The approval of the spot Bitcoin ETFs has brought traditional finance and crypto closer together than ever before. In a new dynamic, financial institutions are interacting with on-chain bitcoin, with each ETF issuer taking a slightly different approach to management of its assets.

In this deep dive, we’ll explore some of the behind-the-scenes movements of Bitcoin related to the ETFs to better understand how they operate. Since the new funds are all based on the spot markets, it's possible to monitor the movement on the bitcoin blockchain itself. Our findings show that:

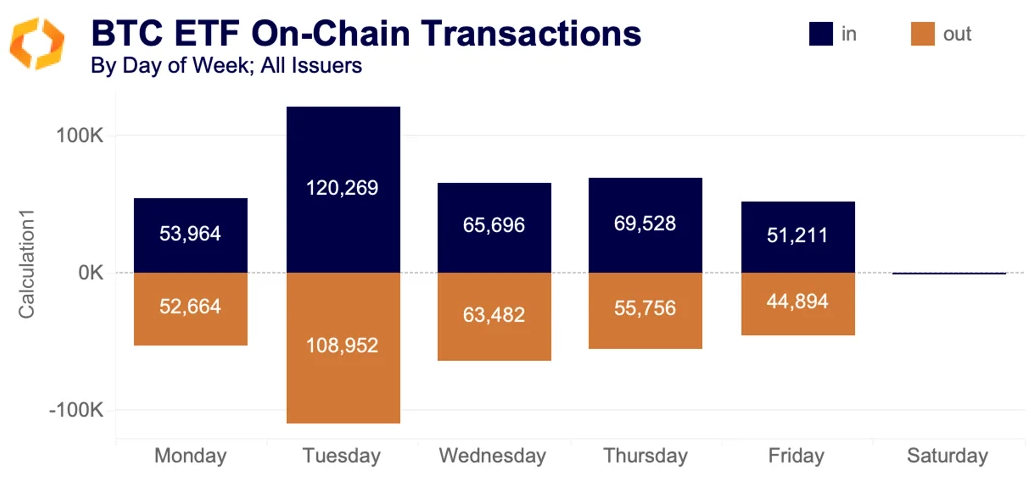

- Tuesday seems to be the most popular day for asset management.

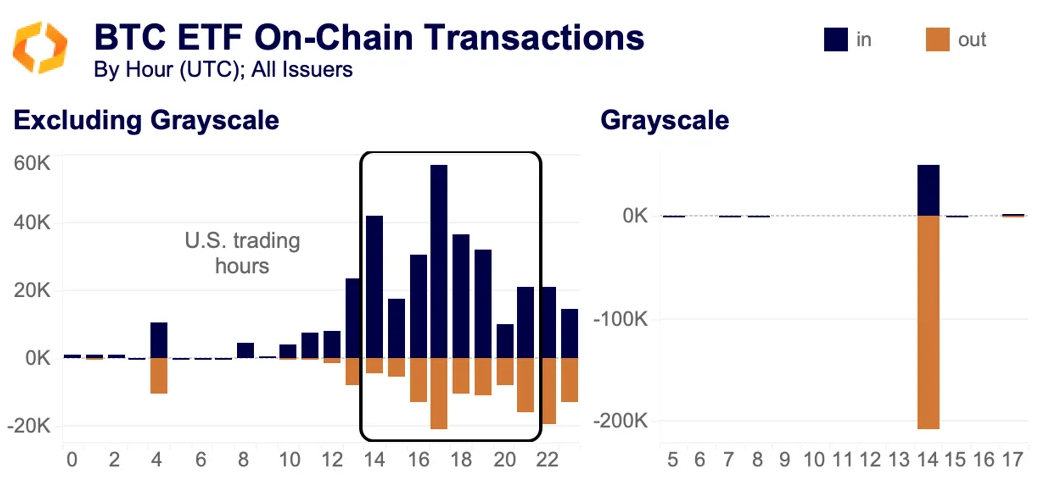

- Most transactions happen during U.S. hours and nearly all are on weekdays.

- Outflows from Grayscale have been offset by other ETFs, which could explain BTC's current rally.

All of these on-chain transactions affect Bitcoin’s supply, which ripples into spot markets, thus impacting price. The more we know about what is happening on-chain, the more insights we can gain into market movements.

An overview of ETF-related transactions

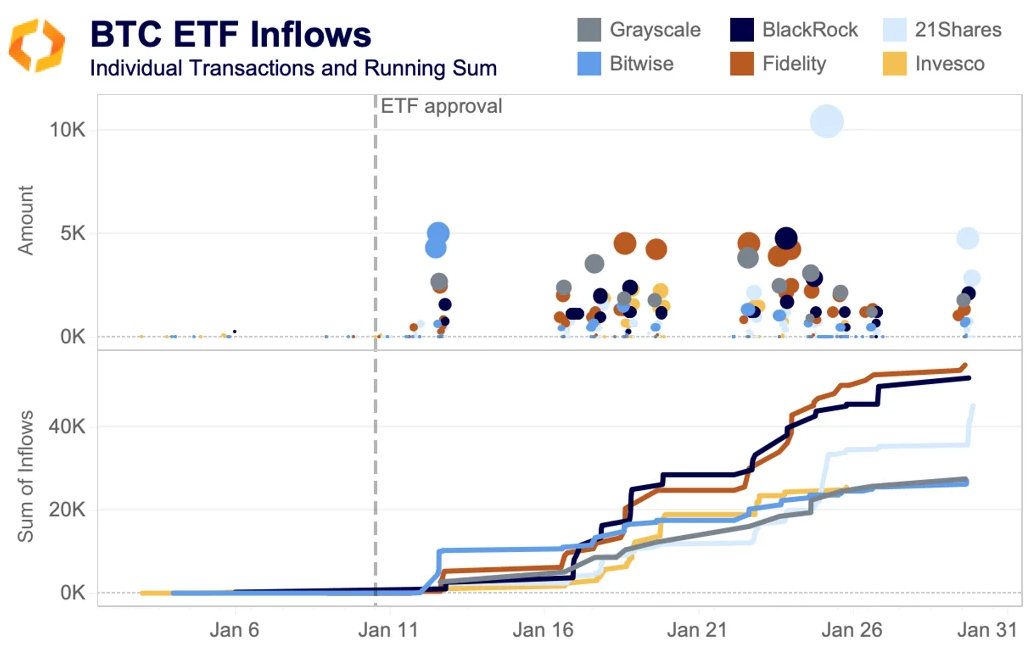

We can begin first by looking at the first month of inflows, showing only those issuers with more than 20k BTC in total inflows. Bitwise and Invesco each registered some very small transactions, likely tests, in the days leading up to approval.

What is especially interesting is the difference between strategies of the issuers, though Coinbase is the custodian for most of the ETFs and likely plays a big role in defining the strategies. For example, Bitwise showed the largest inflow on the first two days after approval, with more than 10k BTC sent to its addresses. After that, there were relatively few inflows. 21Shares had the largest single deposit in January, at more than 10k BTC. Grayscale was the outlier in that it had just a single deposit most days.

On the whole, Tuesdays have been by far the most popular day for on-chain transfers related to the ETFs. This is largely due to Fidelity’s on-chain transfers, seemingly redistributing BTC amongst its wallets each Tuesday. The only issuers to register transactions on the weekend were Bitwise and VanEck. When it comes to timing of on-chain transactions, the vast majority occur during U.S. trading hours.

The only issuer with significant transactions far outside of U.S. trading hours (the bar above at 4am UTC) was the Swiss company 21Shares. Notably, Grayscale conducts virtually all of its on-chain transactions at 2pm UTC (9am ET), the start of the U.S. trading day.

Differences between ETF issuers

Grayscale is the outlier in more than one way. The Grayscale Bitcoin Trust (GBTC) held over 600k BTC before it was allowed to convert into an ETF. Because of frictions with redemptions, GBTC traded at a discount to BTC for much of the bear market. Now that these frictions (and the discount) are gone, there have been persistent outflows.

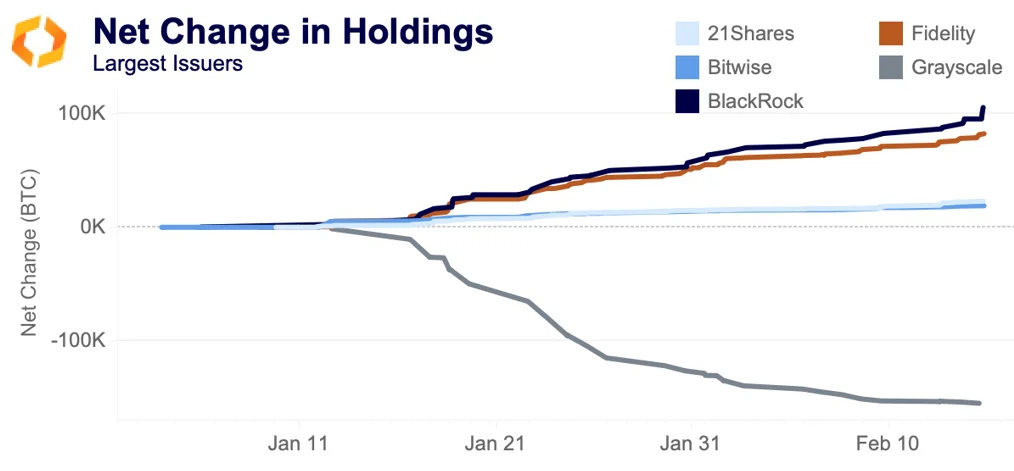

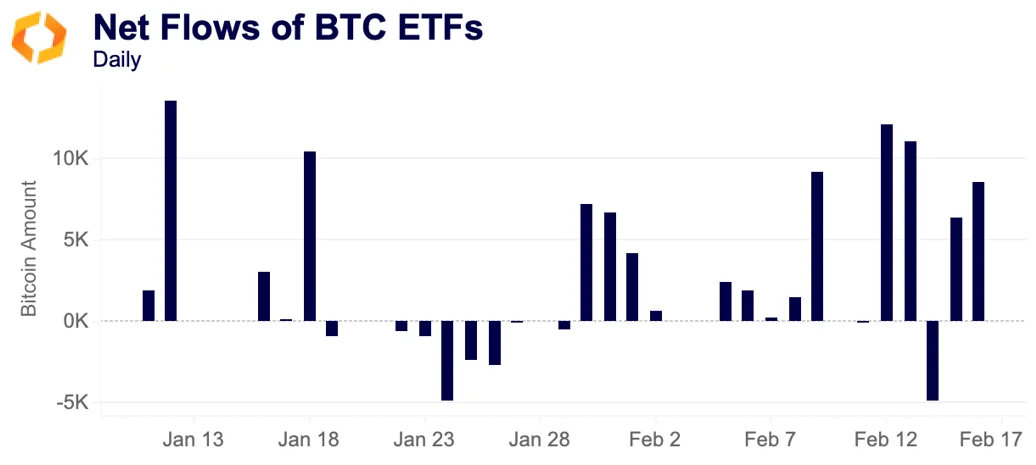

GBTC held 615k BTC when the ETFs were first approved, it currently holds just over 450k. Below we can see how its outflows compare to inflows in other ETFs, as well as how its outflows have slowed significantly in the last two weeks.

While Grayscale stabilizes, BlackRock and Fidelity have shown the largest net inflows, with BlackRock recently breaching 100k BTC, while Fidelity stands at 80k. Both have grown at a consistent rate since trading began in January. 21Shares and Bitwise are the last two with over $1bn in holdings; they have been growing at a nearly identical rate. The inflows into new ETFs have been more than enough to offset outflows from Grayscale, with 20 out of 29 trading days showing net inflows.

Bitcoin’s supply is increasingly flowing into the ETFs, suggesting consistent demand for these products. BTC has begun to rally as outflows have slowed.

Conclusion

The first month of this new interaction between traditional finance and crypto has gone remarkably well, with no obvious hiccups present in the on-chain data. The ETFs are already large holders of BTC, representing about 3.5% of supply; the growth of their holdings shows no sign of slowing down. Because of this, it will become increasingly important to monitor on-chain transactions to determine where this supply is coming from and how it is being held. The change in on-chain dynamics will likely affect existing spot markets, potentially impacting liquidity going forward.