What has been happening around Blockchain Technology and Cryptocurrencies this week? The most relevant local and international developments as well as appealing background reports in a pointed and compact weekly review.

Author: Editorial Office CVJ.CH

The Advent calendar from The Crypto Valley. Expand your crypto knowledge every day and win attractive prizes on the 24th.

Senator Elizabeth Warren is trying to push a bipartisan approach to money laundering in the crypto industry in the U.S. Congress.

The Advent calendar from The Crypto Valley. Expand your crypto knowledge every day and win attractive prizes on the 24th.

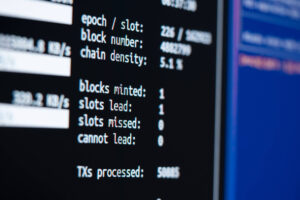

Financial experts and competitors doubt the completeness and credibility of Binance’s proof of reserves.

The Advent calendar from The Crypto Valley. Expand your crypto knowledge every day and win attractive prizes on the 24th.

A month after FTX filed for bankruptcy, authorities in the Bahamas arrested founder and former CEO Sam Bankman-Fried.

The CMTA company is testing a new settlement mechanism for tokenized investment products with several Swiss banks.

The Advent calendar from The Crypto Valley. Expand your crypto knowledge every day and win attractive prizes on the 24th.

The Advent calendar from The Crypto Valley. Expand your crypto knowledge every day and win attractive prizes on the 24th.

The Advent calendar from the Crypto Valley. Expand your crypto knowledge every day and win attractive prizes on the 24th.

The Advent calendar from the Crypto Valley. Expand your crypto knowledge every day and win attractive prizes on the 24th.

ECB chief is pushing to add DeFi, Lending and Staking to the EU crypto framework MiCA, which has not yet come into force.

The Advent calendar from the Crypto Valley. Expand your crypto knowledge every day and win attractive prizes on the 24th.

The Advent calendar from the Crypto Valley. Expand your crypto knowledge every day and win attractive prizes on the 24th with a little luck.

The Advent calendar from the Crypto Valley. Expand your crypto knowledge every day and win attractive prizes on the 24th with a little luck.