With the EIP-1559 upgrade, miners no longer receive the full transaction fees from users – as a portion is burned. Since implementation, over $600 million worth of Ether (ETH) has been destroyed in this way. Investors are hoping this will lead to a deflationary future for Ethereum. The recent upgrade to the Ethereum blockchain included a number of features added to the network’s rulebook. The most long-awaited change was the EIP-1559 upgrade. Its implementation ensures that the network follows a different transaction pricing mechanism that introduces a base fee for each block found on the network. Essentially, the rest of…

Author: Editorial Office CVJ.CH

The Crypto Valley is known to be one of the most “crypto-friendly” regions in the world. But what specifically is happening within the Blockchain ecosystem? The “Crypto Valley Roundup” aims to provide insight and highlights from selected events every two months. With the first Blockchain companies settling in the area of Zug from 2013 onwards, the term “Crypto Valley” was soon born in reference to the “Silicon Valley”. Thanks to politics and regulation, Switzerland was able to create the necessary legal certainty for a flourishing ecosystem around Blockchain and cryptocurrencies at an early stage. The local regulator has been active…

El Salvador is in for a turbulent few weeks. The country is preparing to become the first to introduce Bitcoin as legal tender on the 7th of September. Salvadorans have had no say in the tender so far, and protests accuse the government of corruption. El Salvador’s Bitcoin law is expected to take effect next week. President Nayib Bukele recently announced that the official wallet will be operational the same day, allowing users to exchange their Bitcoin for dollars and vice versa. Although Bukele wants to bring the benefits of the new asset class to the country, hundreds of protesters…

A summarizing review of what has been happening at the crypto markets of the past week. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko. The last 7 days in cryptocurrency markets: Price Movements: A discount has emerged on Korean and Japanese Bitcoin markets following an exchange hack and broader regulatory crackdown. Volume Dynamics: FTX’s spot market share is growing rapidly relative to its biggest competitors. Order Book Liquidity: Ethereum’s market depth recovered after falling to yearly lows during May’s sell-off. Macro Trends: Bitcoin’s correlation with Gold has been…

Originally conceived in December 2013 as a fun cryptocurrency and parody of Bitcoin as well as the fast-growing number of complementary currencies, the Shiba Inu-branded coin still holds its own in the top 10. This article takes a look at how Dogecoin came to be. $DOGE is the “fun and friendly internet currency,” referring to its origins as a joke. Dogecoin was created by Billy Markus, an IBM programmer, and Jackson Palmer, an Adobe programmer. The fun cryptocurrency was intended as a parody of Bitcoin. Initially designed to hold 100 billion coins, founder Jackson Palmer’s decision to remove the limit…

GameFi AG started the same way that everything else does, an idea. This idea grew from the collective consciousness of a small community of game enthusiasts. A dozen or so took the reins and began to manifest these ideas into reality. PIKA is the foundation of GameFi AG, a cryptocurrency that is running on the Ethereum network as an ERC-20 token. As PIKA developed, a core team was formed consisting of developers, marketers, designers, and intellectualists. This core team created the PIKA ecosystem, consisting of three tokens, interacting within a unique system of tokenomics and each also having individual utility.…

Eurex, the leading European derivatives exchange, announced the launch of Bitcoin ETN futures. The new contract offers clients access to the price of Bitcoin in a regulated on-exchange and centrally cleared environment. This offering will be the first regulated market in Bitcoin-related derivatives in Europe. Launch of the new contract by Deutsche Börse Group’s derivatives arm is planned for 13 September. The futures contract is based on the BTCetc Bitcoin Exchange Traded Crypto (ISIN: DE000A27Z304), which is listed on the Frankfurt Stock Exchange and has been among the most heavily traded ETF/ETN contracts on Xetra since its start in June…

Crypto Finance Group, InCore Bank, and Inacta are selecting Tezos to enable innovative, compliant on-chain digital financial products through a new token standard for asset tokenisation. Crypto Finance Group, InCore Bank, and Inacta announced they are selecting Tezos for innovative, compliant on-chain digital financial products. The companies have developed a new Tezos token standard for asset tokenisation based on the Tezos FA2 standard. Additionally, InCore Bank announced the launch of institutional-grade storage, staking, and trading services for Tez (XTZ), the native cryptocurrency of the Tezos blockchain. Tezos is an open source Proof of Stake blockchain network that offers security, reliability,…

A summarizing review of what has been happening at the crypto markets of the past week. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko. The last 7 days in cryptocurrency markets: Price Movements: Bitcoin broke $50k for first time since May, with altcoins leading the crypto-wide rally. Volume Dynamics: NFT’s and fan tokens are the latest crypto sectors to see surging volumes. Order Book Liquidity: The bid-ask spreads for Ethereum and Bitcoin markets are converging. Macro Trends: Bitcoin’s correlation with U.S. bonds turned negative for the first time…

Bitcoin Brokers in Switzerland can sell Bitcoin and send them directly to their customers’ non-custodial wallets without having to do extensive KYC on their customers. Until beginning of this year, the customer didn’t need to create an account or upload any documents if the total amount was below CHF 5’000 (~ USD 5’470) per transaction (or several transactions that appear to be linked to each other) and CHF 100’000 (~ USD 109’400) per year. If the customer is buying Bitcoin through a bank transfer, the name and address of the buyer are still visible to the broker, and the sending…

Microsoft’s Office and the Windows operating system have always led the top downloads of software piracy platforms. The company has already tried to get a grip on them with various (often customer-unfriendly) measures. A research document has published a completely transparent incentive system for anti-piracy campaigns. The document contains an examination of a transparent blockchain-based system by Redmond software giant, with the participation of experts from Alibaba and Carnegie Mellon University. Argus is based on the Ethereum blockchain, and aims to create a trustworthy incentive mechanism while protecting the data of anonymous reporters. Given that piracy is essentially about distributing…

After nearly four years of silent existence, the value of the strictly limited pioneers of the NFT standard is gradually being recognized by the art movement. The possibilities of digital rights, unique and verifiable, is reaching an expanded investor base. A non-fungible token known in the cryptocurrency world as an NFT is a cryptographic asset that represents ownership of something unique that cannot be exchanged. Most NFTs are created on the Ethereum blockchain and represented as ERC-721 tokens, an established standard for non-fungible tokens on the Ethereum network. Unique digital images in the form of NFTs are currently experiencing a…

With technical development on the core platform now complete, testing and scaling for full operations underway, the SIX Digital Exchange (SDX) awaits regulatory approval and readies itself for growth. As part of this preparation, Tim Grant will stand down and hand over the reins to David Newns, an international capital market expert with a strong background in the regulated financial services industry. Newns’s mandate will be to take SDX seamlessly into its next phase of full operations and growth. Waiting for FINMA approval According to Thomas Zeeb, Chairman SDX and Member Executive Board at SIX, they will need to be…

Around 600 million US dollars in stablecoins have been stolen from the “PolyNetwork” DeFi protocol. This is the largest hack of a DeFi application to date. It is currently unclear what enabled the exploit, but the hacker has promised to return the funds. PolyNetwork is a protocol for exchanging tokens across multiple blockchains, including Bitcoin, Ethereum and the Binance Smart Chain (BSC). It was formed by an alliance between the teams behind several blockchain platforms such as NEO and Ontology. Not to be confused with the Ethereum scaling project Polygon. Over $600 million in digital assets were moved by the…

A summarizing review of what has been happening at the crypto markets of the past week. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko. The last 7 days in cryptocurrency markets: Price Movements: Crypto markets react to bullish Ethereum “London” hard fork. Volume Dynamics: Trade volume for perpetual futures markets peaks during US/EU trading hours which suggests a flouting of geographic restrictions. Order Book Liquidity: On average, bid-ask spreads for Bitcoin-Dollar pairs has improved since January. Macro Trends: Treasury bond yields are falling around the world despite strong…

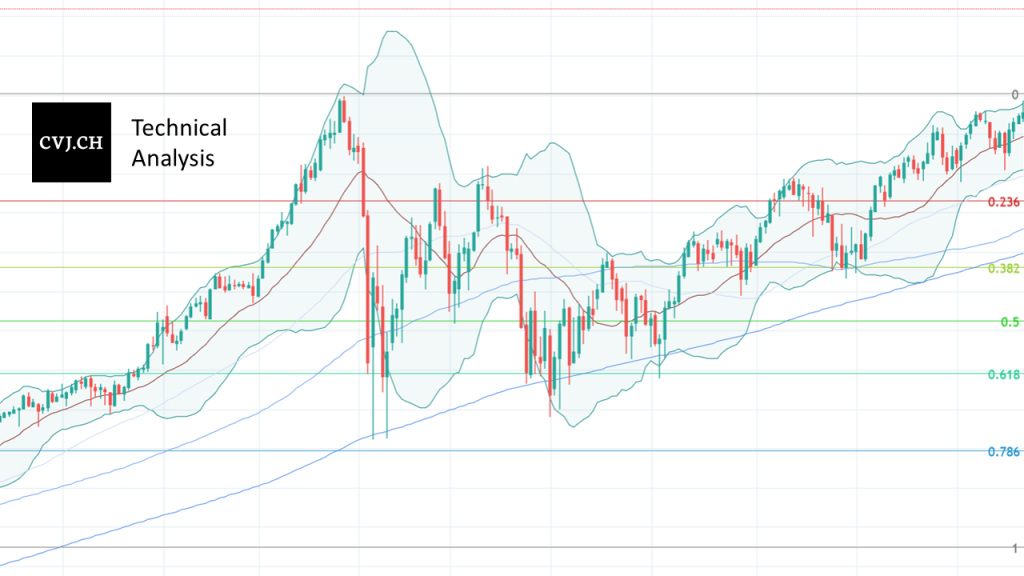

Bitcoin USD daily basis Bitcoin USD chart analysis – Overcoming the 40,000 resistance zone At the beginning of the reporting week, it looked as if the newly climbed price area above the 40,000 mark could not be defended. The strong upward movement of the previous week was followed by a first correction on Sunday, which brought the price back to 39,149 USD by Monday. On Tuesday, Bitcoin exited the market lower again at 38,191 USD. On Wednesday, initial buying set in, bringing the price back to 39,722 USD and thus just below the 40,000 USD resistance zone. A strong sign…