Another market event came to an end last week when Binance reached a settlement with the DOJ. But who emerged victorious? In a comprehensive report in collaboration with market data provider Kaiko, we explore who the key beneficiaries of the settlement could be.

Last week, Binance settled with the U.S. Department of Justice, agreeing to pay a $4bn penalty, retain an independent compliance monitor for three years, and improve its AML/KYC programs. This deal also included agreements with the CFTC, FinCEN, and OFAC, though it notably did not conclude the SEC’s ongoing suit against Binance and Binance.US.; The Wall Street Journal reported that the SEC is investigating whether Binance executives had backdoor access to customer funds.

Naturally, speculation has shifted to what this means for potential spot BTC ETFs, as well as which exchanges stand to benefit. Along the latter line, COIN, DYDX, and UNI all rallied in the wake of the settlement. Regarding the ETFs’ chances, based on my analysis of BTC volumes and the SEC’s past reasoning, it seems unlikely that the settlement has any material effect on the likelihood of approval. While a compliance monitor is nice, the SEC has clearly asked for a surveillance sharing agreement with a market of significant size. Essentially, Coinbase – who is named as the surveillance partner in BlackRock’s updated application – either is or is not a significant market, regardless of a compliance monitor at Binance.

Effects on Binance

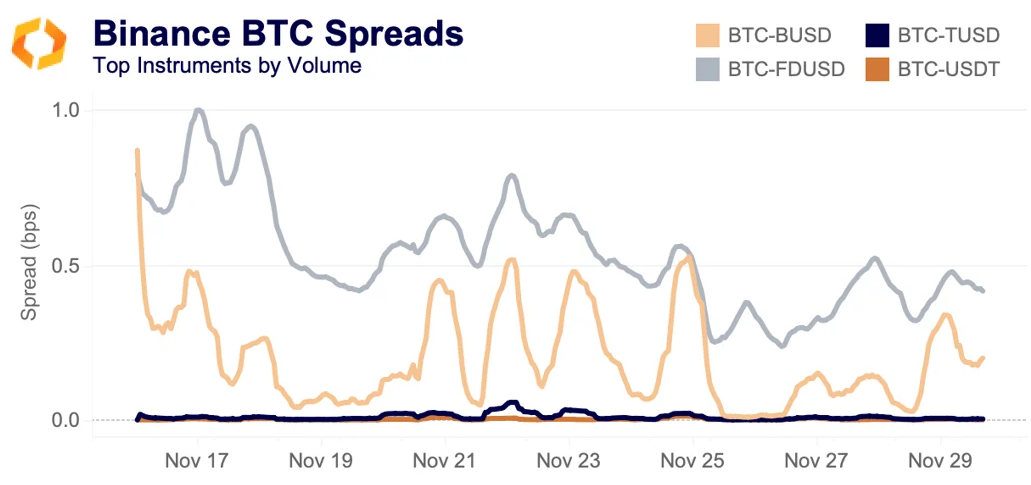

While Binance has registered significant outflows, one would be hard pressed to find evidence of a major exodus in the exchange’s liquidity data. As covered in this week’s Data Debrief, market depth on the exchange is actually up since news of a settlement first broke. Spreads for the exchange’s top BTC instruments showed a slight disturbance around November 21 – the day the settlement was announced – but have trended down since then.

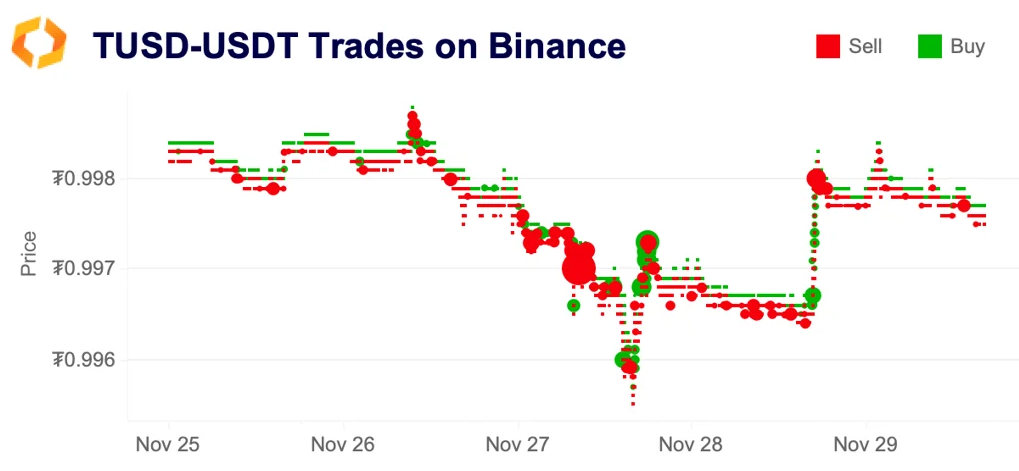

The only truly concerning event came a few days after the settlement, when TUSD depegged down to 0.995 Tether, in part due to a massive $3mn market sell order.

While many outlets linked this to a report that Tron is used in terror financing, it’s more likely that the quick sell off was a result of Binance’s Memecoin “Launchpool” ending on November 26. More than $400mn TUSD that had been deposited into the pool to earn the MEME token was unlocked, leading to a flurry of TUSD to USDT swaps.

Who's the winner?

Coinbase was already in the midst of a strong month when the news broke, and the news seemingly only added fuel to the fire, propelling the stock to a 75% gain in a single month. The prevailing narrative is that the bear market is thawing, and Coinbase will be a major beneficiary of this change in conditions.

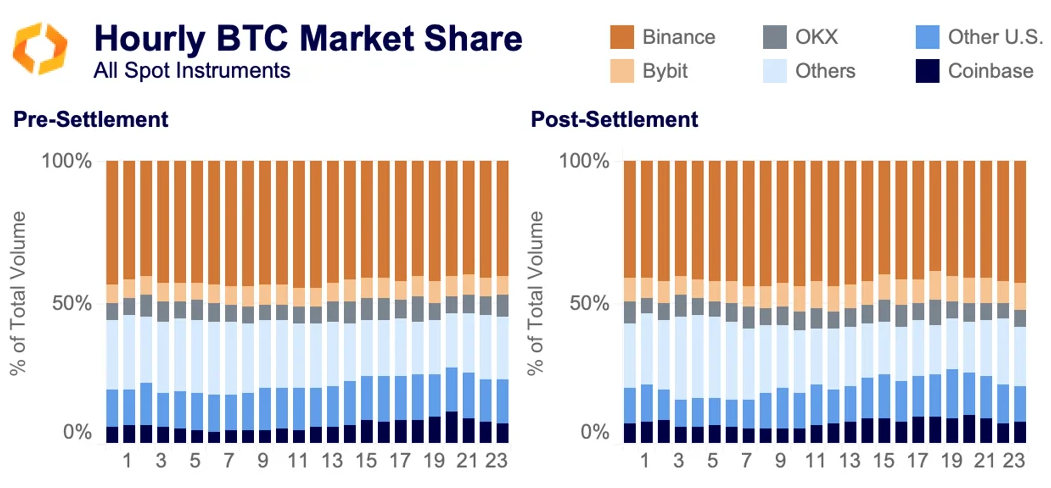

Exchanges generate most of their revenue from transaction fees, and for virtually every non-Korean exchange, BTC is the highest volume non-stablecoin token. Already, some BTC volume trends are becoming clear. The chart below shows each exchange’s BTC market share at each UTC hour.

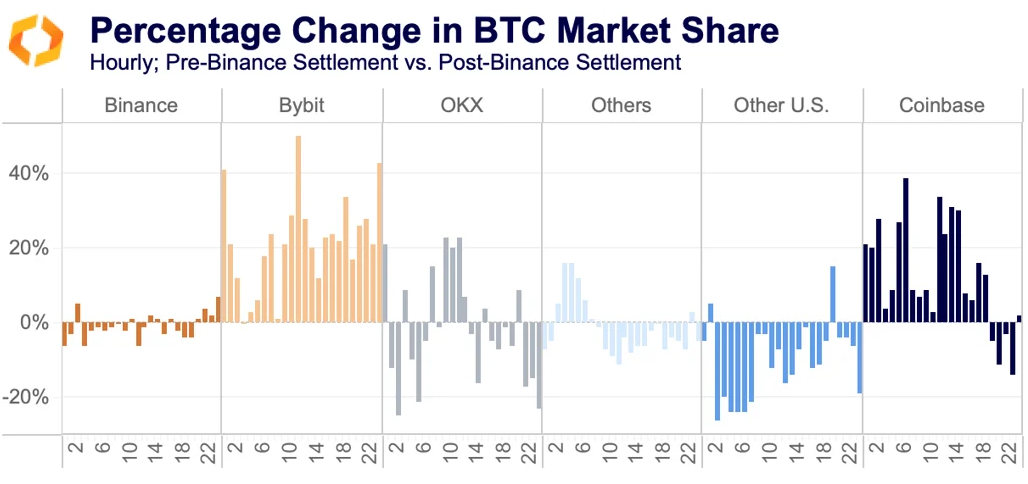

To further illustrate what might seem like small changes, the below charts each exchange’s percentage change in market share. Binance’s market share is so large that a 4% decrease at 11 UTC opened the door for Bybit to increase its market share 50%, and Coinbase 34%.

Bybit is the immediate standout winner, gaining market share in every single hour and growing by more than 20% in 16 out of 24 hours. The exchanges included in “Others'' made most of their gains in the middle of the trading day in eastern Asia, while OKX gained the most at the start of western Europe’s trading day. Perhaps most interestingly, Coinbase’s share grew the most outside of U.S. trading hours (14-22 UTC), instead surging in the middle of the trading day in Europe and the beginning of the trading day in eastern Asia. The other U.S. exchanges category performed poorly across the board, though some exchanges included in this group have shown strength in recent months.

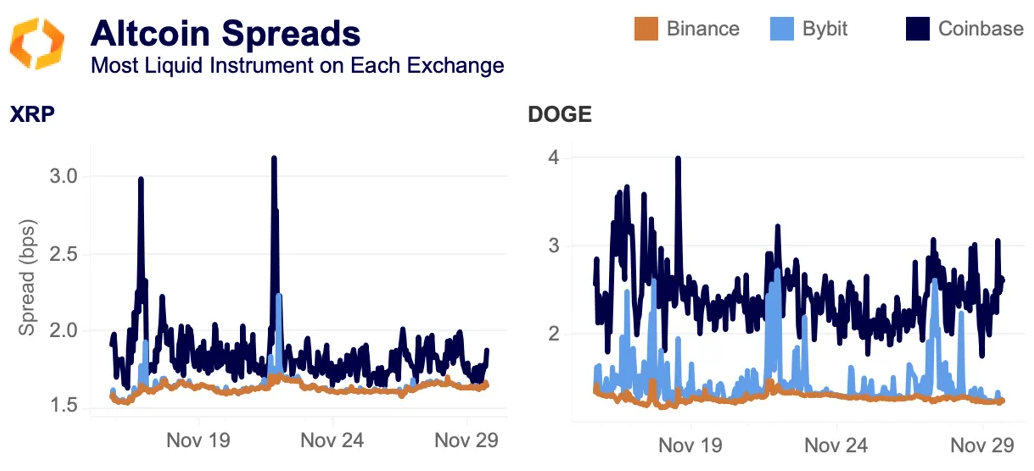

All told, Binance has ceded some market share to Coinbase in non-U.S. hours and Bybit across the board. Despite Coinbase’s volume share growing, Binance remains the leader in liquidity, both for BTC and for altcoins. Meanwhile, Bybit has quietly improved its liquidity over the past year and, for some instruments, is on par with Binance. For example, Binance and Bybit’s XRP spreads are so similar - with Bybit’s just a touch more volatile - that it seems likely that the same market maker(s) is/are operating on both exchanges.

Meanwhile, DOGE shows why Binance is still on top. In the past couple weeks, its spreads have never exceeded 1.5 bps; Bybit’s baseline spread is similar, though it frequently jumps above 2 bps. Coinbase’s spread in both cases is higher than its rivals’ and it hasn’t yet shown signs of closing the gap.

Conclusion

It’s too early to make sweeping predictions, but early trends look far from dire for Binance, while also promising for Coinbase and Bybit. This competition developed an interesting wrinkle this week in the form of an email from Coinbase to its customers, which informed them that Coinbase received a subpoena from the CFTC related to Bybit.

While the most popular theory is that Binance will lose share to other exchanges, it’s also possible that the compliance monitor and improved AML/KYC procedures will increase trust in the exchange, helping to maintain its share. While it could be argued that centralized exchanges are perfect substitutes, the turbulence of the past couple years has shown that there is some stickiness to liquidity and volumes; people tend to want to keep using the exchanges that they're already using. Ultimately, this saga appears to be a positive for everyone: the U.S. government gets a win, Binance can continue to operate, and other exchanges can grow.