The complete overview of the day’s events in the (crypto) markets. Concisely summarized in the CVJ.CH market commentary.

Author: Editorial Office CVJ.CH

What has been happening around Blockchain Technology and Cryptocurrencies this week? The most relevant local and international developments as well as appealing background reports in a pointed and compact weekly review.

The developers of Tornado Cash are facing charges of money laundering and violations of U.S. sanctions in the United States.

The Web3 community will gather in Switzerland for an 11-day series of events from September 7-17, 2023 – the Swiss Web3Fest.

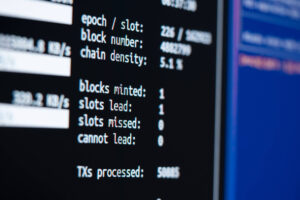

As part of a broader partnership with the City of Lugano, Tether will operate a validation node for the 3Achain.

Decentralized social media app Friend.Tech took the crypto space by storm. A comprehensive overview of the platform’s rise.

The complete overview of the day’s events in the (crypto) markets. Concisely summarized in the CVJ.CH market commentary.

What has been happening around Blockchain Technology and Cryptocurrencies this week? The most relevant local and international developments as well as appealing background reports in a pointed and compact weekly review.

The SEC is not expected to block the first Ether ETF until mid-October, giving the green light to some applicants.

The long-awaited Shiba Inu blockchain Shibarium has gone live, promising crypto users a more efficient DeFi environment.

Base was born out of the partnership between Coinbase and Optimism, which created a Layer 2 solution for the transformative period of the crypto industry.

The U.S. Securities and Exchange Commission (SEC) has delayed a decision on whether to approve the Ark 21Shares Bitcoin ETF.

What has been happening around Blockchain Technology and Cryptocurrencies this week? The most relevant local and international developments as well as appealing background reports in a pointed and compact weekly review.

The U.S. Securities and Exchange Commission (SEC) will appeal the Ripple’s landmark partial victory in its legal battle with the regulator.

PayPal launches its own stablecoin PYUSD, enabling its customers to seamlessly transact between fiat and digital currencies.

What has been happening around Blockchain Technology and Cryptocurrencies this week? The most relevant local and international developments as well as appealing background reports in a pointed and compact weekly review.