A summarizing review of what has been happening at the crypto markets of the past week. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko.

Crypto markets made slight gains this week after the Fed decided to pause interest rate increases, a bullish signal for risk assets, and Blackrock filed for a spot bitcoin ETF, a surprise move amid a tough U.S. regulatory environment. This week, we explore:

- A mysterious attempt to depeg Tether

- The CRV lending predicament on Aave

- Binance.US market share dropping to 1%

The data behind Tether's depeg

Last week, there was a possible attempt to depeg Tether (USDT), the world's largest stablecoin. The company has since claimed the destabilization was caused by manipulation ahead of a big documents release, which shed new light on the firm's banking relationships and commercial paper exposure.

While the facts remain blurry, the selling started a few days before USDT dipped to as low as $.995 on both centralized and decentralized exchanges, suggesting some holders may have had advanced warning of the release.

CVD is an indicator that shows the buying and selling trends for specific pairs. In this chart, positive numbers indicate that traders were swapping into USDT, while negative numbers indicate they were selling USDT. Binance’s USDT-USDC had by far the most USDT selling, registering a massive negative $250mn CVD from Monday to Friday, followed by Uniswap V3 at negative $150mn.

Coinbase and Kraken’s USDT-USD markets were some of the only with a positive CVD, indicating traders were willing to exchange fiat for a slightly discounted USDT. Binance’s USDT-BUSD pair was also positive, with traders perhaps spotting a good opportunity to unload BUSD, which will be phased out early next year.

Curve, which is the primary marketplace for decentralized stablecoin swaps, saw huge selling for USDT in the 3pool for DAI and USDC, with a CVD of negative $150mn.

Interestingly, the largest order recorded during the depeg was actually a swap of about $12mn USDC for USDT, showing some traders sought to profit off of the price discrepancy. As of Monday morning, the 3pool remains unbalanced, holding 48.5% USDT as the stablecoin continues to trade at a slight discount.

Bitcoin stays resilient

The performance gap between BTC and altocins has widened significantly in June after the SEC listed dozens of crypto assets as securities in a wave of lawsuits. To understand sector performance, we created five equally-weighted portfolios with the top tokens by market cap.

BTC is down only 3% since March’s highs, having benefitted from safe-haven flows and regulatory clarity on its status as a commodity. While most crypto sectors have plummeted in June, falling between 30% and 46%, Layer 2 tokens registered the worst performance. The DeFi sector has shown resilience, mainly due to Marker’s DAO native MKR token which gained 6% in June.

Long-term crypto volatility remains at multi-year lows

Volatility is perhaps the best indicator of trading activity in crypto. Today, BTC and ETH's 90D volatility is at multi-year lows, closely matching the trend in trade volume. Ether's volatility has seen a remarkable threefold decline, dropping from a high of 150% in 2021 to 46% today. Meanwhile, bitcoin's volatility has halved, decreasing from 90% to 50%. Historically, ETH has had a higher volatility than BTC, but this gap has since disappeared.

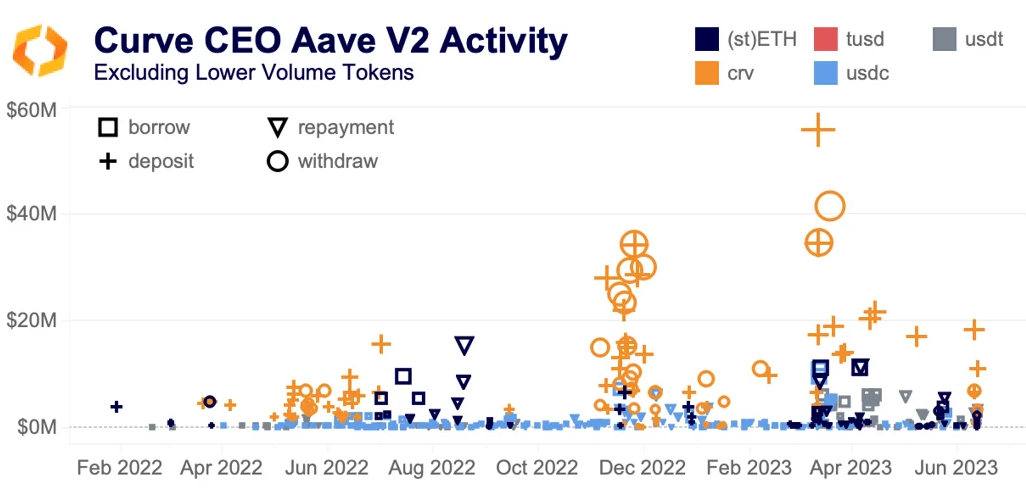

Curve CEO tops up Aave collateral

Curve’s CEO Michael Egorov is in the spotlight after on-chain watchers noticed that he had deposited more CRV tokens into Aave, a decentralized lending protocol. As of this writing, he has supplied over $175mn worth of CRV tokens and borrowed over $60mn worth of USDT. The newest CRV deposits drew attention to the size of the position, though it’s unclear why this happened now, as he has consistently added to his collateral and borrowed stablecoins for over a year.

Some have speculated that he has no intention of repaying the loan and is instead using it as a way to cash out his CRV tokens, because there is nowhere near enough liquidity to support selling such a large holding, even in increments. On centralized exchanges, there is just ~$1mn in bid-side depth for CRV markets within 2% of the price, which means that any significant selling would cause massive price slippage.

For now, a malicious interpretation of Egorov's activity is all just speculation, as he continues to ensure that the loan remains healthy. A liquidation would be catastrophic to CRV’s price and could saddle Aave with a large amount of bad debt. In this instance, its Safety Module – made up of AAVE tokens – could be sold off to cover the debt, likely dropping AAVE’s price, too.

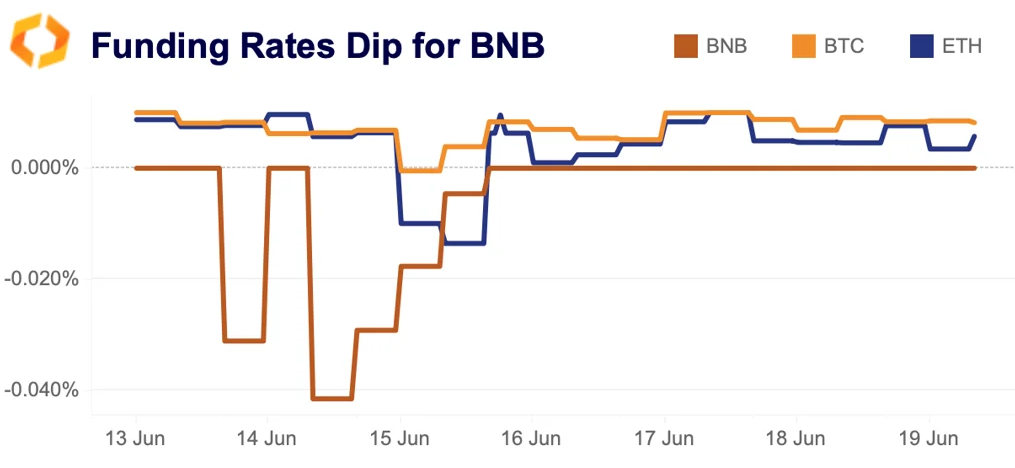

Binance.US market share drops to 1%

Tough times for Binance.US. Last week, the exchange's market share of volume relative to its closest U.S. competitors dropped to 1%, down from all time highs of 27% reached just a few short months ago. The exchange halted several trading pairs amid increasingly tough liquidity conditions as market makers and traders continue to flee the platform. Over the weekend, Binance.US and the SEC entered into an agreement requiring the exchange to keep all customer assets in the U.S and limit private key access. Overall, the exchange's reputation has been severely harmed, and it remains to be seen if they can recover.

Funding rates give insights into investor sentiment in the derivative markets, turning negative when sentiment sours as short positions pay a fee to long positions. Last week, BNB rates dipped deeply negative while BTC and ETH rates were positive as Binance.US faced a lawsuit from the SEC. Since then, BNB funding rates have retreated back to their baseline rate, 0%, which is the level that the rate snaps back to when the difference between the spot and futures price is minimal. Notably on Binance, the baseline funding rate for BNB differs to other assets, with BNB baseline at 0% compared to other assets baseline rate of 1% - leading to naturally lower rates over the long-term for BNB.

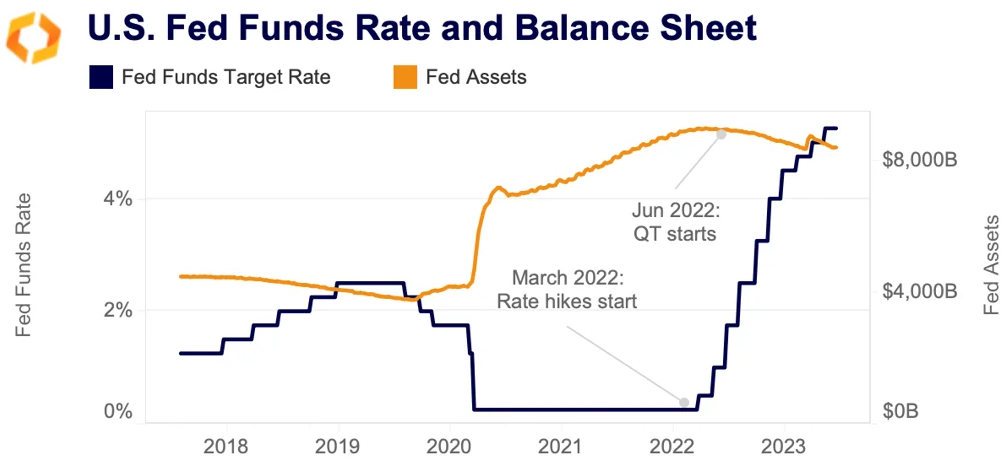

U.S. Fed finally pauses rate increases

The U.S. central bank paused rate increases last week for the first time in 15 months, maintaining its key policy rate at 5-5.25%. Compared to other developed economies, the Fed has been one of the most aggressive central banks in tightening monetary policy. Since March 2022, it has raised rates by 500 basis points while simultaneously reducing its balance sheet through quantitative tightening (QT).

Despite pausing, the Fed maintained a hawkish tone and signalled two more rate hikes by the end of the year, as the latest CPI data showed that core inflation remains persistent. However, futures markets currently anticipate only one rate increase in July, suggesting that traders are skeptical about the necessity of further tightening. U.S. equities rallied as renewed optimism around China growth prospects helped boost risk sentiment.

In contrast, crypto markets reacted sharply, with BTC losing $800 of its value in the hours after the Fed meeting.

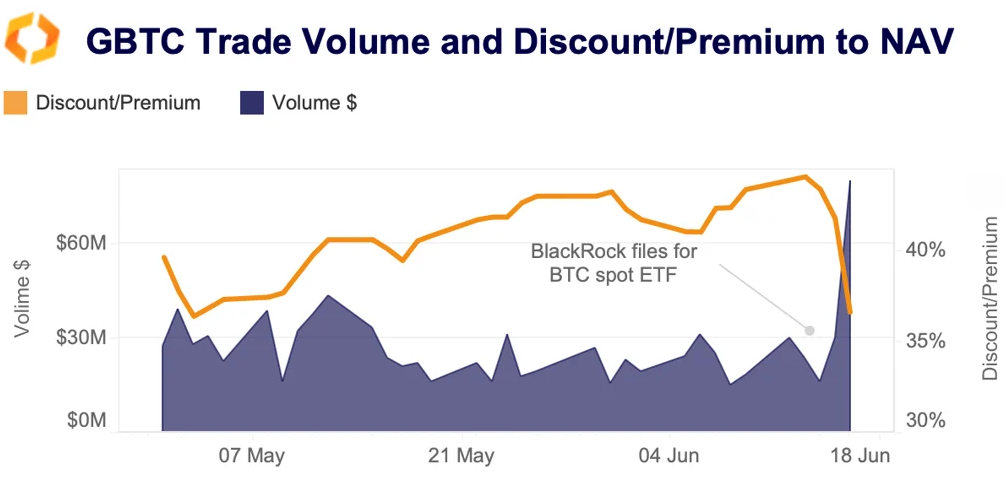

GBTC discount narrows following BlackRock ETF filing

The Grayscale Bitcoin Trust (GBTC) share price to NAV discount narrowed to 36.6%, its lowest level since March following BlackRock’s filing for a spot BTC ETF last week. GBTC trade volumes also picked up hitting a multi-month high of $80M. Initially, the market reaction to BlackRock's filing was muted but bullish sentiment took over after markets digested the news.

BlackRock - the world’s largest ETF issuer by AUM - put forth a proposal to collaborate with Nasdaq in establishing a surveillance-sharing agreement aimed at mitigating price manipulation. The proposal is the first of its kind in such a filling, which boosted optimism around the potential outcome, with BTC recovering most of its post-FOMC losses over the weekend.

Grayscale which is the largest Bitcoin publicly traded fund managing $16.5B in assets - is currently suing the SEC due to its refusal to allow the Trust’s conversion into an ETF. If successful, this move would allow traders to arbitrage the so-called Grayscale discount which emerged in Feb 2021 because of falling institutional demand and heightened market competition. While there is growing optimism regarding Grayscale's chances of winning the lawsuit, it is worth noting that the SEC has previously rejected similar proposals from other prominent asset managers.