A summarizing review of what has been happening at the crypto markets of the past week. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko.

Crypto markets closed the quarter on a positive note despite trade volumes remaining at historical lows. Last week MicroStrategy confirmed that it bought 12.3k BTC throughout Q2, Coinbase was named as the surveillance partner for Fidelity and other BTC spot ETFs after the U.S. SEC stated the recent wave of applications were "inadequate." This week, we explore:

- TUSD scrutiny amid Prime Trust troubles.

- BITO trade volume surge as U.S. ETF competition heats up.

TUSD scrutiny intensifies as Prime Trust struggles

Last week, Nevada's financial regulator filed to place crypto custodian Prime Trust into receivership, stating that the company has a shortfall of around $82mn and is unable to honor customers withdrawals. Prime Trust has ties to several crypto firms, the most significant being TrueUSD.

Prime Trust is apparently holding around $3mn in cash and $68mn in digital assets. However, only $7.5mn of its digital holdings is reportedly held in BTC while the rest ($61mn) is held in AUDIO, the token for decentralized music sharing platform Audius.

The token trades on a handful of centralized exchanges and its 1% market depth is only $400k while its average daily trade volumes hover around $4mn. Prime Trust's holding represents about 15 times the token's daily volume on CEXs. Thus, it is highly unlikely they would be able to liquidate a significant portion of their holdings without massive price impacts.

TrueUSD has acknowledged limited exposure to Prime Trust but faced a crisis of confidence after revelations that its current auditor, the Network Firm, is the rebranded FTX auditor. This resulted in significant selling on DEXes, with the proportion of TUSD in Curve's TUSD pool rising to 70% last week, suggesting that traders are swapping TUSD for other stablecoins. However, despite briefly falling to as low as ₮0.87 on Binance.US, the TUSD-USDT price remained relatively stable at around ₮ 0.999 throughout last week.

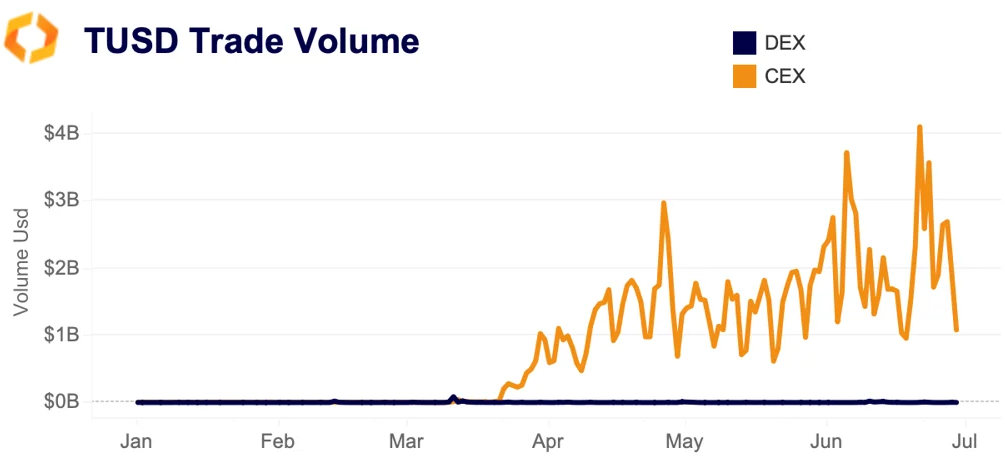

This is largely due to the fact that volumes are almost exclusively concentrated on one exchange, Binance, where all TUSD pairs benefit from various zero-fee trading promotions.

TUSD trade volumes on DEXs averaged just $2mn in Q2, compared to $2bn on Binance. TUSD's market cap has tripled in just four months, making it one of the fastest growing stablecoins in crypto.

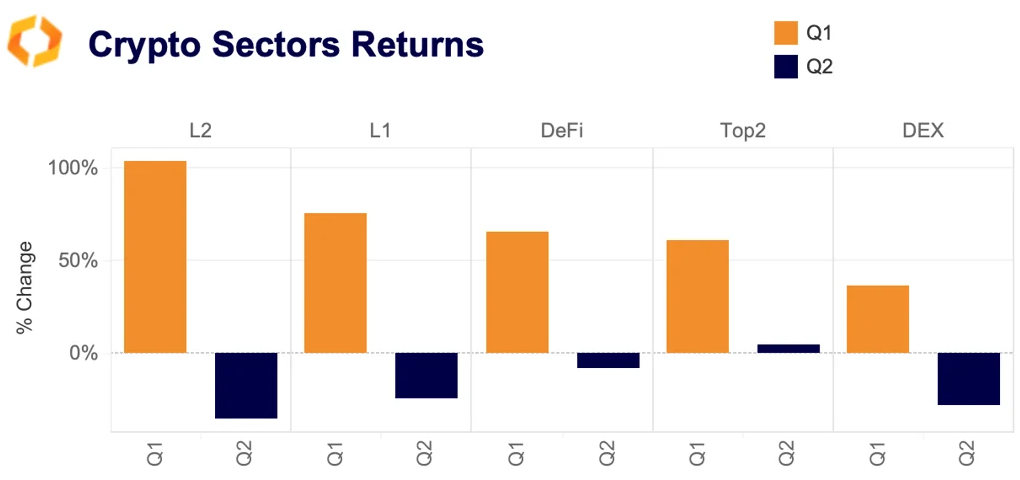

Layer 2s underperform in Q2

Layer 2 tokens were the worst performers in Q2 after registering the strongest returns in Q1. DeFi tokens closed the quarter down 8% but gained momentum in June, driven by MakerDAO’s MKR and Compound’s COMP tokens. COMP surged by over 50% last week amid increased whale buying on Binance. The Top 2 category (containing BTC and ETH) was the only one to close two consecutive quarters with positive growth, showing resilience to a tightening regulatory environment.

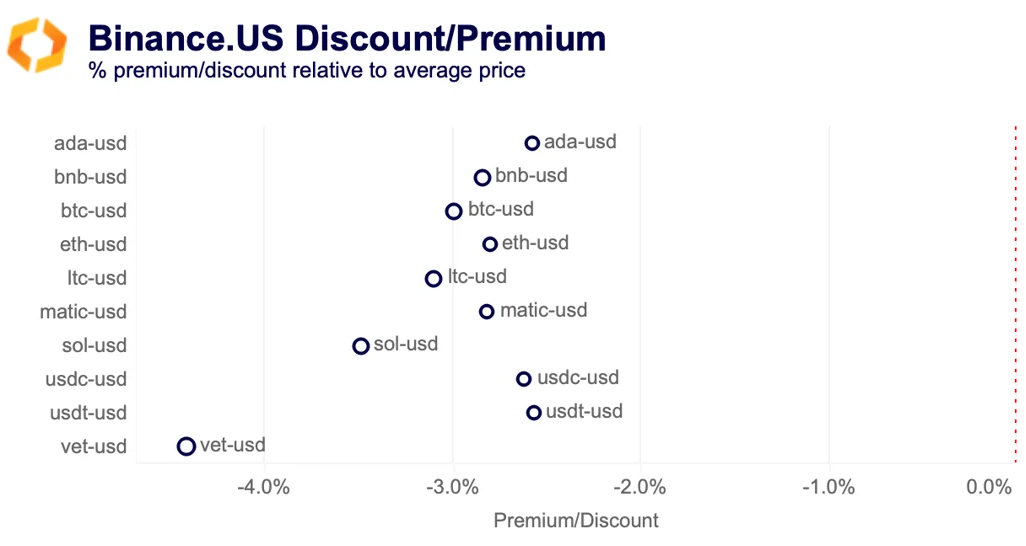

Crypto assets trade at a discount on Binance.US

BTC, ETH, and other crypto assets traded at a discount on Binance.US last week, ranging between 2% and 5% as the exodus from the exchange continues. While there were occasional discounts for specific pairs after the SEC lawsuit on June 5, these discounts became more prominent after Binance.US urged its users to either withdraw or convert their USD holdings into stablecoins on June 22.

In the wake of the SEC suit, Binance.US announced that it will transition to a crypto-only exchange, removing most of its USD-denominated trading pairs and suspending USD deposits. Currently, the exchange still lists ten USD-denominated pairs. However, liquidity has deteriorated significantly, resulting in average daily trading volumes plummeting from $450mn to $20mn.

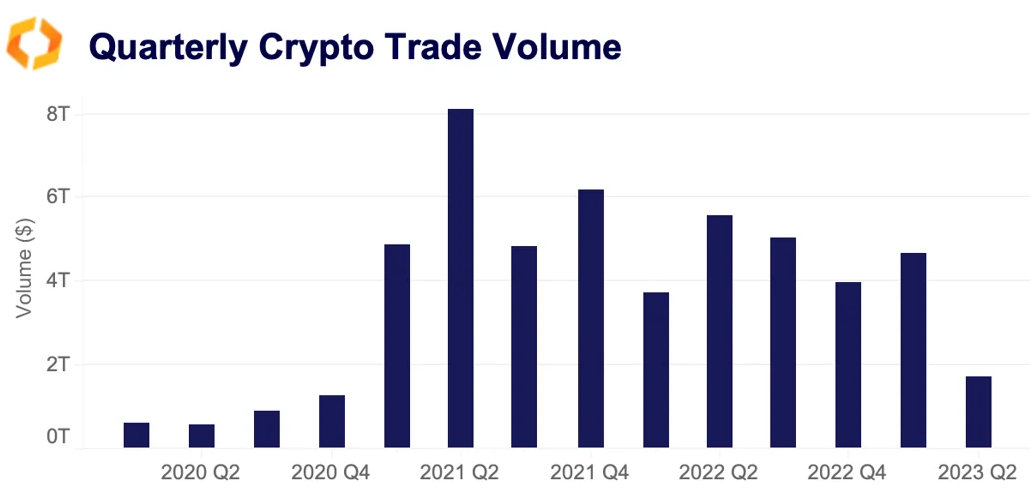

Quarterly trade volume falls to lowest level since 2020

Despite the ongoing June rally, spot trade volumes have declined significantly in Q2, falling to their lowest level since 2020. Binance registered the strongest drop in trading activity, with volumes collapsing by nearly 70% after the exchange reintroduced fees for its most liquid BTC pairs. However, trade volumes on Coinbase, Kraken, OKX, and Huobi also declined over 50% in Q2.

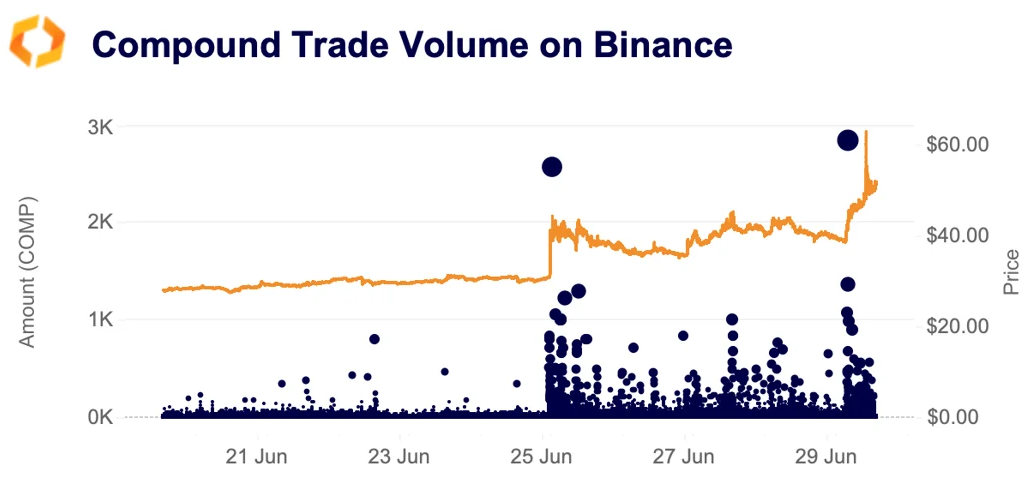

Compound surges more than 50% as large orders pile in

Decentralized finance protocol Compound’s token COMP has surged by nearly 60% since June 24 driven by whale buying on spot markets. The surge in market activity coincides with Compound’s founder creating a new company which aims to invest in short-term U.S. Treasuries while leveraging Ethereum for record-keeping. While Binance registered the strongest rise in volumes, Coinbase and Kraken also saw increased spot trading activity. COMP open interest aggregated on Binance and Bybit skyrocketed from $7mn to $70mn, hitting an ATH. However, funding rates turned sharply negative, falling as low as -0.75% on June 29 on Binance, indicating that traders are aggressively shorting the token.

BTC monthly option volume hits highest since March

BTC option trade volume surged by more than 40% in June to $22bn, hitting its highest level since March. The end of the month saw the largest open interest option expiry YTD with a max pain point of $26.5k. Large options expiries can lead to higher spot market volatility, with prices converging towards the max pain point. However, prices remained mostly range-bound throughout last week, with BTC closing the week above $30k.

Overall, demand for options increased in June, which was mainly driven by upside buying as call option volume accounted for 65% of total volumes.

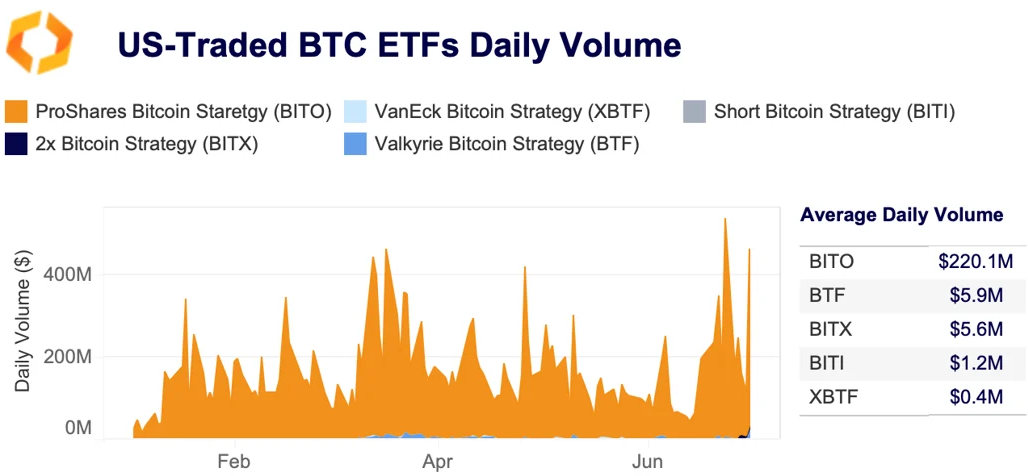

U.S. Bitcoin ETF markets heat up

The BlackRock spot BTC ETF filing boosted inflows into BTC future-backed ETFs with the largest US-traded ETF-Bitcoin Strategy (BITO) benefiting the most. BITO daily trade volumes exceeded $500mn at the end of June which has happened only four times since its launch in October 2021.

Competition on the U.S. ETF market has heated up with a rush of spot ETF filings from other high-profile asset managers among which Fidelity, Wisdom Tree, VanEck and Invesco. While the U.S. SEC has so far rejected over 30 applications for a spot ETF, it approved a 2x leveraged ETF last week.

The approval of a spot ETF would shake the crypto market, intensifying fee competition between ETFs. Most BTC ETF currently offer a relatively high expense ratio of between 0.95% and up to 1.95% for the more volatile BITX.

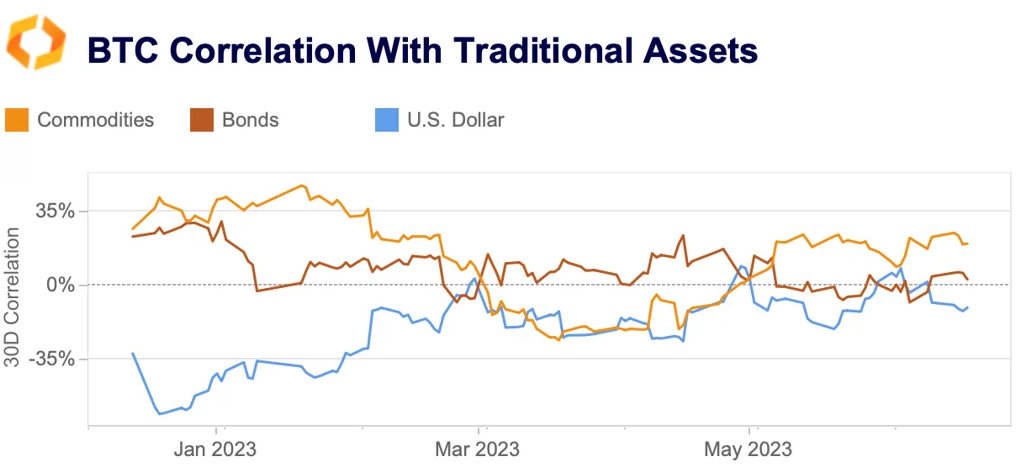

Bitcoin's correlation with traditional assets declines

BTC correlations with traditional assets have shifted significantly throughout this year as crypto-specific factors, notably the regulatory environment, increasingly driving prices. BTC's historical negative correlation with the USD has weakened significantly from -60% in the beginning of the year to just -10% in June. Its correlation with U.S.-investment grade bonds is hovering around zero, down from around 30% in early 2023. While BTC correlation with commodities has increased since March, it also remains low at around 20%.