MakerDAO, the protocol behind the leading over-collateralized stablecoin DAI, is looking to diversify its balance sheet into traditional assets. In doing so, $500 million will flow into “real world assets” (RWAs) and another $500 million will be invested in fixed income securities. Stablecoins are a type of cryptocurrency that is pegged to a non-volatile asset (like the US dollar). These cryptocurrencies address the problem of inherent volatility risk in the crypto space. While the space is led by centrally-backed providers such as Tethers USDT and Circles USDC, there are also decentralized alternatives. MakerDAO’s model of over-collateralization has stood the test of…

Author: Editorial Office CVJ.CH

As part of the “Plan B” economic development program, McDonald’s stores in Lugano accept payments in Bitcoin and other cryptocurrencies.

As part of the Swiss Digital Days, a world record attempt of the world’s largest collaboratively created artwork is being created.

What has been happening around Blockchain Technology and Cryptocurrencies this week? The most relevant local and international developments as well as appealing background reports in a pointed and compact weekly review.

For the first time, a stablecoin pegged to the Swiss franc (CHF) crosses the 10 mio. mark and enters the dollar-dominated arena.

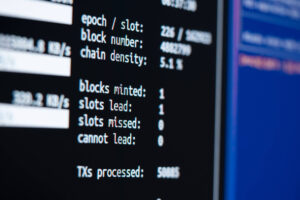

Frederik Gregaard, CEO of the Cardano Foundation, describes the developments within the Cardano ecosystem in a conversation with CVJ.CH.

What has been happening around Blockchain Technology and Cryptocurrencies this week? The most relevant local and international developments as well as appealing background reports in a pointed and compact weekly review.

Under Gary Gensler’s leadership, the U.S. Securities and Exchange Commission (SEC) is attempting to gain jurisdiction over the crypto industry.

Robin Lemann talks to CVJ.CH about the history, strategy and future of digital assets at Swiss online bank Swissquote.

The Luxembourg-based digital asset exchange Blocktrade has been acquired by well-known investors from the Swiss ecosystem.

Covario and AlgoTrader launch a partnership to offer extended liquidity and the best pricing for institutional investors in the crypto space.

What has been happening around Blockchain Technology and Cryptocurrencies this week? The most relevant local and international developments as well as appealing background reports in a pointed and compact weekly review.

The merge, Ethereum’s consensus transition to Proof of Stake, successfully proceeded without any further complications.

Despite the bear market, the NFT landscape on Solana is recording new highs. A look inside the booming ecosystem.

The Ethereum blockchain’s move from PoW to PoS (“The Merge”) will take place in mid-September and will transform decentralized networks.

What has been happening around Blockchain Technology and Cryptocurrencies this week? The most relevant local and international developments as well as appealing background reports in a pointed and compact weekly review.