A monthly review of what's happening in the crypto markets enriched with institutional research on the most important topics in the industry in cooperation with the Swiss digital asset specialist, 21Shares AG.

Markets have tumbled in fear of a default crisis in the U.S.; President Joe Biden and top congressional Republican Kevin McCarthy are closing in on a deal raising the government's $31.4 trillion debt ceiling for two years while capping spending on most items. Regulatory headwinds pushed two of the world's largest market makers to withdraw from trading digital assets in the U.S.

Bitcoin activity rising

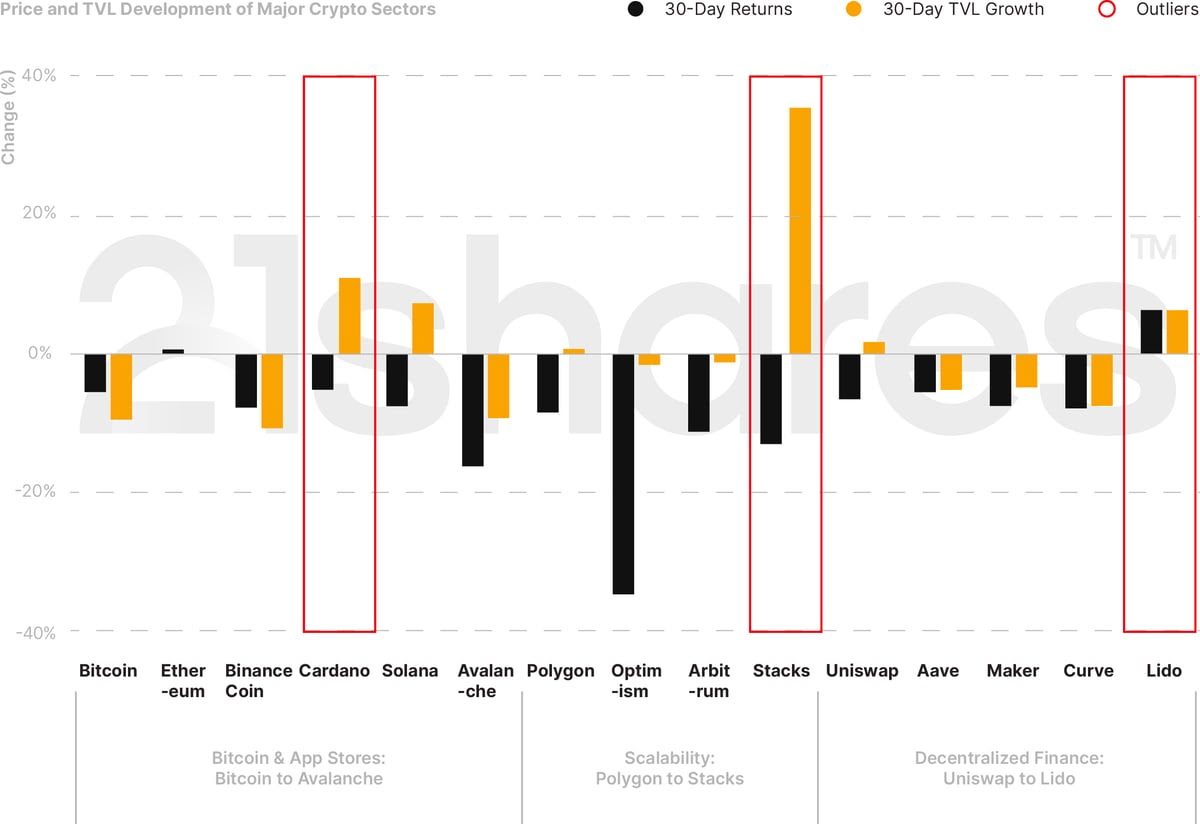

Falling by 5% over the past month, Bitcoin had its share of speculation around its network’s soaring transaction fees, signaling unprecedented congestion. On the upside, Lido was the biggest winner of this month, increasing by 6%. Ethereum’s upgrade unlocking staked ETH has revitalized investor confidence in the cryptoasset. It also boosted demand for protocols like Lido, which saw a 6% increase in net new assets; despite Celsius withdrawing $800M right after the liquidity event. Our dashboards show that Lido processed withdrawals flawlessly to avoid putting additional stress on the activation or exit queue using a buffer of ETH from deposits and rewards.

Spot and derivatives markets

On May 10, we saw over $100 million in liquidations after a pseudonymous source tweeted false information alleging that Bitcoin wallets controlled by the U.S. government were on the move. Most positions liquidated were long, as BTC dropped 5% from ~$28,200 to ~ $26,800 in less than an hour. The market's overreaction was entirely avoidable. We built a dashboard over two months ago that anyone can access to monitor the U.S. government-controlled wallets in real time and in fact, the assets remained in the wallets.

On-chain indicators

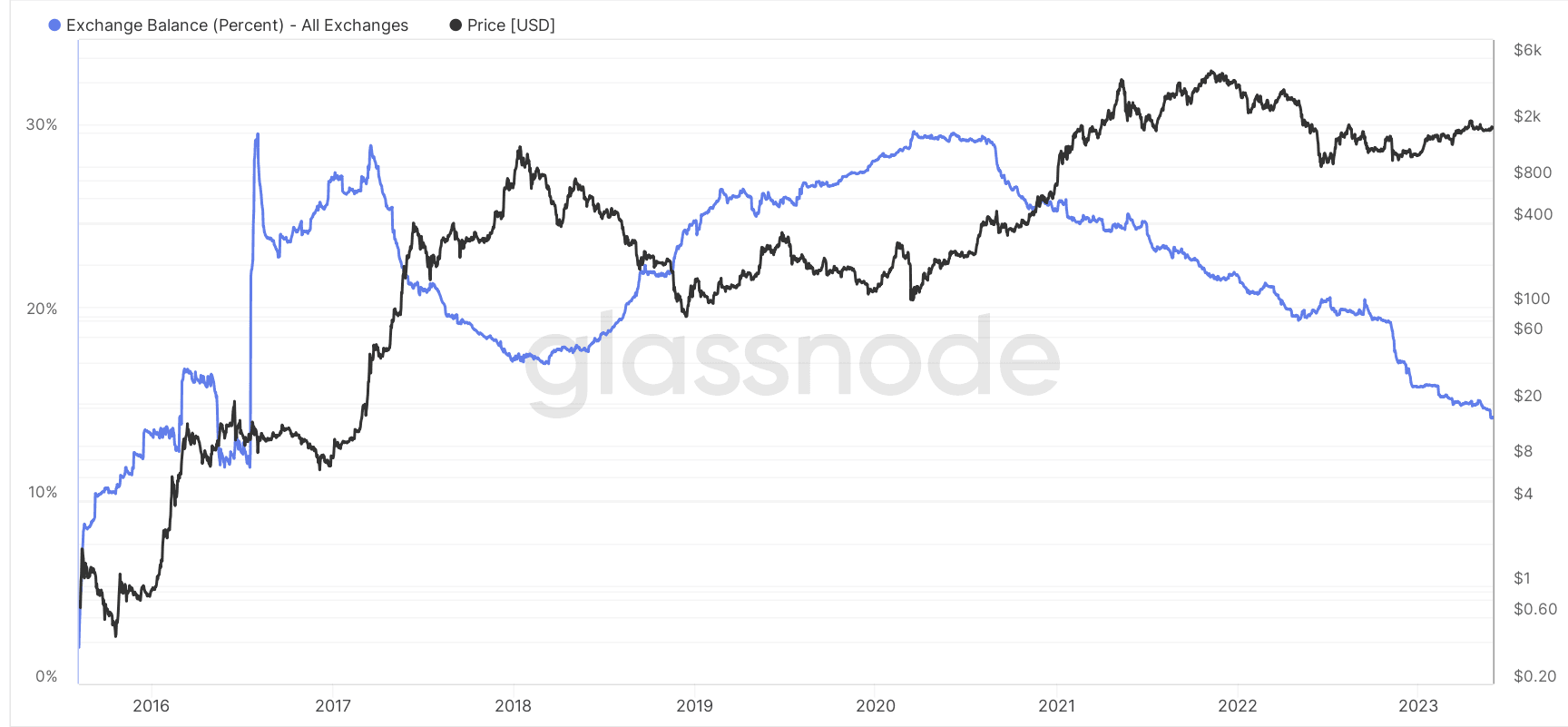

The amount of ETH held on centralized exchanges reached its lowest point in seven years, accounting for only 14% of the total circulating supply. This significant decrease can be traced back to November, when users swiftly withdrew their assets from crypto exchanges due to the collapse of FTX. The trend regained momentum in March, triggered by several banking failures resulting in a sense of distrust in the financial markets. As such, non-custodial staking solutions such as Lido and Rocketpool, benefited from the assets exodus from custodial exchanges.