Crypto derivatives are financial contracts based on underlying cryptocurrencies, which allow investors to speculate on price movements and manage risks in the crypto market. A detailed look at the market data reveals a number of trends.

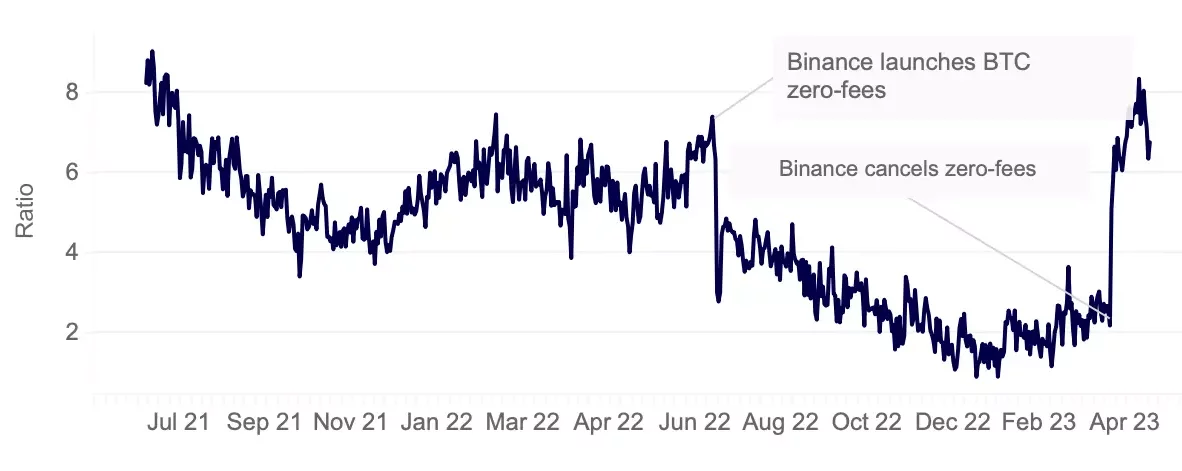

Price discovery in crypto markets has historically been correlated to volumes. The more volumes taking place on Binance for example, the more Binance is responsible for price discovery, obviously. Looking at the ratio of perpetual future volume to spot volume allows us to determine which market is gaining more relative to the other in its share of volumes, suggesting it is becoming more responsible for price discovery. That ratio is at its highest in nearly two years for Bitcoin markets, meaning derivatives have seen relatively more volumes as of late than spot markets. This suggests price discovery is shifting towards futures markets.

Interestingly, Binance introducing zero fee trading on BTC pairs had seen spot markets gain a larger share of volumes last year. However, the reintroduction of fees on most BTC pairs on Binance has seen spot volumes drop, while perpetual futures command more of the market: now over 6x the volumes on spot markets. With that in mind, derivatives markets should be a particularly strong indicator for Bitcoin’s price action in the short term, so let’s take a closer look at various metrics to gauge sentiment.

Bitcoin

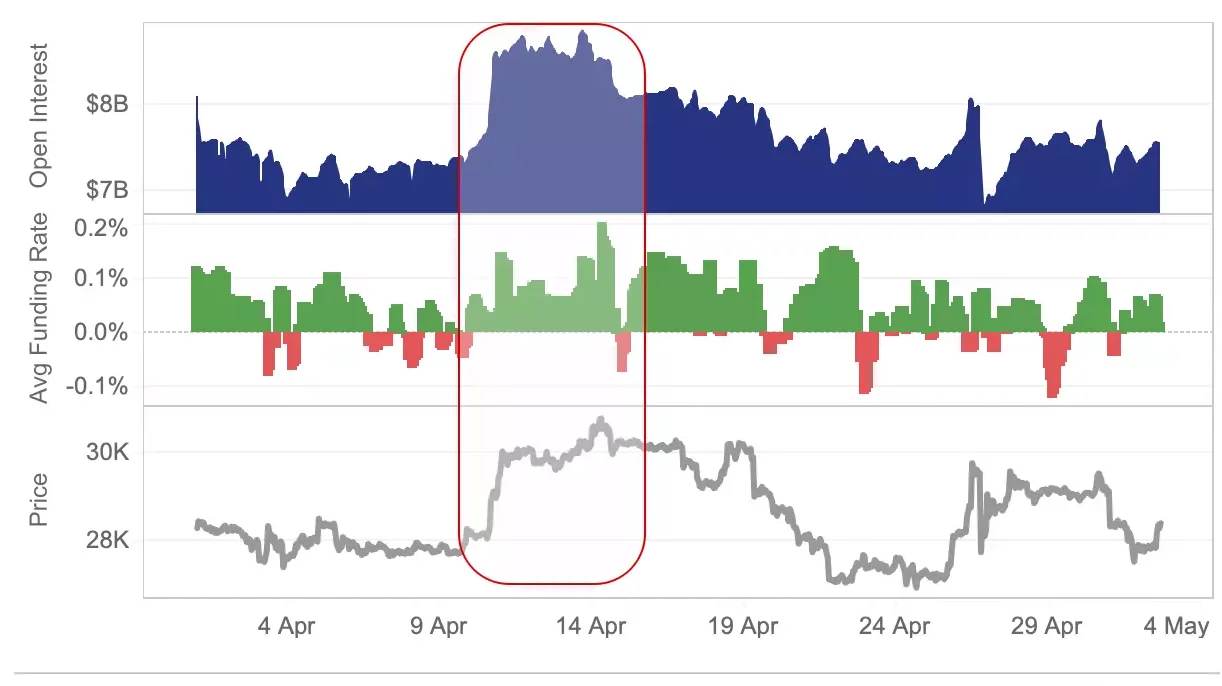

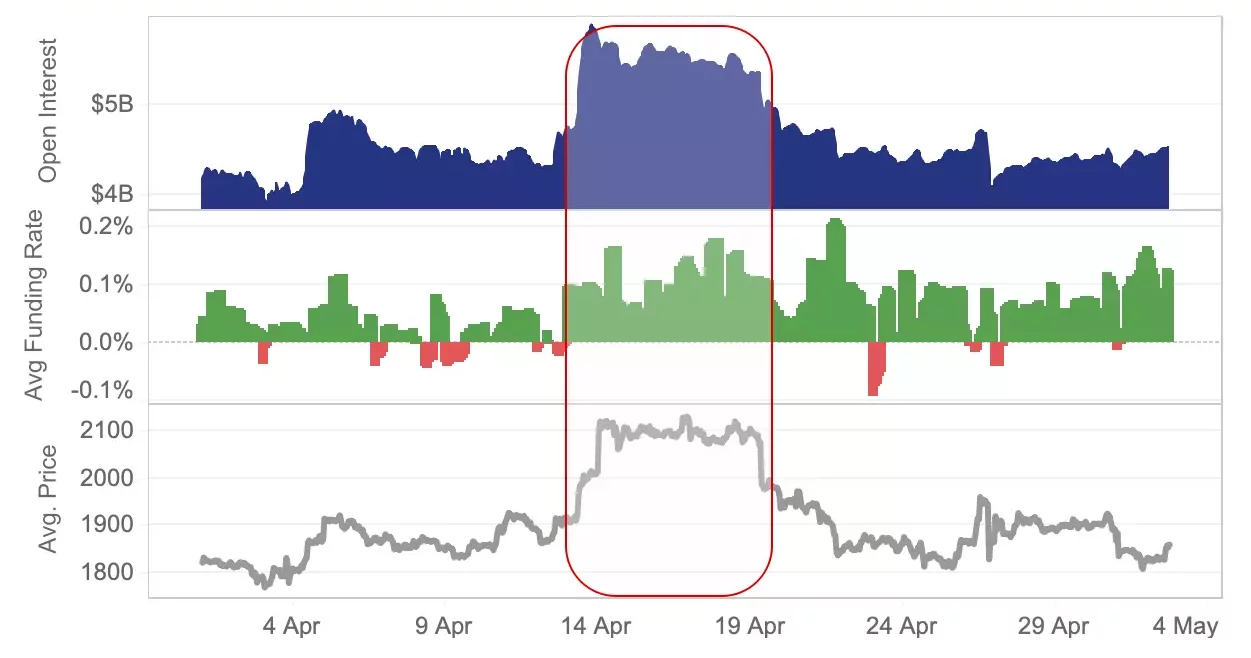

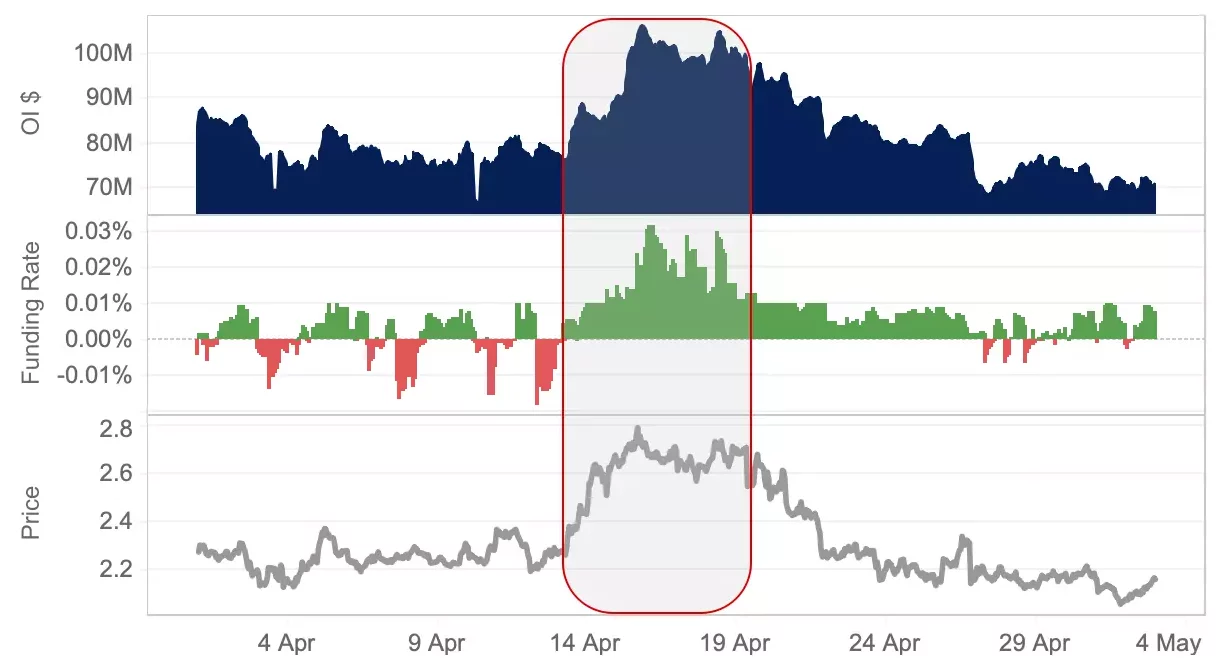

We can conclude that speculative long positions drove this rally and the positive price action seemed to top out as soon as funding rates flipped negative. This chart is a good example of how perps are driving BTC price action at the moment. As of today, open interest is relatively muted and there has been no persistent bias in funding rates, so there is no clear indication of short term price action just yet.

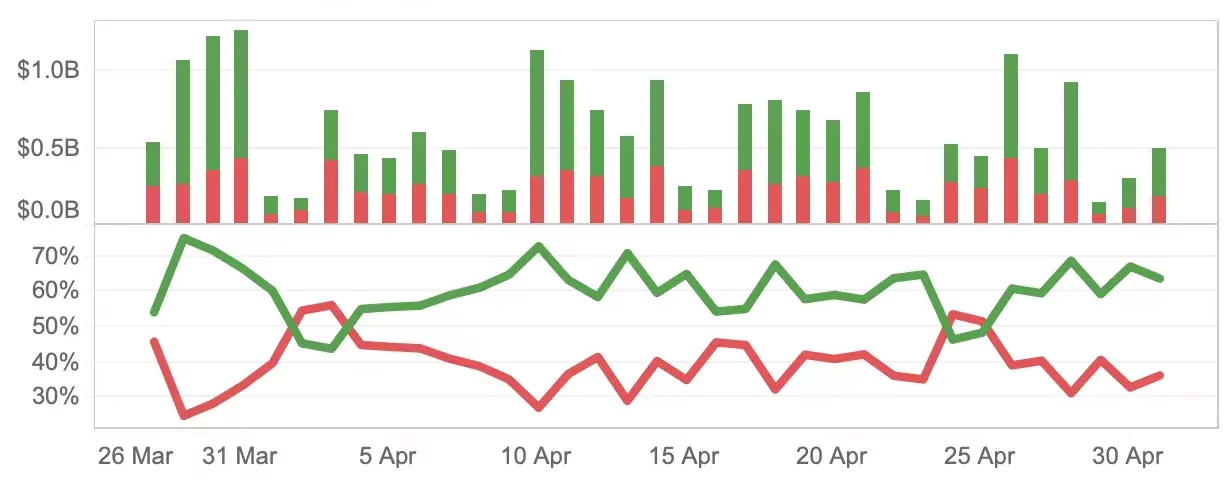

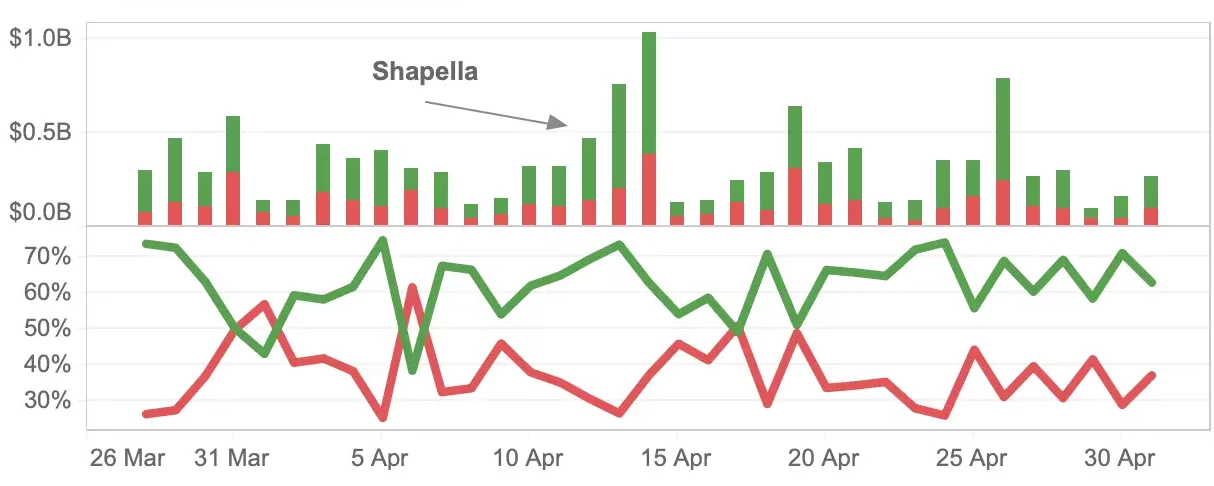

Options markets are another extremely useful gauge of sentiment, with calls being bullish indicators and puts being bearish bets. Keeping track of not only general volume increases in option markets but also the split between calls and puts offers us another insight into investor sentiment. We can see that every spike during the month of April were predominantly calls, often reaching up to 70% of volumes. As of today, that share is around 60%, suggesting continued bullish sentiment among option investors.

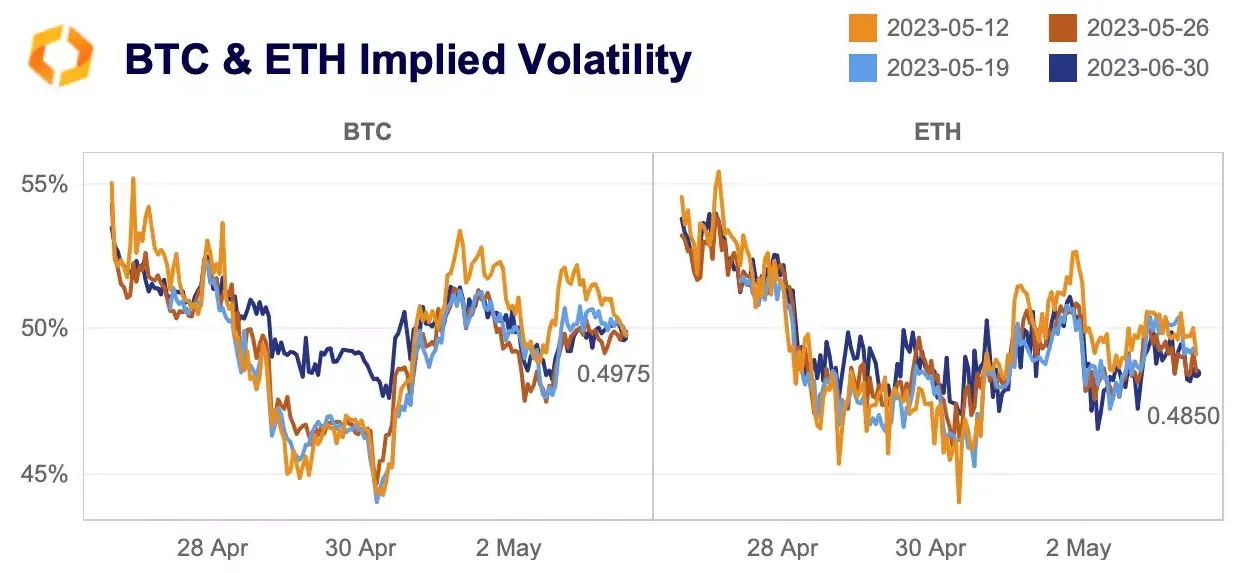

Volatility is one of the inputs that make an options price, and as such can be derived from the other inputs, such as strike price and time to expiry, to give us a measure of implied volatility i.e the amount of volatility that is priced into an options price. This allows us to arrive at implied volatility (IV), a forward looking measure of volatility that offers us an insight into the volatility expected by option prices.

As of today, and for the last week, Bitcoin’s IV is actually higher than ETH’s IV for most expiries, suggesting option investors are expecting relatively more volatility for BTC. This is not the usual structure for IV, normally ETH has consistently higher IV as BTC is seen as the safer asset.

Speculating as to why this might be the case, perhaps the possibility of more bank failures on the horizon has investors expecting BTC’s price to react more than ETH’s. Another explanation could be that with Shapella in its rear view, perhaps ETH has entered a new era following its big upgrades and its volatility may be on par with BTC’s moving forward. With that in mind, let’s take a closer look at ETH derivative markets.

Ethereum

Unlike BTC futures, ETH didn’t have a buildup of open interest on the 10th of April, rather the big buildup for ETH was on the 13th, one day after the successful completion of Shapella. The buildup was huge, touching a near $2bn increase, while funding stayed positive until the 24th of April.

Interestingly, the price rally for ETH was a couple of days later than BTC, which again should show us how driven these prices are now by derivatives markets. As of today, funding rates are more positive for ETH than for BTC, but open interest remains muted for now. ETH option market volumes really picked up pre- and post-Shapella, and a successful update saw call bets commanding over 70% of volumes in the days after.

Altcoins

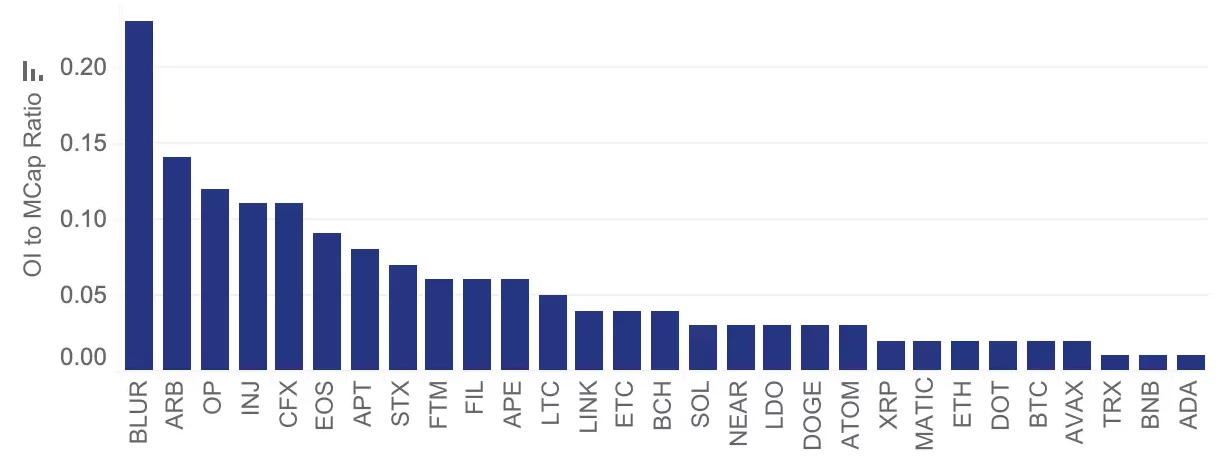

Altcoins are particularly interesting from a derivatives point of view as positions taken up in futures can be rather large compared to that altcoin’s market cap. This makes price discovery for these tokens even more concentrated in futures markets. Using an open interest to market cap ratio allows us to highlight those tokens with outsized perpetual futures positions open relative to its market cap, indicated by a higher ratio.

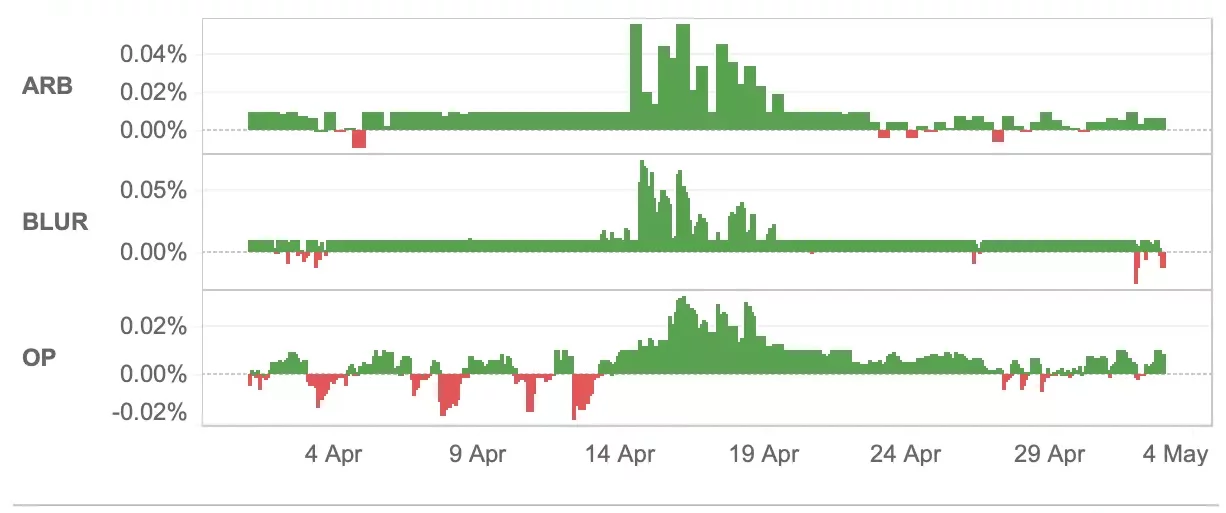

We can see the highest ratios belong to NFT marketplace BLUR, and Layer 2’s ARB and OP, suggesting perpetual futures are having an outsized influence on their token prices. Looking at funding rates, all three tokens benefitted from speculative long positions with persistently positive rates, similar to the run up we saw for ETH. However, there doesn’t seem to be any major bias as of today, with the exception of BLUR whose rates remain negative.

Taking OP as an example, we see very similar action in perpetuals and price movements as we saw with ETH, a buildup of open interest from longs which drove price higher after a successful Shapella update.

Exchange landscape

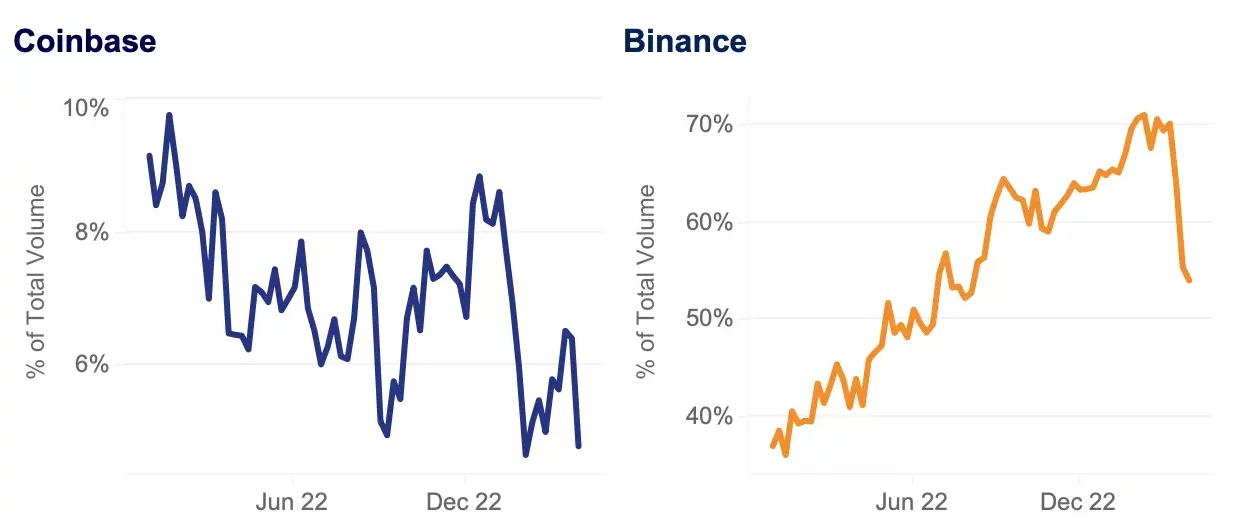

This week, Coinbase launched an offshore derivatives exchange, based in Bermuda. This move makes a lot of sense, particularly when looking at Coinbase’s share of total spot volumes. Since the start of 2022, Coinbase’s share of volumes has almost halved, falling from 10% to 5% while Binance gained as much as 30% market share over the same time period, before losing some in the last couple of weeks with their reintroduction of fees.

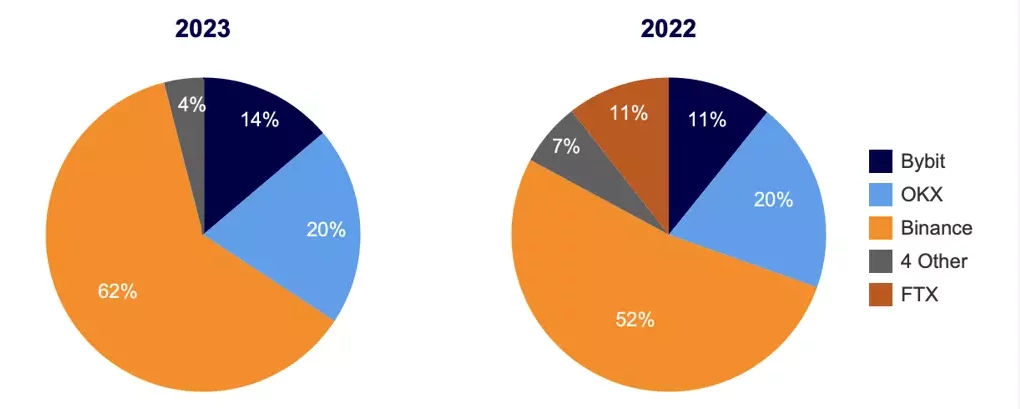

As with most U.S crypto exchanges, Coinbase has been the target of significant attention from the SEC, threatening their growth prospects. Overseas exchanges, on the other hand, are facing a lot less regulatory uncertainty, making them more competitive against their U.S counterparts. Binance benefitted the most from FTX’s collapse in terms of derivatives market share, gaining virtually all of the 11% share FTX had, with Binance rising from 52% share of volumes in 2022 to 62% in 2023.

Gemini also looks to be entering the race for perpetual futures market share, announcing they were making the same move as Coinbase in an effort to become more competitive. With Coinbase and Gemini entering the market, it is very possible they can command significant market share in the space, particularly with less regulatory concerns to worry about offshore.

Final considerations

With perpetual futures increasingly commanding more share of volumes than spot, investors should pay close attention to the shifts in sentiment among derivatives investors for an insight into short term price action. One thing we didn’t see in April was a big buildup of short positions, which usually sets up nicely for a short squeeze on any positive news. Instead, we saw a buildup of longs after both banking failures and a successful ETH update. Exchanges are aware of the increasing relevance of derivatives, as evidenced by Coinbase and Gemini launching offshore exchanges amid falling spot volumes. Launching offshore perpetual future exchanges allows Coinbase and Gemini to be more competitive with the likes of Binance who dominate both spot and derivative markets.