The EU Parliament agrees on a MiCA proposal and lays the foundation for the first comprehensive legal framework for cryptocurrencies.

Author: Editorial Office CVJ.CH

The bankruptcy of crypto broker Voyager Digital reveals highly questionable practices regarding risk management in the industry.

A summarizing review of what has been happening at the crypto markets of the past week. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko.

What has been happening around Blockchain Technology and Cryptocurrencies this week? The most relevant local and international developments as well as appealing background reports in a pointed and compact weekly review.

Major firm Grayscale files suit against U.S. regulator SEC after rejecting its bitcoin ETF and emphasizes that they act with arbitrariness.

The founders of the Bored Ape collection, Yuga Labs, are currently battling accusations of hiding racist motifs in their NFTs.

Registered Breitling owners now have the opportunity to benefit from various digital advantages via the blockchain warranty card.

With the loss of confidence in the most well-known bitcoin price prediction models (S2F), it is uncertain how the price will evolve.

A summarizing review of what has been happening at the crypto markets of the past week. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko.

The complete overview of the day’s events in the (crypto) markets. Concisely summarized in the CVJ.CH market commentary.

What has been happening around Blockchain Technology and Cryptocurrencies this week? The most relevant local and international developments as well as appealing background reports in a pointed and compact weekly review.

A review of the third crypto market cycle, innovations in the field, institutional adoption, and an outlook for the future.

The Saga Android is specifically designed and manufactured to integrate the Solana framework and advanced security features.

MicroStrategy has made bitcoin investments worth nearly $4 billion. Is there a risk of forced liquidation?

A summarizing review of what has been happening at the crypto markets of the past week. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko.

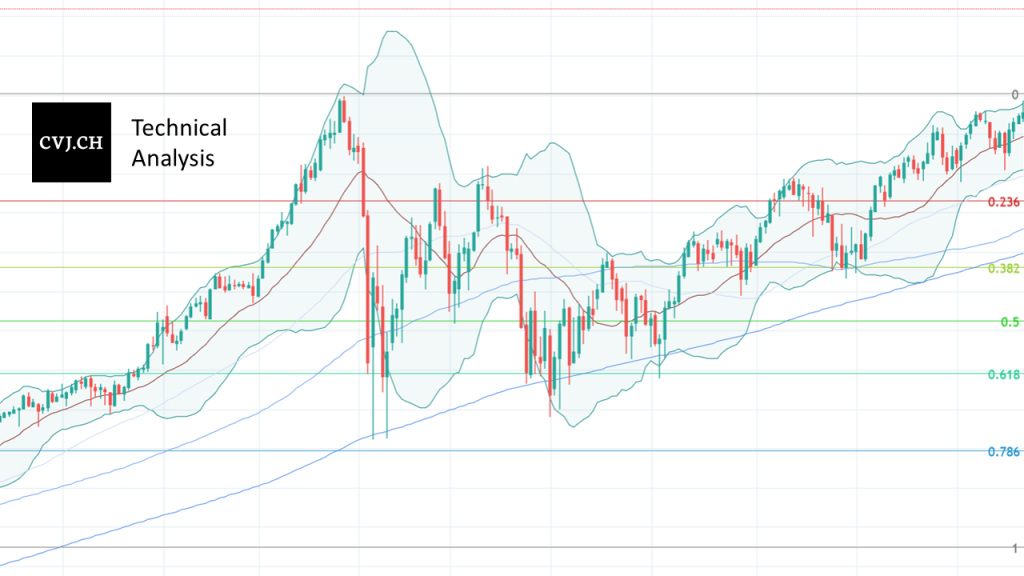

Bitcoin is going through another sharp correction phase after reaching a new all-time high in the USD 69,000 area.