A summarizing review of what has been happening at the crypto markets of the past week. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko.

It was a landmark week for crypto regulation after the House Financial Services Committee advanced a crucial bill that could provide clearer guidelines for the industry if passed. In other news, Curve Finance experienced an exploit, crypto ETPs saw record inflows, and the Bank of Italy tapped Polygon for an institutional DeFi pilot. This week, we explore:

- The impact of zero-fee trading on Binance

- Play-to-earn token activity

- BTC and ETH's long-term volatility

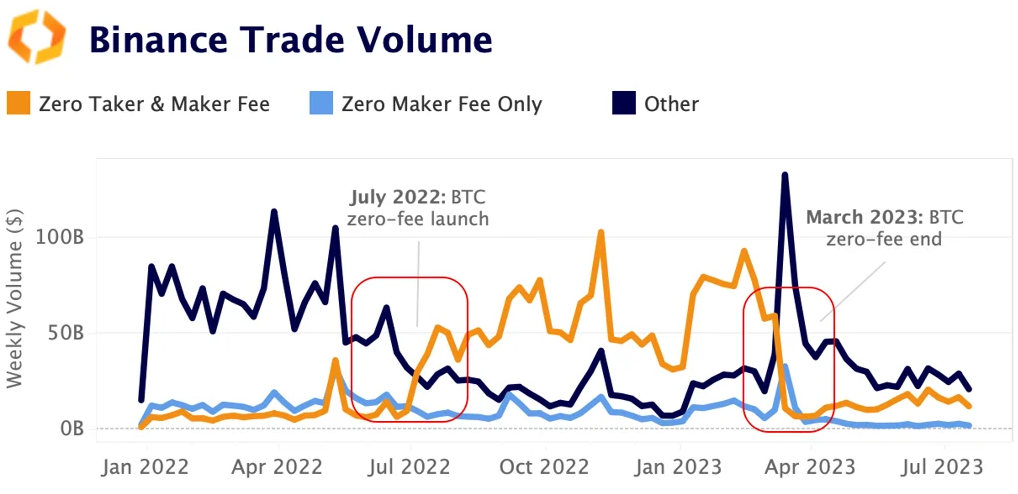

The majority of Binance's volume is zero-fee

About a year ago, right as crypto trade volumes started to slump in the aftermath of the Celsius and Terra collapses, Binance vastly expanded its zero-fee trading promotions to 13 BTC pairs. This practice, though not new, had never been implemented on such a large scale. However, just nine months later the exchange decided to reverse this strategy and adopt a more selective approach. This suggests that while zero-fee trading may have helped Binance gain dominance, it also came at a substantial cost.

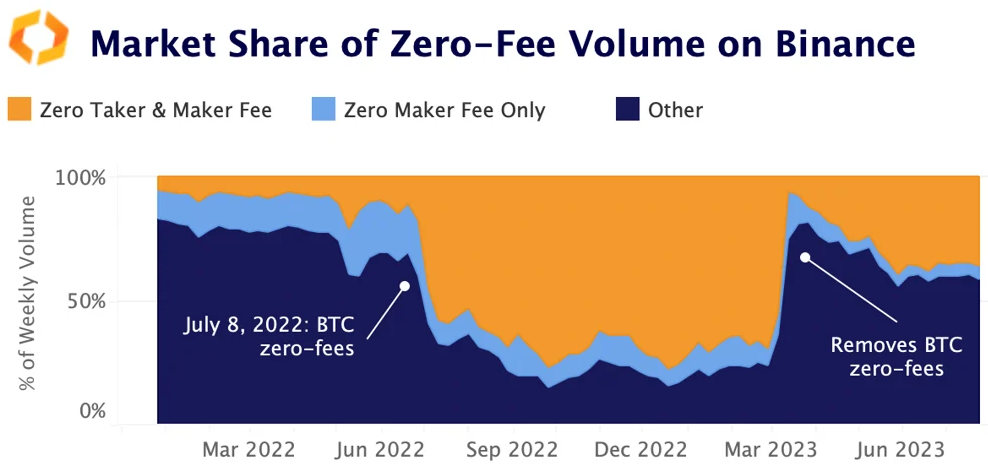

To better understand the impact of zero fees on Binance's revenues, we quantified the total zero-fee trade volume on the exchange over the past year to the best of our ability using official press releases of promotion start and end dates. Some promotions removed both taker and maker fees, while others only had zero maker fees. The introduction of BTC zero-fee trading (orange) on July 8, 2022 had an immediate positive impact on trade volumes, which hit an all-time high shortly after (in native units).

Despite the considerable increase in zero-fee trading, zero-fee trading volumes (dark blue) dropped, which suggests that Binance may have lost significant revenues. However, throughout 2022 monthly volumes consistently remained above $300bn, which helped Binance's market share increase 10%, eventually hitting an all time high of ~70% relative to its biggest competitors.

At its peak, the proportion of zero-fee trading (both maker and taker fees) reached an all-time high of 85% of the total weekly trade volume in September 2022, and remained above 70% until the promotion was ended at the end of March 2023. This means that for the majority of all trades, Binance was earning zero fees until a few months ago.

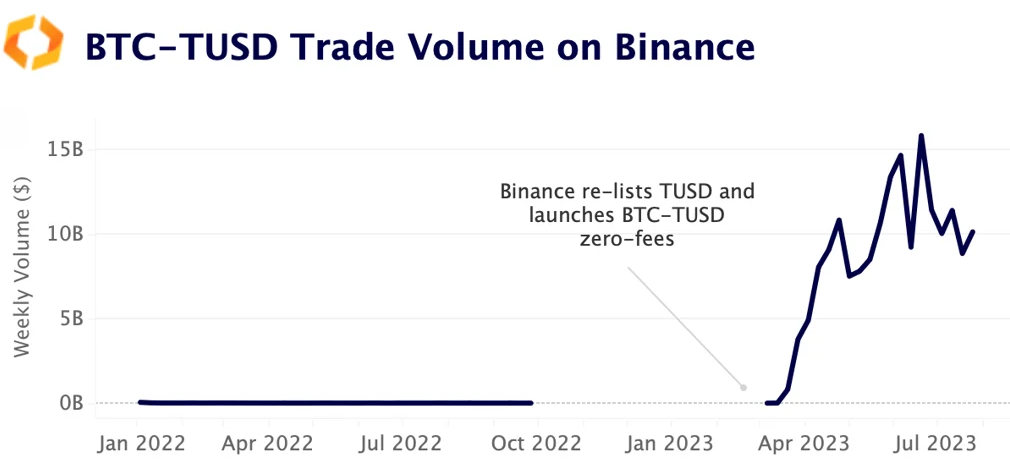

Since March, this ratio has stabilized at around 36%, rebounding from a multi-month low of 18%. This is because in recent months, Binance has returned to a more selective approach to zero-fee trading, focusing mostly on TUSD, a stablecoin it has adopted as a quasi-replacement for BUSD after Paxos was forced to halt issuance.

Today, BTC-TUSD, now Binance's only bitcoin market that has both zero maker and taker fees, is the highest volume pair across all exchanges, with more than $10bn in volume every week.

If Binance's goal with these promotions was to increase its market share of volume, it has succeeded. Market share is a powerful indicator that can direct new and existing traders to use an exchange. However, overall crypto trading activity has slumped over the past year, which has prevented these promotions from causing a trickle-down effect on fee-generating trading activity.

Long-term volatility slumps to multi-year lows

Crypto traders love volatility, so it is no surprise that the overall drop in trade volume is closely correlated with long-term volatility. 180D volatility for both BTC and ETH is at multi-year lows of 46% and 49%, respectively. While BTC started the year trading at just $17k, its gains have been slow and hard-won, in contrast with previous bull markets when BTC soared over short periods of time. ETH, which has historically been much more volatile, is now just as sluggish as BTC.

Is play-to-earn gaming dead?

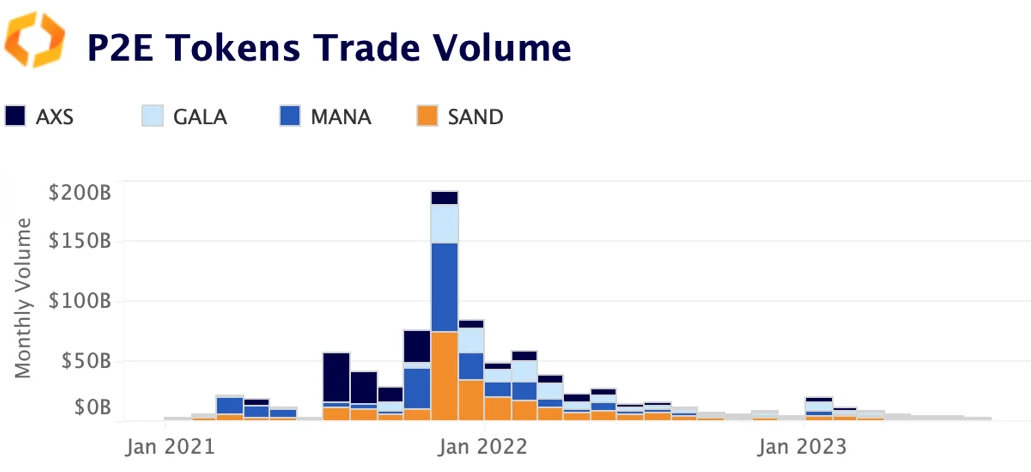

After massive popularity in late 2021 along with mainstream enthusiasm for the metaverse, play-to-earn (P2E) games such as Axie Infinity, the Sandbox, and Decentraland have lost steam over the past year. The monthly trade volume for the top metaverse tokens by market cap has fallen between 95% and 99% since November 2021, from $190bn to just $3bn in June 2023.

The number of daily active users has also collapsed, as these platforms have been struggling to retain users amid falling in-game rewards. According to DappRadar, the Sandbox had only a few hundred users over the past 24 hours.

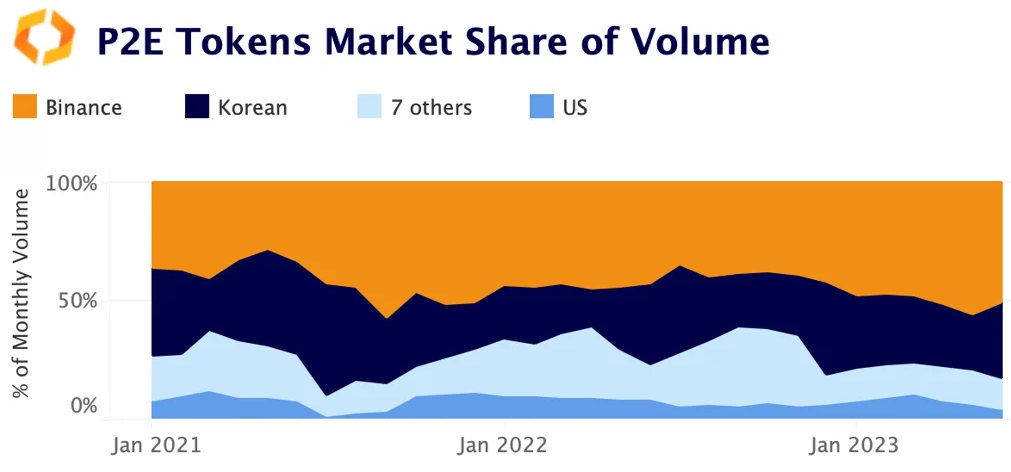

These tokens are mainly traded on Binance and Korean markets, which hold a combined market share of more than 80%. The share of U.S. exchanges has dropped to just 4% in June, its lowest level since late 2021.

The surge in metaverse-linked tokens came after Facebook changed its name to Meta back in October 2021 and announced that it would invest heavily in the metaverse. More than a year later the company’s metaverse division has lost over $13.7bn and Meta is now focusing on efficiency using another buzzy technology: artificial intelligence.

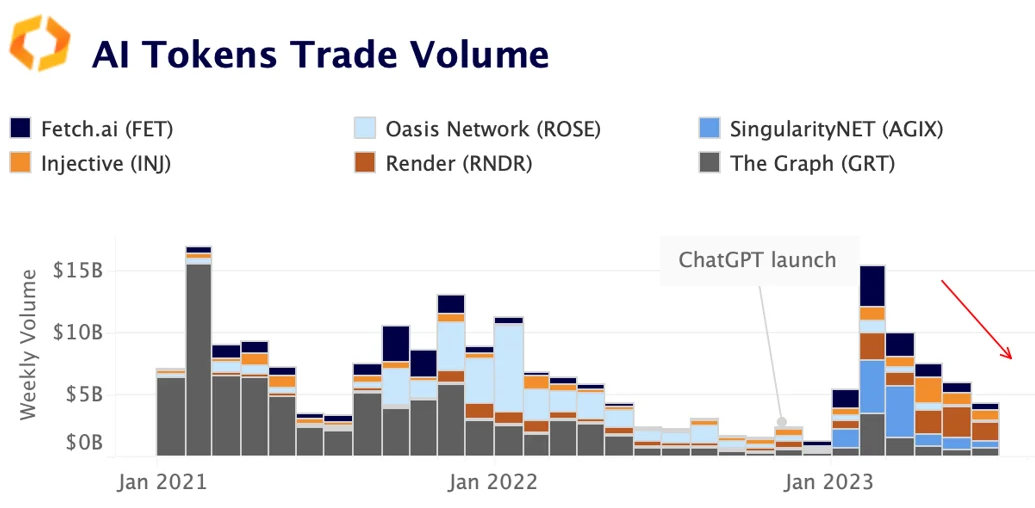

Since the launch of ChatGPT back in November 2022, AI has been the main driver of U.S. tech equities gains. AI-related crypto projects such as Render, which facilitates cloud-based 3D graphics rendering and decentralized machine learning platform SingularityNet (AGIX) have also registered significant gains this year. However, while volumes for AI-linked tokens surged in early 2023, they have declined since, hitting a yearly low in June.

Market makers enable large WLD trades after launch

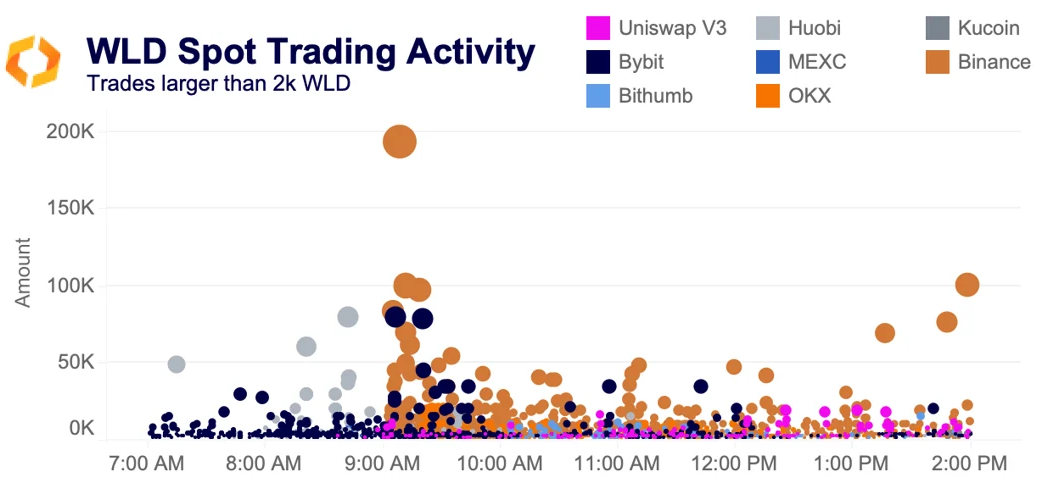

Worldcoin had one of the most unique launches in recent memory, complete with eye scans, huge loans to market makers, and possible wash trading, as detailed in our recent Deep Dive. The project launched by releasing up to 143mn WLD tokens, 100mn of which was loaned to market makers. Users who participated in the project’s pre-launch were eligible to receive 25 WLD tokens.

In the past, projects that airdrop have had inefficient launches with significant price divergences as users rush to claim the token and sell on a DEX or move them to a centralized exchange. In Worldcoin’s case, 99% of initial supply was in the hands of market makers, meaning price discovery happened quickly and large orders were facilitated almost immediately. As shown above, Huobi led with large orders ahead of Binance’s listing; Bybit and Uniswap also facilitated a good number of large orders early on.

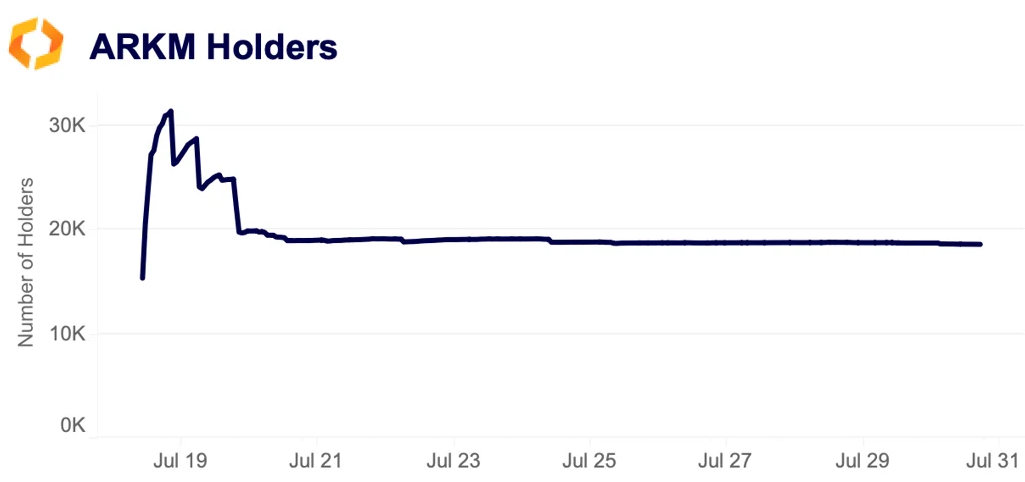

ARKM holders stabilize after nearly 65k claim airdrop

As we covered last week, ARKM launched on July 18 with significant price divergences on centralized exchanges. On-chain, users rushed to claim tokens, with over 55k claiming in the first 24 hours after launch. However, as the above chart shows using Kaiko's new wallet data, the total number of users holding ARKM only briefly topped 30k, meaning that users were quickly selling their airdrops. Currently, about 65k users have claimed their tokens while only 19k wallets still hold tokens. Heavy selling after an airdrop is common, and holders remaining steady over the past week indicates that the wave of airdrop selling is over.

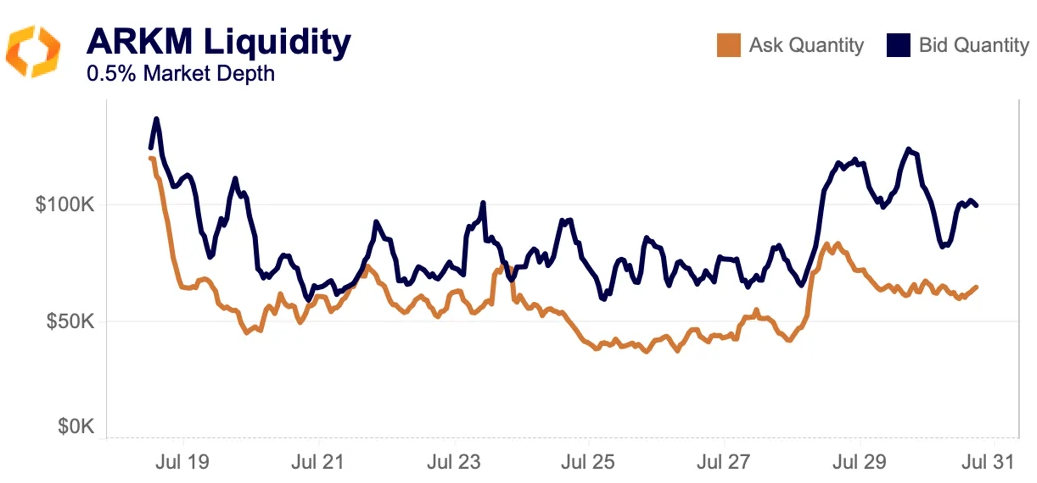

Off-chain, liquidity dropped post-launch, with bids and asks hovering around $75k and $50k, respectively. Bids have consistently remained higher than asks, suggesting that there is buying support despite the token’s drop. Heading into the weekend bids and asks doubled before retreating slightly.

On-chain data indicates that Arkham sent 35mn tokens in total to market makers GSR Markets and Wintermute, who then deposited the tokens on Binance and Bybit. Arkham itself sent 50mn tokens to Binance, in total meaning 85mn of 150mn circulating tokens were quickly sent to centralized exchanges.

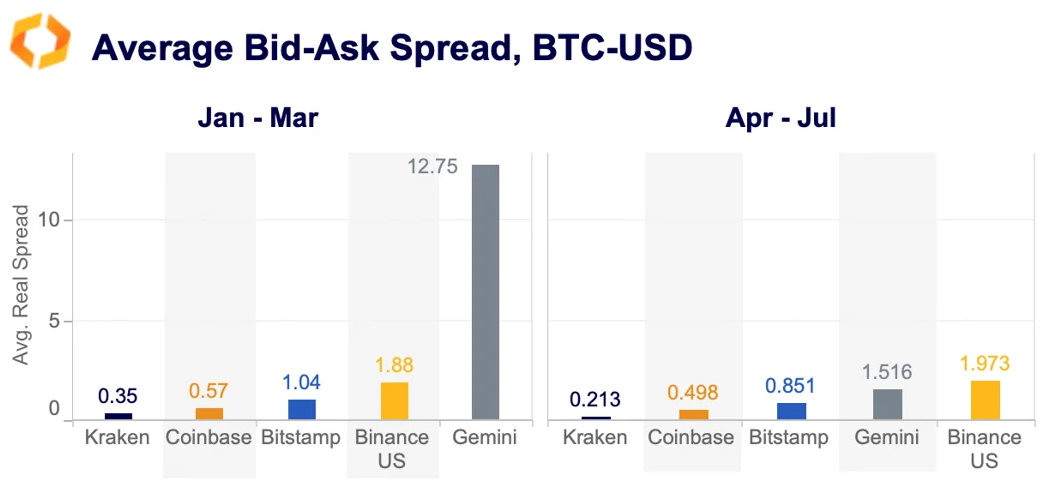

Bitcoin spreads are improving in the U.S.

Q1 was one of the more volatile quarter's in recent crypto history, marked by a regulatory crackdown and traditional banking crisis that generated skittishness among market makers. Spreads for BTC-USD trading pairs were higher than average, which closely correlates to the depleted market depth we saw on BTC order books. The good news is that since the start of Q2, spreads have improved considerably across the board.

On Kraken, average spreads dropped from .35 bps to .2. On Coinbase, they dropped from .57 to .498. This suggests market makers are increasing activity, especially as volatility remains at multi-year lows.

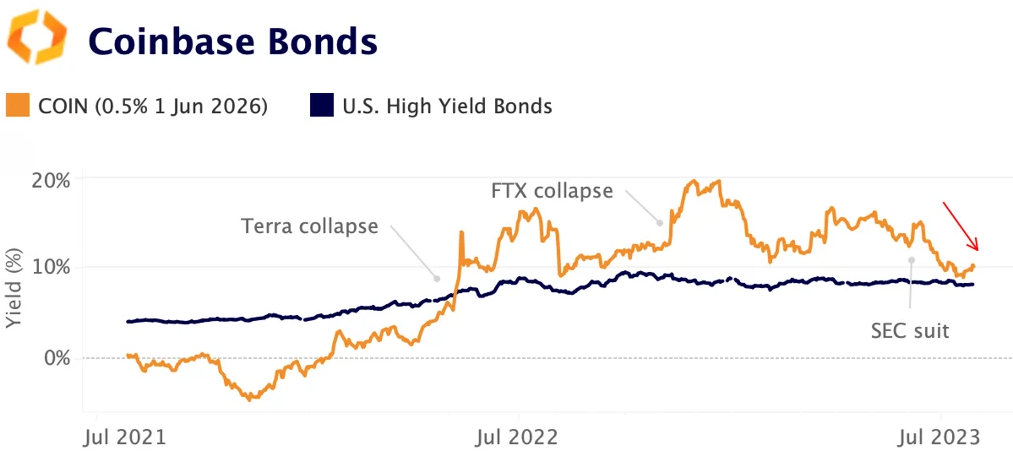

Coinbase bonds yields signal improving sentiment

The yields on Coinbase convertible bonds, which move inversely to prices, have decreased significantly over the past month from 15% to 9%, before inching up slightly last week. This decline comes despite the U.S. SEC suing the exchange in early June, though prominent asset managers filing for spot Bitcoin ETFs have sparked hopes for broader institutional adoption.

While ETFs could have negative implications for crypto exchanges in the long term, providing an easy and affordable way to gain BTC exposure without crypto exchanges, Coinbase stands to benefit from its role as a custodian and the increasing demand for BTC. Despite the decrease, yields on bonds tied to Coinbase remain higher than the yields of U.S. non-investment-grade corporate debt securities, also known as "junk bonds". Coinbase is expected to release its Q2 results this week, having reported a net loss of $79 million in Q1 2023 due to falling crypto trade volumes.

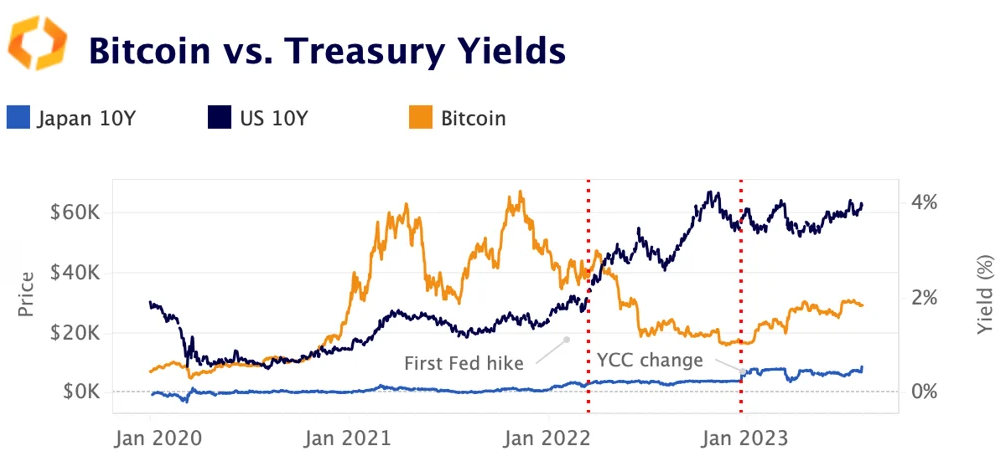

BTC remains range-bound amid global bonds volatility

Last week the Bank of Japan relaxed its yield curve control policy (YCC) spurring bonds and FX volatility. The move is seen as a sign that the BoJ is preparing to put an end to its 30 year-long monetary policy easing which could have a significant impact on global liquidity. Japan 10-year yields jumped to their highest level since 2014 and boosted an increase in U.S. Treasury yields, which surpassed 4% before retreating.

While U.S. equities closed the week in the green on hopes for a soft landing, BTC remained range-bound below $30k. Despite showing resilience to rising borrowing costs over the past few months, BTC has historically moved in the opposite direction to global Treasury yields and bond volatility.