A summarizing review of what has been happening at the crypto markets of the past week. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko.

Bitcoin whipsawed over the past week, closing lower on Sunday after a mixed U.S. jobs report. In industry news, Binance appointed a possible CZ successor as regional director, Celsius has deposited $745 million of ETH into staking contracts since June 1, and Coinbase's derivatives exchange will offer new BTC and ETH futures this week. Today, we explore:

- Privacy token liquidity ahead of Binance trading restrictions

- A big Optimism (OP) token unlock

The fraught future of privacy tokens

Last week, Binance announced that it would restrict trading of privacy tokens for users in France, Italy, Poland, and Spain starting June 26. This follows similar de-listings by Huobi, OkCoin, Bithumb, and Upbit. As the name suggests, privacy tokens are designed to allow users to transact anonymously, rather than pseudonymously. Countries like South Korea, Japan, and Australia have banned privacy tokens and new Financial Action Task Force (FATF) recommendations will likely increase regulatory pressure.

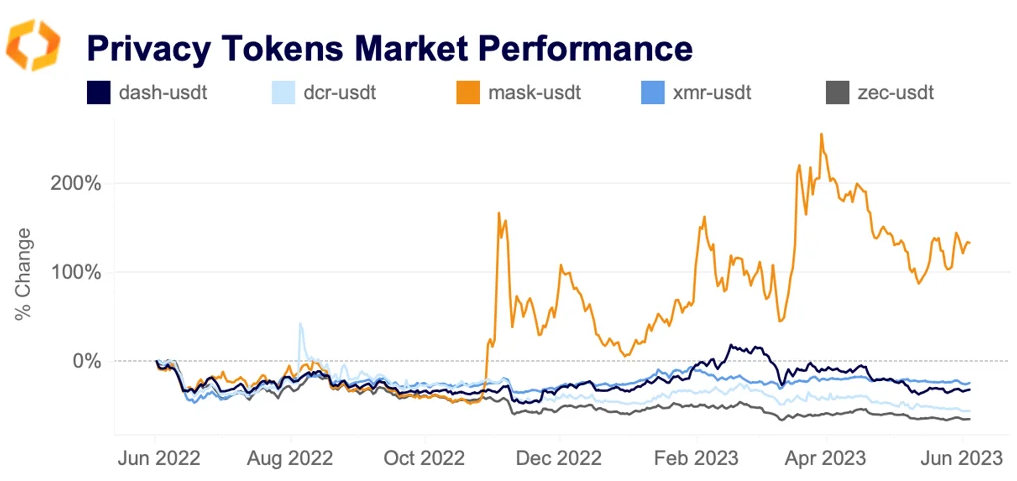

Over the past year, the top 5 privacy tokens have underperformed the broad market amid increased regulatory scrutiny, with the notable exception of the Mask ecosystem’s native MASK token. Mask Network enables social media users to send crypto via decentralized apps or share encrypted content and has gained significant traction after Elon Musk’s acquisition of Twitter.

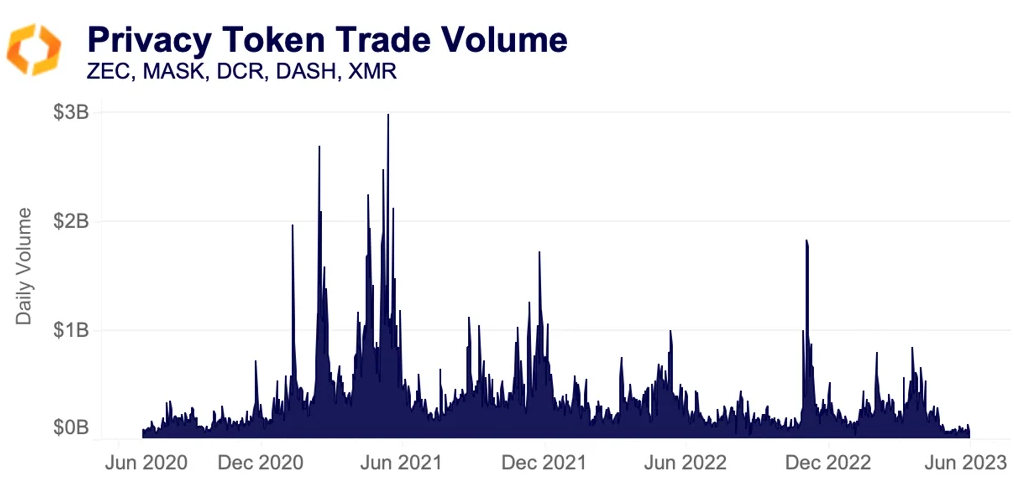

Overall, daily trade volume for the top privacy tokens has held fairly steady on centralized exchanges over the past year, up until the start of May, when it saw a steep drop led mostly by a fall in trade volume on OKX. Over the past month, average volume has been around $100mn, down from all time highs of nearly $3bn.

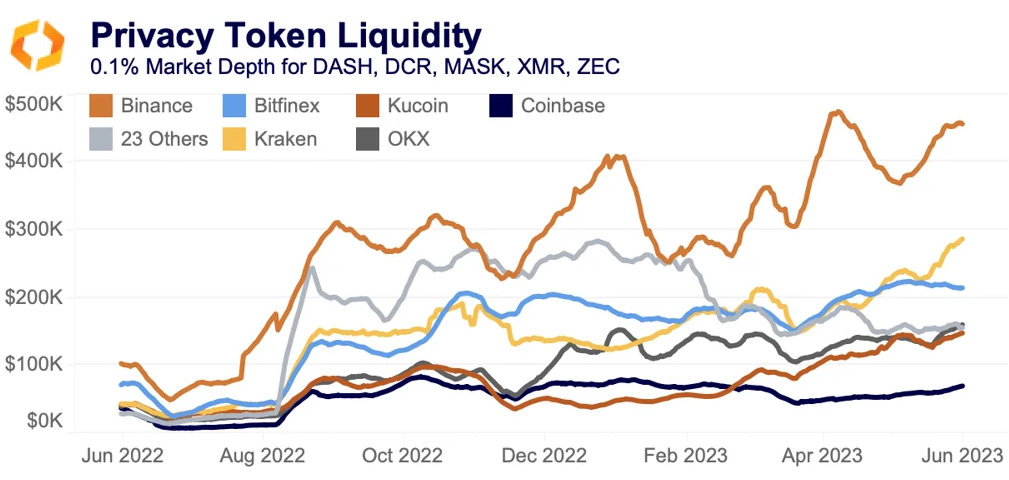

Interestingly, despite a drop in volume and falling prices, privacy token liquidity – as measured by 0.1% market depth, which sums bids and asks immediately surrounding the mid price – has improved significantly over the past year

As usual, Binance leads the way. Interestingly, Kraken is in the second spot despite regulatory uncertainties in the U.S., though privacy tokens have not come under too much scrutiny in the region yet despite a widespread regulatory crackdown.

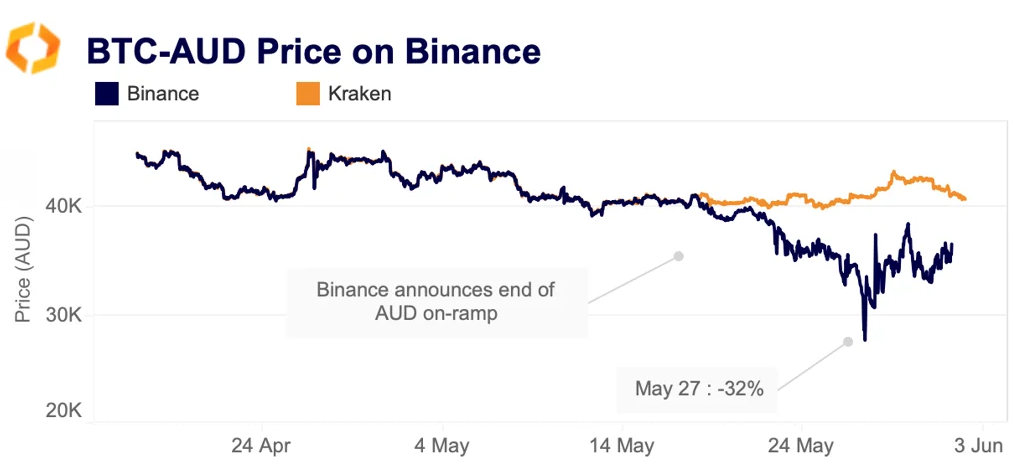

Bitcoin trades at a steep discount to the Australian dollar

Bitcoin (BTC) traded at a steep discount against the Australian Dollar for over a week on Binance as Australian users rushed to cash out after the exchange announced it will be halting its AUD off and on ramp services. Throughout May, the BTC-AUD pair traded at a minor discount of 0.1% on Binance as the exchange winded down its derivative business in Australia.The move came after the country's financial regulator revoked Binance's derivative business license in April.

However, the discount widened considerably after Binance revealed that it would no longer provide AUD deposit services starting May 18 and would cease withdrawals on June 1. Offering fiat on and off-ramp services has been increasingly challenging for Binance, which has been struggling with its banking partners amid growing regulatory scrutiny. The exchange already halted USD transfers for international customers in February and GBP deposits and withdrawals in March. Despite this, the exchange saw a slight increase in its market share in May which currently stands at 58%.

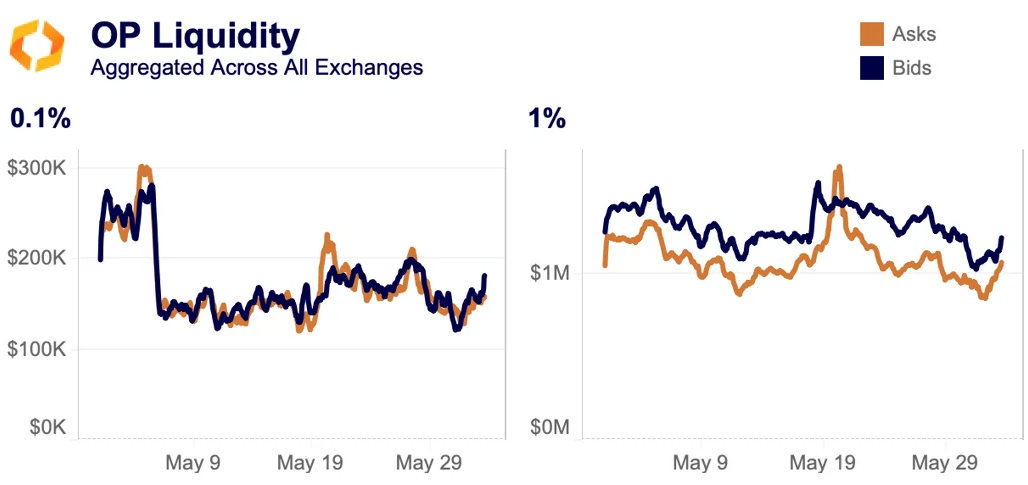

OP liquidity remains steady despite large token unlock

Over $550mn worth of the Layer 2 network Optimism's OP tokens were unlocked this week, more than doubling the circulating supply from under 300mn tokens to nearly 700mn tokens. The unlock distributed 180mn tokens to early investors and 200mn to core contributors.

OP slipped from $1.67 to a low of $1.36, beginning its slide a day before the tokens were unlocked, suggesting much of the move was in anticipation of sell pressure. Despite this, OP’s liquidity has been mostly stable, with a drop in 0.1% bids and asks before a return to normal. At the 1% level, bids dropped more than asks, though both have since bounced back. This suggests that there has not been significant selling of unlocked tokens yet, as market makers would likely pull some liquidity to avoid toxic flow if they detected strong selling.

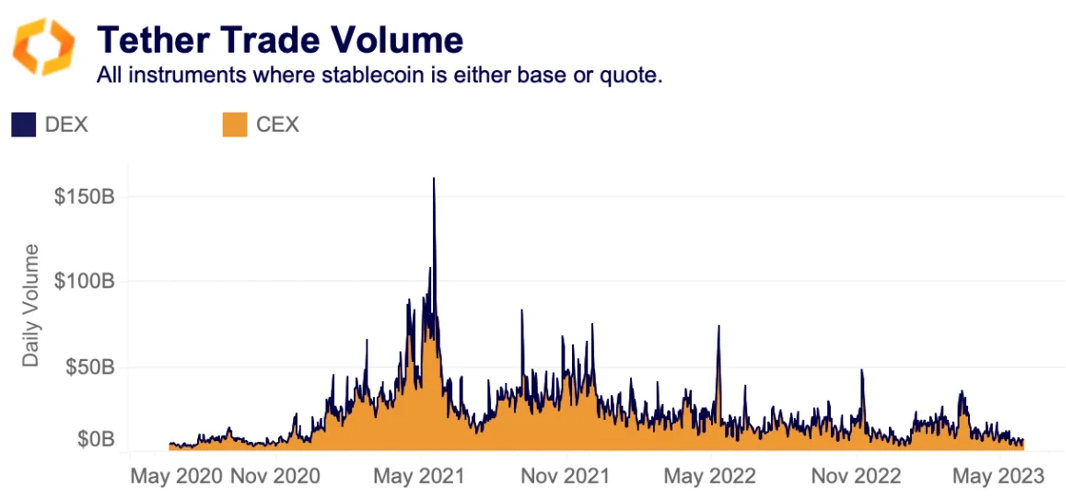

USDT's market cap hits ATH

Last week, Tether's supply hit an all-time high of more than $83bn, bucking the trend that other stablecoins have faced amid a prolonged bear market and falling activity. With trade volumes dwindling on both CEXs and DEXs, recently hitting multi-year lows, demand for USDT seems to be driven elsewhere. It is not secret that trading remains the primary use case for stablecoins today, but Tether's CTO suggested on a recent podcast that demand could be coming from developing countries.

It is difficult to have accurate data on this, though, as Tether transactions are anonymous on-chain. One of the only ways to measure regional activity is via crypto exchange volume, such as on regional venues like BTCTurk or Bitso. Kaiko has observed a big surge in Tether's market share on BTCTurk, which supports a bit of the regional growth narrative, but overall trade volume is still down for the year. Tether's CTO estimated that 60% of USDT is used for trading and 40% for store of value/transaction use cases, and we will continue looking out for more concrete data on this.

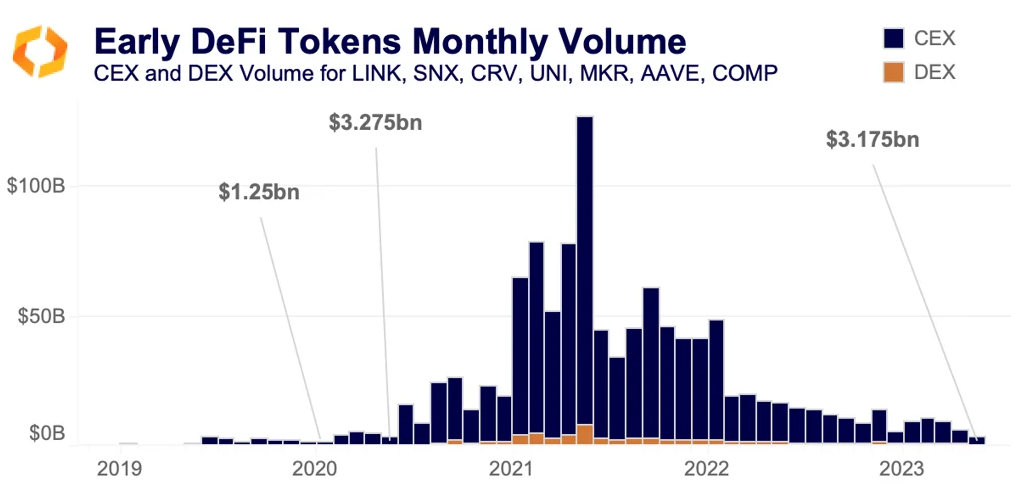

DeFi blue chips register lowest volume in 3 years

The tokens associated with early DeFi projects such as Link (LINK), Synthetix (SNX), Curve (CRV), Uniswap (UNI), Maker DAO (MKR), Aave (AAVE), and Compound (COMP) registered their lowest combined volume in since January 2020 last month. The tokens registered just under $3.25bn in volume, with $225mn on DEXs and $3bn on CEXs. The overall volume is eerily similar to May 2020, right as DeFi Summer was beginning. That month, the tokens registered $3.5bn in volume, though with just $4mn on DEXs. The recent slumping volume is reflective of broader market trends – last month was one of the lowest volume months in the past few years – and changing narratives that have not been friendly to most DeFi 1.0 tokens.

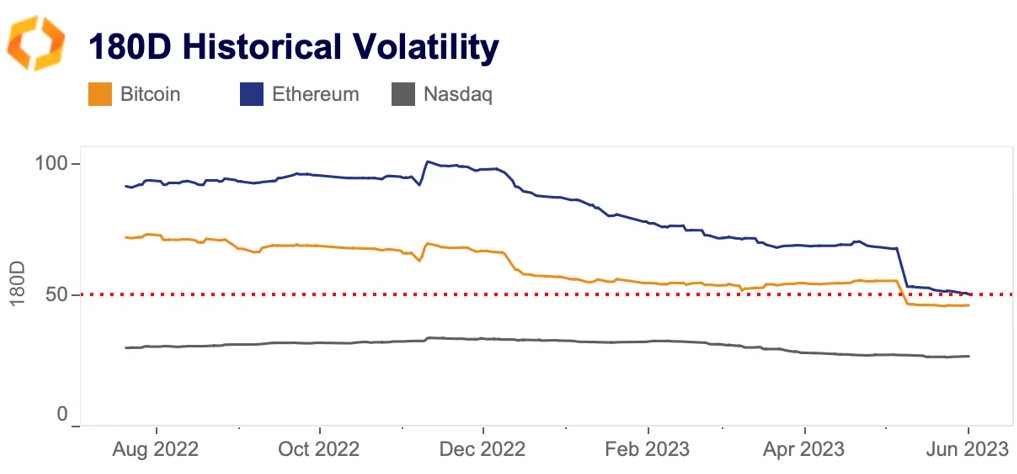

Bitcoin 180D volatility hits a multi-year low

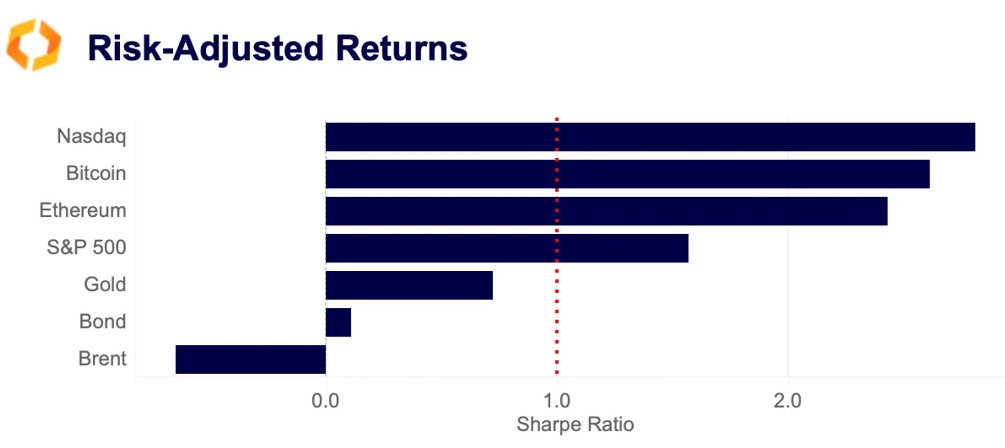

BTC and ETH's long-term volatility, which has been steadily declining since Nov 2022, just hit its lowest level in more than two years. While ETH has historically been more volatile than BTC, the gap between the two assets' volatilities has also decreased significantly. BTC 180-day volatility currently stands at 46% while ETH's hovers around 50%. While on a downward trend, crypto volatility remains almost double that of traditional risk assets such as tech equities. Despite a drop in volatility, BTC's risk-adjusted returns are now less than Nasdaq's.

BTC outperformed in risk adjusted terms in the first four months of the year, but it has recently fallen behind tech stocks. BTC's YTD Sharpe Ratio, which measures the excess return of an asset per unit of volatility, is currently slightly lower that the Nasdaq's despite remaining well above other traditional assets such as gold and commodities.

The Nasdaq rallied in recent weeks, rising 10% in the last month despite the U.S. debt ceiling drama and worsening liquidity outlook. BTC on the other hand, closed last month in the red for the first time this year helped by increasing selling pressure from miners and exceptionally low liquidity.