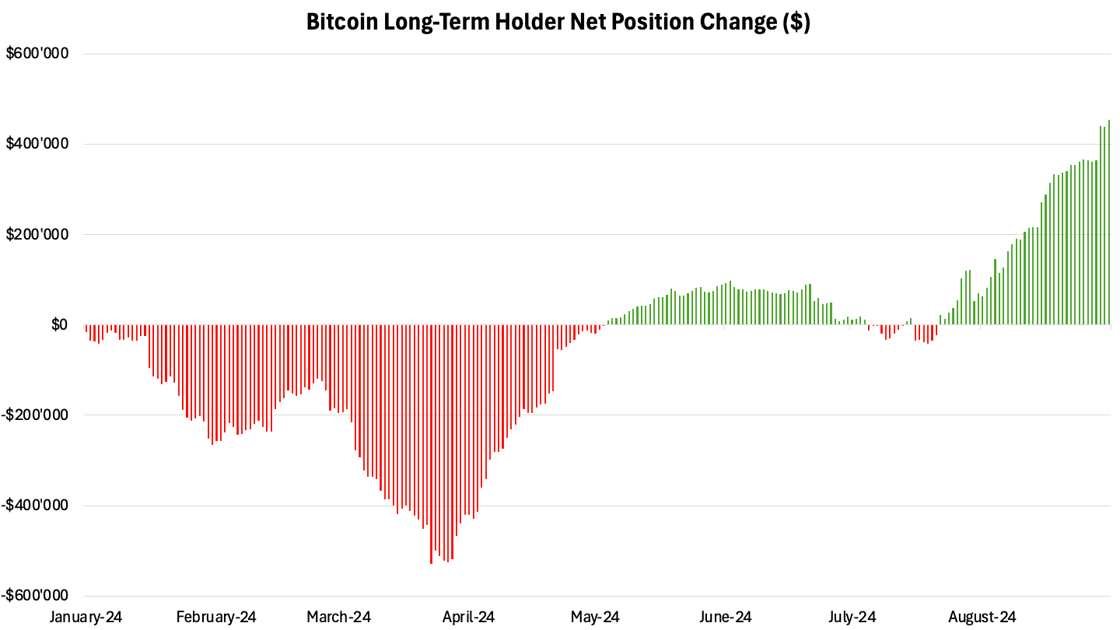

August was not a great month. Despite September rate cuts, we’ll probably see more positive flows in October. A rate cut generally bodes well for risk-on assets like crypto, although some factors may overshadow its impact. Bitcoin long-term investors accumulated over $8M in August, the biggest monthly change year-to-date.

Reminder of the Bitcoin Halving and its abnormal price pattern

Despite the headwinds, Bitcoin’s fundamentals are growing, offering new precedents for the network. Rhyming with historical price movements, August was a slow month for risk-on assets. Equities and cryptoassets took a hit during the first week of August, which exhibited turbulent market conditions instigated by the Japanese interest rates and exacerbated by geopolitical conflicts. Slow recovery followed as macroeconomic data came mostly in line with expectations, setting the stage for a potential rate cut in September.

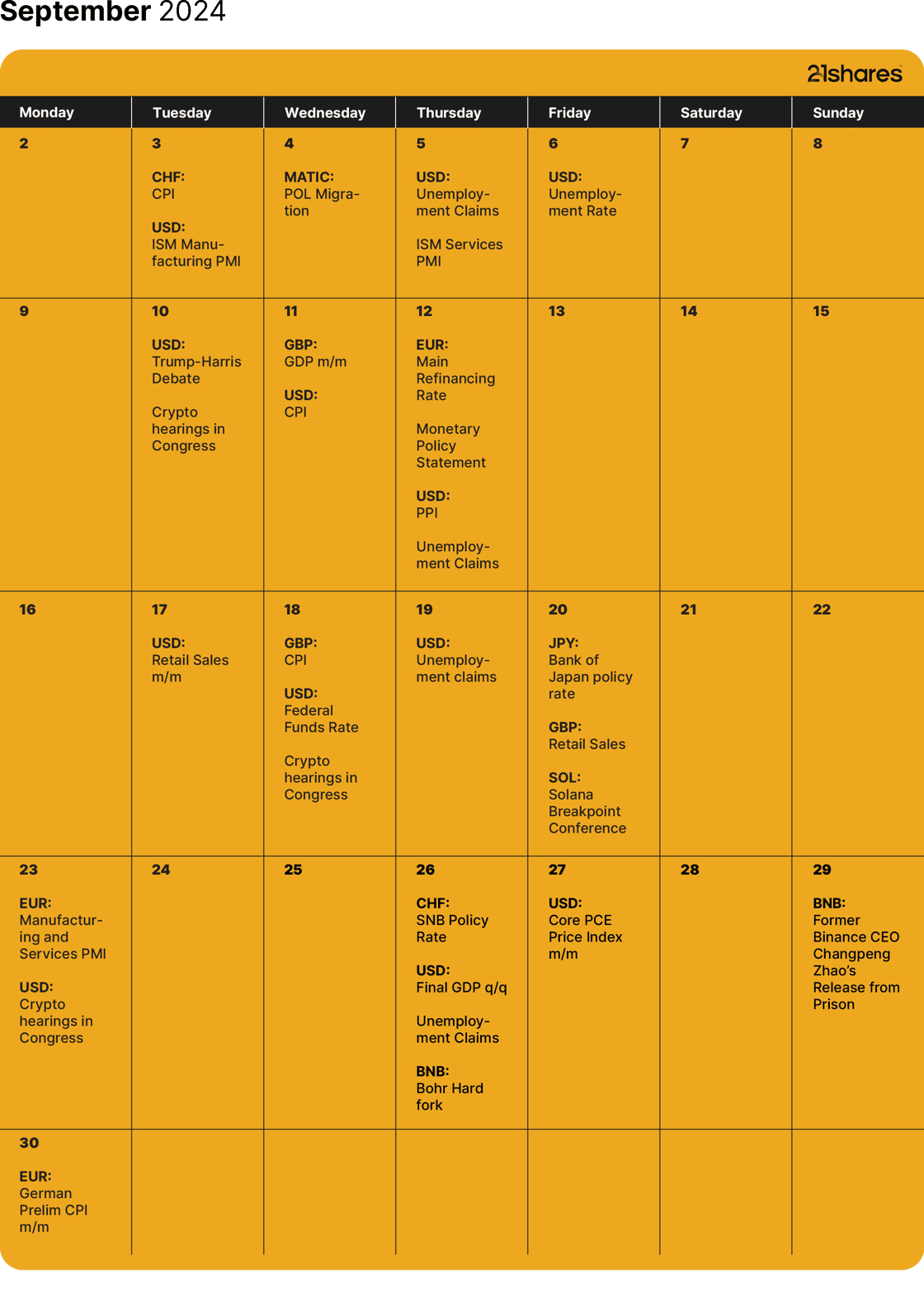

2024 is the year of the Bitcoin halving. Historically, Bitcoin has only had a positive performance in the fourth quarter of the halving year, as shown in Figure 1 below. This year is different, though, since Bitcoin’s price movement defied historical patterns and climbed to a new all-time high in March, thanks to the liquidity flowing into the new Bitcoin exchange-traded funds in the U.S. Therefore, Q4 this year is fueled with catalysts, with the hype around the presidential elections in the U.S. and the impending breakout of global liquidity.

The Fed’s Sentiment

In Jackson Hole, Fed Chair Jerome Powell said it’s time to cut rates, provided the incoming data maintains its current trajectory that inflation is headed in the right direction. The Fed’s favorite gauge for inflation, the Personal Consumption Expenditure (PCE), came in line with expectations, rising by 0.2% in July, indicating that while inflation is improving, it is not entirely out of the woods.

In the lead-up to the Federal Open Market Committee (FOMC) meeting on September 18, we still have some crucial data that would influence the Fed’s decision. With the ratio of vacancies to unemployment returning to its pre-pandemic range, Powell emphasized that they will no longer be seeking cooling labor market conditions. That said, the unemployment rate coming out on September 6 has to be 4.2% or less to shake off recession fears, which have undoubtedly dampened risk-on assets performance this month.

How do we expect crypto to react?

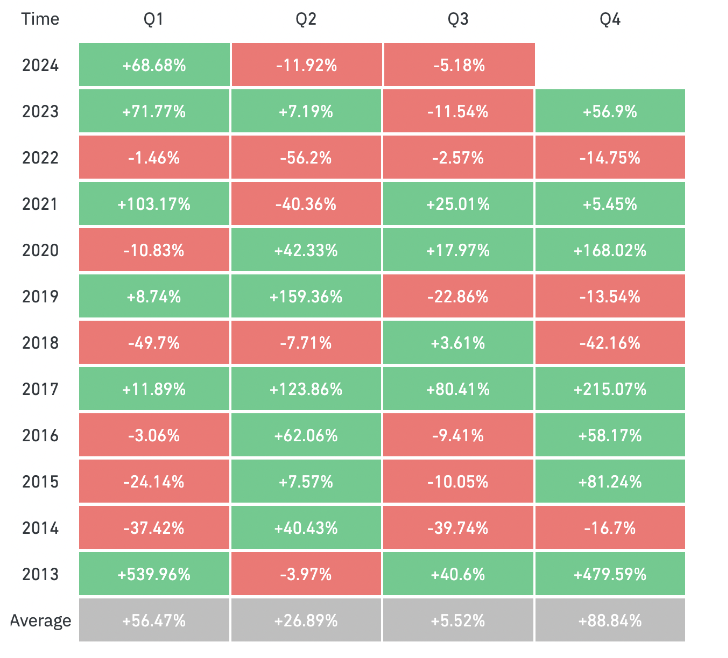

Generally, a rate cut bodes well for risk-on assets, which have historically enjoyed the expansion of the investor appetite as borrowing costs decrease. The last time the Federal Reserve cut rates to weather the pandemic repercussions was in March 2020, when they cut rates by 150 basis points (bps) to reach near-zero levels. The total crypto market cap increased by about 450% towards the end of the year, and Bitcoin’s price surged by 250% during the same period, as shown in Figure 2 below. While the Federal Reserve is anticipated to cut rates by only 25 basis points (bps) in September, the historical context can gauge crypto’s macro sensitivity.

Bitcoin’s Fundamental Prospects

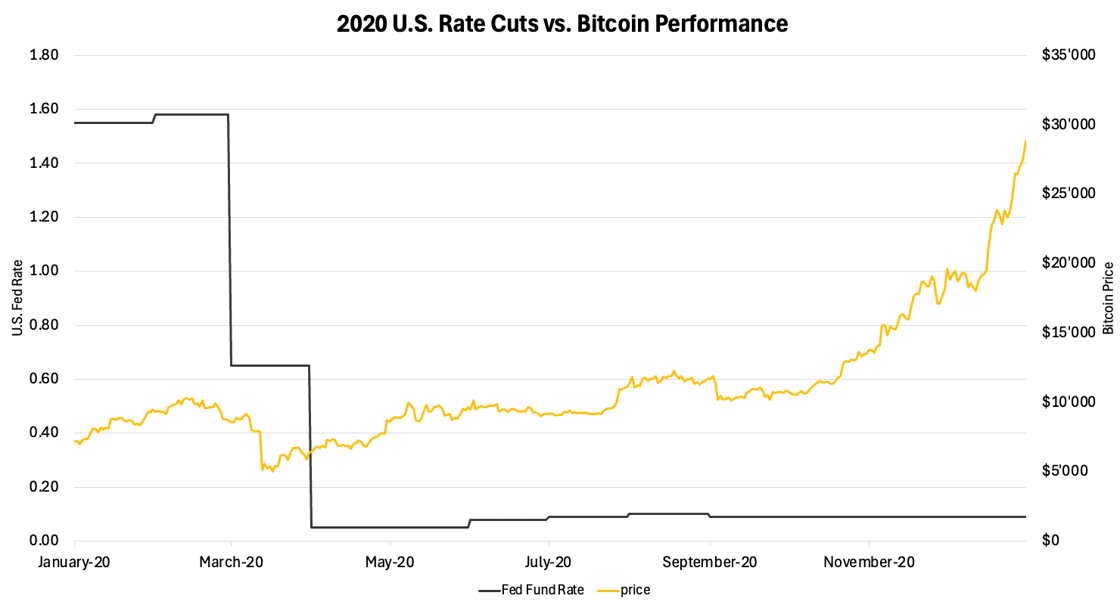

Bitcoin’s performance in August has been disappointing, dropping by over 9% and ending the month at around the $59K mark, as shown in Figure 3 below. This has been largely due to the aforementioned mixed macroeconomic data, which weighed down market sentiment as many investors grow concerned about a potential recession. As we look forward to the likely 25bps rate cut, the market eagerly awaits more data that could signal an improved outlook. However, while we wait, several fundamental developments in the Bitcoin ecosystem could drive momentum for the asset in the near term.

The network’s leading scalability solution, Stacks, is currently undergoing a significant upgrade, which started on August 28, dubbed ‘Nakamoto.’ The upgrade makes Bitcoin more scalable by anchoring Stacks’ transaction finality to Bitcoin, using a unique mechanism called “Proof of Transfer.” This allows Stacks to handle smart contracts and dApps on a separate layer, effectively increasing transaction throughput without congesting the main Bitcoin network. By settling transactions on the Stacks blockchain and periodically anchoring them to Bitcoin, Bitcoin’s functionality scales without compromising its security or decentralization. A key component of the Nakamoto upgrade is sBTC, a synthetic derivative with a decentralized, two-way peg mechanism with Bitcoin. This feature allows BTC to become a productive asset by being deployed in decentralized finance applications like BTC-based lending and borrowing, which is due to attract a host of new users.

The Babylon Chain unlocks Bitcoin’s DeFi potential in Proof-of-Stake systems

Another significant development is the launch of Babylon Chain, whose phase 1 mainnet went live on August 22. The vision for the highly anticipated protocol allows BTC holders to utilize their idle assets to secure Proof-of-Stake (PoS) systems like Ethereum. Over $9B worth of BTC is being utilized across DeFi in the shape of wrapped Ethereum-based tokens; this sets the stage for how Bitcoin-native liquidity solutions could boost the demand for the asset in the form of additional yield!

That said, a Babylon PoS chain will only receive security from the staked BTC in Phase 2 since the first phase merely prepares the BTC assets, which will participate in PoS consensus in subsequent phases. Hence, we might need to wait for the respective phases to be activated for this protocol to translate into real Bitcoin demand.

From Peer-to-Peer payments to smart contracts

The above developments are part of a broader trend in the Bitcoin ecosystem, transforming the oldest crypto network beyond its initial peer-to-peer (P2P) payment use case. Ongoing discussions around re-enabling OP_CAT present another exciting avenue for Bitcoin’s evolution. This would allow for more sophisticated smart contract functionality and multi-party transactions, expanding Bitcoin’s functionality beyond simple peer-to-peer transactions.

Nevertheless, this script was initially disabled due to security concerns, and it may introduce more attack surfaces, which must be managed not to compromise Bitcoin’s security and stability. Similarly, BitVM (short for “Bitcoin Virtual Machine”) proposes a way to achieve Turing-complete computation on Bitcoin, allowing for computational logic to be executed within Bitcoin’s framework. This means more complicated dApps can be built without altering Bitcoin’s core protocol! Bitcoin is becoming a more versatile asset within the on-chain ecosystem, and consequently, the demand for Bitcoin should grow. That said, the effects of these developments are likely to be visible over a longer period, and numerous potential risks must be carefully managed to maintain Bitcoin’s core principles.

Despite the recent sideways performance, long-term holders (HODLers) are showing increased confidence as shown in Figure 4 below. They have accumulated over $8M in BTC in August alone - the highest monthly change in their stance year-to-date. This is likely a result of the anticipated positive performance in Q4, driven by potentially easing macroeconomic pressures and the upcoming U.S. election, which historically catalyze risk assets. Additionally, the growing use cases for the asset are contributing to the increased adoption among long-term holders, who are a key indicator of Bitcoin demand.

Next Month’s Calendar