A summarizing review of what has been happening at the crypto markets. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko.

In a surprising turnaround, the SEC approved the first spot ETH ETFs last week, triggering more than 25% in gains for the second largest crypto asset. The positive regulatory news came in abundance: the US House passed its first comprehensive crypto bill and the UK approved crypto exchange-traded products. This week we explore:

- The market impact of the ETH ETF approvals

- Rising trade volume for AI tokens

- Bitcoin's correlation with gold

Is ETH headed for a bull run?

Last week, the sentiment around ETH changed dramatically after the US Securities and Exchange Commission unexpectedly approved plans for spot ETH ETFs. The regulator approved 19b-4 filings from NYSE, Cboe, and Nasdaq on Thursday evening. The regulator will now review S-1 forms from issuers such as BlackRock, Fidelity, and VanEck. Trading in ETH ETFs won’t begin until these forms are approved, meaning it could be several weeks before they’ll officially launch.

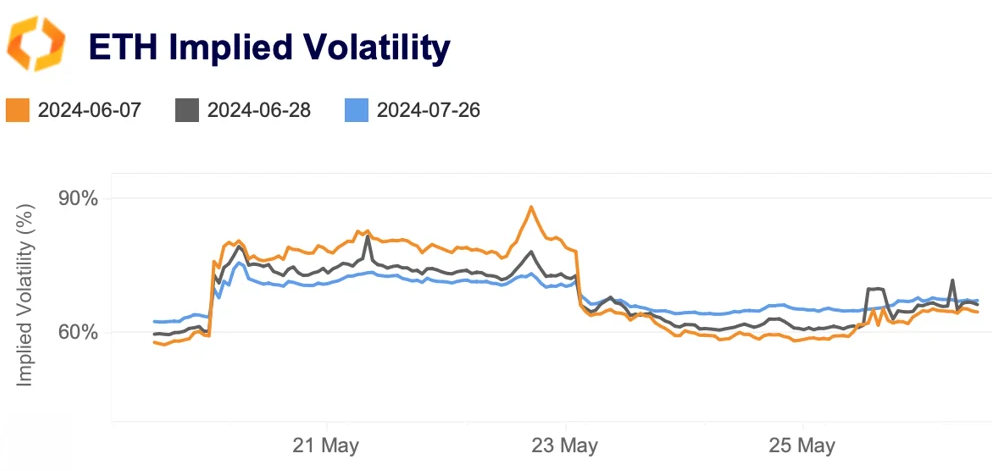

Signs that an approval was likely appeared on Monday after several exchanges amended their filings to exclude staking, and Bloomberg raised its approval odds from 25% to 75%. As we wrote in our latest analysis, an ETF approval had been gradually priced out over the past month amid growing uncertainty around ETH's regulatory status. ETH implied volatility for the nearest expiry surged from less than 60% on May 20 to nearly 90% on May 22, before retreating by the end of the week.

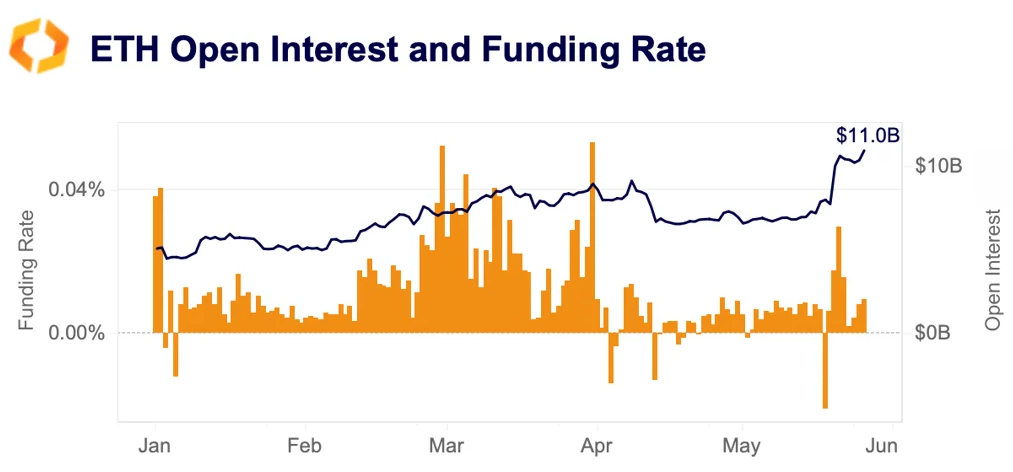

Additionally, the short-term implied volatility exceeded the longer-term gauges (commonly known as inverted volatility structure). This typically signals market stress, with a normal market structure for implied volatility seeing the longer-dated expiries with higher IV as more volatility should be expected over a longer timeframe. The sharp turnabout in ETH sentiment was also evident in derivatives markets. Within just three days, ETH perpetual futures funding rates (orange) surged from their lowest level in more than a year to a multi-month high.

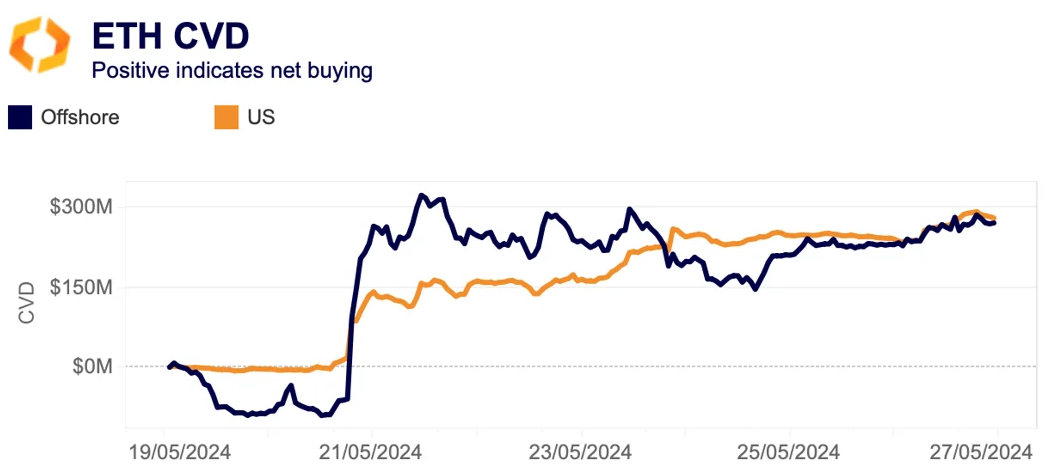

Open interest (blue) hit an all-time high of $11 billion, suggesting strong capital inflows into the space. The ETH to BTC ratio, which measures the two assets' relative performance, also surged from 0.044 to 0.055 despite remaining below February highs. Looking at ETH Cumulative Volume Delta (CVD), the rally was broad-based, with both US and offshore spot markets seeing strong net buying since May 21. Notably, until then, offshore exchanges were registering net selling.

So, will ETH finally catch up to BTC?

Once the ETH ETFs launch, it is reasonable to expect selling pressure on ETH from likely outflows or redemptions due to Grayscale's ETHE, which has been trading at a discount between 6% and 26% over the past three months. ETHE currently has over $11 billion in assets under management, which makes it by far the largest ETH investment vehicle. GBTC's outflows during the first month of trading for bitcoin ETFs amounted to $6.5 billion, which is roughly 23% of its AUM as of launch day.

Should we see a similar magnitude of outflows from ETHE, this would amount to $110 million of average daily outflows or 30% of ETH's average daily volume on Coinbase. However, by the end of January, GBTC's outflows were offset and surpassed by inflows from other BTC ETFs. The overall market impact of ETHE's redemptions is still uncertain, especially considering the lackluster launch of Hong Kong ETFs.

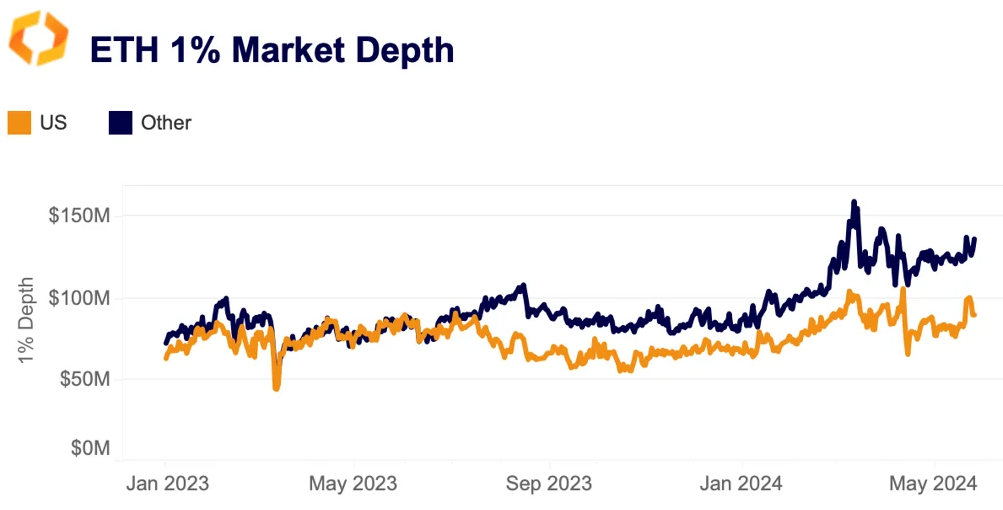

Adding to this, ETH's market depth on CEXs is about $226 million, still 42% below its pre-FTX average levels, and only 40% is concentrated on US exchanges compared to around 50% in early 2023.

Overall, even if inflows disappoint in the short term the approval has important implications for ETH as an asset, removing some of the regulatory uncertainty which has weighed on ETH’s performance over the past year.

AI tokens see mixed performance

AI-affiliated tokens experienced mixed performance last week, despite stronger than anticipated results from Nvidia Corp. (NVDA).Decentralized AI marketplace SingularityNET's AGIX and AI-focused crypto protocol Fetch.ai (FET) gained 11%. However, Akash Network (AKT) and Render (RNDR) saw lower returns, while NEAR ended the week down.

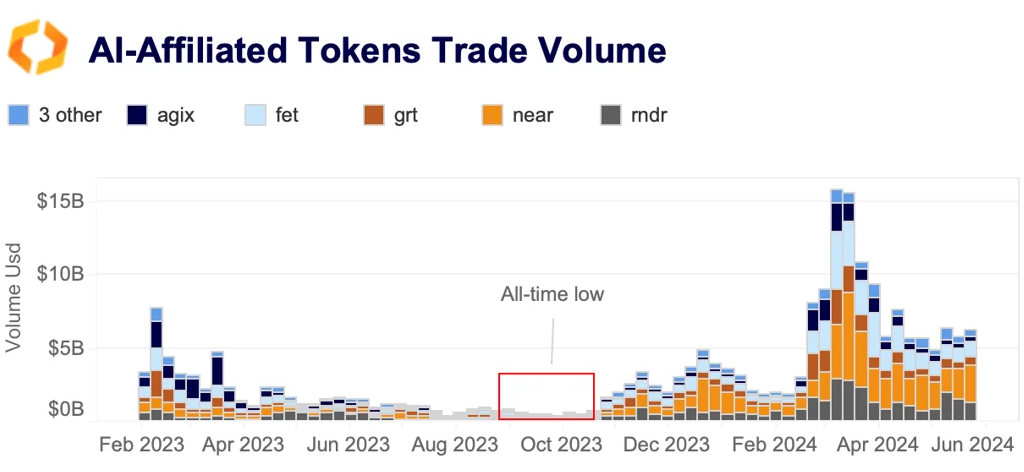

Overall, AI tokens remain among the best performers this year, rising between 60% and 250% year-to-date, and even outperforming Nvidia. Trade volume for these tokens has increased significantly, averaging $8 billion weekly since February, up from an all-time low of just $300 million in mid-2023.

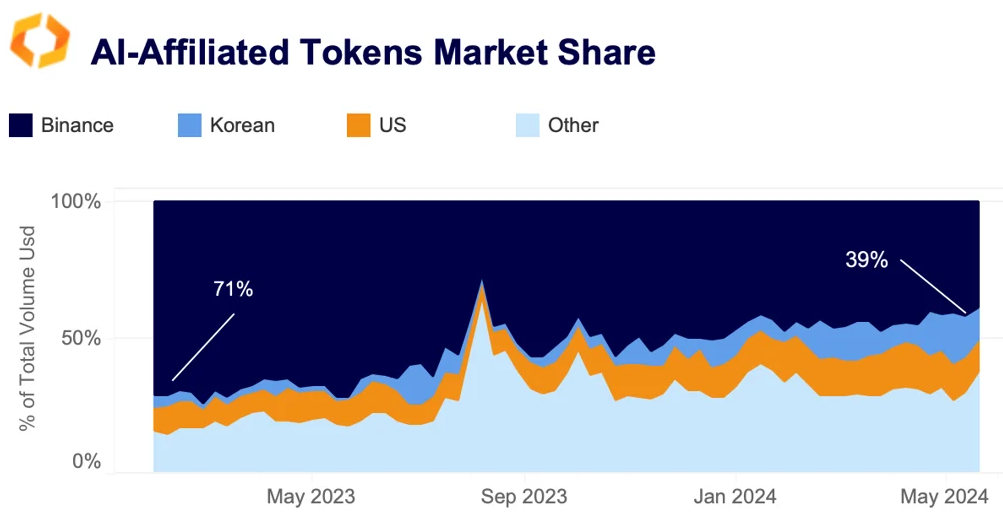

Interestingly, global AI trading volumes have been moving to regulated exchanges. While Binance remains the dominant exchange for other fast growing pockets of the market such as meme tokens, its AI token market share has declined from more than 70% a year ago to 39% as of last week. In contrast, Korean and US exchanges have gained traction.

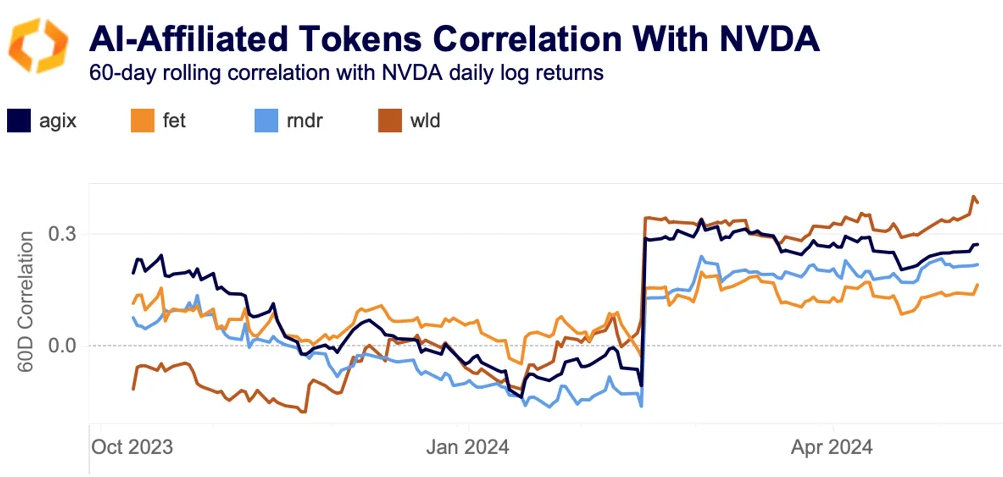

Even though the 60-day correlation between AI tokens and Nvidia surged to a multi-month high in February, it remains relatively low between 0.2-0.3.

Worldcoin (WLD), which is marketed as a global identity and financial network for an AI-driven world, had a higher correlation with NVDA than most AI tokens this year.

Leverage remains high for meme tokens

Last week we explored the state of crypto derivative markets which are the home of high-risk speculation and price discovery. Altcoins in particular are often exhibiting higher level of speculative activity. The open interest to market cap ratio can be seen as an indicator of leverage. A higher ratio indicates that the derivative market positioning for an asset is large compared to its market cap, making price discovery for these tokens more concentrated in perpetual futures markets. This year meme tokens and AI-affiliated coins have been leading the pack exhibiting higher leverage than Bitcoin and Ether.

FDUSD keeps its market share despite higher fees

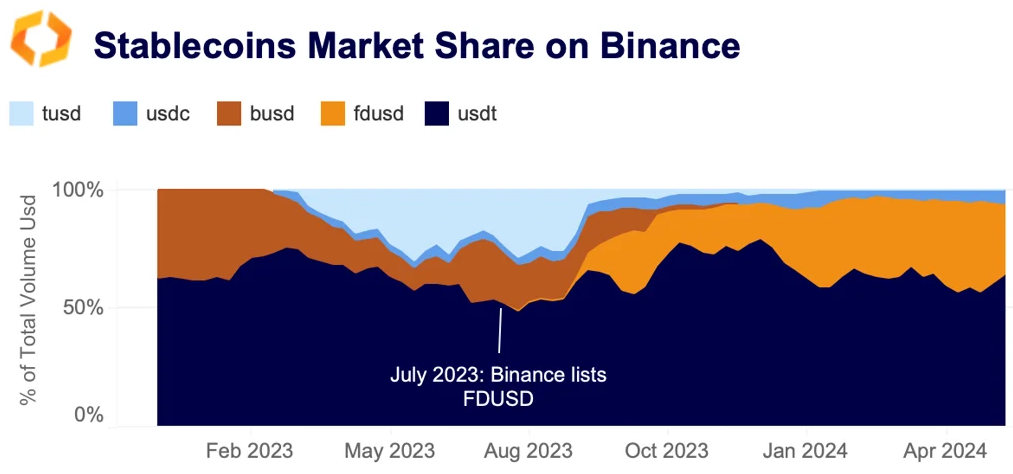

The stablecoin FDUSD has maintained its market share on Binance despite the exchange reintroducing taker fees for FDUSD trading pairs for its regular and VIP-1 users last month.

The average daily FDUSD volume amounted to $7 billion in 2024, which is seven times the combined volume of TUSD and USDC. One possible explanation for the lack of impact of the partial re-introduction of fees could be that most of the FDUSD trading pairs are mainly traded between large users (VIP 2-9) with a 30-day volume of $5 million to $4 billion, who have kept zero fees.

Hong Kong-regulated First Digital USD (FDUSD) was launched in June 2023 and started trading on Binance shortly after with zero maker and taker fees. Its market share skyrocketed, hitting as high as 45% in April 2024.

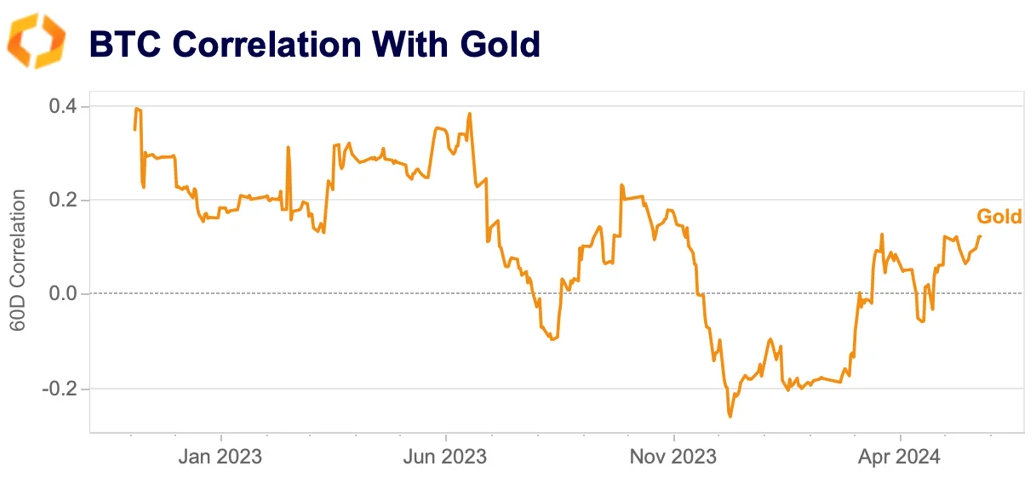

Bitcoin correlation with gold remains weak

Bitcoin's 60-day correlation with safe-haven gold has been increasing in April, nearing a yearly high as of last week. However, it remains significantly below its 2022 highs of nearly 50%.

Gold has rallied in recent months due to strong central bank demand, even as global gold ETFs have experienced outflows. Gold ETF holdings dropped to 3,079 tons in April, the lowest level since February 2020.

In contrast, Bitcoin has been primarily driven by ETF demand. Despite Bitcoin's market cap of $1.3tn remaining low compared to gold's $16tn, there is significant room for growth. This low correlation and potential for growth boost Bitcoin’s appeal as a portfolio diversifier.