Bitcoin falls to $65,633 as oil prices surge to their highest level since 2022 due to the Iran war, as BTC ETF outflows grow.

Author: Editorial Office CVJ.CH

What has been happening this week in the world of blockchain and cryptocurrencies? Current events and background reports in our weekly review.

Justin Sun settles with the SEC for $10 million – all claims against Sun, Tron, and BitTorrent are dropped.

ICE invests in crypto exchange OKX at a $25 billion valuation – the NYSE parent company plans tokenized stocks.

a16z plans a fifth crypto fund worth over 2 billion dollars. Chris Dixon focuses on shorter cycles and pure blockchain investments.

Kraken Financial becomes the first crypto firm to gain a Fed Master Account, securing direct access to the Fedwire payment system.

GenTwo appoints ex-Vontobel blockchain chief Florian Marty as Managing Director of GenTwo Digital, expanding its digital assets division.

Trump warns US banks against blocking his crypto agenda and calls for swift passage of the Clarity Act market structure law.

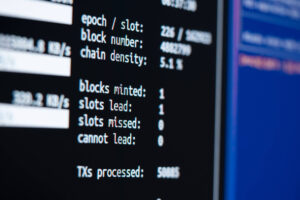

Hyperliquid surpasses Coinbase International in derivatives volume with 2.9 trillion USD in 2025 as DEXes catch up.

Nasdaq files for SEC approval for prediction market options on the Nasdaq 100 index, aiming to enter the booming prediction market sector.

Bitcoin holds at $66,000 despite the US-Iran war as oil and gold surge and Asian stocks plunge. Analysis of the crypto market reaction.

Morgan Stanley files a national trust bank charter with the OCC for crypto custody, trading and staking. What’s behind the move.

What has been happening this week in the world of blockchain and cryptocurrencies? Current events and background reports in our weekly review.

JPMorgan predicts a comprehensive crypto rally if the US crypto market structure law CLARITY Act passes by mid-2026.

Allunity launches CHFAU, the first MiCA-compliant Swiss franc stablecoin – issued from Frankfurt, not Switzerland.

Ethereum co-founder Vitalik Buterin sold over 17,000 ETH worth roughly $35 million in February 2026.